Markets

Will Biden’s announcement fuel the $70K rally?

Bitcoin price hit a 30-day high of $68,457 on Monday, July 22, 2024, as BTC markets reacted to cryptocurrency-friendly Donald Trump further widening his lead following Biden’s withdrawal from the presidential re-election race.

Biden’s announcement sends BTC price to 30-day high

After surviving a mild correction on Friday, July 19, the price of Bitcoin entered another uptrend over the weekend, following a dramatic turn of events in the US presidential election race.

On July 21, the President of the United States Joe Biden announced his decision to withdraw from the 2024 re-election race. Investors expect this move could further tilt market momentum in favor of Donald Trump, a self-proclaimed cryptocurrency-friendly candidate.

As a result, Bitcoin experienced significant buying pressure over the weekend, as did the rest of the cryptocurrency markets.

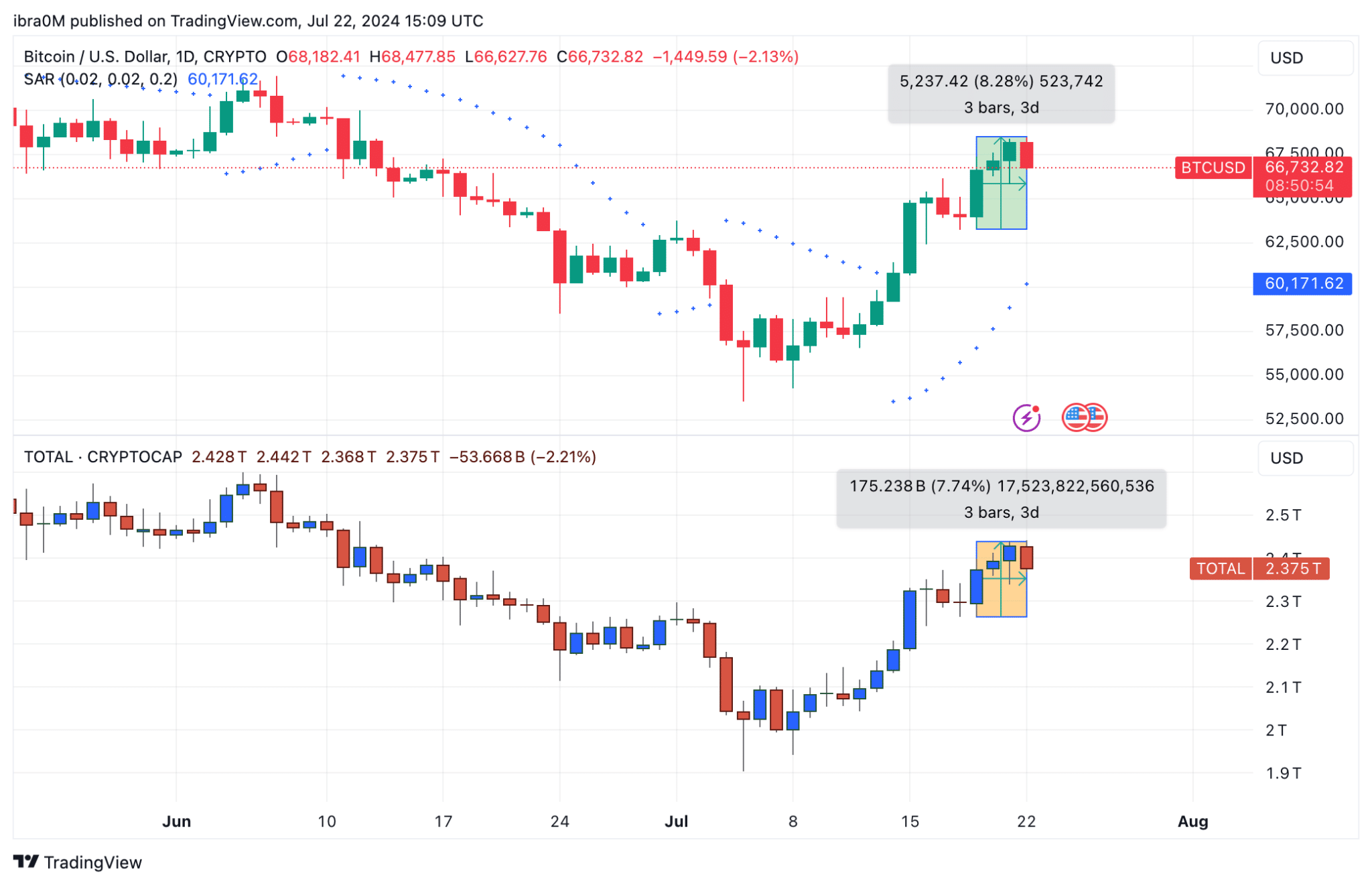

Bitcoin price slid to an intraday low of $63,294 amid intense market volatility on Friday, July 19. However, following Biden’s announcement on Sunday, Bitcoin price surged by 8.28% to reach $68,477 as US markets opened on Monday, July 22.

Notably, $68,477 is the highest Bitcoin price traded in over 30 days as of June 10. This shows that US-based investors are taking bullish positions on BTC as Trump further extends his lead ahead of the presidential election scheduled for November 2024.

Furthermore, while Bitcoin’s market cap has increased by over $100 billion during the 8.2% weekend rally, the rest of the altcoin markets have also benefited from the improved market sentiment. The Crypto TOTAL Cap chart above clearly shows how the aggregate valuation of the broader cryptocurrency market has increased by 7.74% (~$175 billion) over the past 72 hours.

During the Biden administration, US authorities have been engaged in lengthy legal battles with various crypto entities, including Ripple, Binance, Coinbase, Uniswap, to name a few. The administration has also secured convictions of prominent figures including Sam Bankman-Fried and Binance co-founder/CEO Changpeng Zhao.

Unsurprisingly, the positive market reaction over the weekend suggests that investors are interpreting a Donald Trump presidency as potentially providing a more favorable regulatory landscape for the broader cryptocurrency markets than the industry has experienced under a Biden presidency.

If this upward trend persists, it could create a strong wall of buying resistance, preventing any sharp corrections in the short term as the price of Bitcoin gets ever closer to the $70,000 mark.

BTC Price Prediction: $70k Target Now In Sight

Bitcoin price action over the past 72 hours indicates a significant uptrend after recovering strongly from its recent lows. The price has risen above the 9-day Arnaud Legoux (ALMA) moving average of $67,117.61, suggesting near-term bullish momentum.

Furthermore, the Bollinger Bands (BB), with the upper band at $69,353.58 and the lower band at $52,878.43, are widening, indicating increased volatility, which is often a precursor to a major breakout.

Bitcoin is currently facing resistance around the $68,000 level, as evidenced by the recent pullback from its high. If BTC can break out of this resistance, the next significant target would be $70,000, which aligns with the upper Bollinger Band.

On the downside, immediate support lies at the 9-day ALMA level of $67,117.61, with a more substantial support level at the lower Bollinger Band at $61,116.00.

The recent three-day gain of 8.28%, as highlighted in the chart, further supports the bullish outlook. However, traders should remain cautious due to increased volatility. A sustained move above $68,000 could pave the way for further gains towards the $70,000 target, but a failure to hold this level could result in a retracement towards the aforementioned support zones.

Overall, while technical indicators suggest an uptrend with a target of $70,000 in sight, traders should pay attention to the potential resistance at $68,000 and closely monitor support levels to manage their positions effectively.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-