Markets

What Cooling Inflation Means for the Cryptocurrency Market | Video

Good morning and happy Tuesday, it’s July 11th, another day. Another episode of Markets Daily. Thanks for listening. As always, we have a lot to tell our guests today. But first, a quick update on prices and what’s happened so far this morning because we just got a new CP I reading at 8:30 AM Eastern time that showed inflation has fallen to 3%, which is lower than expected. So, great news for the market and Bitcoin jumped about half a percent on the news and is up 2.22% in the last 24 hours to trade at $59,000. Fetcher Powell also continued his week of appearances on Capitol Hill yesterday and said among other things that the Fed will not wait for inflation to return to 2% to start cutting rates. He also said that interest rates will not go back down to near zero, like they were before the pandemic. So it looks like we could maybe see a rate cut or two this year after all. But let’s react and more to all of that with our guests today, who is Ben Emmons, founder and CIO of Fed Watch Advisors. Good morning, Ben. Good morning. Thanks for having us. Sure, Ben. What do you think about today’s reading of the CP I report? Yeah, as you said, it’s a good report. It shows that this inflation that we’re talking about, right? It’s the month-over-month decline in inflation. Which is really on track now. It’s not accelerating, but it’s on a good footing. And I think that’s good for the Federal Reserve. As you also said, the Fed is not going to wait for this number to actually hit 2% and we’re getting close to that. So that means that for the Fed, this rate cut decision is getting close as well, but it’s still going to be a little bit of a mixed bag in September. I don’t think I saw the possibility of September changing too much yet, but yields are definitely coming down in reaction to this number. What’s important here is that, not only was the stock down, there’s a lot of energy effect there, but it’s really the underlying number that, that’s come down a little bit lower. And that’s because the rent component that ultimately shows a further deceleration. That’s really good news because that’s where the problems have been concentrated in inflation, rigid rents and then some of the services aspects of CP I. So let’s take it all together. I say it’s, fortunately it’s a good number. Again, it’s the third good number after the first three bad numbers that we had earlier in the year. So getting, you know, at least neutralizing the trend from the beginning of the year. So hopefully the next few numbers will be good as well. Either way, I think it’s a good day for the market. Now, I just said earlier that Fed Chair Powell said that the Fed is not going to wait for inflation to get back to 2% to start cutting rates. 3% seems pretty close considering where we’re coming from. So is that a good place to start cutting rates? Maybe not in September, but maybe, you know, later in the year? Yeah, I think that’s what the market is doing, this September cut is happening because a party, I think the technicalities that are going on in the futures markets, but you really look at the cumulative number of cuts that are really pricing in, it actually starts in December. And so I think that’s the path that the Fed has a little bit of time here to say, hey, we’re really driving inflation in the direction that we wanted and it’s really working in our favor, so to speak. So, you know, you’re getting a little bit of a repeat of what I wrote in my note this morning. You know what that reminds me of is, it’s 2015. That was, by the way, a bad year for markets. But what it was really about was this heightened speculation that when, with the high Gras at that time and even then, everybody was focused on September and saying, well, they’re going to do it and they ultimately didn’t do it without caution and decided to do it in December. It looks a little bit similar to today. You know, what was interesting at the time is that October was a huge risk in the ring markets when the Fed finally gave forward guidance to the market saying we’re not ready to cut rates. And that, I think is still missing here for the markets today. This number is not going to immediately give Powell the reason to give us forward guidance, which is to say, okay, that’s a good number. We’re going to cut rates in September. He, he, he delayed yesterday and I don’t think he would change his mind, uh, today even on these numbers because they just show that he’s on track, but we’re not there yet, right? So, as you said, we’re at 3% and not 2%, right? It’s interesting that you bring that up because now CP I and the unemployment report are obviously the two most relevant economic reports that the Fed looks at, but there are a lot of other indicators for the state of the economy and some of them have been, you know, pretty weak in the last few weeks. So how much can we really, you know, listen to what Powell is saying instead of looking at the actual data and that’s where the economy is because it’s been out for some time that the forward-looking indicators, the leading indicators are all pointing to this weakness and it’s made, you know, commentators cautious if not very scared that we’re already in a recession and we’re not careful enough to tighten too much and then we’re going to end up in a really bad recession. And that hasn’t really played out partly because I think again, the idea of looking forward is based only on surveys and certain indicators that by definition are more forward-looking, they’re not necessarily always forward-looking. Right. Right. Because just as interest rate expectations have been wrong for many years, you know what the Fed has ultimately delivered in terms of high rates or cuts. So I think it’s really the more hard data like AC PI like a payroll report like the jobless claims this morning, the notable droppers are down again to 222,000, the lowest in, I think the last four or five weeks, you’re still emphasizing like this is a labor market that’s cooling but not really deteriorating. That’s the hard data. I think that’s what matters a little bit more than these forward-looking indicators, even though they’re not wrong, but they tend to overextend. And so I think as an investor, I say, I kind of take this hard data and I look at the trend in the hard data. And what that tells me from CB I today is we had two bad prints at the beginning of the year. We’re getting two good prints, three good prints back. So my trend is flat. So I might say, OK, if the next number comes out better than expected, like weaker, so to speak, then maybe you could say this rate because it’s close right now. Going back to Powell’s words for a second, the market, including cryptocurrencies, has reacted positively to Powell’s remarks this week, it’s the market here in taking his words as a bullish indicator to some extent because, you know, he was cautious and he, he didn’t want to give us any guidance as I said. But I think what they’re, what they’re taking away from this is that he, you know, these words about the models for the advance of inflation and the significant cooling of the labor market. Those kind of modest and significant words are for the markets to say, wow, you wouldn’t say words like that if you weren’t closer in your mind to a decision, right? When you’re going to cut the rate, I think that’s all this, this kind of fat part of the game as we call it. Uh You know, and I think that’s why the markets are latching onto those words. I just started to get back as you said, you know, risk on markets like Bitcoin or, or, ol’ S and P 500. Yeah, it benefits because what we, what those markets are doing is just pricing in for when the Fed actually cuts rates. And that just drives those prices up. I would say on the other hand that, those interest rates like in Treasury yields would be pretty capped but not like the lower end of the range anymore, we haven’t seen a significant move down in yields yet. And that’s because including today’s number is disinflationary, but it’s not like saying we’re going to go into a deflationary environment with really low inflation. It’s not about the data that they say. So, um, I think the markets are taking power at their word. They still want to see several months of data before they actually make that decision. Is that, is that a takeaway? Now the Fed has two mandates like, as you know, better than I do. Um, it’s keeping inflation low and labor market strong between those two right now. What would you say? The Fed is mostly focused on or or what is their priority right now? I think there is still uh uh inflation as the highest priority because the labor market is coming into equilibrium and that’s the wording that they’ve been using for the last six months or so. And that’s it. And just seeing payroll growth moderate further and seeing these unemployment claims rise a little bit and the employment rate rise a little bit and it’s really driven by labor supply because of all the immigration influx into the labor market that has actually added net supply of workers. And that’s led to this cooling trend. So they’re looking at that said as if it’s a normal healthy pattern in the labor market that was really hot and steamy before and as a result, wage increases are kind of moderating. But the inflation numbers, so they’re with these reports in the minutes that were also highlighted as slow progress, right? They made good progress last year and then they stalled and slowed down and got a little bit worrisome and maybe we’re back on track now, but we’re not, we’re still making slow progress. And I think that’s why it makes them cautious, like if it’s that slow, can we make some quick moves here on rates, you know, they want to cut rates. I think that’s not a problem on the Fed’s part, but it’s really about making sure that they’re actually at the right time or at the right time that they can because if they don’t, there’s a concern that they’re, you know, actually making the wrong decision at the wrong time and letting things heat up again and get overinflated, right. So the slow progress is, I think that’s why they’re focused on the demand inflation side. Right. Well, I think today’s report was definitely a step in the right direction. Uh, thank you, Ben, for coming on the show. Thank you, Elena. It was great to be here. Thank you. That was Ben Emmons, founder and CEO of Fet Watch Advisors. Thanks for tuning in today.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

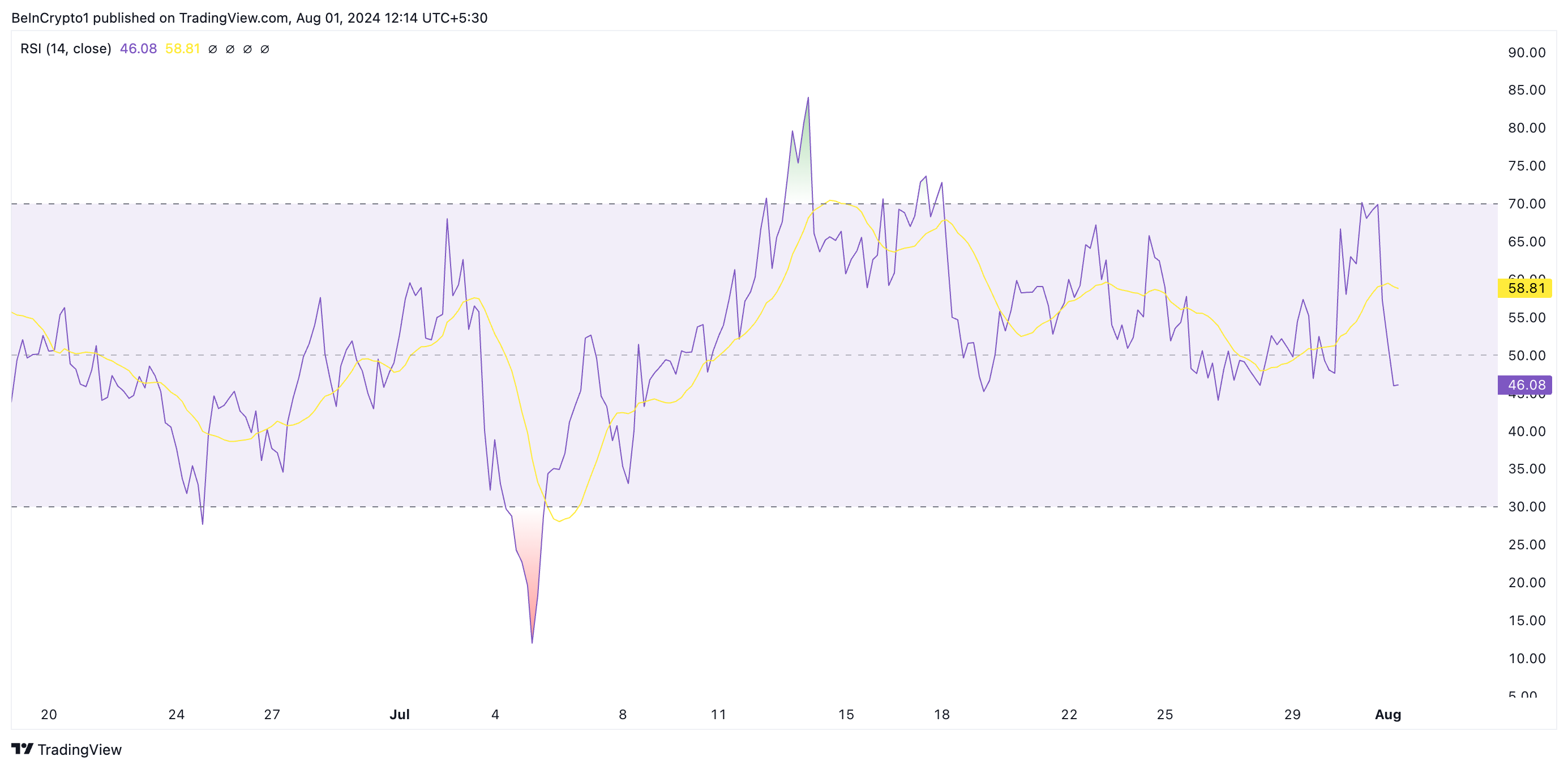

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit