Markets

Weekly Crypto Report: Hacks, Market Trends, and the Latest in Blockchain and Web3

Welcome to your go-to source for all things Web3, Blockchain and Crypto! Our Weekly report dives into the freshest updates and game-changing developments in the fast-paced world. We curate the best data from trusted sources to keep you ahead of the curve. Ready to stay informed and inspired? Let’s explore the latest trends and insights together!

1. Web3, Blockchain & Crypto Breaking News This Week

Here are this week’s major breaking news reports related to Web3, Blockchain, and crypto that you should never miss.

- Japanese Crypto Exchange DMM Bitcoin Hacked, Loses $305 Million

DMM Bitcoin Suffered a hack, losing 4,502.9 bitcoins worth $305 million. The exchange investigates and implements measures to prevent future attacks.

- Riot Platforms Seeks to Acquire Bitfarms Ltd.

Riot Platforms aims to acquire Bitfarms, owning 9.25% and planning a public takeover offer despite Bitfarms’ board rejection.

- Ramp Expands Crypto-to-Fiat Services Across Europe

Ramp now supports SEPA money transfers and over 35 local currencies, enabling seamless crypto cash-outs directly to credit and debit cards across Europe.

- ENS Labs Proposes Expansion to Layer-2 Protocols

ENS Labs suggests expanding Ethereum Name Service to layer-2 scaling, making ‘.eth’ names cheaper and more accessible, through no specific layer-2 network is chosen yet.

- Former FTX Co-CEO Ryan Salame Sentenced to Prison

Ryan Salame received a 90-month prison sentence for illegal political contributions and unlicensed money-transmitting business conspiracies.

- ASI Alliance Finalise Merger, Launches New Token

Fetch.ai, SingularityNET, and Ocean Protocol merge to form the Artificial Superintelligence Alliance, launching the ASI token, enhancing AI network scalability.

- Argentina and El Salvador Discuss Bitcoin Adoption

Argentinian and Salvadoran officials met to discuss enhancing Bitcoin adoption and leveraging EI Salvador’s experience with digital assets.

- Donald Trump Opposes Central Bank Digital Currency

Trump vows to block the creation of a central bank digital currency in the US if re-elected, making cryptocurrency a key election issue.

- Caitlyn Jenner Promotes $JENNER Meme Coin.

Caitlyn Jenner promotes $JENNER, a meme coin on the Solana-based DEX pump. fun, reaching a market cap of over $24 million despite community scepticism.

- Worldcoin Project Halted by Hong Kong Privacy Regulator

Hong Kong’s PCPD ordered Worldcoin to stop operations due to excessive biometric data collection, violating local privacy laws.

2. Blockchain Weekly Analysis

The blockchain weekly analysis primarily covers the blockchain dominance analysis and the blockchain 7-day change analysis. In order to bring more clarity, the Layer 1 chains and Layer 2 chains are analysed separately.

2.1. Blockchain Dominance Analysis

Ethereum, TRON, BNB Smart Chain, Solana, and Arbitrum One are the top five blockchains as per dominance and TVL.

| Blockchains | Dominance | TVL |

| Ethereum | 64.85% | $65,327,694,474 |

| TRON | 8.21% | $8,270,766,940 |

| BNB Smart Chain | 5.25% | $5,291,115,742 |

| Solana | 4.76% | $4,796,403,295 |

| Arbitrum One | 3.08% | $3,104,010,123 |

| Others | 13.85% |

Among the top five blockchains, Ethereum dominates with 64.85%. TRON and BNB Smart Chain follow with 8.21% and 5.25%, respectively. Solana and Arbitrum One mark 4.76% and 3.08% dominance, respectively.

2.1.1. Top Five Layer 1 Chains By Dominance

Ethereum, BNB Smart Chain, Solana, Bitcoin and Avalanche are the top five Layer 1 Blockchain by dominance and TVL.

| Layer 1 Blockchains | Dominance | TVL |

| Ethereum | 81.35% | $65,397,387,128 |

| BNB Smart Chain | 6.58% | $5,292,935,843 |

| Solana | 5.97% | $4,798,824,590 |

| Bitcoin | 1.42% | $1,142,834,728 |

| Avalanche | 1.14% | $914,650,933 |

| Others | 3.54% |

Among the top five-layer 1 chains, Ethereum dominates with 81.35%. BNB Smart Chain and Solana follow with 6.58% and 5.97%, respectively. Bitcoin records 1.42% dominance, and Avalanche reports 1.14% dominance.

2.1.2. Top Five Layer 2 Chains By Dominance

Arbitrum One, Blast, Base, Polygon POS, and Optimism are the top five Layer 2 Blockchains on the basis of dominance and Total Value Locked.

| Layer 2 Blockchains | Dominance | TVL |

| Arbitrum One | 28.51% | $3,107,741,567 |

| Blast | 20.68% | $2,254,576,560 |

| Base | 16.04% | $1,748,575,639 |

| Polygon POS | 8.71% | $949,220,251 |

| Optimism | 7.67% | $836,324,225 |

| Others | 18.93% |

Among the top five-layer 2 chains, Arbitrum One dominates with 28.51%. Blast and Base closely follow with 20.68% and 16.04%, respectively. Polygon POS shows a dominance of 8.71%, and Optimism registers a dominance of 7.67%.

2.2. Blockchain 7-Day Change Analysis

Let’s analyse the top five Layer 1 chains using the 7-day change index.

| Layer 1 Blockchains | 7-Day Change |

| Ethereum | +1.8% |

| BNB Smart Chain | -4.4% |

| Solana | +1.3% |

| Bitcoin | -2.2% |

| Avalanche | -8.5% |

Only two blockchains among the top five L1 chains show a positive seven-day change: Ethereum, which displays a seven-day change of +1.8%, and Solana, which displays a change of +1.3%. Conversely, Avalanche, BNB Smart Chain, and Bitcoin display a negative seven-day change. Avalanche shows the highest negative seven-day change (-8.5%). BNB Smart Chain and Bitcoin follow with -4.4% and -2.2%, respectively.

Let’s analyse the top five Layer 2 chains using the 7-day change index.

| Layer 2 Blockchains | 7-Day Change |

| Arbitrum One | +1.7% |

| Blast | +19.4% |

| Base | +2.6% |

| Polygon POS | -2.7% |

| Optimism | -3.3% |

Among the top five L2 chains, at least three blockchains display a positive 7-day change. Blast shows the highest positive 7-day change of +19.4%. Base and Arbitrum One follow with +2.6% and +1.7%, respectively. Optimism showcases the highest negative 7-day change of -3.3%. Polygon POS follows with -2.7% change.

3. Cryptocurrency Weekly Analysis

The Cryptocurrency Weekly analysis covers a wide range of analyses, from the general cryptocurrency market cap analysis and the top gainers and losers analysis to the Stablecoin, Memecoin, AI Coins and Metaverse Coins analyses.

3.1. Top Cryptocurrency Categories By Market Cap

Layer 1 (LI), Smart Contract Platform, Andreessen Horowitz Portfolio, Alameda Research Portfolio, and Alleged SEC Securities are the top five cryptocurrency categories by Market Cap. The Layer 1 (L1) category, with a $2,088,167,099,227 market cap, is the one with the highest market cap. The Smart Contract Platform category follows with a $770,415,441,846 market cap.

| Crypto Categories | Market Cap | 7-Day Change |

| Layer 1 (L1) | $2,088,167,099,227 | -1.0% |

| Smart Contract Platform | $770,415,441,846 | +0.4% |

| Andreessen Horowitz Portfolio | $623,160,252,002 | +1.0% |

| Alameda Research Portfolio | $569,768,419,193 | +1.4% |

| Alleged SEC Securities | $246,966,021,146 | -3.1% |

Among the top five crypto categories, at least three show a positive 7-day change, though mild in nature. Alameda Research Portfolio, Andreessen Horowitz Portfolio, and Smart Contract Platform report +1.4%, +1.0% and +0.4% change, respectively. The biggest negative 7-day change is recorded by Alleged SEC Securities (-3.1%). The Layer 1 (L1) category follows with -1.0%.

3.1.1. Trending Categories This Week

PolitiFi, Pantera Capital Portfolio, Alleged SEC Securities, DePIN, Smart Contract Platform, and DWF Labs Portfolio are the top six trending categories this week.

| Trending Categories | Market Cap |

| PolitiFi | $1,781,076,640 |

| Pantera Capital Portfolio | $89,238,479,901 |

| Alleged SEC Securities | $246,840,741,279 |

| DePIN | $30,253,587,021 |

| Smart Contract Platform | $770,357,776,148 |

| DWF Labs Portfolio | $59,183,686,433 |

Among the top six trending categories of the week, the Smart Contract Platform category has the highest market cap of $770,357,776,148. The Alleged SEC Securities category follows with a $246,840,741,279 market cap. Pantera Capital Portfolio and DWF Labs Portfolio display $89,238,479,901 and $59,183,686,433 market cap, respectively.

3.2. Top Cryptocurrencies By Market Cap

The top five cryptocurrencies by market cap are Bitcoin, Ethereum, Tether, BNB, and Solana. Bitcoin has the highest market cap of $1,333,856,983,170. Ethereum follows with a market cap of $454,960,182,691.

| Cryptocurrencies | Market Cap | 7-Day Change |

| Bitcoin | $1,333,856,983,170 | -1.5% |

| Ethereum | $454,960,182,691 | +0.4% |

| Tether | $112,102,885,363 | -0.1% |

| BNB | $91,680,517,280 | -1.2% |

| Solana | $76,795,835,981 | -1.6% |

Among the top five cryptos, only one shows a positive 7-day change; Ethereum reports a 7-day change of +0.4%. The highest negative change is recorded by Solana (-1.6%). Bitcoin and BNB follow with -1.5% and -1.2%, respectively. Tether, the most prominent stablecoin, displays a mild change of -0.1%.

3.2.1. Trending Coins This Week

MANTRA, Notcoin, Foxy, JasmyCoin, and Pepe are the most trending cryptocurrencies at the time of preparing this analysis.

| Trending Cryptocurrencies | Market Cap |

| MANTRA | $610,502,346 |

| Notcoin | $1,293,303,319 |

| Foxy | $71,323,734 |

| JasmyCoin | $1,770,142,107 |

| Pepe | $6,419,889,652 |

Among the top five trending cryptocurrencies of the week, Pepe, a popular Memecoin, has the highest market cap of $6,419,889,652. JasmyCoin and Notcoin follow with $1,770,142,107 and $1,293,303,319, respectively. MANTRA displays a market cap of $610,502,346. Foxy registers a short market cap of $71,323,734.

3.2.2. Top Gainers & Losers This Week

Beercoin, Super Trump, MINATIVERSE, LandWolf and Notcoin are the week’s top gainers as per the 7-day gain index.

| Top Gainers | 7-Day Gain |

| Beercoin | +745.6% |

| Super Trump | +307.0% |

| MINATIVERSE | +296.5% |

| LandWolf | +236.6% |

| Notcoin | +162.0% |

Beercoin marks the highest 7-day gain of +745.6%. Super Trump and MINATIVERSE follow with +307.0% and +296.5%, respectively. LandWolf reports a 7-day change of +236.6%, and Notcoin records a 7-day gain of +162.0%.

Harambe on Solana, Apu Apustaja, The Doge NFT, OpSec, and enqAI are the top losers of the week as per the 7-day loss index.

| Top Losers | 7-Day Loss |

| Harambe on Solana | -53.9% |

| Apu Apustaja | -44.8% |

| The Doge NFT | -43.1% |

| OpSec | -41.2% |

| enqAI | -40.1% |

Harambe on Solana marks the highest 7-day loss of -53.9%. Apu Apustaja and The Doge NFT follow with -44.8% and -43.1%, respectively. OpSec and enqAI display -41.2% and -40.1% 7-day loss, respectively.

3.3. Top Stablecoins Analysis

Tether, USDC, Dai, Ethena USDe, and First Digital USD are the top five stablecoins as per market cap.

| Stablecoins | Market Cap |

| Tether | $111,812,258,509 |

| USDC | $32,336,510,399 |

| Dai | $5,303,873,042 |

| Ethena USDe | $2,999,857,950 |

| First Digital USD | $2,902,433,891 |

Among the top stablecoins, Tether has the highest market cap of $111,812,258,509. USDC and Dai follow with $32,336,510,399 and $5,303,873,042 market cap, respectively. Ethena USDe and First Digital USD mark $2,999,857,950 and $2,902,433,891 market cap, respectively.

3.4. Top Memecoins 7-Day Change Analysis

Dogecoin, Shiba Inu, Pepe, dogwifhat, and FLOKI are the top five Memecoins as per market cap. Dogecoin has the highest market cap of $23,012,805,115. Shiba Inu and Pepe follow with $14,884,794,410 and $6,426,728,734 market cap, respectively.

| Memecoins | Market Cap | 7-Day Change |

| Dogecoin | $23,012,805,115 | -3.3% |

| Shiba Inu | $14,884,794,410 | +2.3% |

| Pepe | $6,426,728,734 | +1.7% |

| dogwifhat | $3,337,699,708 | +16.2% |

| FLOKI | $2,481,188,793 | +14.0% |

Among the top five Memecoins, only Dogecoin shows a negative 7-day change; it marks a change of -3.3%. Dogwifhat displays the highest 7-day change of +16.2%. FLOKI closely follows with +14.0%. Shiba Inu and Pepe showcase +2.3% and +1.7% change, respectively.

3.5. Top AI Coins 7-Day Change Analysis

NEAR Protocol, Internet Computer, Fetch.ai, Render, and The Graph are the top five AI Coins as per market cap. NEAR Protocol has the highest market cap of $7,789,058,588 . Internet Computer and Fetch.ai closely follow with $5,578,204,219 and $5,372,352,253 market cap, respectively.

| AI Coins | Market Cap | 7-Day Change |

| NEAR Protocol | $7,789,058,588 | -9.8% |

| Internet Computer | $5,578,204,219 | -2.8% |

| Fetch.ai | $5,372,352,253 | -9.1% |

| Render | $3,892,248,710 | -2.4% |

| The Graph | $2,839,397,653 | -8.0% |

All the top five AI coins show a negative 7-day change. The highest negative 7-day change is recorded by NEAR Protocol (-9.8%). Fetch.ai and The Graph follow with -9.1% and -8.0%, respectively. Internet Computer registers a -2.8% change, and Render records a -2.4% change.

3.6. Top Metaverse Coins 7-Day Change Analysis

Render, FLOKI, Axie Infinity, The Sandbox, and Decentraland are the top five Metaverse Coins on the basis of market cap. Render has the highest market cap of $3,886,518,932. FLOKI, Axie Infinity, and The Sandbox closely follow with $2,458,516,480, $1,081,176,676 and $979,500,947 market cap, respectively.

| Metaverse Coins | Market Cap | 7-Day Change |

| Render | $3,886,518,932 | -2.4% |

| FLOKI | $2,458,516,480 | +14.0% |

| Axie Infinity | $1,081,176,676 | -7.4% |

| The Sandbox | $979,500,947 | -5.5% |

| Decentraland | $829,832,623 | -3.0% |

Among the top five Metaverse coins, only one coin shows a positive 7-day change; FLOKI records a 7-day change of +14.0%. The largest negative 7-day change is reported by Axie Infinity (-7.4%). The Sandbox and Decentraland follow with -5.5% and -3.0%, respectively. Render reports a minimal 7-day change of -2.4%.

4. Crypto ETF Weekly Analysis

The crypto ETF weekly analysis covers Bitcoin Spot ETFs, Bitcoin Futures ETFs, and Ethereum Futures ETFs.

4.1. Bitcoin Spot ETF Price Change Analysis

GBTC, IBIT, FBTC, ARKB and BITB are the top five Bitcoin Spot ETFs based on Asset Under Management. GBTC marks the highest AUM of $24.33B. IBIT closely follows with an AUM of $17.24B.

| Bitcoin Spot ETFs | Price | Change | AUM |

| Grayscale (GBTC) | $60.09 | -1.56% | $24.33B |

| BlackRock (IBIT) | $38.55 | -1.56% | $17.24B |

| Fidelity (FBTC) | $59.16 | -1.65% | $9.90B |

| Ark/21 Shares (ARKB) | $67.55 | -1.75% | $2.85B |

| Bitwise (BITB) | $36.85 | -1.65% | $2.16B |

All the top five Bitcoin Spot ETFs mark a negative change. Ark/21 Shares’s ARKB records the highest negative change of -1.75%. Both Fidelity’ FBTC and Bitwise’s BITB follow with the same change value of -1.65%. Grayscale’s GBTC and BlackRock’s IBIT, both, report the same value of -1.56%.

4.2. Bitcoin Futures ETF Price Change Analysis

BITO, XBTF, BTF, BITS, and ARKA are the top five Bitcoin Futures ETFs as per Asset Under Management. BITO has the highest AUM of $598.78M. XBTF follows with $42.41M AUM.

| Bitcoin Futures ETFs | Price | Change | AUM |

| ProShares (BITO) | $27.28 | -2.12% | $598.78M |

| VanEck (XBTF) | $39.22 | +0.33% | $42.41M |

| Valkyrie (BTF) | $21.07 | -0.61% | $38.20M |

| Global X (BITS) | $66.37 | -2.45% | $26.10M |

| Ark/21 Shares (ARKA) | $65.26 | +2.00% | $8.01M |

Among the top five Bitcoin Futures ETFs, at least two mark a positive change; Ark/21 Share’s ARKA and VanEck’s XBTF register +2.00% and +0.33% change, respectively. The highest negative change is reported by Global X’s BITS (-2.45%). ProShares’s BITO closely follows with -2.12% change. Valkyrie’s BTF also showcases a minimal change of -0.61%.

4.3. Ethereum Futures ETF Price Change Analysis

BITW, BTF, EFUT, EETH, and AETH are the top five Ethereum Futures ETFs based on Asset Under Management. BITW has the highest AUM of $478.00M. BTF follows with $25.93M AUM.

| Ethereum Futures ETFs | Price | Change | AUM |

| Bitwise (BITW) | $37.05 | +0.10% | $478.00M |

| Valkyrie (BTF) | $21.07 | -0.61% | $25.93M |

| VanEck (EFUT) | $29.25 | +0.58% | $7.84M |

| ProShares (EETH) | $81.83 | +0.38% | $6.43M |

| Bitwise (AETH) | $49.50 | +0.15% | $585.75K |

Among the top five Ethereum Futures ETFs, only one displays a negative change; Valkyrie’s BTF shows a change of -0.61%. Others showcase a positive change, though minimal in nature. The highest positive change is marked by VanEck’ EFUT (+0.58%). ProShare’s EETH, Bitwise’s AETH and Bitwise’s BITW follow with +0.38%, +0.15% and +0.10%, respectively.

5. DeFi Protocols Weekly Analysis

Lido, EigenLayer, AAVE, Maker and JustLend are the top five DeFi protocols as per Total Value Locked. Lido marks the highest TVL of $36.002B. EigenLayer and AAVE follow with $19.109B and $13.008B, respectively.

| DeFi Protocols | TVL | 7-Day Change |

| Lido | $36.002B | +2.88% |

| EigenLayer | $19.109B | +3.09% |

| AAVE | $13.008B | +0.40% |

| Maker | $8.87B | -1.67% |

| JustLend | $6.502B | -2.23% |

Among the top five DeFi Protocols, at least three record a positive 7-day change. EigenLayer registers the highest positive change of +3.9%. Lido and AACE follow with +2.88% and +0.40%, respectively. Conversely, JustLend reports the highest negative change of -2.23%. Maker follows with -1.67% change.

6. Crypto Exchange Weekly Analysis

6.1. Top Crypto Centralised Exchanges

Binance, Coinbase Exchange, Bybit, WhiteBIT, and OKX are the top five crypto centralised exchanges on the basis of Monthly Visits.

| Crypto Centralised Exchanges | Monthly Visits | Trust Score |

| Binance | 75.3M | 9/10 |

| Coinbase Exchange | 46.3M | 10/10 |

| Bybit | 31M | 10/10 |

| WhiteBIT | 24.8M | 8/10 |

| OKX | 24.1M | 10/10 |

Among the top five crypto centralised exchanges by Monthly Visits, Binance has the highest number of monthly visits of 75.3M. Coinbase Exchange and Bybit closely follow with 46.3M and 31M monthly visits, respectively. WhiteBIT marks 24.8M monthly visits and OKX 24.1M.

Of these exchanges, at least three, Coinbase Exchange, Bybit, and OKX, report a 10/10 trust score. Binance shows 9/10 trust score and WhiteBIT 8/10.

6.2. Top Crypto Decentralised Exchanges

Uniswap V3 (Ethereum), Jupiter, Orca, Uniswap V3 (Arbitrum One), and Rydium are the top five crypto decentralised exchanges on the basis of Market Share by Volume.

| Crypto Decentralised Exchanges | % Market Share by Volume | 24-Hour Volume |

| Uniswap V3 (Ethereum) | 21.4% | $1,165,265,584 |

| Jupiter | 13.6% | $739,042,874 |

| Orca | 6.5% | $351,937,928 |

| Uniswap V3 (Arbitrum One) | 6.1% | $332,249,299 |

| Raydium | 5.3% | $287,529,813 |

Among the top five decentralised crypto exchanges, Uniswap V3 (Ethereum) has the highest marke share by volume in per cent of 21.4%. Jupiter follows with 13.6%. Orca, Uniswap V3 (Arbitrum One), and Raydium register 6.5%, 6.1% and 5.3%, respectively.

6.3. Top Crypto Derivative Exchanges

Binance (Futures), Bybit(Futures), Deepcoin (Derivatives), Bitget Futures, and CoinW (Futures) are the top five crypto derivative exchanges by 24-hour open interest.

| Crypto Derivative Exchanges | 24-Hour Open Interest | 24-Hour Volume |

| Binance (Futures) | $21,163,375,400 | $48,434,469,183 |

| Bybit (Futures) | $13,529,713,119 | $15,858,146,927 |

| Deepcoin (Derivatives) | $11,096,765,826 | $6,534,055,599 |

| Bitget Futures | $10,764,440,969 | $15,882,809,660 |

| CoinW (Futures) | $7,914,807,900 | $26,636,487,009 |

Among the top five crypto derivative exchanges, Binance (Futures) has the highest 24-hour Open Interest of $21,163,375,400. Bybit (Futures) and DeepCoin (Derivatives) follow with $13,529,713,119 and $11,096,765,826, respectively. Of these exchanges, Binance (Futures) marks the highest volume of $48,434,469,183. CoinW (Futures) follows with $26,636,487,009 volume.

7. NFT Marketplace Weekly Analysis

Blur, Blur Aggregator, Cryptopunks, Gem, X2Y2, and Gem are the top five NFT Marketplaces by Market Share. Blur has the highest market share of 68.79%. Blur Aggregator and Cryptopunks follow with 23.38% and 4.43% market share, respectively.

| NFT Marketplaces | Market Share | Volume Change (Change of last 7-D Volume over the Previous 7-D Volume) |

| Blur | 68.79% | -25.81% |

| Blur Aggregator | 23.38% | -32.53% |

| Cryptopunks | 4.43% | -9.93% |

| X2Y2 | 1.30% | +113% |

| Gem | 0.96% | -0.62% |

Among the top five NFT marketplaces, only one shows a positive volume change; X2Y2 records a massive change of +113%. The highest negative change is recorded by the Blur Aggregator (-32.53%). Blur closely follows with -25.81%. Cryptopunks display a change of -9.93%. Gem registers a minimal change of -0.62%.

7.1. Top NFT Collectibles This Week

Azuki #3374, $ORDI BRC-20 NFTs #8b1e444e, BOOGLE #Ai822dfBR7, CryptoPunks #9461, and CryptoPunks #1714 are the top NFT collectables based on Price.

| NFT Collectibles | Price |

| Azuki #3374 | $393,112.31 |

| $ORDI BRC-20 NFTs #8b1e444e | $305,258.05 |

| BOOGLE #Ai822dfBR7 | $206,935.53 |

| CryptoPunks #9461 | $160,409.63 |

| CryptoPunks #1714 | $160,409.63 |

Azuki #3374 marks the highest price of $393,112.31. $ORDI BRC-20 NFTs #8b1e444e and BOOGLE #Ai822dfBR7 follow with $305,258.05 and $206,935.53 price, respectively. CryptoPunks #9461 reports $160,409.63 price, and CryptoPunks #1714 registers $160,409.63 price.

8. Web3, Blockchain & Crypto Funding Analysis

8.1. Crypto Fundraising Trend

| Week | Funds Raised | Number of Fundraising Rounds |

| May 27 – June 2, 2024 | $348.10M | 38 |

| May 20 – 26, 2024 | $250.47M | 32 |

This week, the crypto sector has so far raised nearly $348.10M, higher than the previous year’s value of $250.47M.

8.2. Most Active Investors This Week

Animoca Brands, DWF Labs, Blockchain Founders Fund, SNZ Holdings, and The Spartan are the most active investors this week, based on the number of deals.

| Investors (or Fund’s Name) | Deals (26 May – 1 June, 2024) | Investments | Lead Investments |

| Animoca Brands | 7 | 6 | 1 |

| DWF Labs | 3 | 2 | 1 |

| Blockchain Founders Fund | 3 | 2 | 1 |

| SNZ Holdings | 3 | 2 | 1 |

| The Spartan Group | 3 | 3 | 0 |

Among the most active investors, Animoca Brands records the highest number of deals of 7, of which at least 6 are investments and one lead investment. DWF Labs, Blockchain Founders Fund, SNZ Holdings, and The Spartan Group mark three deals each; among them, The Spartan Group records no lead investments, but others register a deal each.

8.3. Crypto Fundraising By Category

Blockchain Infrastructure, Blockchain Services, CeFi, Chain, DeFi, GameFi, NFT and Social are the categories raised funds this week.

| Category | Number of Fundraising Rounds (May 27 – June 2, 24) | Funds Raised |

| Blockchain Infrastructure | 6 | $98.50M |

| Blockchain Services | 5 | $170.30M |

| CeFi | 2 | $7.25M |

| Chain | 3 | $8.30M |

| DeFi | 9 | $34.20M |

| GameFi | 8 | $23.80M |

| Social | 5 | $5.75M |

Blockchain Services is the category that raised the highest amount of $170.30M. Blockchain Infrastructure follows with $98.50M. DeFi and GameFi show $34.20M and $23.80M funds raised, respectively. Chain, CeFi and Social report $8.30M, $7.25M, and $5.75M, respectively.

8.4. Top Crypto Investment Locations

Apart from the undisclosed category, Singapore, the US, China, Switzerland, Cayman Islands, and Colombia are the top crypto investment locations, on the basis of funds raised.

| Investment Location | Funds Raised (May 26 – June 1, 2024) | Funds Raised % | Number of Rounds |

| Singapore | $150.00M | 43% | 2 |

| Undisclosed | $93.65M | 27% | 23 |

| United States | $86.45M | 25% | 6 |

| China | $6.00M | 2% | 1 |

| Switzerland | $5.00M | 1% | 1 |

| Cayman Island | $4.00M | 1% | 1 |

| Colombia | $3.00M | 1% | 1 |

Singapore is the topmost crypto investment location, with $150.00M funds raised. The Undisclosed category is the one which follows with $93.65M. The US, the third highest crypto investment location, records $86.45M funds raised. China, Switzerland, Cayman Island, and Colombia mark $6.00M, $5.00M, $4.0M and $3.00M, respectively.

8.5. Most Active Crypto VC Jurisdictions

The US, Singapore, China, the UK, Switzerland, and the UAE are the most active crypto venture capital jurisdictions.

| Crypto VC Jurisdiction | Number of Projects (May 26 – June 1, 2024) |

| The United States | 69 |

| Singapore | 20 |

| China | 17 |

| The United Kingdom | 6 |

| Switzerland | 5 |

| The UAE | 5 |

The US, with 69 projects, is the top most venture capital jurisdiction this week. Singapore and China follow with 20 and 17 projects, respectively. The UK shows six projects, and Switzerland and the UAE, both, record five projects each.

9. Web 3, Blockchain & Crypto Hack Updates

The total value hacked is $8.2B. The total value hacked in DeFi is $5.96B, and total value hacked in Bridges is $2.83 billion.

| Total Value Hacked | $8.2B

Total Value Hacked in DeFi$5.96BTotal Value Hacked in Bridges $2.83B |

| Project Name | Amount Lost | Date |

| DMM Bitcoin | $305M | 31 May, 2024 |

| Gala | $22M | 20 May, 2024 |

| ALEX | $23.9M | 16 May. 2024 |

| pump.fun | $2M | 16 May, 2024 |

| Sonne Finance | $20M | 15 May, 2024 |

DMM Bitcoin, Gala, ALEX, pump.fun and Sonne Finance are the top five project hacks reported this month. The Sonne Finance hack is the first reported this month. In this hack reported on 15th May, 2024, the project lost nearly $20M. ALEX and pump.fun were reported on 16th May. In the ALEX hack, nearly $23.9M was lost. In the pump.fun hack, only $2M was lost. It is the smallest hack this month in terms of the amount lost. In the Gala hack, reported on 20th May, nearly $22M were lost. The DMM Bitcoin hack, reported on 31st May, 2024, is the latest hack. The hack resulted in a huge loss of $305M, which is the worst loss reported in recent history.

Endnote

This report comprehensively analyses the current performance of various blockchains and cryptocurrencies, including Bitcoin, Altcoins, Stablecoins, AI Coins, Memecoins and Metaverse. It highlights trending coins, top gainers and losers, and delves into Crypto ETFs such as Bitcoin Spot ETFS, Bitcoin Futures ETFs, and Ethereum Futures ETFs. Additionally, it examines centralised, decentralised, and derivatives crypto exchanges, DeFi protocols, and NFT marketplaces. The report also covers crypto fundraising activities, prominent investors, key investment locations, and notable crypto hacks reported lately.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

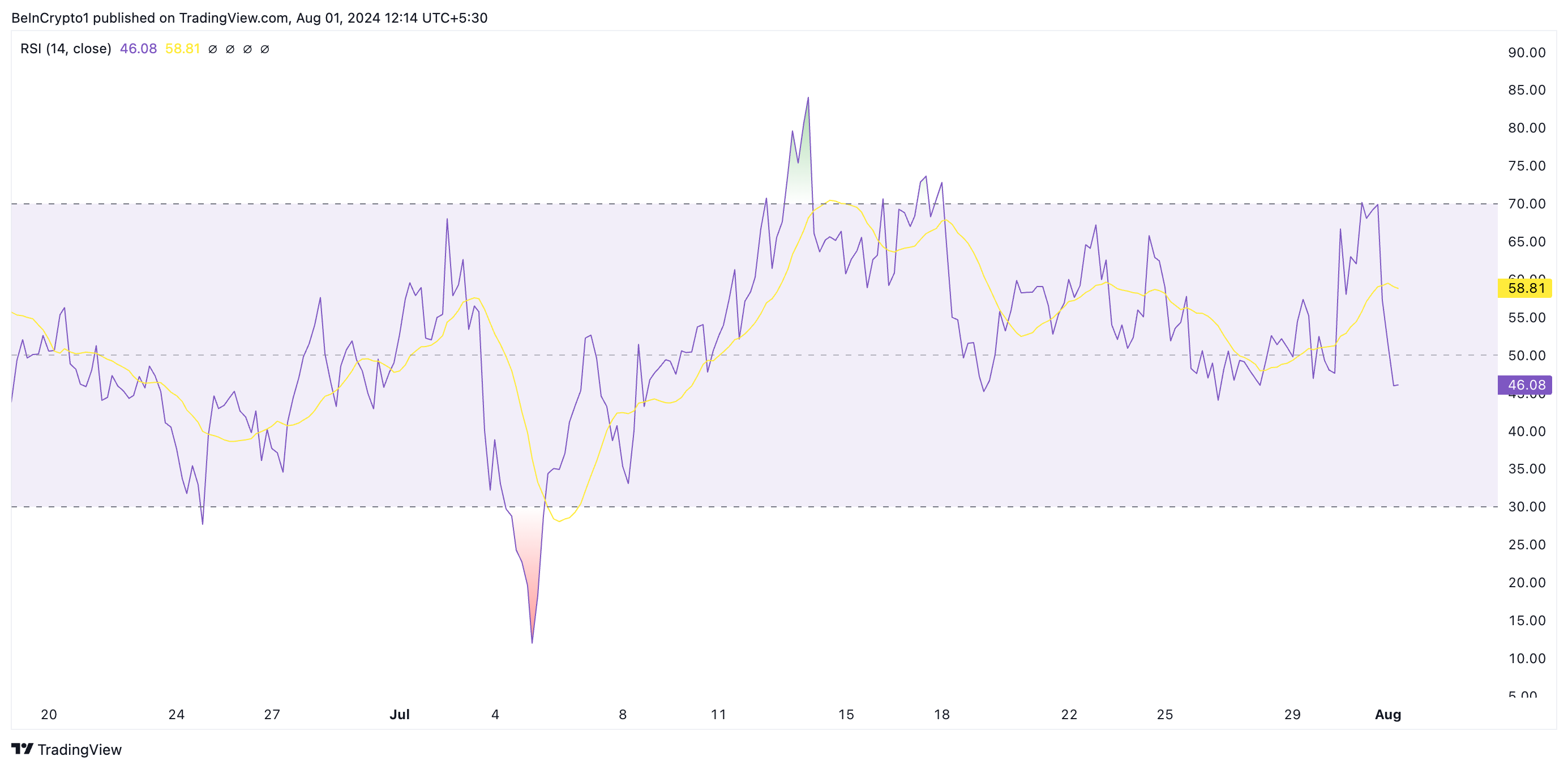

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit