Markets

Volatility ahead as Whales make $40 million

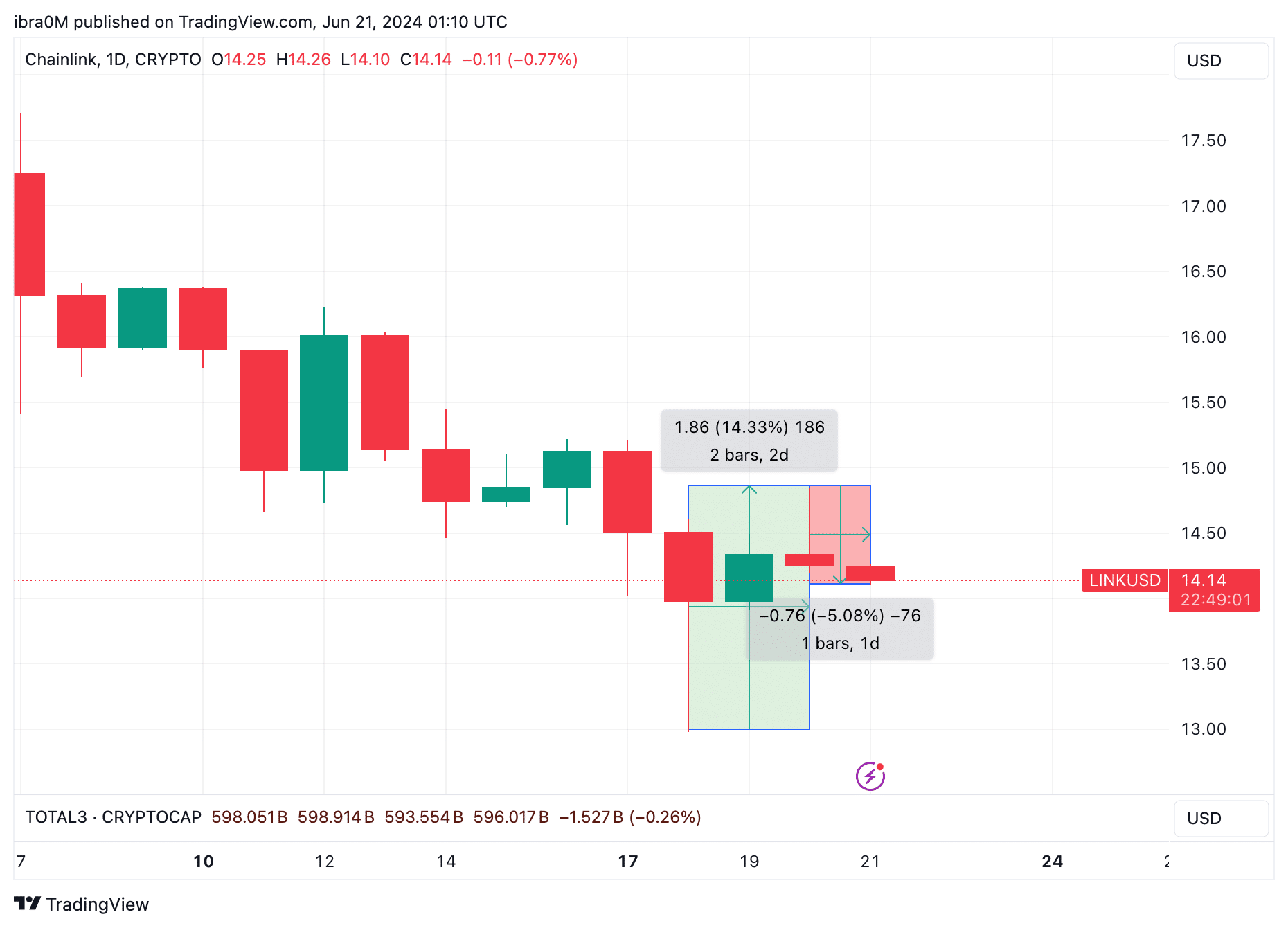

Chainlink price fell 5% on Thursday, June 20, 2024, as bulls failed to capitalize on the 10% bounce recorded 48 hours earlier; On-chain data shows that Whaling investors unloading behind the scenes may be behind the latest pullback.

Chainlink drops 5% as bears interrupt rebound phase

Chainlink price posted double-digit gains between June 18 and 19, when the SEC dropped its investigation into Ethereum and triggered a brief rebound in cryptocurrency markets.

But like the US S&P 500, led by the chip manufacturing giant NVIDIArose to new highs on Wednesday, it caught the attention of seasoned cryptocurrency traders, some of whom appear to have now redirected short-term gains into roaring stock markets.

As things currently stand, on June 20, LINK’s price succumbed to another wave of bearish pressure.

The chart above shows how LINK price gained 14.33% after plummeting towards $12.98 on June 18. Notably, that was the first time in 32 days, dating back to May 15, that Chainlink’s price fell below the critical $13 mark.

This brief bounce in Chainlink prices was evidently fueled by bullish sentiment surrounding the SEC’s muted stance on Ethereum. However, after reaching a major resistance group around the $15 mark, the bears are now back in the driver’s seat.

Chainlink Whales Unload $40 Million as SEC Ends Ethereum Investigations

The latest price data shows that LINK has fluctuated 5% on the daily time frame as it quickly retraced the $14 territory at the time of writing on June 20. Looking at the underlying on-chain data, it appears that Chainlink whale investors took advantage of the brief to initiate the market recovery and offload some of their holdings.

The Santiment chart below tracks real-time changes in the balance of LINK tokens held by the 1,000 largest Chainlink whale wallets.

The yellow shaded trend line in the chart above shows how the top 100 whale wallets held a total of 704.47 million LINK tokens as of June 16, having remained firmly in their positions as the cryptocurrency market’s correction phase ensued lasted a month.

But on June 17, when news of Ethereum’s historic legal clearance from the SEC broke, Chainlink whales immediately went into a selling frenzy. At the time of publication on June 20, the top 100 largest LINK whales now hold a cumulative balance of 702.22 million LINKs.

This effectively means that Chainlink whales sold approximately 2.25 million LINK tokens between June 17th and 20th. Valued at the current price of approximately $14.20 per coin, the recently downloaded coins are worth approximately $40 million.

Such a rapid selling trend among whale investors is often considered a major bearish signal. Not surprisingly, the whale selling frenzy coincided with the 5% price correction recorded on Thursday.

Chainlink Price Prediction: $13 Support Still at Risk

Despite the 5% correction towards $14.2, Chainlink price is still a good distance away from the weekly low of $12.98 recorded on June 18. But when whale investors sell such a large amount of coins in a short period, they send bearish signals to others. strategic retail merchants within the ecosystem.

After breaking the $13 support earlier in the week, bears may now aim for a much larger decline towards $12.

However, IntoTheBlock’s GIOM chart shows that LINK bulls will move the buy-wall support towards the $12.40 area. As seen above, 59,180 active addresses purchased 67.88 million LINKS at the average price of $12.43. To avoid massive liquidations with losses, bull traders may start to arrange covering purchases once LINK price starts to collapse towards the $12.40 area.

But if this support were to collapse, the price of Chainlink could suffer a further decline towards the $11 mark.

On the other hand, the bulls could regain their foothold in the markets if Chainlink manages to reclaim the psychological resistance of $15 in the coming days.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Announcement-