Markets

US spot Bitcoin ETFs attracted over $1 billion in net inflows last week despite bearish sentiment in cryptocurrency markets

Key points

- US spot Bitcoin ETFs have attracted over $1 billion in a week.

- Mt. Gox creditor repayments could represent a buying opportunity for Wall Street.

Share this article

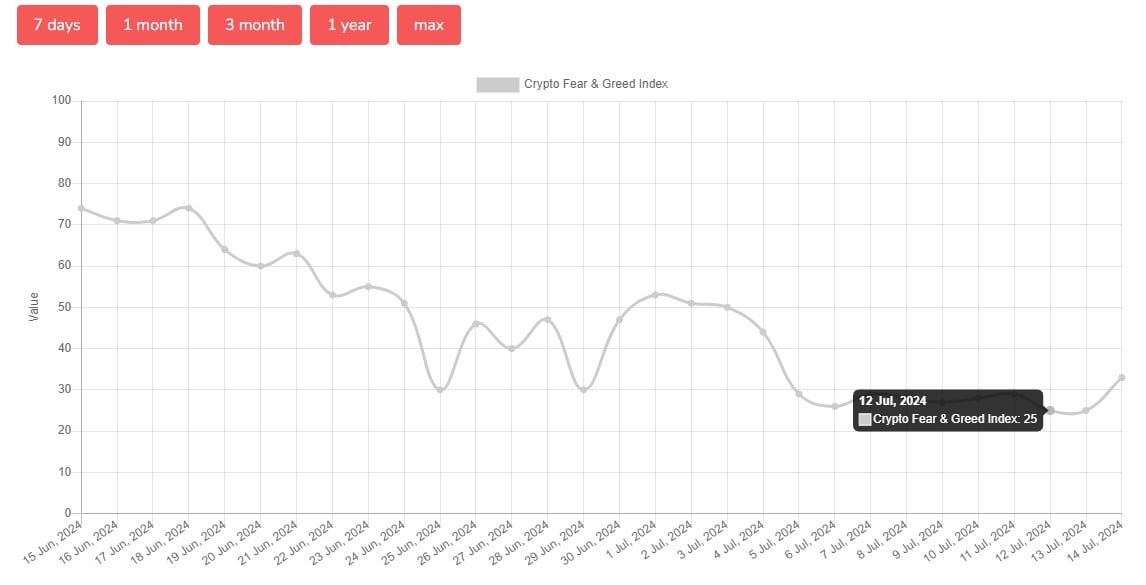

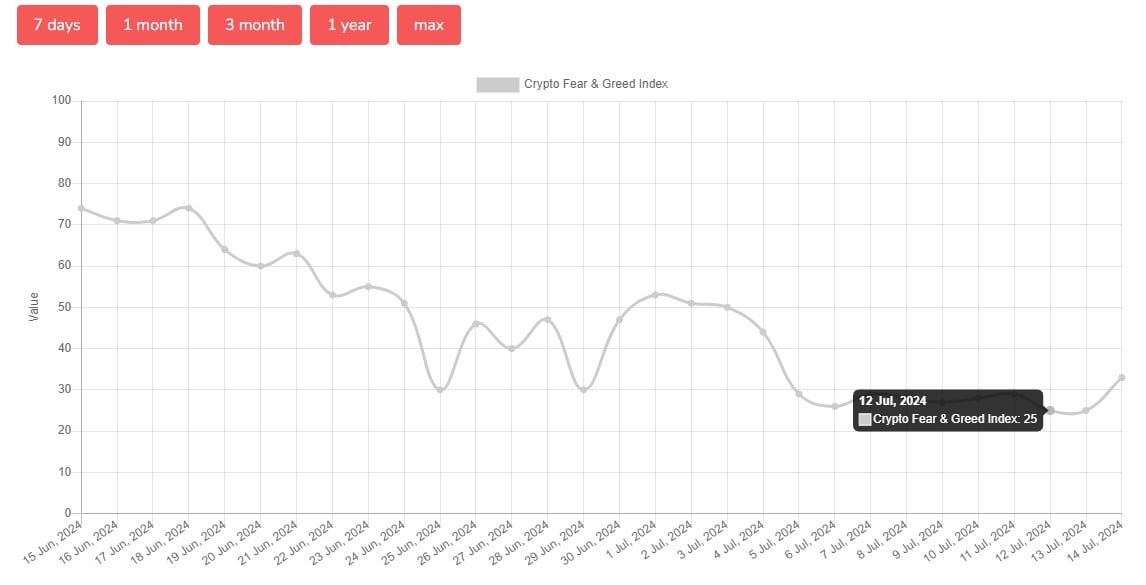

US spot Bitcoin exchange-traded funds (ETFs) have attracted over $1 billion in net inflows over the past week, despite bearish sentiment in cryptocurrency markets, with the Crypto Fear and Greed Index plunging to its lowest point since January 2023.

Data from Alternative.me shows that the Crypto Fear and Greed Index, a tool used to gauge overall investor sentiment in the cryptocurrency market, particularly towards Bitcoin, fell to 25, the “extreme fear” zone on Friday.

The declining index score came as the price of Bitcoin (BTC) has struggled to break above the $60,000 mark for over a week, stagnating between the $57,000 and $58,000 levels, according to TradingView data Shows.

Over the past week, the index remained below 30 until reaching 33 today as Bitcoin Reclaims $60,000 Milestone.

Despite the bearish momentum, US spot Bitcoin ETFs had a successful week. According to data According to SoSoValue, U.S. spot Bitcoin ETFs saw $310 million in inflows on Friday alone, marking the largest daily inflow in five weeks.

BlackRock’s IBIT leads the way with $120 million in daily inflows, followed closely by Fidelity’s FBTC with about $115 million.

The last time U.S. Bitcoin ETFs generated daily inflows above $310 was June 5, when investors poured $488 million into the funds, data from SoSoValue shows.

While investors were actively investing in US Bitcoin funds, the German government was gradually moving its Bitcoin to various crypto platforms.

AS reported By Crypto Briefing, On Friday, wallets allegedly owned by the German government completed the move of $3 billion in Bitcoin to exchanges and cryptocurrency addresses suspected of being linked to OTC trading desks. However, it is not known whether the government is selling its BTC.

Most cryptocurrency investors are still pessimistic about the short-term future of Bitcoin, as selling pressure from many whales and large entities continues to weigh on the market.

Attention is currently focused on Mt. Gox creditor repayments, and Wall Street may seize the opportunity to buy on the dip.

Share this article