News

Understanding Crypto Money Laundering and How to Control It

by Johanan Devanesan

July 18, 2024

The rapid rise of cryptocurrencies has ushered in a new era of financial innovation, but has also created new challenges in the fight against financial crime. A recent comprehensive report from Chainalysis sheds light on the complex world of cryptocurrency-related money laundering.

The large-scale study encompasses both native and non-native methods of cryptography, as well as prevention strategies. Today, we examine the key findings, focusing on the most significant trends and data points, to provide a deep understanding of this complex problem.

The scale of crypto money laundering

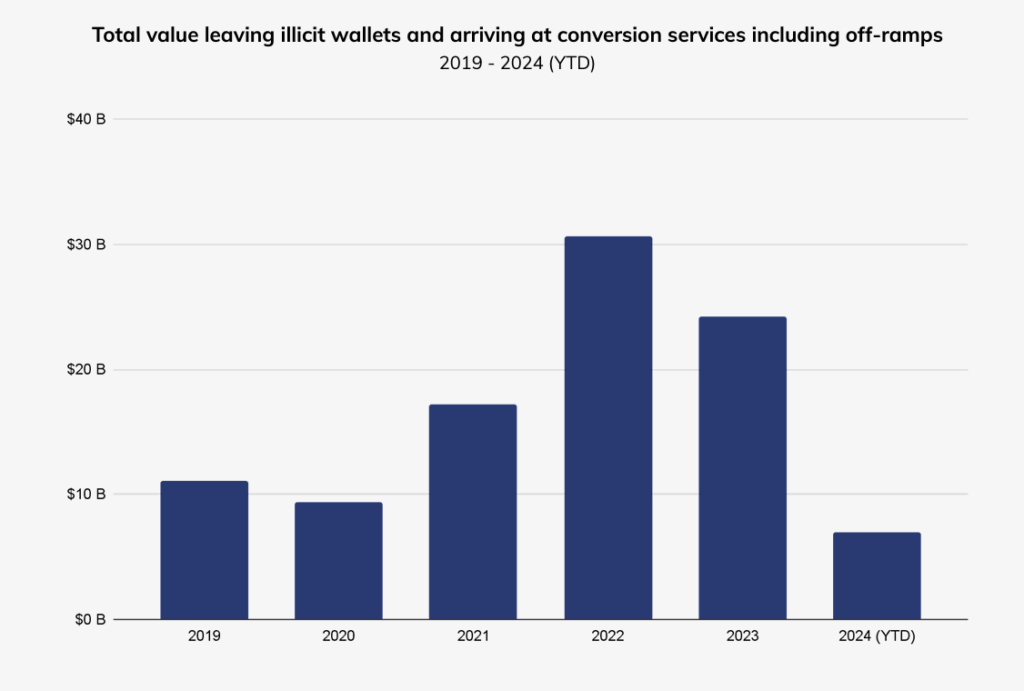

The scale of cryptocurrency-related money laundering is staggering. Since 2019, nearly $100 billion in funds have been transferred from known illicit wallets to conversion services.

The peak was reached in 2022, with an alarming $30 billion identified, largely attributable to transactions involving sanctioned services such as the Russian exchange Garantex.

And unlike the non-crypto native space, the Hong Kong Monetary Authority (HKMA) has just fined DBS Bank (Hong Kong) Limited, the Hong Kong subsidiary DBSA HK$10 million fine for violations of the Ordinance on the fight against money laundering and the financing of terrorism (AMLO).

The HKMA concluded that the bank failed to continuously monitor business relationships, failed to exercise enhanced due diligence in high-risk situations for a period of time and failed to maintain adequate records for some customers.

These figures underscore the immense challenge facing regulators and law enforcement in their efforts to curb illicit financial flows in the crypto space.

Money laundering techniques based on cryptocurrencies

Intermediate wallets: more than 80% of the value of laundering channels

One of the main methods employed in crypto-native money laundering is the use of intermediary wallets. This “layering” process is designed to obscure the link between illicit funds and their eventual integration into the legitimate financial system.

THE Chain Analysis Report reveals that intermediary wallets often represent more than 80% of the total value circulating in laundering channels, highlighting their essential role in these illicit operations.

The proliferation of intermediary wallets has been remarkable. By 2023, there were over 1.4 million intermediary wallets known to be moving illicit funds, a substantial increase from around 800,000 in 2022.

This growth indicates that criminals are becoming more sophisticated in their attempts to evade detection, using increasingly complex wallet networks to hide the trail of illicit funds.

Cryptocurrency Obfuscation Services: Mixers, Privacy Cryptocurrencies, and Gateways

Mixers, also known as tumblers, have seen a fluctuating popularity as a money laundering tool. These services mix together the cryptocurrencies of many users, making it difficult to trace the origin of the funds.

Mixer usage peaked in 2022, with over $1.5 billion in perceived value in April alone. While usage has declined following regulatory action, some mixers like Tornado Cash have seen renewed growth in 2024, suggesting criminals are adapting to regulatory pressures.

Private coins, in particular Monerohave seen increased adoption among those looking to avoid controls. Monero transactions have been steadily increasing, with a notable spike in March 2024 due to a spam event called Black Marble.

The enhanced anonymity features of privacy coins make them particularly attractive to illicit actors, posing significant challenges to law enforcement and compliance professionals.

Crypto bridges, which facilitate the transfer of assets between different blockchain networks, are increasingly popular for money laundering. In January 2024, nearly $234 million in illicit flows were recorded via bridges – the highest value to date.

This trend highlights how criminals are exploiting the interoperability of different blockchain networks to further obscure the trail of illicit funds.

Destination of illicit funds

The report reveals that more than 50% of illicit funds end up on centralized exchanges, either directly or indirectly. This preference for centralized exchanges is likely due to their high liquidity and the ease with which they can convert cryptocurrencies into fiat currency.

However, there has been a notable downward trend in the volume received by centralised exchanges, from almost £2 billion per month at its peak to around £780 million per month.

This decrease suggests that centralized exchanges’ anti-money laundering (AML) programs are becoming more effective in detecting and mitigating laundering activities.

Non-Crypto-Native Money Laundering Methods

As traditional money launderers adapt to the digital age, they are integrating cryptocurrencies into their operations. String analysis The report identifies several on-chain activity patterns that may indicate non-crypto native money laundering, providing valuable insights to compliance professionals and law enforcement agencies.

Transfers just below reporting thresholds

The report highlights notable increases in transfers just below the $1,000, $3,000 and $10,000 thresholds. These thresholds correspond to various regulatory reporting requirements, suggesting that some actors may be structuring their payments to avoid triggering additional scrutiny.

This behavior, known as “smurfing” in traditional finance, appears to have been adapted to the crypto world.

Using Multiple Intermediate Wallets

Interestingly, the number of intermediary wallets used by bad actors is increasing faster on exchanges with KYC (Know Your Customer) verification processes compared to non-KYC exchanges.

This trend could indicate that launderers are becoming increasingly sophisticated in their attempts to evade detection on platforms with stricter verification processes, potentially using multiple wallets to fragment their activities and avoid raising red flags.

Consolidation portfolios

Another technique to watch out for is the use of consolidation wallets, which receive and combine funds from multiple sources. In 2024, the top 100 bitcoin consolidation wallets received £968 million worth of bitcoin from over 14,970 separate addresses.

Expanding the scope, over 1,500 consolidation wallets received a total of £2.6 billion worth of bitcoin in 2024, with each receiving funds from at least ten different wallets.

This consolidation pattern could indicate attempts to obscure the origin of funds before transferring them to exchanges or other withdrawal points.

Prevention strategies

To combat money laundering, whether crypto-native or not, a multidimensional approach is needed. This includes strong regulatory frameworks, advanced technological solutions, and enhanced global cooperation.

Regulatory frameworks

The report highlights various regulatory initiatives around the world that are shaping the fight against cryptocurrency-related money laundering:

- The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) and the updated Transfer of Funds Regulation (TFR) extend anti-money laundering requirements to virtual asset service providers (VASPs) and implement the travel rule for crypto transactions.

- Singapore Payment Services Act (PSA) places cryptocurrency businesses under regulatory oversight, impose strict AML/CFT requirements.

- Hong Kong’s amendments to the aforementioned Anti-Money Laundering and Combating the Financing of Terrorism Ordinance (AMLO) formally cover the operation of virtual asset businesses, with a New regulatory regime for virtual asset trading platforms.

- The UK has implemented proactive domestic law enforcement measures, including the power to seize crypto assets suspected of being involved in money laundering activities before making arrests.

- The United Arab Emirates amended Federal Decree Law No. (20) of 2018 to introduce AML/CFT requirements for VASPs, with various regulatory authorities providing specific requirements in their jurisdictions.

- The United States continues to rely on the Bank Secrecy Act (BSA) as the primary legal framework governing AML regulations, with the Financial Crimes Enforcement Network (FinCEN) providing guidance on how these regulations apply to cryptocurrency businesses.

Technological solutions

Advanced transaction monitoring systems play a crucial role in combating money laundering. The report highlights the growing adoption of blockchain analytics tools, with the number of transactions reviewed by Chainalysis’ crypto compliance solutions increasing significantly from less than 200 million in 2018 to more than 1.4 billion by 2024.

These tools use machine learning and artificial intelligence to detect unusual patterns indicative of money laundering, providing real-time alerts to compliance teams.

Cross-border collaboration and public-private partnerships

The report highlights the need for international cooperation to address the cross-border nature of cryptocurrency transactions. This involves harmonizing regulations across jurisdictions, sharing intelligence, and conducting joint operations.

Public-private partnerships are also essential, enabling the exchange of information and best practices between government agencies and crypto companies.

Combating cryptocurrency-related money laundering is an ongoing challenge that requires constant vigilance and adaptation. As the cryptocurrency ecosystem continues to evolve, so do strategies to prevent its exploitation for illicit purposes.

By combining strong regulatory frameworks, cutting-edge technology, and international cooperation, the crypto industry can work towards building a safer and more reliable financial system.

Featured Image Credit: Edited from Freepik

Get the latest Fintech Singapore news delivered to your inbox once a month