DeFi

“Exchange what you want, with who you want”

HONG KONG, June 10, 2024 /PRNewswire/ — The world of decentralized finance (DeFi) is a vital part of the cryptocurrency industry, offering innovative financial solutions outside of traditional banking systems. However, as the industry evolves, DeFi mechanisms become more and more complex. This complexity presents challenges not only for newcomers but also for seasoned enthusiasts, often referred to as “DeFi Degens,” who need a lot of time to understand the sophisticated operations.

Founders

SOFA Workflow Overview

In simpler terms, if early DeFi could be compared to a basic children’s Lego set, today’s DeFi is more akin to a Technic Lego set with thousands of complex pieces. Innovating within DeFi to reduce this complexity and make it more accessible has become a pressing need.

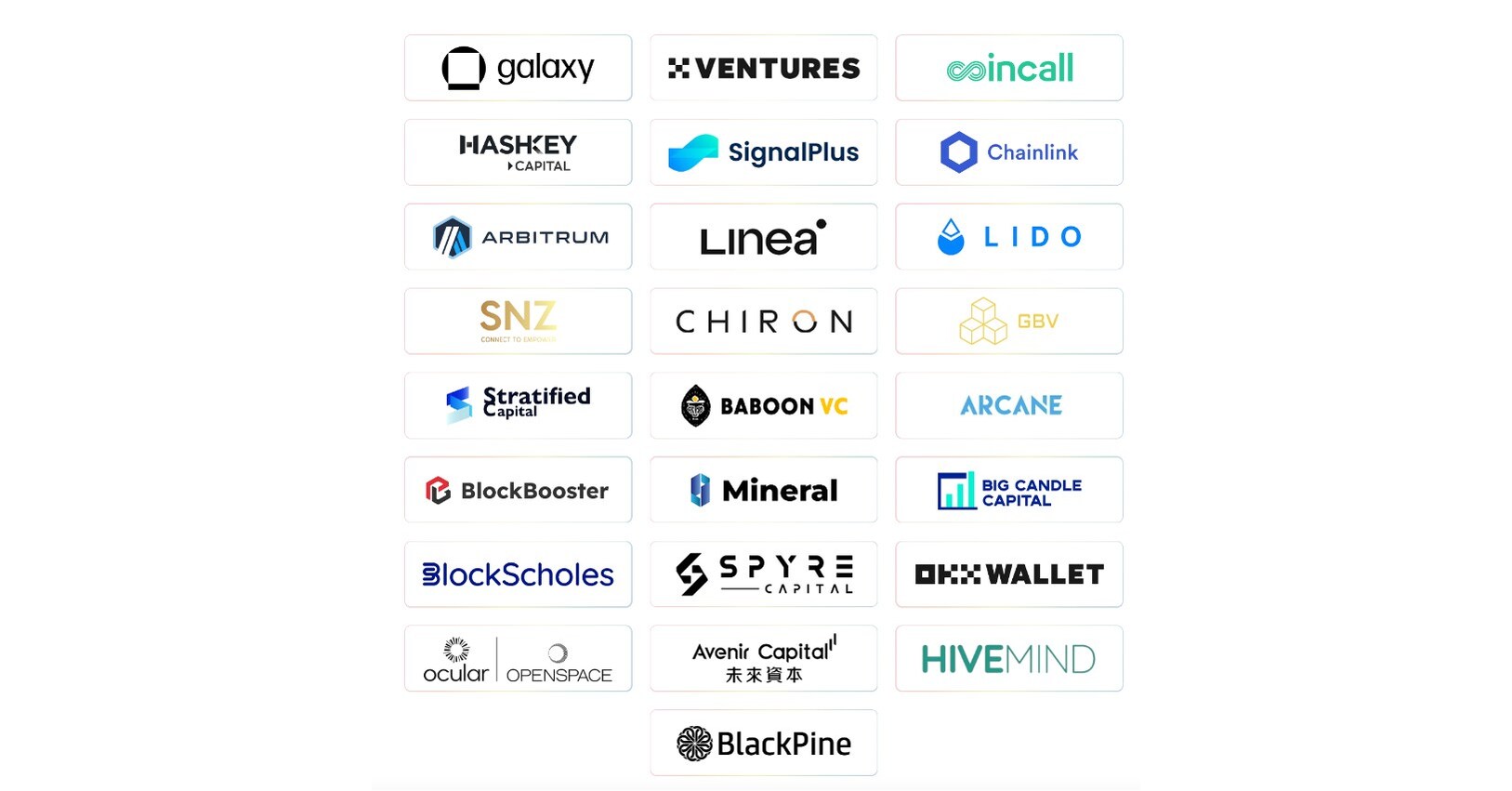

To solve this problem, various DeFi protocols, investment institutions, middleware providers and blockchain builders have come together to form SOFA.org, a decentralized non-profit organization. SOFA.org is dedicated to promoting the highest standards in DeFi, supporting high-quality projects, and advocating for the widespread adoption of blockchain technology in finance. Its founding members include notable names such as Galaxy Asia Trading Ltd, OKX Wallet, Coincall, HashKey Capital, SignalPlus, and Chainlink, among others.

SOFA.org’s grand vision for an on-chain clearing ecosystem

Clearing is one of the most critical elements of DeFi derivatives trading, ensuring the stability of the system and protecting the interests of all participants. Today’s DeFi derivatives are diverse and complex, involving various assets and complex business logic. In the decentralized world, clearing is carried out via smart contracts and decentralized protocols, enabling automated processes with minimal trust required. This real-time clearing ensures the security of participants’ funds and maintains the integrity of transactions.

SOFA.org aims to tackle the complexities of on-chain derivatives with the near-term goal of creating a comprehensive clearing and settlement ecosystem. Essentially, SOFA.org aspires to be the “Android” of DeFi, allowing various DeFi protocols to clear different financial derivatives on its platform. Just like mobile apps installed on different phones, these derivatives positions can operate seamlessly across different protocols. By joining SOFA.org, the protocols will achieve underlying interoperability, allowing them to mutually offset their derivatives positions. This will pave the way for even more complex and sophisticated on-chain financial products.

Overview of SOFA protocols

SOFA.org unveils a set of structured products called SOFA protocols. This innovative protocol brings together several functions of the DeFi product, creating a hybrid derivatives protocol. The initial launch will take place on Ethereum and Arbitrum, with future expansions planned for Linea, X Layer and other EVM-enabled chains.

SOFA protocols offer a new way to manage crypto by making transactions clear and secure. It allows users to benefit from the best products without worrying about who they are trading with or where their money is held. All details are recorded transparently on the blockchain, supporting a wide range of products. Tokenized positions improve capital efficiency and can be pledged on DeFi and centralized platforms as assets. Using ERC-1155 tokens saves money and the system is designed to be durable and user-friendly.

As the first proof of concept of SOFA, they will initially focus on three popular product structures called Rangebound, Bull Trend, and Bear Trend.. All of these products are available in “Earn” or “Surge” format. Additionally, additional product types will be continually added based on user demand and ecosystem feedback.

SOFA Workflow Overview

The volatile nature of crypto asset prices often causes them to move up, down, or sideways. SOFA protocols recognize these patterns and have transformed them into Bull Trend, Bear Trend and Rangebound structures, and available in “Earn” and “Surge” formats to suit different risk preferences.

Earn is designed for users seeking stability and capital preservation. This involves depositing initial funds into established yield protocols such as Compound or AAVE to generate base interest. This process is meticulously reviewed, with governance token holders voting on the choice of protocol. If market conditions match specific criteria, additional profits can be generated.

Earn aims to minimize risks, ensuring the safety of the initial deposit, providing stable returns and providing the opportunity to make additional profits without risking capital. Even though potential returns are lower than high-risk products and profits are capped in highly volatile markets, it remains a reliable option.

For example, if a user opts for a Rangebound structured product with an annual yield of 4% in Earn and predicts that ETH will fluctuate between $3,500 and $3,900 by June 28, they will get an excess return if the ETH remains in this range at expiration. If ETH breaks out of this range, it will still earn a 4% annual return.

Overvoltage aims to maximize potential returns by speculating on high-risk strategies. This product involves predicting a specific price range for crypto assets at a given time. If the price is within the expected range, users receive high returns. However, if the prediction is incorrect, the user will lose the initial deposit.

For example, if a user predicts that the price of Bitcoin will be between $71,250 and $74,000 on June 11 and purchases notes worth $20, the potential return could be $60.28. Conversely, the maximum loss would be $20.

SOFA Protocols’ products look like a combination of various DeFi protocol offerings. The innovation of SOFA protocols lies in integrating the strengths of multiple protocols, providing a more intuitive user interface and user-friendly interactive products. This approach is particularly beneficial for new entrants and those who do not wish to delve deeper into the complexities of DeFi.

SOFA Protocols aims to improve user experience and offer a rich set of financial tools to the market. In doing so, it promotes the further development of the DeFi ecosystem, making it accessible and beneficial to a wider range of users.

Tokenomics: the war of curves

In terms of business model, SOFA.org uses a dual-token model similar to many GameFi projects, incorporating unique game theory mechanics. The dual token system includes the RCH utility token and the SOFA governance token.

RCH token: The total supply is 37 million. Before the official launch, 67.6% (25 million RCH) will be placed in a Uniswap liquidity pool with at least 700 ETH (approximately $2.7 million) to establish the initial price and liquidity. The corresponding Uniswap LP tokens will be destroyed, permanently blocking this part of the liquidity in Uniswap.

The remaining 32.3% of RCH tokens will be released on a fixed schedule. After launch, 12,500 RCH will be unlocked daily, decreasing by 20% every 180 days until all tokens are distributed. This allocation method ensures a gradual release, avoiding market volatility.

Initially, daily RCH production represents only 0.05% of the circulating supply, which has minimal impact on the market. Simultaneously, all revenue from the SOFA.org ecosystem will be used to purchase and burn RCH on Uniswap, further increasing its scarcity and value.

SOFA Token: The launch is planned six months after the project comes into operation. SOFA tokens grant their holders voting rights to directly participate in ecosystem decisions. As a decentralized, non-profit, open source technology organization, all decisions at SOFA.org will be determined by the votes of SOFA token holders.

Early Founding Members, Developers, Ecosystem Advisors, Active Community Members, Early RCH AMM Liquidity Contributors, and CeFi and DeFi protocols supporting SOFA Protocol Position Tokens will have the opportunity to get SOFA tokens.

The economic value of SOFA tokens is directly linked to their governance function. Holders can vote on the introduction of new financial products, the ratio of RCH distribution between introduced products and the ratio of distribution between protocols within the ecosystem. The inclusion of new guarantees and new partners also requires the approval of SOFA holders.

As SOFA.org’s popularity grows, a positive flywheel effect between RCH and SOFA will ignite the market. Increased use of SOFA.org will result in full use of fees to purchase and burn RCH. However, the daily production of RCH is fixed, which further increases its rarity and market value.

As RCH prices increase, some users will increase their use of SOFA.org ecosystem projects to obtain more RCH, while others will purchase SOFA tokens to influence the distribution of RCH. Some projects in the SOFA.org ecosystem may even bribe SOFA holders to obtain higher RCH allocation ratios, thereby boosting project usage.

It seems a new war of curves is on the horizon.

Media Contact:

Lynloo Lee

+65 88107289

[email protected]

SOURCE SOFA.org

DeFi

Haust Network Partners with Gateway to Connect to AggLayer

Dubai, United Arab Emirates, August 1, 2024, Chainwire

Consumer adoption of cryptocurrencies is a snowball that is accelerating by the day. More and more people around the world are clamoring for access to DeFi. However, the user interface and user experience of cryptocurrencies still lag behind their fundamental utility, and users lack the simple and secure access they need to truly on-chain products.

Haust Network is a network and suite of products focused on changing this paradigm and bringing DeFi to the masses. To achieve this goal, Haust Network has announced its far-reaching partnership with bridgeseasoned veterans in rapidly delivering revolutionary blockchain utilities for projects. The Gateway team empowers blockchain developers to build DAOs, NFT platforms, payment services, and more. They drive adoption of crypto primitives for individuals and institutions around the world by helping everyone build their on-chain presence.

Gateway specializes in connecting sovereign blockchains to the Aggregation Layer (AggLayer). The AggLayer is a single unified contract that powers the Ethereum bridge of many disparate blockchains, allowing them all to connect to a single unified liquidity pool. The AggLayer abstracts away the complexities of cross-chain DeFi, making tedious multi-chain transactions as easy for the end user as a single click. It’s all about creating access to DeFi, and with Polygon’s technology and the help of Gateways, Haust is doing just that.

As part of their partnership, Gateway will build an advanced zkEVM blockchain for Haust Network, leveraging its extensive experience to deploy ultra-fast sovereign applications with unmatched security, and enabling Haust Network to deliver its products to its audience.

The recently announced launch of the Haust Wallet is a Telegram mini-app that provides users with access to DeFi directly through the Telegram interface. Users who deposit funds into the wallet will have access to all standard send/receive services and generate an automatic yield on their funds. The yield is generated by Haust Network’s interconnected network of smart contracts, Haustoria, which provides automated and passive DeFi yielding.

As part of this partnership, the Haust Network development team will work closely with Gateway developers to launch Haust Network. Gateway is an implementation provider for Polygon CDK and zkEVM technology, which the Haust wallet will leverage to deliver advanced DeFi tools directly to the wallet users’ fingertips. Haust’s partnership with Gateway comes shortly after the announcement of a high-profile alliance with the Polygon community. Together, the three will work to build Haust Network and connect its products to the AggLayer.

About Haust Network

Haust Network is an application-based absolute liquidity network and will be built to be compatible with the Ethereum Virtual Machine (EVM). Haust aims to provide native yield to all users’ assets. In Telegram’s Haust Wallet, users can spend and collect their cryptocurrencies in one easy place, at the same time. Haust operates its network of self-balancing smart contracts that interact across multiple blockchains and then efficiently funnel what has been generated to Haust users.

About Gateway

bridge is a leading white-label blockchain provider that offers no-code protocol deployment. Users can launch custom blockchains in just ten minutes. They are an implementation provider for Polygon CDK and have already helped projects like Wirex, Gnosis Pay, and PalmNFT bring new utility to the crypto landscape.

About Polygon Labs

Polygon Laboratories Polygon Labs is a software development company building and developing a network of aggregated blockchains via the AggLayer, secured by Ethereum. As a public infrastructure, the AggLayer will aggregate the user bases and liquidity of any connected chain, and leverage Ethereum as the settlement layer. Polygon Labs has also contributed to the core development of several widely adopted scaling protocols and tools for launching blockchains, including Polygon PoS, Polygon zkEVM, and Polygon Miden, which is currently under development, as well as the Polygon CDK.

Contact

Lana Kovalski

haustnetwork@gmail.com

DeFi

Ethena downplays danger of letting traders use USDe to back risky bets – DL News

- Ethena and ByBit will allow derivatives traders to use USDe as collateral.

- There is a risk in letting traders use an asset partially backed by derivatives to place more bets.

Ethena has downplayed the dangers of a new feature, which will allow traders to put up its synthetic dollar USDe as collateral when trading derivatives, which are risky bets on the prices of crypto assets.

While allowing users to underwrite their trades with yield-bearing USDe is an attractive prospect, Ethena said there is potential risk in letting traders use an asset partially backed by derivatives to place even more derivatives bets.

“We have taken this risk into account and that is why Ethena operates across more than five different sites,” said Conor Ryder, head of research at Ethena Labs. DL News.

The move comes as competition in the stablecoin sector intensifies.

In recent weeks, PayPal grown up the amount of its stablecoin PYUSD in circulation 96%, while the MakerDAO cooperative plans a rebrandingaiming to increase the supply of its DAI stablecoin to 100 billion.

US dollar growth stagnates

It comes as Ethena has lost momentum after its blockbuster launch in December.

In early July, USDe reached a record level of 3.6 billion in circulation.

That figure has now fallen by 11% to around 3.2 billion.

Join the community to receive our latest stories and updates

New uses for USDe could boost demand for Ethena’s products.

This is where the new plan, announcement Tuesday with ByBit, one of its partner exchanges, is coming.

Ethena users create USDe by depositing Bitcoin or Ether into the protocol.

Ethena then covers these deposits with short positions – bearish bets – on the corresponding asset.

This creates a stable support for USDe, unaffected by price fluctuations in Bitcoin or Ether.

Mitigate risks

While using USDe as collateral for derivatives trading is proving popular, it is unclear what the effects will be if the cryptocurrency market experiences major fluctuations.

Using derivatives as collateral to place more bets has already had disastrous effects.

In June 2022, Lido’s liquid staking token stETH broke its peg to Ether following the fallout from the Terra collapse.

Many traders who used looping leverage to increase their stETH staking yields were liquidated, creating a cascade that caused the price of Ether to drop by more than 43%.

Ethena Labs founder Guy Young said: DL News His office and his partners have taken many precautions.

Ethena spreads bearish bets supporting the USDe across the five exchanges it partners with.

According to Ethena, 48% of short positions supporting USDe are on Binance, 23% on ByBit, 20% on OKX, 5% on Deribit, and 1% on Bitget. website.

In doing so, Ethena aims to minimize the impact of an unforeseen event on a stock market.

The same theory applies to the distribution of risks across different supporting assets.

Fifty percent of USDe is backed by Bitcoin, 30% by Ether, 11% by Ether liquid staking tokens, and 8% by Tether’s USDT stablecoin.

Previous reviews

Ethena has already been criticised regarding the risks associated with USDe.

Some have compared USDe to TerraUSD, an undercollateralized stablecoin that collapsed in 2022.

“It’s not a good design for long-term stability,” said Austin Campbell, an assistant professor at Columbia Business School. said as the USDe launch approaches.

Young replied to critics, saying the industry needs to be more diligent and careful when “marketing products to users who might not understand them as well as we do.”

Ethena has since added a disclaimer on its website stating that USDe is not the same as a fiat stablecoin like USDC or USDT.

“This means that the risks involved are inherently different,” the project says on its website.

Tim Craig is DL News DeFi correspondent based in Edinburgh. Feel free to share your tips with us at tim@dlnews.com.

DeFi

Cryptocurrency and defi firms lost $266 million to hackers in July

In July 2024, the cryptocurrency industry suffered a series of devastating attacks, resulting in losses amounting to approximately $266 million.

Blockchain Research Firm Peck Shield revealed in an X post On August 1, attacks on decentralized protocols in July reached $266 million, a 51% increase from $176 million reported in June.

The most significant breach last month involved WazirX, one of India’s largest cryptocurrency exchanges, which lost $230 million in what appears to be a highly sophisticated attack by North Korean hackers. The attack was a major blow to the stock market, leading to a break in withdrawals. Subsequently, WazirX launched a program in order to recover the funds.

Another notable incident involved Compound Finance, a decentralized lending protocol, which suffered a governance attack by a group known as the “Golden Boys,” who passed a proposal who allocated 499,000 COMP tokens – valued at $24 million – to a vault under their control.

The cross-chain liquidity aggregation protocol LI.FI also fell victim On July 16, a hack resulted in losses of $9.73 million. Additionally, Bittensor, a decentralized machine learning network, was one of the first protocols to suffer an exploit last month, loming $8 million on July 3 due to an attack targeting its staking mechanism.

Meanwhile, Rho Markets, a lending protocol, suffered a $7.6 million breach. However, in an interesting twist, the exploiters research to return the stolen funds, claiming the incident was not a hack.

July 31, reports The Terra blockchain protocol was also hacked, resulting in a loss of $6.8 million across multiple cryptocurrencies. As crypto.news reported, the attack exploited a reentrancy vulnerability that had been identified a few months ago.

Dough Finance, a liquidity protocol, lost $1.8 million in Ethereum (ETH) and USD Coin (USDC) to a flash loan attack on July 12. Similarly, Minterest, a lending and borrowing protocol, saw a loss of $1.4 million due to exchange rate manipulation in one of its markets.

Decentralized staking platform MonoSwap also reported a loss of $1.3 million following an attack that allowed the perpetrators to withdraw the liquidity staked on the protocol. Finally, Delta Prime, another decentralized finance platform, suffered a $1 million breach, although $900,000 of the stolen funds was later recovered.

DeFi

The Rise of Bitcoin DeFi: Then and Now

The convergence of Bitcoin’s robust security and Layer 2 scaling solutions has catalyzed the emergence of a vibrant DeFi ecosystem.

By expanding Bitcoin’s utility beyond simple peer-to-peer payments, these advancements have opened up a new frontier of financial possibilities, allowing users to participate in decentralized lending, trading, and other complex smart contract operations on Bitcoin.

Read on to learn about the rise of Bitcoin-based decentralized finance and how the space has expanded to accommodate a new generation of native assets and features.

Note: If you want to learn candlesticks and chart trading from scratch, this is the best book available on Amazon! Get the book now!

What is DeFi?

Decentralized finance (DeFi) represents a paradigm shift in financial services, offering internet-based financial products such as trading, lending, and borrowing through the use of decentralized public blockchains.

By implementing blockchains, smart contracts, and digital assets, DeFi protocols provide financial services through a decentralized ecosystem, where participants do not have to deal with intermediaries when transacting.

What is Bitcoin DeFi?

The inherent limitations of the Bitcoin mainchain in supporting the intricacies of decentralized finance have created the need to develop smart contract-based Layer 2 solutions.

Additionally, the advent of the Ordinals protocol in 2023, which facilitated the emergence of fungible token standards such as BRC-20 and Runes, catalyzed the growth of DeFi on the Bitcoin blockchain.

This expansion in protocol diversity has broadened the applications of the world’s leading cryptocurrency network beyond the core base-layer use cases around value preservation and transactional capabilities.

Therefore, Bitcoin DeFi has become a nascent sector within the digital asset market, after previously being a missing essential part of the Bitcoin ecosystem.

Bitcoin DeFi in its early days

Integrating decentralized finance (DeFi) concepts into the Bitcoin ecosystem has been a journey of innovation and perseverance. Early attempts to bridge the gap between Bitcoin’s fundamental simplicity and DeFi’s complexities have spawned pioneering projects that, while laying essential foundations, have also encountered significant obstacles.

Colored coins

Colored coins represented an early foray into tokenizing real-world assets on the Bitcoin blockchain. By leveraging the existing network to track ownership of assets ranging from stocks to real estate, this approach highlighted Bitcoin’s potential as a platform beyond digital currency. However, scalability and practical implementation challenges have limited its widespread adoption.

Counterpart

Building on the colored coins, Counterparty has become a platform for creating and trading digital assets, including non-fungible tokens (NFTs), on Bitcoin.

The introduction of popular projects like Rare Pepe NFTs has demonstrated the growing appeal of digital collectibles. However, constraints around user experience and network efficiency have hampered its full potential.

These early experiments, while not fully realizing their ambitions, served as valuable stepping stones, informing Bitcoin DeFi’s subsequent developments. Their challenges highlighted the need for more sophisticated infrastructure and protocols to harness the full potential of decentralized finance on the Bitcoin network.

Bitcoin DeFi Today

Today, building DeFi applications on Bitcoin is primarily done in the realm of Layer 2 (L2) networks. This architectural choice is motivated by the limitations of Bitcoin’s base layer in supporting complex programmable smart contracts.

Bitcoin’s original design prioritized security and decentralization over programmability, making it difficult to develop sophisticated DeFi protocols directly on its blockchain. However, the recent emergence of protocols like Ordinals, BRC-20, and Runes, while not DeFi in their own right, has sparked possibilities for future DeFi-like applications on the main chain.

In contrast, L2 solutions offer a scalable and programmable environment built on Bitcoin, enabling the creation of various DeFi products.

By expanding Bitcoin’s capabilities without compromising its core principles, L2s have become the preferred platform for developers looking to build DeFi applications that encompass trading, lending, staking, and more.

Leading L2 networks such as Lightning Network, Rootstock, Stacks, and Build on Bitcoin provide the infrastructure for these efforts. Some of these L2s have even introduced their own native tokens to the network, further expanding Bitcoin’s DeFi ecosystem.

Essentially, while Bitcoin’s core layer presents challenges for DeFi development, its security and decentralization have provided a foundational layer for the innovative L2 landscape to thrive.

Bitcoin Layer 2 offers a promising path to building a robust and thriving Bitcoin-based DeFi ecosystem that offers trading, staking, lending, and borrowing. All you need is a DeFi Wallet like Xverse to access the new world of decentralized financial services secured by Bitcoin.

Conclusion

The integration of DeFi principles into the Bitcoin ecosystem, primarily facilitated by Layer 2 solutions, marks a significant evolution in the digital asset landscape.

Building on the foundational work of pioneers like Colored Coins and Counterparty, the industry has evolved into more sophisticated platforms like Rootstock, Stacks, and Build on Bitcoin to create a thriving Bitcoin-powered DeFi ecosystem.

Advertisement

-

News12 months ago

News12 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi12 months ago

DeFi12 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News12 months ago

News12 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi12 months ago

DeFi12 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets12 months ago

Markets12 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈