Markets

Crypto stabilizes, market expectations for second half of 2024: Market Domination Overtime

On today’s episode of Market Domination, hosts Josh Lipton and Seana Smith explore trending tickers and the afternoon’s leading market events.

US equity markets (^DJI, ^IXIC, ^GSPC) closed higher together on the first trading day of the third quarter. Jared Blikre details movements seen from Nasdaq 100 (^NDX) tech stocks. Bitcoin (BTC-USD) has stabilized following several volatile weeks since reaching an all-time price high earlier in 2024. IDX Advisors chief investment officer Ben McMillan shares his cryptocurrency outlook based on ETF inflows and speculates about which presidential candidate will be able to win over the crypto crowd. MJP Wealth Advisors chief investment officer Brian Vendig also joins the show to explain how continued confidence in slowing inflation could catalyze a catch-up in the markets.

This article was written by Gabriel Roy.

Video Transcript

And that’s the closing bell on a Wall street and now it’s market domination over time.

We’re joined by Jared Bry to get you up to speed on the action from today’s trade.

Let’s first though, check out where we are closing the day.

You’ve got the NASDAQ up just about 8/10 of a percent.

That really was the driver here in today’s action.

A lot of that out performance here in the market being driven by a lot of those larger cap tech names.

You have the dow closing up just about 50 points here and you’ve got the S and P getting closer and closer that 5500 level up just about 3/10 of a percent.

Now’s head over to Jared for a closer look at some of the today’s sector action, Jared.

Yes, I didn’t see the record highs in any individual sectors, but I did see them in the NASDAQ composite and a couple of individual issues.

But first, let’s take care of those sectors.

XLK and XL Y.

That’s those other two out performers that would be tech and consumer discretionary.

So really those are mega cap featured sectors and then also financials and energies in the green, but everything else in the red led down by materials down 1.5% and industrials down just a little over 1%.

And taking a look inside the NASDAQ, that’s where we’re seeing some of these records, I believe Microsoft.

And uh also Apple, Apple hasn’t had a record high in a couple of weeks.

Both of those up, more than 2% you can throw Amazon in there as being uh up more than 2%.

And also also seeing some action from Tesla that finally pushing above 200 dollars per share, almost closing at $210 per share.

So that’s been one of those breakout moves that I’ve been looking for personally.

And then looking at our leaders today, Bitcoin was actually the big leader G BT C up 5% as a Bitcoin proxy.

Story continues

Also seeing New York Fang and our components in the Green Arc is that disruption place?

We’ll take a look that in a second to the downside home builders and uh solar each of those down more than 2.5, at least those representative ETF S and now here’s a look at the Arc Innovation holdings.

Um I said it was a leader, a lot of that has to do with Tesla because that is the lion chair right there.

But also seeing some strength in Coinbase and Roku Josh, thank you, Jared.

We are officially in the second half of the year and markets kicking things off with modest gains.

The NASDAQ, the top performer on the day joining us now is Brian Vig M JP.

Wealth Advisors, Chief Investment Officer, Brian.

It, it is good to see you.

So we had a real strong start to the year.

Brian.

It sounds like what you’re saying is, listen, stay positive, more, good times ahead.

Well, Josh, I think all of the balance of the year.

I think that is our, our tone right now and I think it’s predicated on the fact that we’re expecting earnings to continue to expand on a sequential basis.

But as we know this first half of the year was dominated by some of those mag five mag seven names from last year continuing to lead the charge, especially if you break that down over the last three months with nine of the 11 sectors in the S and P 500 trailing um our friends in technology and communication services where most of those sectors were flat or uh uh to negative, slightly positive on an overall basis, big disparity in returns.

But I think has an opportunity to change because as earnings expand from areas outside of mega cap tech and we start to see continued confidence in that slowing inflation story with rate cuts being more and more reality from September on.

I think that’s where you have a chance for a little catch up in the markets So my question is, does today’s action maybe point to the fact that maybe some of that is at risk when you take into account, what maybe the market was pricing in today looks like it was more of a Trump presidency, some of the risks associated with that just in terms of the spending, the tax cuts and what ultimately that could do to inflation.

And then of course, the conclusion being what that means for the fed is some of that.

Are you, are you confident that this disinflation trend is going to remain intact or how much of that is at risk right now?

J that’s a great question.

Um I think in the last couple of days, the bond market is telling us that with this higher probability or near jerk reaction of, of Trump, uh coming back to the White House, we saw rates go up in the bond market with those concerns based on fiscal policy adding to inflation and the economy moving forward.

Uh But I’m looking at things from uh let’s get to the election first perspective because as we know it’s really difficult to handicap uh politics.

And so when you break that down, the consumer part of the story is what’s really been driving inflation.

Uh and, and sticking on that stickier side.

Um And so with a slowing consumer, slower spending, uh we’ve seen and we’re gonna get the jolts number tomorrow, we’ve seen less job openings, less leapfrogging with wage inflation and also housing prices um uh sticky.

Yes.

But uh with demand supply and, and uh a little bit of a freeze there because rates are still high.

We expect some of that data to change as, as uh real market data is showing up in the government inflation numbers.

So we still feel confident that over the second half of the year inflation will come down, rates will come down.

The fed has signaled that they want to cut rates, but they’re playing the wait and see game because no one really knows.

But at the end of the day, I think we’re seeing some disinflation in the system and we’re seeing uh the expectation of better earnings and that’s why our con is positive for the second half.

And Brian, do you think the market needs the fed to cut in order to keep moving higher here or, or is it just, no, the market just needs to think Jay Powell wants to cut is looking to cut that.

That’s, that’s a great point.

I mean, I think right now the market is looking for clarity of policy.

I think when you’re dealing with the uncertainty, that’s what’s really holding back on business leaders and, and some other um uh uh decisions to be made on where capital is going to be allocated.

But I think right now the market is still having a pretty high ho uh probability for at least one rate cut for in September, I think the, the the futures market there are saying around 60% and a higher probability has just ticked up in December.

So we’re still in the camp of 1 to 2 cuts assuming that disinflation story uh creeping through over the summer months into the fall.

And I think that’s gonna help the cyclical parts of the market to go back to your question.

You know, the last couple of days when the rates going up, is it a surprise that the cyclical parts of the market like industrials, basic materials take a little bit of a pause.

Why technology keeps showing their leadership?

We think not.

I think if we get a little bit more confidence that that fed policy is going to be there for cuts, that’s where we’ll see the cyclical part of the market have a chance to rebound and that might even play into the small cap market as well.

I was gonna say Brian.

So given that, what, what are you seeing in terms of the opportunity maybe within small caps and then even mid caps as well?

Given those expectations.

Yeah, Shana, I mean, that’s where this big picture value paired with growth has been our theme for uh for investors over the course of the year and staying diversified.

And I think when you break that down, you don’t have to pay 30 times plus forward pe like we’re seeing in some of these mega cap tech names to get growth.

I mean, think about industrials with this rise of infrastructure spending that’s still going to play out over the next nine years and data centers and other areas of, of, of, of making our grid smarter health care uh M and A transactions, innovation, new therapies coming out and small caps have always been uh disproportionately punished and that’s been going on since March of 23 when we had two bank failures.

And people were concerned about a recession in rates and what that, what’s gonna happen to smaller companies will.

Well, yes, they still need to play catch up.

But from a, from a reality point of view, they’re usually ones that price price the bad news first and then, uh, and knowing that that’s behind us, then they’re the ones that come out of, um, uh, uh those, those situations that actually bounce back first.

And I think we saw that in the fourth quarter last year.

And I think, uh, Chana, there’s an opportunity for that to play out when there’s more certainty around that fed policy measures on rates.

As I said before, Brian, as you look for opportunities, do you want to stay us focused or do you see any opportunities overseas as well?

That’s a great question, Josh, I think, you know, we definitely lean or, you know, we do have some exposure to international equities, but we’re leaning more in the developed part of Europe and Japan.

But our bias has been more focused domestically here in the US.

Um And that’s just because of concerns with changes in the dollar as well as just recognizing some of these political uncertainties that keep coming up with policy as we saw over the weekend with things going on in France and also a little bit of this start stop what’s going on in China.

So right now, we’re leading more domestic uh but we’re playing a close eye on where the dollar is going to move uh post election as we get a little bit more clarity on, on policy, uh both from a tariff as well as foreign policy perspective.

All right, Brian, great insight there.

Thanks so much for joining us here today.

Thank you both.

Well, the Supreme Court ruling, former President Donald Trump has some immunity from criminal charges related to his attempts to reverse the 2020 election results.

This partial backing of the former president will delay any trial on the matter.

Joining us now, from more at Yahoo finance is Rick Newman.

Rick.

It’s good to see you.

So certainly, I think a lot of people are trying to figure out exactly what this means.

Maybe what is the impact or implications here on former president Trump’s campaign for the 2024 election.

What can you tell us very hard to tell um on a bank shot basis how that this affects Trump in the 2024 election, I guess.

It means that we are not going to have this trial completed this Washington DC trial completed by the time of the election.

I think that was considered a long shot anyway, just by the fact that when the Supreme Court took up this question, it delayed those proceedings by, by several months, it looks like what is going to happen is it is going to go back to the, uh, to the judge in the Washington DC Court and she will probably get started pretty quickly.

But she has also said that once she got a ruling from the Supreme Court, she would give both sides time to prepare.

And what they now need to do is go through these, the charges in this case one at a time and see, well, given what the Supreme Court said, do the are these charges now, do these charges now no longer apply because this is something, yes, the president is immune from prosecution for and that probably will be the case.

So what’s probably gonna happen here is the prosecutors are going to have to winnow down the charges, um, to maybe just one or two charges.

It would have to clearly be stuff that happened outside of what you would consider Trump’s presidential duties.

And then once they get to that point, even then Trump can appeal it again to the Supreme Court.

So he’s going to run out the clock on this one in terms of the 2024 election.

I think it’s very hard to tell, you know, in what other way this, this might affect what’s happening in the campaign.

I mean, I think the political system is frankly on overload right now.

Democrats are still trying to figure out what to do about, uh Joe Biden’s terrible performance in the debate last Thursday.

Should he stay in the race?

Apparently, the family says he’s staying in a lot of Democrats seem to be saying, huh?

We’re not so sure about that.

What are our options here?

So that’s going to take time to play out.

And by the way, barely anybody knows today, Steve Bannon went to jail.

This was Trump’s former campaign adviser in 2016.

So yet another Trump person, somebody from Trump world headed to prison, but so far not Trump himself, Rick, what did you make if anything of the, of the 63 split on the court with his decision?

Uh, it, I mean, it was, it was very predictable because it was, uh, it was the, uh, six conservatives saying, uh that Trump president, well, not the Trump presidency.

It’s the presidency has more power than anybody really ever thought before.

At least they, uh they made that clear, it was sort of predictable.

I mean, I thought it’s not automatically obvious that just because you are a conservative judge that you think that the president should be more able rather than less to get away with something that might be criminal.

Um While, while he’s serving as president, I mean, there used to be Law and Order Republicans who were really tough on crime including crime committed by public officials, which presumably includes a president.

So um I I one thing that I think people should keep in mind is this is a finding about the powers of the president, whoever the president is and it happens to be in a case involving Trump.

But guess what?

It also applies to Joe Biden, who’s the current president?

It is possible President Trump will uh excuse me, Donald Trump will never be president again, if that’s what voters decide this year and this will not apply to anything Trump might do uh as president, but it might apply to F I mean, it clearly applies to future presidents.

So I think there’s a chance this could unravel in ways that are different from a lot of the reactions you’re seeing today.

All right, Rick, always great to have you on the show, my friend.

Thanks for joining us.

You guys, Bitcoin down more than 9% over the past three months as spot ETF Enthusiasm Wanes.

But could the Cryptocurrency be in for a near term rebound?

More market domination over time coming right up, Bitcoin regaining some momentum to start the second half of the year with prices up just about 2% today.

Now the move higher following a down be quarter for the Cryptocurrency still off about 12% from its March high as investors excitement surrounding Bitcoin ETF had cooled.

So what can investors expect in the second half of the year here to help us answer that question and more we want to bring in Ben mcmillan, Chief Investment Officer at ID X Advisors.

Ben, it’s good to see you.

So here we are kicking off the second half of the year for crypto.

I think lots of people are, are at home questioning whether or not we are going to see this return of excitement when it comes to the crypto market, more specifically Bitcoin, what’s it going to take in order to regain some of that momentum?

Well, I mean, we do have a couple of near term catalysts to look forward to, to um you know, the first of which is being uh the presumption of Spot Ethereum ETF S um that could really cut them as early as this week.

We’ve seen a lot of excitement about that, especially as kind of adoption of the crypto market starts to broaden.

I think the spot ETF S did a really good job of kind of, you know, for lack of a better term mainstreaming the idea of Bitcoin to a broader audience that, you know, probably wouldn’t have really thought about it.

Otherwise we’ve been hearing those conversations with, you know, we’ve been hearing those in conversations with advisors and institutional investors that we talked to that once the Blackrock ETF all of a sudden came onto the marketplace, they’re starting to, you know, consider it more closely for their, you know, so called 6040 portfolios.

But I do think a lot is going to depend on the macro in Q three, you know, Bitcoin is for better or for worse, highly correlated with the NASDAQ.

It looks and feels a lot like a very, you know, high beta growth stock and, you know, to the extent that we see, you know, the emergence of a US recession, even if it’s shallow and we do start to see a rotation out of, you know, higher beta, you know, tech type stocks.

I do think that can weigh on Bitcoin, you know, but I, I also wanna get your take on a different topic.

I don’t know if you saw this but um billionaire Peter Thiel was on another network recently and he was talking about Bitcoin and it was interesting, Ben just because um he didn’t sound as enthusiastic as maybe a lot of people would imagine.

He, he’s still not listen, he, he holds some bit Bitcoin, but he said he isn’t sure the price will rise dramatically from here.

I was just curious, Ben, what if anything you made of those comments?

Um do those comments matter, Ben?

You know, I I saw that as well.

I found it interesting because it’s hard to not be kind of structurally bullish on crypto in general at this point.

In the cycle, it’s still very early from an adoption rate.

You know, it’s still very early too in terms of use cases, you know, a lot of what we’ve seen is just kind of scratching the surface in terms of, you know, what crypto can do in terms of facilitating, you know, real world outcomes.

Um you know, we saw a glimmer of it with kind of defi summer web three.

you know, the idea of, of, of kind of smart contracts and, and things like ordinals, kind of, you know, branching out to the broader world.

So, you know, it’s hard to, it’s hard to see how this is kind of the end of the run for Bitcoin.

I, I just don’t see it now, that’s not to say there’s not going to be volatility ahead and again, you know, Bitcoin, you know, Bitcoin is gonna go where the macro environment goes.

So I do think it’s important to be cautious for investors that, you know, just because the secular B story or thesis is intact doesn’t mean it’s gonna be a straight shot upwards.

But I, I’m hard pressed to believe that, you know, Bitcoin doesn’t set new highs over the next, you know, 12 to 24 months from here, Ben, you just mentioned uh that correlation a couple of times here just in terms of what we’ve seen with some of those more risk on assets and the price of Bitcoin.

We, we take a look at that correlation.

Does that make sense?

Given some of the activity that we had seen prior to the last 12 months?

And I guess drawing from that, what does that then tell us maybe about what that activity could or should maybe potentially look like here in the coming months?

Yeah, that’s an excellent question.

And it’s, it’s one where, you know, we were, we were very reticent kind of if you look at the correlation of Bitcoin.

So stocks in general or, you know, or tech stocks in particular, um it was very low kind of pre COVID.

And then after COVID, particularly after, you know, quote unquote money printing, you saw that correlation spike and that makes a ton of sense.

We think that’s here to stay now, that doesn’t necessarily mean it’s going to be as high as it has been recently forever.

You know, it’s running at kind of a, you know, 0.6 correlation, but we’re not going to go back to the days of Bitcoin being, you know, zero or even negatively correlated to risk assets.

So, you know, investors need to understand that positive correlation to risk assets of a Bitcoin is here to stay.

It’s something to, you know, it’s, it’s something to factor in when you think about it within your portfolios.

But that also doesn’t mean that it’s not at times, you know, gonna move a little bit differently or that it doesn’t have, you know, any diversification advantages.

But I do think again, we always caution investors think about Bitcoin as a very high beta, you know, high duration or long duration kind of tech play and you know, in the context of your portfolios, because that correlation, you know, is gonna ebb and flow kind of around the 0.5 0.6 mark, but it’s not gonna go back to zero, it’s certainly not gonna go back negative now with, you know, any kind of long term structural outcome.

So I think, you know, it’s, it, think of it like a, like a high beta tech stock.

Ben, are you surprised the way crypto has become an issue uh in this presidential election?

And, and do you think Ben, there’s a candidate by or Trump who’s gonna have an easier time winning over that crypto crowd?

Well, yeah, I mean, what’s been interesting to me in this election cycle is the degree to which the crypto pacs came out in force with real big money and they’ve been influencing outcomes already and, and kind of, you know, congressional races, you know, we saw the one in the Bronx, there was a big one in California and, you know, the crypto PAC, you know, fair shake.

Uh and some other ones, you know, spent real money backing crypto, you know, crypto favorable candidates.

And so I think what’s interesting there is crypto now is all of a sudden, you know, kind of a force to be reckoned with and I think, I think politicians are taking note on both sides of the aisle.

Um You know, I also think the crypto community by and large is favorable to a Trump outcome.

You know, if you know Trump, I think has been strategic about trying to court the crypto community saying, you know, he’s going to do a lot of good things for crypto.

But I think even if you have heavily discount that just the fact that it’s probably at a minimum, gonna be much more laissez Faire than what we’ve seen with, you know, Biden is what’s driving a lot of the crypto enthusiasm for Trump.

But yeah, I mean, I think the bigger takeaway, at least to me has been how active and how big the kind of crypto lobby has become this election cycle.

And I think that’s here to stay as well too.

Ben, don’t tell us a little bit more just about the significance of that and the influence, maybe you see that having just more broadly here beyond the election.

Well, yeah, I mean, it’s, you know, it’s interesting because I think it’s going to force a little bit more thoughtful narrative.

And I think I have to say, I mean, I think the crypto lobby has done a very good job of, you know, being very clear that listen, this is a source of innovation for America.

And so, you know, we’re not asking for any kind of special treatment.

We’re just simply asking for, you know, uh you know, lawmakers and politicians to, you know, look at crypto as a technology as a source of it in and not just kind of cast it out as the domain of illicit, you know, criminals and, and you know, money launderers and things like that, which is kind of the early narrative or early rhetoric we heard from, you know, some, some, you know, congress people, you know, a couple of years ago.

And so I think it’s been, I think it’s come from a good place.

I think it makes a lot of sense.

Um And I think it is actually having an impact in terms of educating Congress people and politicians and also not forget it, you know, record amounts of people own crypto.

You know, if you look at the estimates, it’s upwards of 60 million people.

So it, again, it’s, it’s not a French thing anymore.

It affects a lot of Americans.

People are paying close attention, you know, especially if you look at things as, you know, federal, uh you know, federally backed CBD CS and potential privacy concerns around there.

You know, it’s, it’s starting to occupy a very real mind share for a lot of Americans.

Ben.

Great to have you on the show.

Thanks for taking the time to chat today.

Absolutely.

Thanks time now for to watch Tuesday, July 2nd, Tesla is reporting deliveries for the second quarter and also expecting the company’s deliveries to fall.

Another drop would be the first time deliveries for Tesla have dropped for two straight quarters.

It’s coming after Chinese ev rivals including Neo and Lee Auto reported better than expected deliveries on Monday.

Moving on to the fed chair, Jerome Powell is speaking at the European Central Bank for in Portugal in the morning.

This coming after a round of that commentary on Friday.

Now San Francisco fed President Mary Daly saying that recent inflation data indicates monetary policy is working, but she also says that it’s too early to tell when to cut.

And finally the monthly jolts report, that’s the job openings and labor turnover survey for May coming out in the morning economist forecasting that number to tick down to just under 8 million.

The new job data tomorrow giving us more insight into the health of the labor force and coming ahead of Friday’s full jobs report.

That’ll do it for today’s market domination over time.

Be sure to come back tomorrow at 3 p.m. Eastern time for all of your coverage leading up to and after the closing bell.

But don’t go anywhere on the other side of the break.

It’s asking for a trend.

I’ve got you covered for the next half hour with the latest and greatest market moving stories.

So you can get ahead of the themes affecting your money.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

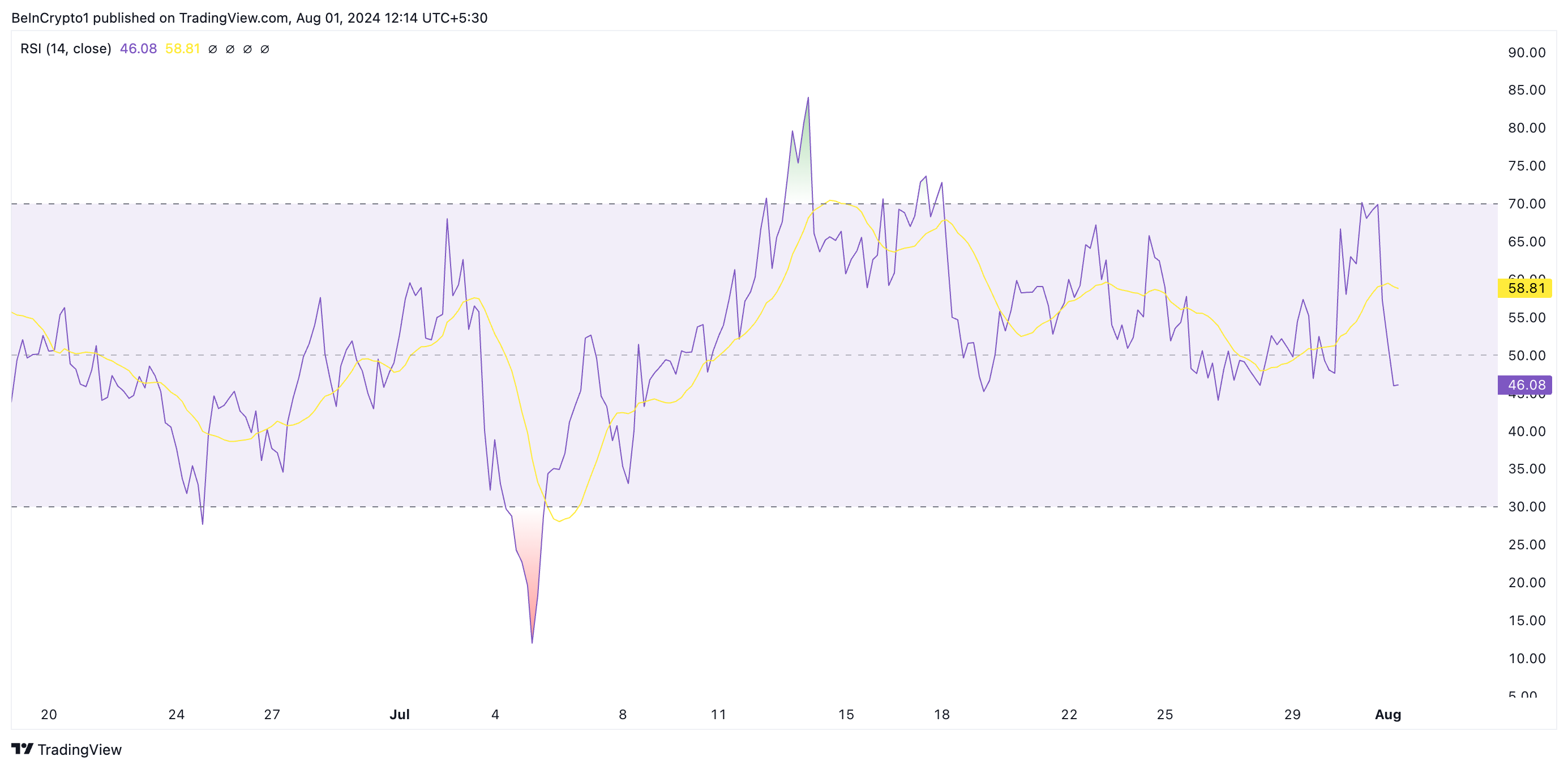

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈