DeFi

ChatGPT-4o Latest Crypto Predictions: Possible Outcome of Ripple (XRP) Case and New AI DeFi Token – Times Tabloid

As Ripple (XRP) holders closely monitor developments in the legal battle with the SEC, ChatGPT-4o has revealed its predictions regarding the lawsuit.

Interestingly, experts claim that the world-famous Chatbot’s prediction will have ripple effects across the entire crypto industry. Meanwhile, ChatGPT-4o highlighted a new AI DeFi token as the next big thing in crypto. Let’s get the latest news from ChatGPT-40!

Ripple v. SEC expected to go to the United States Court of Appeals

Recent information from ChatGPT suggests that the Ripple lawsuit could be sent to a higher court for judgment. According to the chatbot and other experts, the recent settlement between the SEC and Terraform Labs could lead to a review of the case by the Second Circuit Court of Appeals.

This is crucial because a higher court ruling could provide guidance on whether cryptocurrencies can be classified as securities in the United States. Attorney James Murphy suggests that Ripple or Coinbase, which is appealing a separate case to the SEC, could be the first to appear in court. Court of Appeal.

These legal updates are impacting the crypto market, with the price of XRP increasing in recent days, reaching a high of $0.5307. According to CoinMarketcap data, there was also an increase in trading volume.

This increase in trading volume indicates growing investor confidence in XRP as the legal situation evolves, which experts I think Ripple’s XRP token will climb to $0.744.

On the other hand, experts monitoring XRP price action believe that if the weekly Ripple candlestick closes below $0.467, then XRP could fall another 10% from its previous support at $0.419 in the coming weeks.

Revolutionizing Crypto Investing: RCO Finance Launches AI-Powered Trading

RCO Financing is a pioneering platform that allows users to directly purchase stocks, shares and other assets using cryptocurrency. This approach eliminates the need to convert to fiat currency, marking an important step towards the democratization of investing.

Additionally, RCO Finance’s integration of cryptocurrency into investment transactions simplifies the process and improves security and transparency. Every transaction is verified through the immutable ledger of blockchain technology, fostering a culture of trust and accountability among users.

What’s even more interesting is that the RCO Finance platform is powered by a AI-powered bot advisora sophisticated tool that allows investors to have personalized investment strategies.

Leveraging artificial intelligence and machine learning, the robo-advisor analyzes market trends and risk factors and tailors investment recommendations to individual preferences. By eliminating human bias and emotion, this tool ensures that investors make informed decisions, based on data-driven insights.

Additionally, RCO Finance’s robust tokenomics promotes community growth and ensures the long-term sustainability of the platform. Through strategic token allocations and deflationary mechanisms, the platform creates a dynamic ecosystem from which every participant can benefit.

In addition, there is a deflationary model in place to ensure that unsold tokens are systematically burned, thereby increasing the value of remaining tokens and encouraging long-term holding.

Maximize your gains with RCOF: early investors could reap potential returns of 3,000%!

The native token of the RCO Finance platform, RCOF, is in its pre-sale stage, offering investors discounted prices. This step is essential for early RCOF investors looking to maximize their gains, with gradual price increases providing a balanced investment opportunity.

For example, an investor purchasing $1,000 worth of RCOF tokens at the start of the presale could see their investment reach $30,000 by the official launch of the DeFi token, which could generate a potential gain. 3,000% back. This predicted return highlights the exceptional profit potential for early participants.

Currently, the price of RCOF is $0.0127 per token at stage 1 of the pre-sale. This RCOF price is expected to increase in later stages, providing investors with the opportunity to benefit from the growth of the platform and join the DeFi revolution!

For more information on the RCO Finance presale:

Join the RCO Finance community

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of The Times Tabloid and is not intended to be used as legal, tax, investment or financial advice.

DeFi

Here Are The Smartest Ways To Make Money In DeFi: IntoTheBlock Report

Crypto market intelligence provider IntoTheBlock released a report on Thursday comparing the best risk-adjusted methods for earning yield in the world of decentralized finance (DeFi).

Despite the “nearly infinite number of composable strategies,” the company says it’s best to stick with “simple strategies,” which boil down to “just a handful of different primitives.”

The best way to earn in DeFi

The first strategy put forward by the firm is AMM Liquidity Provisioning.

An AMM is an automated market maker. To earn yield, DeFi users can deposit their assets into AMM pools for different trading pairs, where they help provide liquidity to enable transactions. Depositors earn yield on trading fees every time a user trades between two assets using this pool.

AMM yields tend to produce higher returns for trading pairs in which the two assets have a low price correlation. However, the volatility of the assets in these pairs also creates a risk of fleeting losses for investors.

“As new capital is added to the pool, the expected annual return is diluted,” IntoTheBlock continues. “Since expected returns decrease as more capital enters the pool, the initial size of the pool relative to the capital deployment must be considered.”

Another promising source of high yield is “recursive lending,” where protocol users can supply and borrow the same asset, taking advantage of the difference between borrowing costs and protocol incentives. As with AMM pools, yields decline as more capital is added to the strategy, which is why the company recommends lower leverage when depositing more than $3 million in assets.

Assessing the risks of DeFi

Then there is the “supervised loan”, which integrates the two previous techniques. Users use an “unproductive asset” (e.g. BTC) as borrowing collateral, then use their borrowed funds to purchase a “more productive asset” that generates yield elsewhere, such as an AMM pool.

Returns from this strategy may be low or net negative, as borrowing rates can often exceed protocol incentives and carry risk of liquidation and loss of value.

Finally, the report highlighted “leveraged staking” as a strategy to produce “average” returns on assets like ETH or SOL, which can be natively generated. staked for yield to secure their respective blockchains.

The return remains positive with this strategy as long as the borrowing rates of said asset remain lower than their staking rate. Returns increase as leverage increases, potentially exceeding 10% APY, compared to the 2% to 4% typically seen with simple staking.

“The combination of these strategies can create a complex chain of risk considerations when it comes to rebalancing and taking profits,” IntoTheBlock warned.

DeFi

Ethereum DeFi Follows Triangle Formation That Hints at 800% Rally for AAVE, RCOF, and MKR

The Ethereum DeFi sector is witnessing a significant technical pattern – an ascending triangle formation – which indicates a potential 800% rally for major DeFi tokens such as Aave (AAVE), RCO Finance (RCOF), and Maker (MKR).

As the cryptocurrency market heats up, it is essential to understand the unique value propositions of these tokens and why RCO Finance (RCOF) stands out as the first choice for informed investors.

RCO Finance AI-Powered DeFi Revolution

RCO Finance (RCOF) is a DeFi ERC-20 token that is making a name for itself in the DeFi cryptocurrency sector. The platform is highly recognized because it uses AI tools like Robo Advisor, its main tool, to facilitate users’ trading and investing. To do this, it uses fully automated AI and ML algorithms to provide investors with trading and investment advice.

The Robot Advisor also uses its trade alert feature to suggest investors the best entry and exit points. This reduces the risk of potential losses and eliminates the need to use traditional brokers. In addition, RCO Finance prioritizes the security of its users.

To protect user funds and data, the platform has undergone a smart contract audit by a leading security company, SolidProof.

By allowing users to purchase stocks, bonds, and other real-world assets directly with cryptocurrency, RCO Finance acts as a bridge between traditional and digital finance. Additionally, the DeFi trading platform offers investors over 120,000 tradable assets across 12,500+ asset classes globally.

They enjoy other benefits of tokenization such as low-interest loans, borrowing, and high leverage options of over 1,000x.

Aave defies cryptocurrency slowdown, aims for massive growth

The DeFi market continues to show resilience amid the overall cryptocurrency downturn. Aave (AAVE), one of the largest lending protocols, surged over 7.5% last week after a $2.26 billion increase in total value locked (TVL).

This optimism is reflected in the AAVE exchange supply, which has dropped from 3.18 million to 3.15 million in two days. This reduction indicates that investors are moving tokens from exchanges to wallets, signaling less selling pressure and a potential bullish trend.

However, Aave (AAVE) remains significantly down from its all-time high, down 85.6%. As a result, many crypto analysts are arguing that RCO Finance has comparatively greater upside potential for investors looking for sustainable and high returns.

Maker Rises Amid Major MakerDAO Announcement

While most altcoins are struggling to grow, Maker (MKR) has seen a strong rise thanks to a major announcement from MakerDAO. On Tuesday, MakerDAO launched the Endgame audit competition, offering a massive $1.35 million reward to bug finders on the Sherlock platform.

This news, shared on June 25, boosted Maker Tokens (MKR), increasing its trading volume by 21.49% with its price up 9.49% over the past week, reflecting growing bullish sentiment . The MACD indicator shows increased buying pressure, while the simple moving average suggests a bullish outlook.

Analysts have also detected an ascending triangle pattern for Maker (MKR) tokens. If the market remains positive, it could witness a massive price rally as it retests its $2,606 resistance level this weekend.

However, this is different from the returns that RCO Finance investors expect to see when the token officially launches.

RCO Finance: Earn up to 3000% return on pre-sale

RCO Finance (RCOF) is expected to return investors over 800% of the triangular pattern spotted in its business performance forecast for the token in the coming weeks. The official launch of the token is expected to net early investors up to 3,000% returns, but how can they claim these gains?

Investors who join the platform’s ongoing presale can now purchase the presale tokens for $0.01275, which they can reduce by 30% using the discount code RCOF30. The presale tokens will trade at $0.0343 during Stage 2, meaning Stage 1 investors are already set to achieve 169%.

But the benefits don’t stop there. On the RCO Finance platform, RCOF investors generate passive income through subsidized trading fees and benefit from various benefits such as access to voting rights and the opportunity to participate in the platform’s decision-making process.

Why hesitate any longer? Join the RCO Finance pre-sale and your $1,000 investment could potentially turn into $30,000 or more!

For more information on the RCO Finance (RCOF) presale:

Visit the RCO Finance pre-sale

Join the RCO Finance community

No spam, no lies, only insights. You can unsubscribe at any time.

DeFi

Why Swiss and Hong Kong crypto regulations will lead the DeFi revolution

The following is a guest post from James Davies, CEO of Crypto Valley Exchange.

Regulators worldwide, international organizations, and market participants have published many consultation papers, recommendations, and opinions. The writers include groups like the Global Financial Markets Association, the Institute of International Finance, the International Swaps and Derivatives Association, the Futures Industry Association, the Financial Services Forum, and IOSCO (International Organization of Securities Commissions).

All major players from Coinbase to Circle are publishing responses to the regulatory framework and legislative drafting worldwide.

All of this is brought together in an IOSCO paper, “Policy Recommendations for Crypto and Digital Asset Markets,” which, rather unbelievably, doesn’t mention permissionless protocols once and only decentralized in passing.

I pity the regulator that bases its crypto policy development on this publication. Separately, IOSCO published a “Policy Recommendation for Decentralized Finance,” which combines their analysis with the Financial Stability Board (FSB) report “The Financial Stability Risks of Decentralised Finance.”

However, and this is a major criticism, the papers miss the core idea of decentralized projects. Trying to succinctly explain where they are wrong and what they can do to shift the perspective takes more input from insiders. The essential goal of decentralized projects is “to create the project features as the result of emergent behaviors through the actions of unrelated and replaceable actors.”

These effects are emergent, making decentralized projects so difficult to regulate. The report makes some reasonable insights, such as run-risk on assets from liquidity mismatch, such as the events that collapsed TerraUSD/Luna, and the roll-forward of this hitting Celsius very reminiscent of the events in 2008, the “collateral chain” risk.

Notably, traditional finance regulators still do not cover this well, where banning new activities dominates integration and understanding.

It also makes valuable points on cross-border regulatory arbitrage; however, this is where it demonstrates very precisely that it doesn’t understand DeFi. These structures make identifying appropriate legal ownership/control and relevant legal authorities difficult. It presupposes that there is a legal ownership and control point, the antithesis of decentralization.

This doesn’t mean that there aren’t some DeFi entities that do have these, and while running via smart contracts on-chain are not more like centralized entities, these, though, will get picked up in the core of the rest of the crypto regulation.

IOSCO doubles down on these misapprehensions about how decentralization works in some of their recommendations to regulators, especially the recommendation to identify responsible persons. Comments suggesting layer-1 blockchains might be considered clearing and settlement operations feel bizarre.

Other areas to look at include leverage, lending pool structures, tokenization, pseudonymous information, reporting, IP, and off-chain/on-chain touchpoints. Continued adoption and growth are undoubted and will have major impacts on world economies and traditional finance over time.

Most notably, every respondent to IOSCO, that is, every major regulator, when asked to provide an overview of current regulatory treatment, stated that they do not have separate regulatory frameworks specially dedicated to DeFi activities. They further note that whilst respondents state that they have regulation for crypto underway, they are not specifically targeting DeFi. Respondents also express their views that existing frameworks can apply to DeFi protocols.

Like social scientists everywhere, the Bank of International Settlement also seeks to understand the DeFi landscape. Their process is being examined through the lens of categorizing DeFi. While they appear to do an adequate job in this respect, it comes across in the conventional manner of treating each project as a standalone company.

To summarize the areas of concern from IOSCO:

- Conflicts of interest arising from vertical integration of activities and functions

- Market manipulation, insider trading, and fraud

- Cross-borderrRisks and regulatory cooperation

- Custody and client asset protection

- Operational and technological risk

- Retail access, suitability, and distribution.

How should regulators look at DeFi?

Rigid classification-based regulation has led to many unintended consequences; Sarbanes-Oxley requirements drove companies away from public markets. The subprime mortgage crisis resulted from a focus on individual loans and not their aggregation. The initial responses to the rise of the Internet and digital business were slow and reactive. By the time regulations arrived, companies already had established practices. Uber and Airbnb’s growth was restricted by a patchwork of local regulations that didn’t support these business models.

Urban planners misunderstood the effect of adding roads, leading to more traffic issues rather than less. The climate models debate focuses on specifics rather than the emergent effects, clouding the issues.

Regulators should start with governance structures, not individual properties. DAOs typically have a presence of some form, such as an organization with a corporate identity, often because a Labs entity needs something to hold the equity to pay real-world bills.

These entities, though, are often controlled entirely through the DAO. Requiring DAO registration and setting up specific corporate entity types that match how they operate would add value. Setting transparency, reporting, voting, staking, delegation, and control rules would remove the ambiguity on how to operate. Weed out abusive entities that want to rug pull and encourage entities that want to operate in a decentralized manner genuinely.

There can be many further developments related to operation style, such as requiring those that border otherwise regulated activities to have the appointed people selected by the DAO to face future regulatory developments in these areas. However, engaging and setting a framework for DAO establishment would be a good start.

A second area for examination would be about mutual recognition, currently regulation is fragmented, in some areas such as derivatives markets mutual recognition works well, in payments and crypto it acts as a barrier to growth creating a difficult patchwork of regulation. If DAO regulation were recognized between major regulators, then regulating in one country would enable access to other countries, a major incentive to projects to choose a grown-up location for their DAO, a good indicator to users of the intent of those involved in the project.

More thought needs to be given to dealing with emergent properties related to aspects such as clearing and settlement. There are compelling reasons why these should exist. For a start, trading on-chain assets supported by on-chain collateral causes real issues for existing traditional finance aspects. We all want to support this tokenization and transparency push, but this doesn’t come without traditional finance equivalents. This is about the disintermediation of existing power bases and control and the empowerment of new economy models, but friction in these systems needs to drop to establish. It is almost the precise point of free markets.

Ethical behavior, transparency, and clarity at the top of the list, along with DAO registration and support, can begin this. Regulators will need to become much more educated in the mechanics of these protocols and their operations to ensure they slowly build the right regulation, not just restrictive regulation.

How Switzerland and Hong Kong have gotten right what the US gets wrong

The crypto industry is still largely in its infancy, and regulators are still figuring out how to oversee its various aspects, but not all efforts are equal.

Once a beacon of innovation, the US has become a challenging jurisdiction for crypto finance projects, let alone decentralized versions. It is well documented how the country’s relatively strong anti-crypto stance and enforcement-heavy approach has stifled growth, driving founders to seek more welcoming environments.

Meanwhile, Switzerland and Hong Kong have crafted regulatory frameworks that accommodate crypto and permissionless projects.

The Swiss Financial Market Supervisory Authority (FINMA) doesn’t regulate protocols based in Switzerland if the activities conducted on the protocol result from the actions of actors based outside Switzerland. They are accessible, transparent, and engaging. Self-regulatory approaches, in general, are well supported.

The Securities and Futures Commission (SFC) of Hong Kong assesses each Defi project on a case-by-case basis, balancing a “same business, same risk, same rules” approach for crypto in general with a more nuanced position on permissionless protocols. At the same time, the US Securities and Exchange Commission (SEC) has confused and caused the US to fall behind the pack.

The EU is focused on examining everything through a payments lens, and the UK talks a better game than it implements. By embracing crypto’s unique needs and fostering a culture of entrepreneurship, these jurisdictions have become the go-to destinations for crypto companies seeking regulatory clarity and freedom to experiment. They are likely to do the same with DeFi.

As DeFi continues to evolve and transform the financial landscape, the role of regulatory frameworks becomes crucial in shaping its trajectory. With digital assets gaining momentum, tokenization under discussion, and traditional finance entering the space, the quest for regulatory environments that not only accommodate but also nurture DeFi is intensifying more even than just centralized crypto entities.

Navigating the DeFi Regulatory Landscape

With the current hot crypto market and lots of capital flowing into projects, the number of projects establishing DAOs over the next 18 months will be huge.

From a regulatory perspective, it’s time for them to set out their intent for these entities and the services that will be possible through these protocols.

Regarding the regulatory landscape for current DeFi projects, we see why more and more industry professionals feel drawn toward Switzerland’s approach. While the EU’s MiCA Regulation offers a comprehensive, harmonized framework with detailed rules for consumer protection and market integrity – appealing for projects seeking a uniform environment for cross-border European operations – Switzerland’s principle-based approach, flexibility is more compelling for projects not focussed on payment services. Not every project fits neatly into a one-size-fits-all mold; Switzerland seems to understand that.

Switzerland’s willingness to foster a supportive ecosystem, exemplified by Crypto Valley in Zug, is remarkable. Being part of a vibrant community with access to capital and opportunities for experimentation and growth is a crypto native’s dream.

Switzerland’s regulatory philosophy and pro-business stance make it particularly appealing. Innovative projects will have a better opportunity, be more likely to get regulatory clarity early and emerge from this thriving ecosystem, pushing DeFi boundaries and shaping finance’s future evolution. Switzerland’s approach resonates persuasively.

Hong Kong: A Financial Renaissance

Hong Kong is redefining its role as a crypto hub by implementing its new Virtual Asset Service Provider (VASP) regime. This regulatory framework introduces a structured yet dynamic environment that supports crypto innovation while maintaining robust safeguards.

The comprehensive VASP licensing ensures crypto platforms meet stringent criteria for liquidity, customer protection, and cybersecurity, fostering a balanced approach to regulation and innovation. By permitting retail trading of cryptocurrencies, Hong Kong nurtures a vibrant ecosystem that attracts retail investors while upholding necessary safeguards. It has yet to develop Defi specific regulation, we can only encourage to look at this holistically, developing DAO regulation first, but the approach to the rest lends confidence that this is a good location for businesses to establish whilst we wait.

Regulatory routes forward

Countries mustn’t follow in the footsteps of those who have failed to innovate in this field. The US, for instance, has been slow to adapt to the changing financial landscape, with regulatory uncertainty stifling growth and innovation. Meanwhile, US companies keep demanding clarity on regulation, with giants like Coinbase and their legal team demanding the SEC engage in rulemaking. Similarly, countries like Japan and South Korea have struggled to integrate crypto into their traditional financial systems, leading to a lack of progress.

Countries, including the US, must divide and approach centralized and decentralized activities differently. Some decentralized activities, such as market rate set risk, have many risks that could be prevented fairly easily under the right approvals regime. We know this will come and squeeze some major players, but early transparency on the direction will save the industry a lot of costs.

Currently, we look to countries like Switzerland and Hong Kong, which have taken a proactive approach to crypto, to lead in creating a supportive regulatory environment that will foster innovation and growth in Defi. By learning from their example, other countries can catch up and move forward rapidly.

While the future of decentralized tech watches the American Dream turns into a coma, Swiss developers are pouring Aperol and planning their ski trips.

DeFi

Hong Kong targets DeFi, metaverse for fintech expansion — TradingView News

Government-backed studies in Hong Kong have identified decentralized finance (DeFi) and metaverse technologies as new opportunities to strengthen the region’s dominance in the global fintech landscape.

The Hong Kong Institute of Monetary and Financial Research (HKIMR), the research arm of the Hong Kong Academy of Finance (AoF), released two reports on June 25, each detailing the implications of DeFi and the metaverse on the financial sector.

The Hong Kong report on DeFi highlighted the ecosystem’s explosive growth from a modest market capitalization of $6 billion in 2021 to over $80 billion in 2023. It adds:

“These figures demonstrate that the potential of DeFi cannot be ignored. »

DeFi, which represents 4% of the overall cryptoasset market, currently remains a largely untapped market. As shown below, over 70% of the crypto companies participating in the study had not yet explored this technology. Cointelegraph

Read Cointelegraph’s beginner’s guide to learn more about decentralized finance.

Harnessing the DeFi potential

The study highlighted existing issues in DeFi around governance, compliance, and vulnerabilities, but remained generally optimistic about its unique characteristics:

“DeFi has the potential to deliver new financial services, such as liquid staking, flash loans, and automated market makers, with reduced transaction speed and improved innovation, automation, and financial inclusion.”

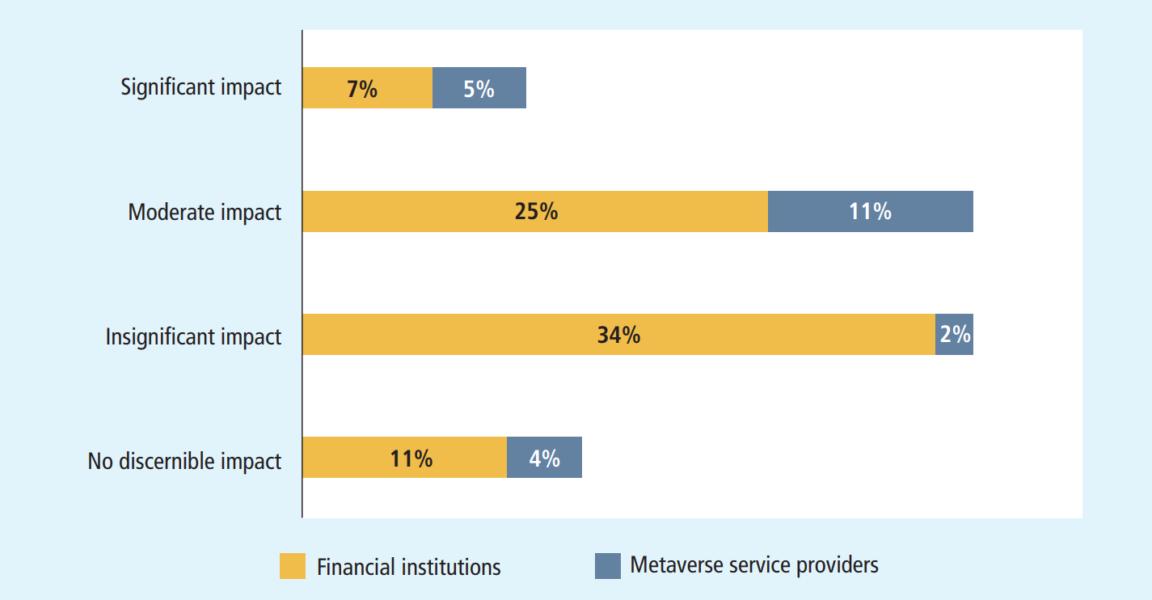

When it comes to the metaverse, the Hong Kong study found that local financial institutions showed a moderate level of engagement despite their high interest in it. This result corresponds to the sentiment displayed by those surveyed in Hong Kong.

Mixed Feelings About the Metaverse

More than 51% of respondents are betting against the future potential of the metaverse, of which 6% were metaverse service providers. Cointelegraph

Cointelegraph

However, a sector of Hong Kong fintech companies is actively pursuing metaverse-related developments. Enoch Fung, CEO of the AoF and Executive Director of the HKIMR, said:

“Emerging DeFi and metaverse technologies, which are closely linked to broader developments in virtual assets and Web3, will likely provide various opportunities for the financial services sector in Hong Kong.”

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs

-

News1 year ago

News1 year agoBitcoin holds near $63,000, solidifying the week’s rally

-

Markets1 year ago

Markets1 year agoRipple’s XRP Price Rises to $10 Looks Likely in This Scenario Amid $3 Trillion XRP Market Outlook ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoBlackRock and Wall Street ready to take Bitcoin directly to $200,000 – Anthony Scaramucci