Markets

Carbon Crypto Guide Klimadao Carbon NFTS and Carbon Tokens

It can be easy to assume that blockchain is bitcoin, and bitcoin is blockchain. After all, bitcoin dominates the crypto airwaves; it makes a certain amount of sense to assume that blockchain begins and ends there.

The reality is far different. Bitcoin is important, to be sure, but only as a symbol of far greater things to come. Like Ford with the early automobile industry; even if Ford Motors had failed in the 1930s, or after WWII, or even in 2008 – the broader automobile and manufacturing industry would have been largely unaffected.

Blockchain powers Bitcoin, and it’s the success or failure of blockchain technology that will ultimately have a far greater impact than any one cryptocurrency.

1. What is a Blockchain?

A blockchain is a digital ledger of transactions that can’t be tampered with by any one entity because of its decentralized design. A blockchain is made up of blocks, which are chained together cryptographically. Each block contains a hash pointer (a number) linking it to a previous block, a timestamp, transaction data, and fees.

The combination of these components – the hash pointer, timestamps, and transactions – make up a record or block.

These records are linked like pearls on a string, forming a chain. This chain gets longer every time a new block is added, making the blockchain bigger over time.

Publicity and security

The prospect of a seemingly-endless stack of blocks towering into the digital heavens might be a bit intimidating, but there’s an immense amount of real-world value in it.

Because new block are inextricably linked to the old ones, old data can’t be changed. Previous entries into the ledger are therefore immutable. In addition, the total blockchain functions as an authentic record of all transactions on the chain. The actions of individual wallets, or the sale of individual items, can be easily traced through the blockchain.

Each crypto wallet has a public address and a private key. Users access the blockchain through wallets. The address receives cryptocurrency and other digital assets, sends them on, and can store them, and it’s the address that’s identified in the distributed ledger.

At the same time, private keys secure each individual wallet.

Users can hold assets securely in a wallet while the wallet’s address is publicly visible. The idea is similar to a postal system. Your postman knows where you live and how to pick up and deliver mail, but he doesn’t know what you do at that address.

Decentralized control

Blockchain structure raises a couple of important questions. With everything visible to the public, how are blockchains secured? What guarantees trust in the network?

One way in which blockchains can guarantee security and ledger accuracy is by limiting access. Blockchains can be permissioned or permissionless. Permissioned blockchains require users to obtain special permissions before they can use them. Blockchains designed to be used by one institution are a good example – trust is guaranteed by controlling who has access.

On the other hand, public blockchains face the very real problem of guaranteeing security and trust with a huge number of distributed users, including at some potential bad actors. That’s where cryptography comes in. The cryptographic hash – an algorithmically-generated number – secures each new block on the chain. Change the block, and you change the hash. And if you change the hash, you invalidate the chain, and the change is instantly viewable.

Cryptography guarantees security despite (and perhaps due to) being publicly visible. The longest-running blockchain in the world illustrates this point clearly. It isn’t Bitcoin, or even some private Ivy-League pet project; it’s a simple cryptographic hash published every week in the classifieds of The New York Times. Every week since 1993. Participants in that particular blockchain use that information to validate transactions over the previous week (in this case, security seals issued by a particular company).

The use of cryptography solves one trust-related problem, but it raises another: who, exactly, is allowed to make changes to the chain?

Nodes, mines, and stakes

Nodes are the control points of the blockchain. With a decentralized structure, someone has to validate the chain of transactions, add new transactions to a block, and add the block to the chain. If only one person or entity controls that process, the blockchain isn’t decentralized at all. But if too many entities control it, then there’s little chance for transactions to be processed quickly or efficiently.

In the case of the NYT blockchain, there’s one node – the classified ad itself. Transactions are processed weekly – fast enough for that company’s purposes, but not fast enough for anything like a high-performance digital blockchain.

Using a handful of select nodes solves part of that problem.

Everyone can participate in the chain itself (permissionless), but some kind of entry point is set for nodes. Usually this involves requiring nodes to have certain assets, whether technical (hardware or technical know-how) or in the form of digital assets (typically the token for that particular blockchain).

Nodes govern the chain. The exact method they use is known as the consensus mechanism. Currently, there are two primary consensus mechanisms in widespread use: Proof-of-Work (PoW, aka mining ), and Proof-of-Stake (PoS, or simply staking).

Proof-of-Work requires the use of real-world hardware in order to solve an algorithmic equation and win the right to create the next block on the chain. These chains tend to be energy-intensive, often requiring mass amounts of hardware, and are competitive – miners are essentially fighting each other over the solution. The most notable PoW chain is, without a doubt, Bitcoin. Ethereum is another well-established PoW chain.

Proof-of-Stake selects Validators who amass a stake of digital currency or tokens. The greater the stake, the more likely the Validator will be to win the block. PoS is less a fight, and more of a race. But it’s not a fair race; the greater the stake, the farther down the track you get to start.

Having said that, there’s always an element of chance, and even smaller stakes might occasionally win the block. Most new blockchains are PoS, as it lends itself to being more easily scalable than the PoW consensus mechansim.

Notable examples include Cardano, NEAR, and Ethereum again. The Ethereum network is a mixed bag; it’s a current PoS chain, that nevertheless still has staking options as it prepares to transition to a PoS mechanism in the near future.

Use-cases: Blockchain in Real Life

Enough technical details. What does the blockchain have to do with the real-world? What makes it more than just an unusually technical thought experiment?

Most importantly, what does it have to do with carbon credits?

Blockchains provide two crucial benefits with real-world uses.

Blockchains allow the coordination of large groups of disparate users.

And, perhaps even more importantly,

Blockchains can guarantee ownership.

The whole idea of a distributed ledger is to tie public addresses, and by extension, shared assets, to individual accounts without sacrificing privacy to a central authority. In theory, this can be done with almost any asset imaginable. Digital currencies are the obvious starting point, but blockchains can also be used with data. That’s all a transaction is, of course, so the entries in a distributed ledger don’t need to be simple sales. They can be data points, non-fungible (unique) tokens tied to real-world or digital assets, or anything else.

The application to carbon credits is especially promising. In a global carbon market beset by problems of quality assurance, the blockchain offers the potential to tie one credit to one project. And that’s just a starting point.

The Crypto Carbon Ecosystem

In their simplest form, blockchains are distributed ledgers for digital information. In an information-driven age, that means that almost any bit of information could, at least in theory, be linked to a blockchain.

Cryptocurrencies still draw the lion’s share of media attention and investor interest. But as the crypto world matures, developers have begun to apply blockchain to one of the other hot markets of recent years: carbon credits.

The idea is simple.

Carbon offsets are a unit of measure, certifying that a particular action, project, or thing has removed the same one metric tonne of CO2. One credit = one tonne. The math is simple, but applying it to the real world proves challenging.

Measurement – how do you measure how much CO2 a certain set of actions will remove, before it even does so? This can be especially complicated when you add in living organisms, such as trees, as is teh case for the majority of nature-based offsets.

Verification – even if you can measure things accurately, how do you verify that the set of actions did actually result in a measurable offset?

The blockchain can, in theory, help with both of those issues by linking offsets to blockchain-based cryptocurrencies or tokens. The tokens help to incentivise verification, while tokenizing offset projects can ensure correct measurement.

The emerging carbon crypto world is dominated by a number of trends coming together at once. Not all are directly aimed at tokenization. Here are three of the biggest trends that form the crypto carbon ecosystem.

Trend 1: Carbon-friendly Crypto

The OG cryptocurrency, Bitcoin, employed a Proof-of-Work consensus mechanism. That mechanism is well-known for being energy-intensive and therefore not particularly environmentally friendly.

Just how unfriendly? It’s hard to nail down for certain, but studies in 2019 put Bitcoin mining as responsible for 22 million metric tonnes of CO2e, roughly the same amount of CO2 emissions as the Netherlands. A significant amount, for sure. And it’s worth noting that even crypto-friendly news sources place recent emissions for 2020 and 2021 even higher – 36 million tonnes and 41 million tonnes, respectively.

However, even the higher numbers pale when compared to global emissions. As a number of outlets noted recently, Bitcoin mining accounted for less than 0.10% of global CO2e. Far less, even, than the CO2e produced by mining and printing traditional fiat currency.

Regardless, the idea of “carbon-hungry crypto” has stuck, particularly with Bitcoin. The result has been to push the crypto world towards a more carbon-friendly approach. Sometimes that takes a particularly mundane form, such as Elon Musk dropping Bitcoin payments and then accepting Dogecoin.

In other cases, it can mean developing entirely new ecosystems around more carbon-friendly blockchains. The recent increase in Solana’s exposure owes something to its reputation as a carbon-neutral blockchain. And the industry-wide turn towards Proof-of-Stake instead of Proof-of-Work can be attributed to the former’s more eco-friendly consensus mechanism.

Trend 2: Tokenized Carbon Offsets

The global market for carbon offsets shows no sign of slowing down, and is seen to be worth billions by the end of the decade. A market growing so fast, and so widespread across the globe, poses unique challenges in verifying and enforcing offsets.

Tokenization answers some of those challenges. Non-fungible tokens are by their very nature unique. That allows some crypto carbon projects, like Moss, to issue NFTs for particular projects or even particular pieces of offset projects. The Amazon NFT by Moss is one of many examples; a far splashier one is the Rimba Raya NFT which sold for $70,000. That’s a single carbon offset, for a price that’s beyond current market value.

More down-to-earth NFT offset projects include the much-anticipated Save Planet Earth effort, the first to incorporate industry-leading Gold Standard offset verification into its NFT schemes.

Most of these efforts are in the early stages, and there’s little track record on which to assess their performance. But the ability to link carbon offsets to a blockchain offers a solution to a number of VCM problems, such as double counting credits. That promise alone will be enough to drive the NFT offset trend even further.

Trend 3: Blockchain-powered Carbon Exchanges

Carbon NFTs and tokenized offsets are often sold on blockchain-powered carbon exchanges. Abu Dahbi reached carbon neutrality by purchasing offsets on AirCarbon Exchange. The exchange offers offsets from around the globe, but tokenizes them on its own exchange. AirCarbon follows the same model as a traditional commodities exchange to facilitate carbon trading.

Nor is AirCarbon the only game in town. Some of the upcoming efforts follow all three major trends at once: Cambridge University’s proposed carbon exchange will be built on Tezos, another eco-friendly PoS blockchain.

Other projects often involve aspects of each trend. The CryptoCarbons NFT project produces art-inspired NFTs that are linked to already-generated offsets. But the project also allows users to request custom NFTs created just for them, and linked to a specific number of offsets.

Major crypto exchanges, like Binance, Coinbase, and others, may sell carbon-related tokens without being a dedicated crypto carbon exchange. Some of the biggest crypto carbon projects, like Klima, Toucan, and others, are only available on these centralized exchanges.

The crypto world is more aware of the need to be eco-friendly. This has led to an ecosystem primed to accept ambitious carbon offset NFT projects and tokenized offsets.

Leading Carbon Projects

Harness the blockchain, verify carbon credits, and solve two problems with one cutting-edge stone. All the projects on this list promise some variation on that idea; the only challenge is putting everything into practice in a market-friendly, cost-efficient way.

Here are current carbon crypto projects that are generating buzz and drawing some attention. Not all of them are equally successful, and few have established anything like a long-term track record. But all of them offer

Moss

Moss is two projects in one: a popular token (MCO2) and a climate-based NFT project. Both projects rely on the concept of tokenization to incentivize carbon offset production and carbon reduction.

The MCO2 token is available as an ERC-20 token on popular exchanges such as Coinbase. Purchase of the token (trading at $11.46 at time of writing) funds carbon offset projects. Most are based in and around the Amazon rainforest.

Moss doesn’t administer offset projects directly. Instead, they source high-quality offsets from other providers and tokenize them. Each project results in a given amount of offsets; Moss produces a set amount of tokens based on the projected offsets. One MC02 token = an offset for one tonne of CO2.

By burning MC02 tokens, Moss locks in offset projects permanently, reducing the overall supply of offsets in the market and boosting the price of remaining offsets.

The Moss Amazon NFT project operates a bit differently. Moss buys portions of the Amazon that are at-risk for deforestation. That land is then divided into 1-hectare portions, each roughly the size of a football field. The rights to those portions are digitized and tokenized as NFTs (Non-Fungible Tokens). Each NFT is unique and tied to a unique piece of property.

The Moss Amazon NFTs are actual land sales; proceeds from the sales fund further purchases, with 30% of the proceeds going to a preservation fund. That fund pays for patrolling and physically protecting the Amazon NFT holdings.

Moss distinctives:

- Amazon NFT based on actual ownership

- Due diligence for purchase and enforcement

- Part of the Celo Reserve, supporting a climate-based stablecoin (cUSD, cEUR)

- Brazil-based

KlimaDAO

Read the documentation.

KlimaDAO is nothing if not ambitious. Built on the common crypto carbon model of tokenized carbon offsets, Klima is also a DAO. As a Decentralized Autonomous Organization, KlimaDAO aims to boost the price of offsets on the VCM. This is done by purchasing carbon offsets, tokenizing them, and then selling or burning them to influence the market.

What sets Klima apart is its stated goal to be a carbon-backed currency, rather than simply a marker for credits held in reserve. To that end, all KLIMA tokens are backed 1:1 by reserve holdings in BCT, tokens issued by Toucan (see the next review).

Put more simply, to mint more KLIMA tokens (and increase supply), KlimaDAO needs to lock away BCT (Basic Carbon Tonne) in the treasury. KLIMA is backed by one BCT 1:1, and BCT is pegged to real-world offsets. Klima’s treasury functions as a blackhole for BCT and carbon offsets, removing them from the market and pushing the carbon price higher.

The DAO structure allows holders of KLIMA to take part in Klima’s governance. Holders can propose new measures and vote on their passage.

KlimaDAO Distinctives

- DAO structure and governance

- KLIMA as the currency of a new, carbon-based ecosystem

- Pegged to the BCT

Toucan

It’s not enough to describe Toucan.earth as a crypto carbon project; Toucan is more about bringing a number of related projects together, each with their own distinctives.

Toucan helps bridge carbon credits on-chain. Toucan links the Web3 architecture to the decarbonization push. Put another way, Toucan forms the base of a new, carbon-focused Web3 stack.

The core of Toucan’s project is the TCO2, which simply stands for Tokenized CO2. Each TCO2 represents one verified, real-world carbon credit. TCO2’s are semi-fungible, with unique information about each project encoded on-chain. The tokens are Verra verified, linking Toucan to one of the premier carbon offset standards.

The bridging process is complete once the BatchNFTs are approved by a Toucan verifier.

Approved BatchNFTs can then be fractionalized, creating TCO2 tokens. TCO2 tokens can be deposited into Toucan carbon pools, with depositors receiving carbon reference tokens like BCT in return. These pools aggregate liquidity and the carbon reference tokens provide a carbon building block for DeFi and ReFi developers.

Most projects planned for the Toucan stack won’t use the TCO2 directly. Trading TCO2 tokens one-for-one isn’t always possible, simply because the projects each token represents are different. To achieve the necessary liquidity for market projects such as Klima, the TCO2 tokens are fractionalized and pooled.

The first Toucan pool was the BCT pool, with Klima being the first user. The pools are gated, meaning each TCO2 token must have specific attributes to pass the gating criteria. Toucan and Pool Party members are able to set these factors for gating.

Toucan forms the foundation for a Web3 carbon crypto stack. Projects like KlimaDAO build on that stack. Tokenized carbon credits are the key.

Toucan.earth distinctives

- TCO2 token

- Token pooling and gating; BCT token

- Development of a Web3 carbon crypto stack

SavePlanetEarth

Read the whitepaper.

SavePlanetEarth’s self-description captures it all: a “carbon sequestration crypto project.” Structurally, SavePlanetEarth shares similarities with the Toucan/Klima project. The base of the project is tokenization of verified carbon credits, on which an entire ecosystem will be built – a currency and a blockchain powered by green energy.

There are a few key differences; the base token is $SPE, and the verification standard used for the carbon offsets is the Gold Standard, rather than Verra. The SPE project also relies more heavily on NFTs for the initial stage of project management, as well as something called “carbon credit certificates.”

The SPE roadmap includes a multi-level exchange, powered by the $SPE currency, where carbon credits can be bought and sold. It will also encourage external investment by allowing companies to trade their own credits on the exchange, once verified by SPE.

SPE distinctives

- Phantasma blockchain (with native SPE blockchain in development)

- Carbon-based exchange in roadmap

- Uses The Gold Standard verification

- Projects conform to all 17 of UN Sustainable Development Goals

Other notable projects:

Not every project is as well-developed as the ones above. Some are in the early stages, while others are more narrowly-focused. Here are a few significant projects to keep in mind.

AirCarbonExchange

AirCarbonExchange made the news by helping Abu Dhabi’s financial sector achieve full carbon neutrality. As an exchange, ACE sources carbon offset projects and tokenizes them into several different tokens, each tailored to a specific sector of the market. There’s no broader plan; AirCarbonExchange exists to promote the adoption of carbon crypto tokens as a commodity, and to trade them accordingly.

See how it works here.

Base

Base Carbon focuses on funding and support for developing crypto carbon projects. It also serves to source and verify projects for entry into Toucan’s TCO2 and BCT programs.

Details at the link.

CarbonTokenProject

Tokenization on the smallest scale – the trees in your backyard. CarbonTokenProject uses an innovative approach of human verification, data oracles, and the blockchain to tokenize trees. With its innovative approach, CarbonTokenProject is probably the first grassroots (treeroots?) carbon crypto initiative.

Read more here.

KumoDAO

Another crypto carbon currency, but with a twist: KumoDAO aims to be a USD-pegged stablecoin. Stablecoins pose unique technical challenges, but offer more ease of use with the traditional monetary system. KumoDAO is in the early stages, part of a wave of carbon crypto projects begun in the wake of KlimaDAO’s launch in 2021.

More info here.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

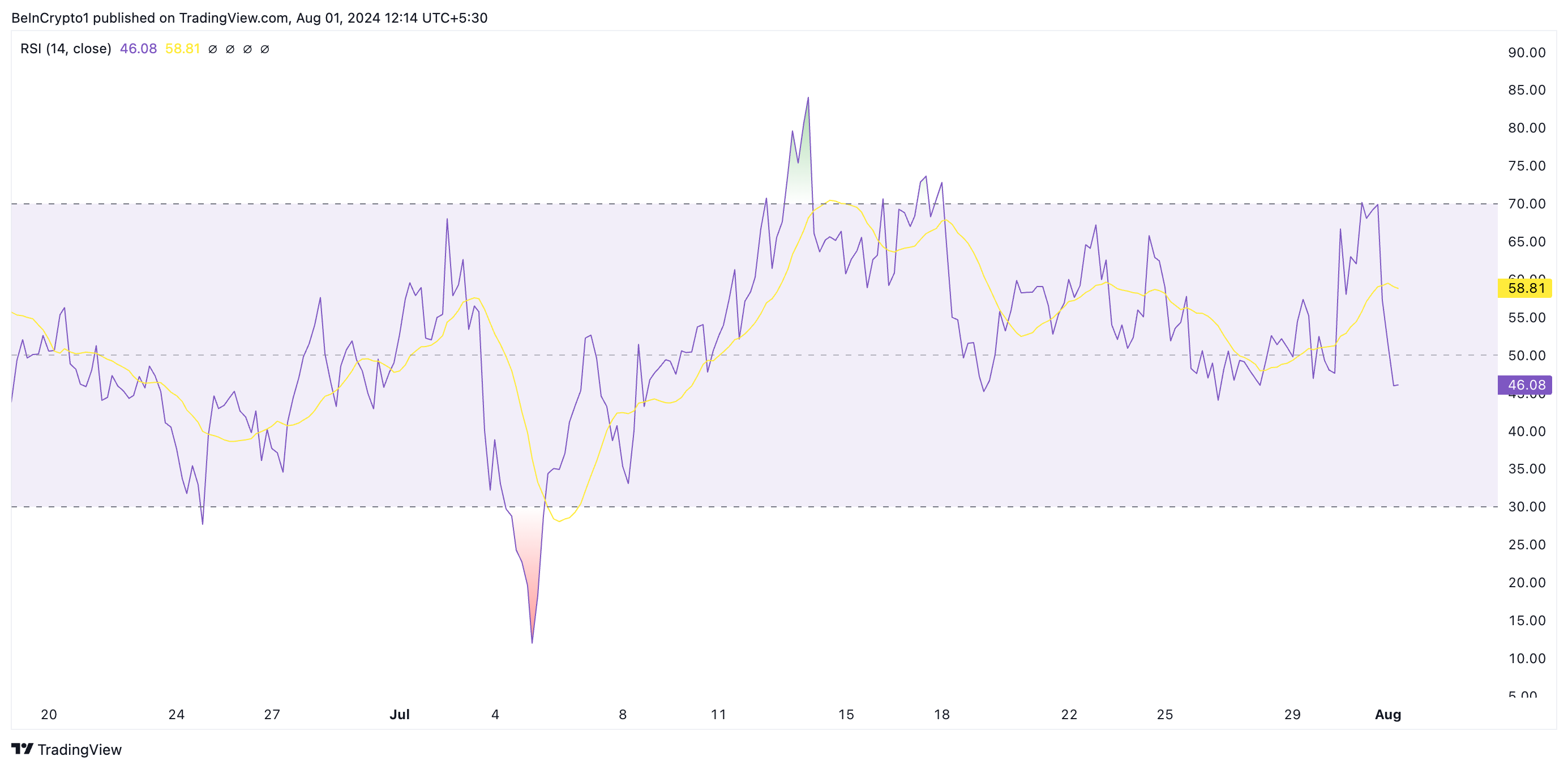

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News11 months ago

News11 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News11 months ago

News11 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi11 months ago

DeFi11 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets11 months ago

Markets11 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings