News

Bulls bet on Wall Street adoption

Bitcoin is booming again, just weeks after two of the industry’s biggest names fell. Bulls hope the lawsuits will put the industry’s troubled past behind them and allow it to tap billions of dollars from Wall Street.

The price of the most actively traded cryptocurrency has soared about 160% this year to a 20-month high of $44,000, leading the charge among digital tokens as gloomy market sentiment fades and traders return in force.

This comes just weeks after the United States successfully secured criminal charges against Changpeng Zhao and Sam Bankman-Fried, the former executives of exchanges Binance and FTX respectively and two of the biggest names associated with the 2020-21 bubble market.

Speculators are now betting that the toughest regulatory sanctions have passed and Bitcoin will be adopted by major global fund managers and investment banks.

“You see the two biggest players in cryptocurrency potentially both going to jail and yet cryptocurrency continues… the old guard is being replaced by new money,” said Ed Hindi, chief investment officer at investment management firm Tyr Capital.

“Everything has been put into bitcoin and it has held up. Like it or not, it’s going to occupy a place in wallets.”

The surge in bitcoin, along with other cryptocurrencies, comes as investors bet on growth stocks and riskier assets in anticipation of central banks cutting interest rates next year.

CK Zheng, co-founder and chief investment officer of crypto hedge fund ZX Squared Capital, said the Fed’s rate cuts were just “icing on the cake.” “Bitcoin’s price fundamentals are driven by the introduction of highly regulated companies into the market. Wall Street is embracing crypto,” he added.

The cryptocurrency market, known for its ups and downs, has regained a particular momentum after 20 months of bad news and painful declines. After peaking at just over $69,000 in November 2021, the value of bitcoin fell by three-quarters to just $16,000 at the start of this year.

This year’s steady recovery accelerated in November, especially after U.S. authorities fined Binance $4.3 billion for violating financial sanctions and money laundering. Crucially, they did not shut down the world’s most influential cryptocurrency exchange.

The move has helped attract cryptocurrency supporters. This week, El Salvador’s authoritarian president, Nayib Bukele, under whom bitcoin became legal tender in 2021, triumphantly posted on the social media site X that the country’s holdings of the digital currency were profitable again. Meanwhile, Brian Armstrong, chief executive of the U.S. exchange Coinbase, said he has been thinking about how bitcoin “could be the key to the expansion of Western civilization.”

Some even see it as the start of a new supercycle. US investment bank Bernstein predicted last month that bitcoin’s value could more than triple to $150,000 by 2025.

Key to the optimism is the Securities and Exchange Commission’s approval of exchange-traded funds that invest directly in cryptocurrency.

The market has long viewed spot Bitcoin ETFs as a way to attract U.S. retail investors with a cheap but safe and regulated investment product. For a decade, the SEC has resisted all requests, arguing that Bitcoin prices are set on unregulated exchanges and therefore cannot provide adequate investor protection.

But pressure on the SEC has been mounting since it lost a ruling last summer over its reasons for blocking an ETF application from asset manager Grayscale. BlackRock and Franklin Templeton are among the big names that have filed applications, raising hopes they can attract a large number of U.S. retail investors to cryptocurrencies. An SEC decision could be made as early as next month.

“Just improving market access shouldn’t really drive prices up, but I think it does because it’s an explicit signal from the SEC that they approve of bitcoin, at least in some respects,” said James Butterfill, head of research at investment group CoinShares.

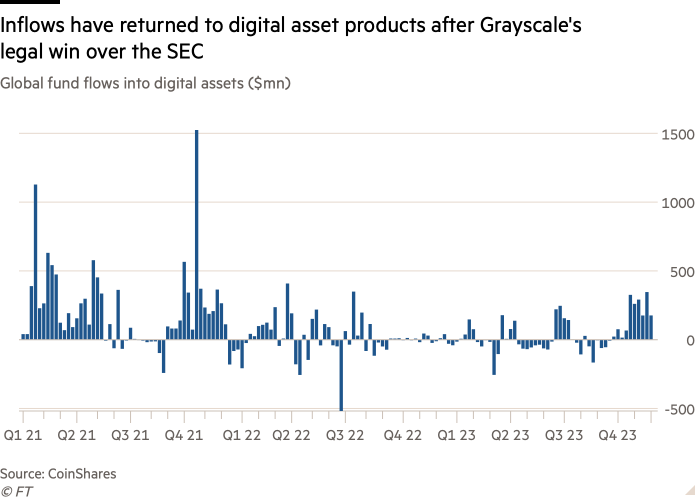

Many investors have already bought cryptocurrencies in anticipation of continued demand growth. According to CoinShares data, there have been 10 consecutive weeks of inflows into digital asset products, an investment surge that came shortly after Grayscale’s legal victory against the SEC.

Speculators are hoping that the acceptance of Bitcoin ETFs by U.S. regulators will provide more lasting support for prices, unlike previous bitcoin rallies, such as 2013, 2017 and 2021, when prices soared quickly only to crash just as violently.

“This will be the first time that there might be real recognition of bitcoin… I think that means that this time the rally will be more sustained,” Butterfill added.

Optimists also point to a technical shift in bitcoin production that they believe will support demand. Next April, the number of bitcoins miners receive for verifying cryptocurrency transactions will be halved, in an effort to reduce the supply of new bitcoins on the market.

“This will be a very powerful technical driver for the price of bitcoin as mining becomes more difficult and less profitable, and scarcity continues to increase,” said Tim Frost, CEO of Yield App, a crypto platform that offers its clients yields on digital assets.

Despite the renewed confidence, some doubts remain about the sustainability of bitcoin’s rally. Two of the largest U.S. ETF providers, Vanguard and State Street, have not filed to list a spot bitcoin ETF. State Street told Financial News in summer that there was “no investment case for crypto.”

Recommended

U.S. authorities said monitoring of illicit behavior in subsectors such as the stablecoin market would continue next year.

The SEC has pending cases against Binance and U.S.-listed Coinbase, alleging that both exchanges were unregistered and sold unregistered securities. The SEC’s victories could force many of them to register with the regulator and impose stricter oversight and transparency on their markets.

Some industry insiders also doubt that the SEC will end this long-standing habit and approve a Bitcoin spot ETF.

David Mercer, chief executive of LMAX Group, a currency trading platform, said the SEC’s approval of an ETF was already priced into the market, but added that the primary goal was to transform traditional assets such as securities into digital tokens.

“The ultimate goal is for most of traditional finance to be enabled by blockchain in the coming decades. From that perspective, we are only at the beginning,” he added.

But after months of negative headlines and a barrage of enforcement actions, some are hoping the rally will only mark a break with the past, rather than spark a new bull run.

“We’re focused on getting out of this orbit that we’ve been in for the last 18 months rather than driving prices up astronomically,” said Michael Safai, co-founder of trading firm Dexterity Capital. “Those days are over, or should be,” Safai added.

Video: Bitcoin mines could be used for energy storage | FT Tech

Fuente

News

Bitcoin soars above $63,000 as money flows into new US investment products

Bitcoin has surpassed the $63,000 mark for the first time since November 2021. (Chesnot via Getty Images)

Bitcoin has broken above the $63,000 (£49,745) mark for the first time since November 2021, when the digital asset hit its all-time high of over $68,000.

Over the past 24 hours, the value of the largest digital asset by market capitalization has increased by more than 8% to trade at $63,108, at the time of writing.

Learn more: Live Cryptocurrency Prices

The price appreciation was fueled by record inflows into several U.S.-based bitcoin cash exchange-traded funds (ETFs), which were approved in January this year.

A Bitcoin spot ETF is a financial product that investors believe will pave the way for an influx of traditional capital into the cryptocurrency market. Currently, indications are favorable, with fund managers such as BlackRock (BLK) and Franklin Templeton (BEN), after allocating a record $673 million into spot Bitcoin ETFs on Wednesday.

Learn more: Bitcoin’s Success With SEC Fuels Expectations for an Ether Spot ETF

The record allocation surpassed the funds’ first day of launch, when inflows totaled $655 million. BlackRock’s iShares Bitcoin Trust ETF (I BITE) alone attracted a record $612 million yesterday.

Bitcoin Price Prediction

Earlier this week, veteran investor Peter Brandt said that bitcoin could peak at $200,000 by September 2025. “With the push above the upper boundary of the 15-month channel, the target for the current market bull cycle, which is expected to end in August/September 2025, is raised from $120,000 to $200,000,” Brandt said. published on X.

The influx of capital from the traditional financial sphere into Bitcoin spot ETFs is acting as a major price catalyst for the digital asset, but it is not the only one. The consensus among analysts is that the upcoming “bitcoin halving” could continue to drive flows into the bitcoin market.

The Bitcoin halving is an event that occurs roughly every four years and is expected to happen again next April. The halving will reduce the bitcoin reward that miners receive for validating blocks on the blockchain from 6.25 BTC to 3.125 BTC. This could lead to a supply crunch for the digital asset, which could lead to price appreciation.

The story continues

Watch: Bitcoin ETFs set to attract funds from US pension plans, says Standard Chartered analyst | Future Focus

Download the Yahoo Finance app, available for Apple And Android.

News

FRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

Forensic Risk Alliance (FRA), an independent consultancy specializing in regulatory investigations, compliance and litigation, has welcomed U.S.-based cryptocurrency specialist Thomas Hyun as a director of the firm’s global cryptocurrency investigations and compliance practice. Hyun brings to the firm years of experience building and leading anti-money laundering (AML) compliance programs, including emerging payment technologies in the blockchain and digital asset ecosystem.

Hyun has nearly 15 years of experience as a compliance officer. Prior to joining FRA, he served as Director of AML and Blockchain Strategy at PayPal for four years. He established PayPal’s financial crime policy and control framework for its cryptocurrency-related products, including PayPal’s first consumer-facing cryptocurrency offering on PayPal and Venmo, as well as PayPal’s branded stablecoin.

At PayPal, Hyun oversaw the second-line AML program for the cryptocurrency business. His responsibilities included drafting financial crime policies supporting the cryptocurrency business, establishing governance and escalation processes for high-risk partners, providing credible challenge and oversight of front-line program areas, and reporting to the Board and associated authorized committees on program performance.

Prior to joining PayPal, Hyun served as Chief Compliance Officer and Bank Secrecy Officer (BSA) at Paxos, a global blockchain infrastructure company. At Paxos, he was responsible for implementing the compliance program, including anti-money laundering and sanctions, around the company’s digital asset exchange and its asset-backed tokens and stablecoins. He also supported the company’s regulatory engagement efforts, securing regulatory approvals, supporting regulatory reviews, and ensuring compliance with relevant digital asset requirements and guidelines.

Thomas brings additional experience in payments and financial crime compliance (FCC), having previously served as Vice President of Compliance at Mastercard, where he was responsible for compliance for its consumer products portfolio. He also spent more than seven years in EY’s forensics practice, working on various FCC investigations for U.S. and foreign financial institutions.

Hyun is a Certified Anti-Money Laundering Specialist (CAMS) and a Certified Fraud Examiner (CFE). He is a graduate of New York University’s Stern School of Business, where he earned a bachelor’s degree in finance and accounting. Additionally, he serves on the board of directors for the Central Ohio Association of Certified Anti-Money Laundering Specialists (ACAMS) chapter.

Commenting on his appointment, Hyun said, “With my experience overseeing and implementing effective compliance programs at various levels of maturity and growth, whether in a startup environment or large enterprises, I am excited to help our clients overcome similar obstacles and challenges to improve their financial crime compliance programs. I am excited to join FRA and leverage my experience to help clients navigate the complexities of AML compliance and financial crime prevention in this dynamic space.”

FRA Partner, Roy Pollittadded: “As the FRA’s sponsor partner for our growing Cryptocurrency Investigations and Compliance practice, I am thrilled to have Thomas join our ever-expanding team. The rapid evolution of blockchain and digital asset technologies presents both exciting opportunities and significant compliance challenges. Hiring Thomas in a leadership role underscores our commitment to staying at the forefront of the industry by enhancing our expertise in anti-money laundering and blockchain strategy.”

“Thomas’ extensive background in financial crime compliance and proven track record of building risk-based FCC programs in the blockchain and digital asset space will be invaluable as we continue to provide our clients with the highest level of service and innovative solutions.”

“FRA strengthens cryptocurrency practice with new director Thomas Hyun” was originally created and published by International Accounting Bulletina brand owned by GlobalData.

The information on this website has been included in good faith for general information purposes only. It is not intended to amount to advice on which you should rely, and we make no representations, warranties or assurances, express or implied, as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our website.

News

Bitcoin trades around $57,000, crypto market drops 6% ahead of Fed decision

-

Bitcoin fell in line with the broader cryptocurrency market, with ether and other altcoins also falling.

-

Financial markets were weighed down by risk-off sentiment ahead of the Fed’s interest rate decision and press conference later in the day.

-

10x Research said it is targeting a price target of $52,000 to $55,000, anticipating further selling pressure.

Bitcoin {{BTC}} was trading around $57,700 during European morning trading on Wednesday after falling to its lowest level since late February, as the world’s largest cryptocurrency recorded its worst month since November 2022.

BTC has fallen about 6.3% over the past 24 hours, after breaking below the $60,000 support level late Tuesday, according to data from CoinDesk. The broader crypto market, as measured by the CoinDesk 20 Index (CD20), lost nearly 9% before recovering part of its decline.

Cryptocurrencies have been hurt by risk-off sentiment in broader financial markets amid stagflation in the United States, following indications of slowing growth and persistent inflation that have dampened hopes of an interest rate cut by the Federal Reserve. The Federal Open Market Committee is due to deliver its latest rate decision later in the day.

Ether {{ETH}} fell about 5%, dropping below $3,000, while dogecoin {{DOGE}} led the decline among other major altcoins with a 9% drop. Solana {{SOL}} and Avalanche {{AVAX}} both lost about 6%.

Bitcoin plunged in April, posting its first monthly loss since August. The 16% drop is the worst since November 2022, when cryptocurrency exchange FTX imploded, but some analysts are warning of further declines in the immediate future.

10x Research, a digital asset research firm, said it sees selling pressure toward the $52,000 level due to outflows from U.S. cash exchange-traded funds, which have totaled $540 million since the Bitcoin halving on April 20. It estimates that the average entry price for U.S. Bitcoin ETF holders is $57,300, so this could prove to be a key support level.

The closer the bitcoin spot price is to this average entry price, the greater the likelihood of a new ETF unwind, 10x CEO Markus Thielen wrote Wednesday.

“There may have been a lot of ‘TradeFi’ tourists in crypto – pushing longs all the way to the halving – that period is now over,” he wrote. “We expect more unwinding as the average Bitcoin ETF buyer will be underwater when Bitcoin trades below $57,300. This will likely push prices down to our target levels and cause a -25% to -29% correction from the $73,000 high – hence our $52,000/$55,000 price target over the past three weeks.”

The story continues

UPDATE (May 1, 8:56 UTC): Price updates throughout the process.

UPDATE (May 1, 9:57 UTC): Price updates throughout the process.

UPDATE (May 1, 11:05 UTC): Adds analysis from 10x.

News

The Cryptocurrency Industry Is Getting Back on Its Feet, for Better or Worse

Hello from Austin, where thousands of crypto enthusiasts braved storms and scorching heat to attend Consensus. The industry’s largest and longest-running conference, which can sometimes feel like a religious revival, offers opportunities to chat and listen to leading names in crypto. And for the casual observer, Consensus offers a useful glimpse into the mood of an industry prone to wild swings in fortune.

Unsurprisingly, the mood is noticeably more positive than it was a year ago, when crowds were sparse and many attendees were quietly confiding that they were considering switching to AI. In practice, that means some of the more obnoxious elements are back, but not to the level of Consensus 2018 in New York, when charlatans parked Lamborghinis outside the event and the hallways were lined with booth girls and scammers pitching “ICOs in a box.”

This time around, Elon Musk’s Cybertrucks have replaced Lamborghinis as the vehicle of choice for marketers. One of the most notable publicity stunts was a startup that paid a poor guy to parade around in the Texas sun in a Jamie Dimon costume, wig, and mask, and then staged a mock assault on him by memecoin characters.

Outside the event was a giant “RFK for President” truck, while campaign staffers manned a booth instead — a reflection of both the election year and crypto’s willingness to latch onto any candidate, no matter how outlandish, who will talk about the industry. RFK himself is scheduled to address the conference on Thursday.

Excesses aside, the general sense of optimism was understandable. The cryptocurrency market has not only recovered from the wave of fraud that nearly sank it in 2022, it is riding a new wave of political legitimacy. This month, cryptocurrencies scored once-unthinkable political victories in Washington, D.C., and there is a sense that the industry has not only withstood the relentless regulatory assaults of SEC Chairman Gary Gensler and Sen. Elizabeth Warren, but is poised to defeat them.

And while cryptocurrency is still searching for its flagship application, the optimists I spoke with pointed to signs that it is (once again) upon us. Those signs include the rapid advancement of zero-knowledge proofs as well as the popularity of Coinbase’s Base blockchain and, perhaps most importantly, the large-scale arrival of traditional finance into the world of cryptocurrencies – a development that not only provides a major financial boost, but also a new element of stability and maturity that will, perhaps, tame the worst of crypto’s wilder side. Finally, this consensus marked the end of the Austin era as the conference, under new leadership, will be held in Toronto and Hong Kong in 2025.

The story continues

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

This story was originally featured on Fortune.com

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit