Bitcoin

Bitcoin (BTC) Sees $630 Million Outflows Amid Crypto Bloodbath

Mushumir’s ass

Bitcoin’s Troubles Continue as Bearish Sentiment Prevails in the Market

Read U.TODAY at

google news

Bitcoin (BTC) has witnessed massive outflows amid the ongoing crypto bloodbath. According to CoinShares Research Blog, Bitcoin recorded outflows of US$630 million last week. Although this has raised concerns in the community, the situation appears to be getting worse.

Collectively, digital asset investment products recorded outflows of US$584 million. Notably, this was the second consecutive week of outflows observed in the market. This dramatic drop in digital asset investment products comes in a context of macroeconomic concerns.

Investors seem to be worried about the FED’s next decision regarding interest rate cuts. There is a negative sentiment in the market as investors have started to ignore risky assets like Bitcoin and altcoins.

Ethereum (ETH), the market’s leading altcoin, also saw outflows of $58 million last week. This negative trend for ETH is crucial as it highlights how bearish traders have become on the broader market.

Bitcoin price drop

Amid these huge outflows of digital asset investment products, the price of Bitcoin also collapsed today. BTC price plummeted 4.80% to $61,184 per CoinMarketCap. This is a worrying situation as the top cryptocurrency has not increased significantly following the recent halving.

Many expected a big recovery after the Bitcoin halving. Historical patterns suggest that BTC continues to rise following these events. However, the market did not witness this trend this time.

Although bearish sentiment prevails in the market, some still suggest that Bitcoin will not start a rally right after the halving. They predict that Bitcoin will take time and may begin this early recovery in the long term.

Notably, today’s Bitcoin crash comes amid the latest declaration of the defunct Mt. Gox crypto exchange. The statement revealed that the exchange will begin refunding stolen goods to its users starting next month. These refunds will be made in Bitcoin and Bitcoin Cash (BCH).

About the author

Mushumir’s ass

With over three years of immersive experience in the crypto industry, Mushumir is an experienced crypto writer dedicated to unraveling the complexities of blockchain technology and decentralized finance. From dissecting the latest blockchain innovations to demystifying trading strategies, he brings a unique combination of technical insight and communicative talent to the crypto space. Having written countless articles, analyzes and market reports, Mushumir has developed a distinct voice that resonates with both seasoned investors and crypto newcomers.

Bitcoin

Bitcoin (BTC) payments app strike continues global expansion with UK launch

Strike, the payments app that uses the Bitcoin blockchain, has launched a service in the United Kingdom, the company said in a blog post on Tuesday, expanding its global reach just months after launching in Europe and Africa.

Customers in the UK can now buy, sell and withdraw funds using the Strike app, the company said. Users can send and receive bitcoin (BTC) or pound sterling.

The payments company has been expanding aggressively and now operates in more than 100 countries and territories around the world. Strike launched in Europe in April and in Africa at the beginning of the year. Although some crypto companies have withdrawn from the UK, Strike said it was expanding its presence and doubling down on its commitment to greater bitcoin adoption across the world.

“With a population of 67 million, the UK is the second largest economy in Europe and the sixth largest in the world and presents significant opportunities for bitcoin adoption,” the company said.

The company will serve cross-border customers from its European base. The company registered by the Financial Conduct Authority Engelberto will ensure that it complies with regulatory requirements regarding crypto promotions.

Beat was developed by Chicago-based startup Zap Solutions, allowing customers to send and receive money around the world, like Cash App or PayPal (PYPL). The app, launched in the US in 2020, uses Bitcoin Lightning Network for payments, which makes transfers faster and cheaper.

UPDATE (June 25, 11:52 am UTC): Changes first paragraph to say UK service rather than UK operation.

Bitcoin

MtGox’s $9 billion payment is creditors’ gain, but Bitcoin’s pain

getty

Bitcoin is trading below $60,000 for the first time since early May, when exchange MtGox announced that it will begin distributing approximately $9 billion in cryptocurrencies and $50 million in bitcoin cash to its long-suffering creditors.

The now-defunct Tokyo-based platform, once the world’s largest bitcoin spot exchange, closed in 2014 after a series of hacks. Of the 950,000 bitcoins lost, approximately 140,000 were recovered after MtGox declared bankruptcy, leaving thousands of creditors around the world stranded. Nine years later, authorities identified the hackers as two Russian citizens loaded by the US Department of Justice for conspiring to launder approximately 647,000 bitcoins from the exchange.

Over the years, MtGox has faced several delays in repaying creditors, but today administrator Nobuaki Kobayashi announced the exchange will begin distributing bitcoin and bitcoin cash (which customers automatically received in 2017 when the token was created) to the cryptocurrency exchanges it has agreed to distribute payments with, which include Kraken, Bitstamp and BitGo, next month. The exchange emerged from an online card trading service, and MtGox stands for Magic: The Gathering Online Exchange.

The crypto market’s reaction was swift, with more than $200 million worth of long positions forcibly liquidated in the last 12 hours, according to Georgi Koreli, co-founder and CEO of privacy protocol Hinkal. “We expect the payments to be a stress for the market, however, they could be a tremendous opportunity for those waiting to ‘buy the dip,’” Koreli said in a comment to Forbes.

Alex Thorn, head of research at Galaxy Digital, a cryptocurrency-focused investment firm founded by billionaire Mike Novogratz, believes the market is overestimating the potential impact. Of the 140,000 bitcoins held by the bankruptcy estate, only about 65,000 will be handed over to 20,000 individual creditors, many of whom are tech-savvy early adopters and well-known bitcoiners, Thorn noted in a research note to clients last seen by Forbes. month. These include co-founders of bitcoin technology firm Blockstream Adam Back and Greg Maxwell and longtime bitcoin booster Roger Ver.

A significant reason for lenders not to sell all of their tokens at once is the risk of a massive capital gains tax. Many creditors purchased their bitcoin for as little as $451 (the price when MtGox filed for bankruptcy), and with bitcoin now trading just below $60,000, the tax implications are considerable.

The remaining tokens will be sent to separate large claims and bankruptcy funds. Contrary to market expectations, Thorn suggested that these funds will not flood the market. “In speaking with several LPs in these funds, we do not believe there will be significant sales from this group. Likewise, Bitcoinica (a bitcoin exchange that was also hacked and whose administrator placed its recovered coins in Mt. Gox for safekeeping…) will not be able to sell for payment because the funds will enter their own bankruptcy process in New Zealand,” he said. he wrote.

Matt Hougan, chief investment officer at crypto asset manager Bitwise, agrees: “The best studies on MtGox claims suggest that most early investors have already sold their claims on the secondary claims market. For example, NYDIG has some quality research that suggests the actual amount likely to enter the market is closer to $3 billion than $10 billion. Still, $3 billion is a lot of bitcoin. I suspect what you are seeing now is market pre-positioning for these distributions. That makes this a ‘sell the rumor, buy the news’ event.”

Bitcoin cash, however, is expected to perform worse. It was created in 2017 as a result of a blockchain split when some developers were unhappy with Bitcoin’s scalability, according to CoinGecko. “The creditor group is significantly comprised of ‘OG’ bitcoiners who have never purchased bitcoin cash and will likely have no affinity for the 2017 bitcoin fork,” Thorn wrote, noting that bitcoin has 60 times more liquidity than bitcoin cash in the Kraken and Bitstamp, where individual lenders will receive coins.

All known MtGox admin wallet addresses can be tracked via Arkham Intelligence.

Bitcoin recently traded at $59,026, according to CoinGecko, down 8.3% in the last 24 hours.

Bitcoin

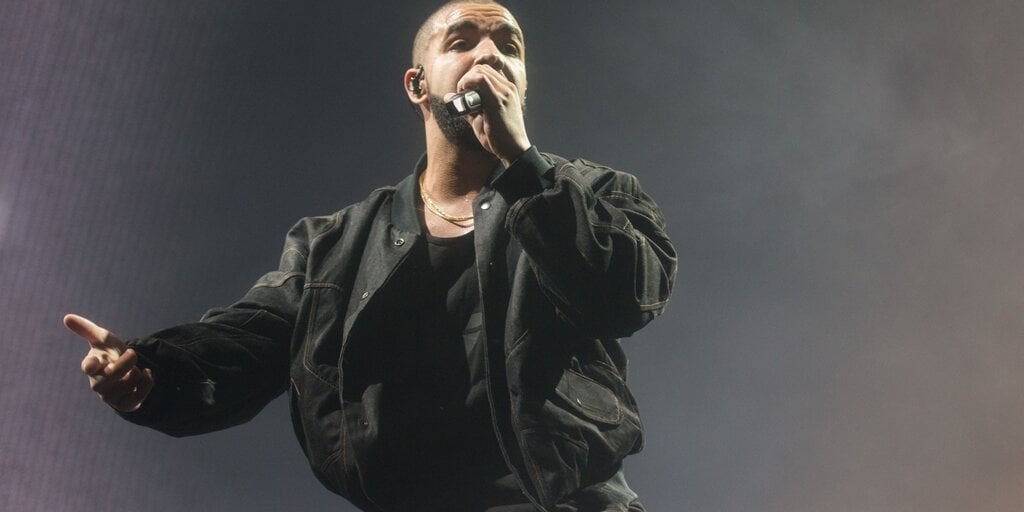

Rapper Drake lost more than $1 million on Bitcoin bets on the Stanley Cup and NBA Finals

On a wild ride of high stakes and cryptocurrencies, rap icon Drake found himself on the wrong end of a seven-figure Bitcoin betting spree.

The Canadian superstar, known for his love for sports bettinghas already lost more than $1 million in Bitcoin (BTC) after two ill-fated bets on the NBA Finals and the Stanley Cup Finals.

Earlier this month, Decrypt reported that Drake had lost half a million in Bitcoin on the Dallas Mavericks to take the NBA title. The Mavs ended up being defeated by the Boston Celtics in a five-game series that left Drake’s digital wallet a little lighter.

But that was just the beginning Drizzy’s Bitcoin Betting problems. The “God’s Plan” rapper also invested another $500,000 in BTC in the Edmonton Oilers to hoist the NHL’s Stanley Cup. On Saturday, the Oilers fell to the Florida Panthers in Game 5, sealing Drake’s second-largest crypto L bet in as many weeks. Then last night, the Panthers beat the Oilers in Game 7 to clinch their first championship in franchise history.

Never one to hide his bets, Drake decided Instagram to share his betting slips, writing “Dallas because I’m a Texan. Oilers are self-explanatory. Picks are @stake.” Stake, for those who don’t know, is a popular cryptocurrency casino and sports betting platform. The Toronto rapper has been closely linked to Stake since 2020, when he partnered with the company and eventually became co-owner.

Source: Instagram

Drake’s public losses shine a light on the growing intersection between celebrities, sports betting and cryptocurrencies. The popularity of crypto gambling has exploded in recent years, with a number of Bitcoin casinos and betting sites now competing for a piece of the action.

But it’s not just sports betting that attracts the crypto crowd. Political betting markets such as Polymarket have also seen an increase in activity, especially around high-stakes events such as the 2024 US presidential election.

Polymarket, which allows users to bet on outcomes using cryptocurrencies, has seen trading volumes in the millions for markets such as “Who will win the US presidential election in 2024?” The platform has been praised for its potential to harness the “wisdom of the crowd”, but also criticized (and fined) due to its lack of regulation. But the controversy hasn’t dampened industry interest. The platform just raised US$70 million in May. The round was led by Ethereum founder Vitalik Buterin and Peter Thiel’s Founders Fund.

Drake’s high-profile losses serve as a fascinating case study in the evolving world of crypto betting. As digital currencies continue to gain widespread acceptance, their integration into traditional betting markets seems inevitable.

While for Drake, the $1 million drop in Bitcoin betting is likely a drop in the bucket. The rapper, who has an estimated net worth of $250 million, is undoubtedly bringing more attention to the world of crypto gambling. As this space continues to evolve, it will be fascinating to watch how it shapes the future of online betting, celebrity engagement, and even the broader crypto ecosystem.

Edited by Stacy Elliott.

Bitcoin

Bitcoin Price Outlook: Key $60,000 Support Level Could Trigger Downside

- Bitcoin’s 16% sell-off this month is testing a key support level around $60,000.

- This support level is reinforced by Bitcoin’s 200-day moving average of just under $58,000.

- A break below $60,000 could lead to a 15% decline to the next support level at $51,500.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go. get the app

By clicking “Register”, you accept our Service Terms It is Privacy Policy. You can unsubscribe at any time by visiting our Preferences page or clicking “unsubscribe” at the bottom of the email.

Bitcoin’s steady decline this month has caused the cryptocurrency to test a key support level that could ultimately give way to a more painful sell-off.

Bitcoin fell 4% on Monday and is down 16% from its June 7 high of nearly $72,000, hitting an intraday low of around $60,000 on Monday.

According to Katie Stockton, founder of Fairlead Strategies, $60,000 represents a key line in the sand that should support the price of the world’s largest cryptocurrency.

But if that doesn’t happen, and bitcoin falls decisively below $60,000, it suggests the token could continue its descent to its next support level around $51,500.

“Support is now reinforced by the 200-day MM, giving it more importance,” Stockton said in a note to clients on Monday.

Bitcoin’s rising 200-day moving average stands at just under $58,000.

“There are no ‘buy’ signals, so we would wait for support to be discovered in bitcoin. If a breakdown were to occur, that would place the next support near $51,500,” Stockton said.

A further decline to $51,500 would represent a potential drop of around 15% from current levels and would represent a 30% decline from its record high of nearly $74,000 reached in March.

Leadership Strategies

The latest bitcoin sell-off also sounded the alarm for the broader stock market, according to a Wall Street analyst.

“Recently, the weakening of bitcoin signals an imminent S&P 500 summer correction and consolidation phase,” Stifel strategist Barry Bannister said last week.

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs

-

News1 year ago

News1 year agoBitcoin holds near $63,000, solidifying the week’s rally

-

Videos1 year ago

Videos1 year agoBlackRock and Wall Street ready to take Bitcoin directly to $200,000 – Anthony Scaramucci

-

Markets1 year ago

Markets1 year agoRipple’s XRP Price Rises to $10 Looks Likely in This Scenario Amid $3 Trillion XRP Market Outlook ⋆ ZyCrypto