Markets

Arbitrum price points to $1.50 on an 80% increase in whale activity

Arbitrum price regained the $1.20 territory on June 6, after falling to a 2-week low of $1.10 48 hours earlier, on-chain analysis explores the key catalyst behind the resurgence of the ARB.

ARB price rebounds 7% in 48 hours, ending a 14-day losing streak

Founded in 2022, Arbitrum has quickly risen to prominence over the past two years, becoming one of the most widely adopted Ethereum Layer 2 (L2) scaling solutions. The price of the ARB token has seen significant volatility over the past month.

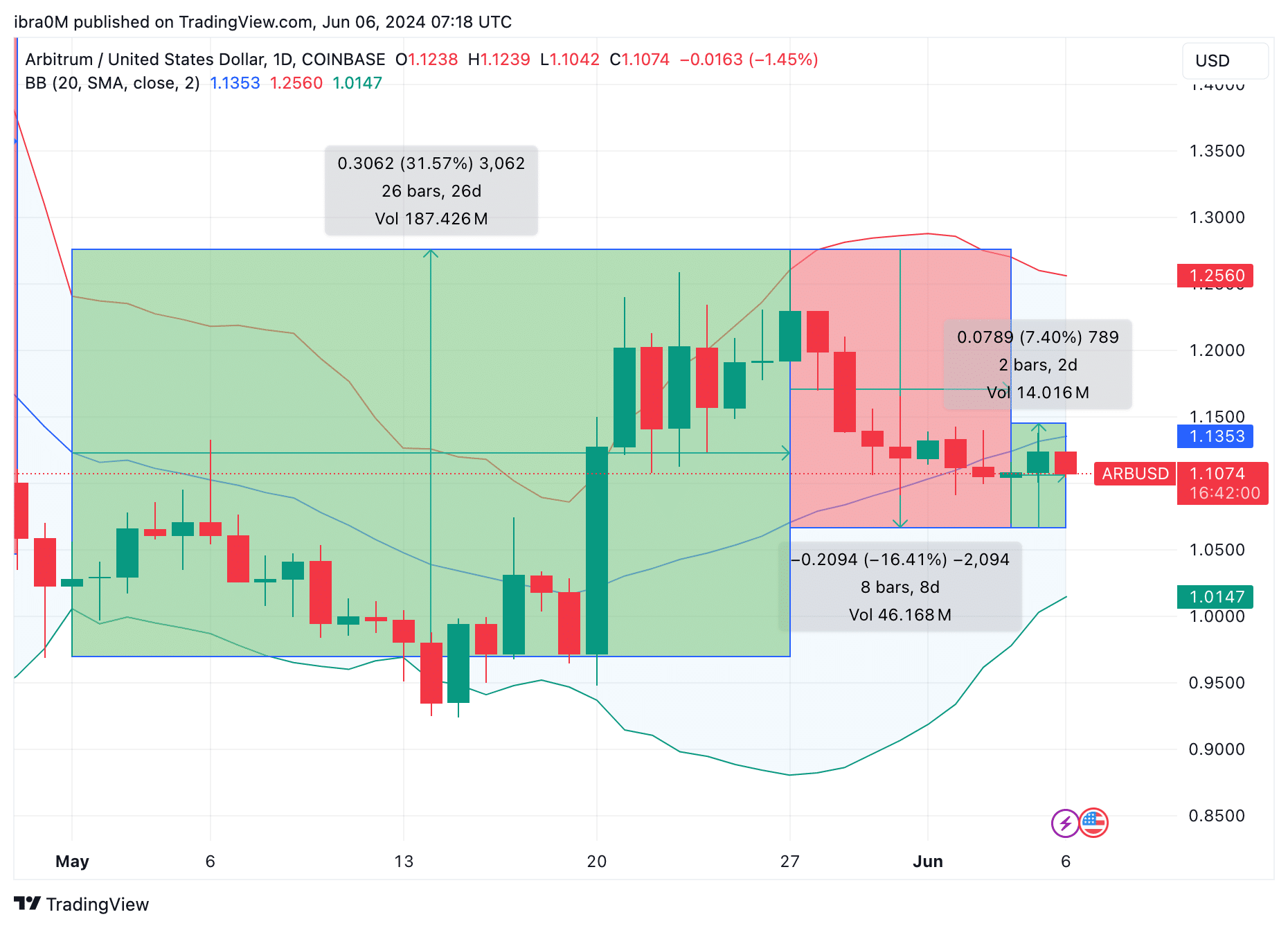

Starting in May 2024 with a strong performance, Arbitrum price increased by 31% between May 1st and May 21st. However, the momentum was halted by the approval of the Ethereum ETF.

While new entrants have shifted their focus to the Ethereum markets, existing Arbitrum investors have taken a more cautious approach. As a result, ARB underwent a rapid price correction of 17% starting May 21, reaching a two-week low of $1.10 on June 4.

However, this week, growing optimism about the upcoming US non-farm payrolls report and an expected Fed rate cut have triggered bullish activity in cryptocurrency markets.

As illustrated in the chart, Arbitrum price has rebounded 7% over the past 48 hours, briefly rising above the $1.20 level on June 6.

Whale activity up 68% in June 2024

Looking beyond the daily price charts, on-chain data indicates that recent fluctuations in whale investor activity may be fueling the ongoing Arbitrum recovery phase. As demand returns to cryptocurrency markets this week, the near-term price outlook for Arbitrum appears increasingly bearish.

– Announcement –

IntoTheBlock’s large transaction trends, shown in the chart below, track the daily number of transactions on a crypto network exceeding $100,000. This metric offers insight into the level of whale demand a cryptocurrency has attracted over a specific period.

As of June 1, Arbitrum has recorded just 129 whale transactions. However, investor demand for whales has increased significantly since then.

Over the next five days, whale activity steadily increased, culminating in 218 large transactions on June 5. This represents a 68% increase in whale demand for Arbitrum since the start of the month.

A sustained increase in whale transactions typically puts upward pressure on the token’s price. The additional liquidity from these transactions allows profit takers to exit without disrupting the ARB price rally.

ARB Price Prediction: $1.50 Resistance at Risk

Historically, Arbitrum price has often faced strong resistance at the $1.20 level, but the 68% increase in whale trades means the bulls may now be aiming for a bounce towards the $1.50 level .

Meanwhile, IntoTheBlock’s GIOM data, which compares all current Arbitrum investors based on their buy-in prices, also supports this bullish position.

As seen above, there is a formidable resistance group of 100,900 ARB addresses that have acquired 158.36 million ARBs at an average price of $1.45. If Arbitrum whales continue buying and those sales collapse, ARB price could advance to new monthly highs above the $1.50 mark.

Conversely, if the market enters a prolonged correction phase, bears could aim for a major reversal below $1.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Announcement-