DeFi

XPAD Review | CoinCodex

In recent years, the decentralized finance (DeFi) industry has seen incredible growth and innovation. However, many challenges still need to be addressed that prevent widespread adoption. One of the main issues facing both investors and projects is the need to strengthen the security and quality control of launch platforms. It’s too easy for scams and attempted fraud to slip through the cracks, undermining trust in the entire ecosystem.

Enter XPADPRO, a new player aiming to completely disrupt the launch pad model and set a new benchmark in security and governance. Through its proprietary Xpad protocol and a unique DAO structure, XPADPRO seeks to eliminate the risks that have held DeFi back while opening new opportunities for investors.

In this article, we’ll take an in-depth look at what makes XPADPRO so compelling. We’ll discuss the problems they aim to solve, how their technical solutions work, and why their tokenomics offer investors strong upside potential. By the end, you’ll understand why XPADPRO might just become the premier home to launch the next generation of leading crypto projects.

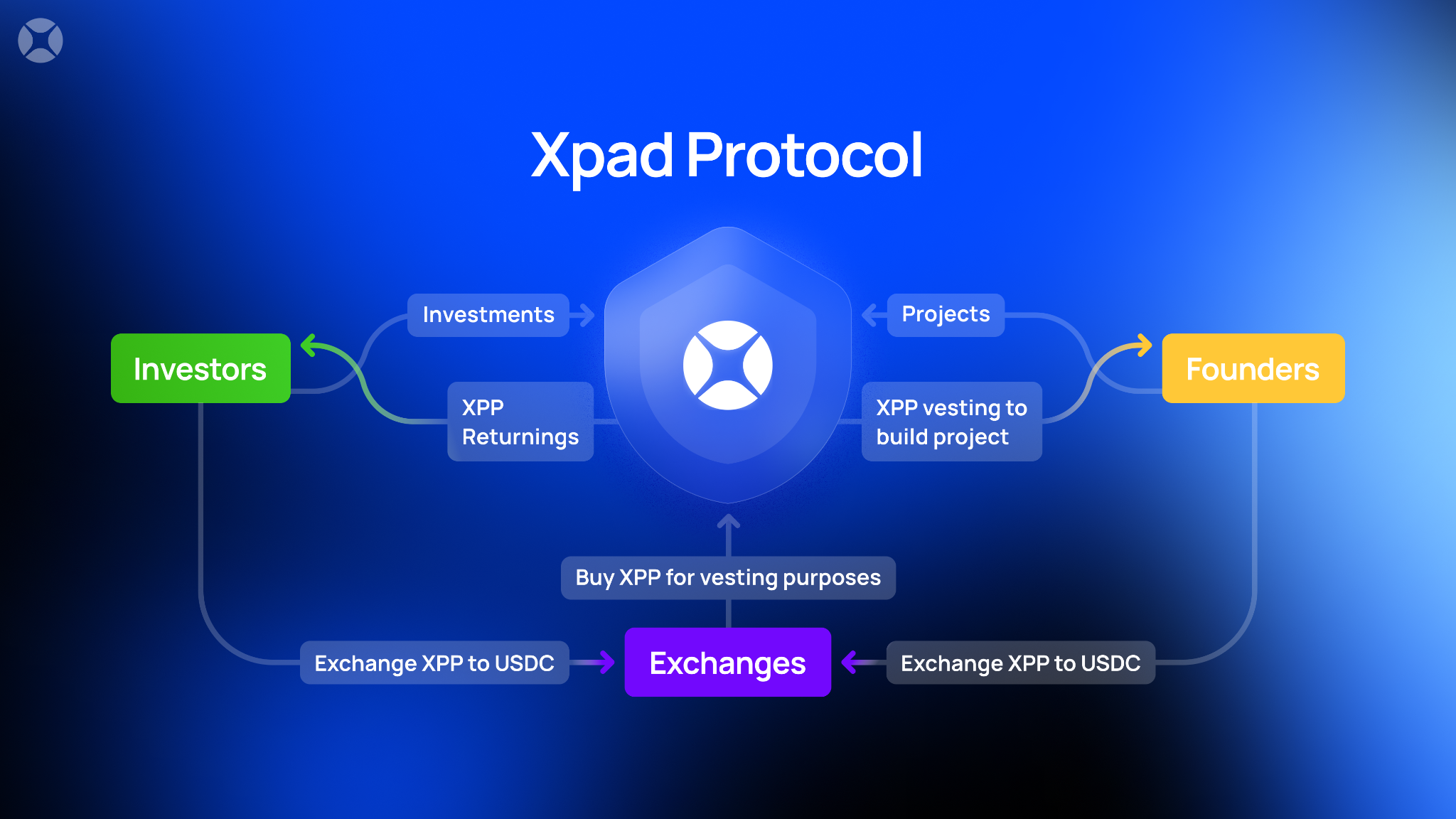

Picture: Highly Utility XPADPRO System Using $XPP Token

Solving DeFi’s Biggest Problems

As the saying goes, “one bad apple spoils everyone.” Unfortunately, in the Wild West era of DeFi, there have been more than a few “bad apples” in the form of exit scams, rug pulls, and other nefarious activities. This understandably scared many potential investors away from the entire industry.

The launch pads themselves haven’t always helped matters either. Even if the biggest names launch solid projects, they still don’t have foolproof ways to weed out potential scams during the listing process. There is also no recourse once a project draws on and steals funds.

It is this lack of accountability and quality control that XPAD aims to fundamentally solve. Their mission is to restore trust in the DeFi ecosystem by establishing the safest possible environment for projects and investors to thrive.

Using their proprietary XPad Protocol smart contracts coupled with DAO community governance, XPAD creates an “unhackable” system of checks and balances. Projects must meet strict criteria to be considered, and funds are blocked and released gradually according to predefined conditions. This eliminates the risk of projects abandoning tokens immediately after launch.

For investors, this means having the confidence that their funds will not disappear overnight if a project turns out to be a scam. XPAD essentially acts as a guarantor that the terms of any project launch will be faithfully executed. Don’t worry about being a victim of the next big headline-grabbing ‘rug pull’.

Through its next-generation security models and community monitoring, XPAD seeks to solve DeFi’s biggest persistent problem hindering its mainstream adoption. This creates the kind of trust and accountability that the space has long needed.

How the Xpad protocol works its magic

The key to XPADPRO’s value proposition is its revolutionary Xpad protocol. This proprietary smart contract system forms the backbone for the secure operation of the entire platform.

At the same time, tokens allocated to investors and the team itself are also locked through smart contracts. They are released gradually according to a pre-established schedule agreed by all parties.

It avoids “carpet pulls” by not allowing teams immediate access to funds. The money is only released once the community voting stages have been passed.

It stops “pumping and dumping” by gradually releasing tokens over long periods of time, from six months to a year.

All activities are transparent on-chain and regulated according to the conditions programmed at launch.

Perhaps most importantly, this system is completely “unhackable” because it works entirely on-chain. No third party or centralized entity can intervene once the conditions are set.

Through the Xpad protocol, projects benefit from equity while investors benefit from unprecedented security. No other launch platform can claim such strong protections against the risks that still weigh on DeFi.

A DAO-powered launchpad

Behind the scenes, engineering XPADPRO’s innovative model is a world-class team of serial entrepreneurs, top engineers, and crypto/DeFi heavyweights. But they don’t believe their vision of security and accountability is limited to protocol alone.

That’s why XPADPRO is taking the next step by establishing itself as a DAO, or Decentralized Autonomous Organization. This creates an autonomous community which has real decision-making powers over the operation of the platform.

With a DAO structure, it is the investors and users themselves who evaluate project applications, vote on the lists, and have a say in how funds are allocated and which features are prioritized in the long term. No entity has unilateral control.

Some main ways the DAO is involved:

- Review all potential projects using objective criteria before allowing registrations.

- Can blacklist teams that violate terms or act against community interests.

- Votes on platform cash budgets and initiatives such as marketing/development.

- Elects representatives to act as board members who govern important decisions.

By decentralizing control, XPADPRO ensures that decisions will always be aligned with the interests of its community rather than those of any single company. With governance literally in the hands of users, trust is maximized that the platform will remain fair and uncensored in the long term.

Leading project pedigree

When a platform aims to list only top-notch and quality crypto projects, it is best if it has a rock-solid track record to make it happen. Fortunately, XPADPRO’s pedigree gives investors confidence that only the best of the best projects will have access.

XPADPRO’s founders include serial entrepreneurs who have successfully launched numerous technology startups. They also have extensive relationships with leading venture funds, exchanges and crypto industry influencers, who will guide valuations.

More importantly, the engineering team behind Xpad Protocol has years of experience developing other popular DeFi platforms, like decimal string, bit team, polylastic. They understand the complex requirements of creating a robust and scalable blockchain infrastructure.

With such hefty CVs involved, you can rest assured that they will only let the cream of the crop through the doors. In other words, while access will always be competitive, in the XPADPRO-curated launch pool you’ll avoid worrying about whether something is a low-quality cash grab. Only true top-notch potential will gain community approval.

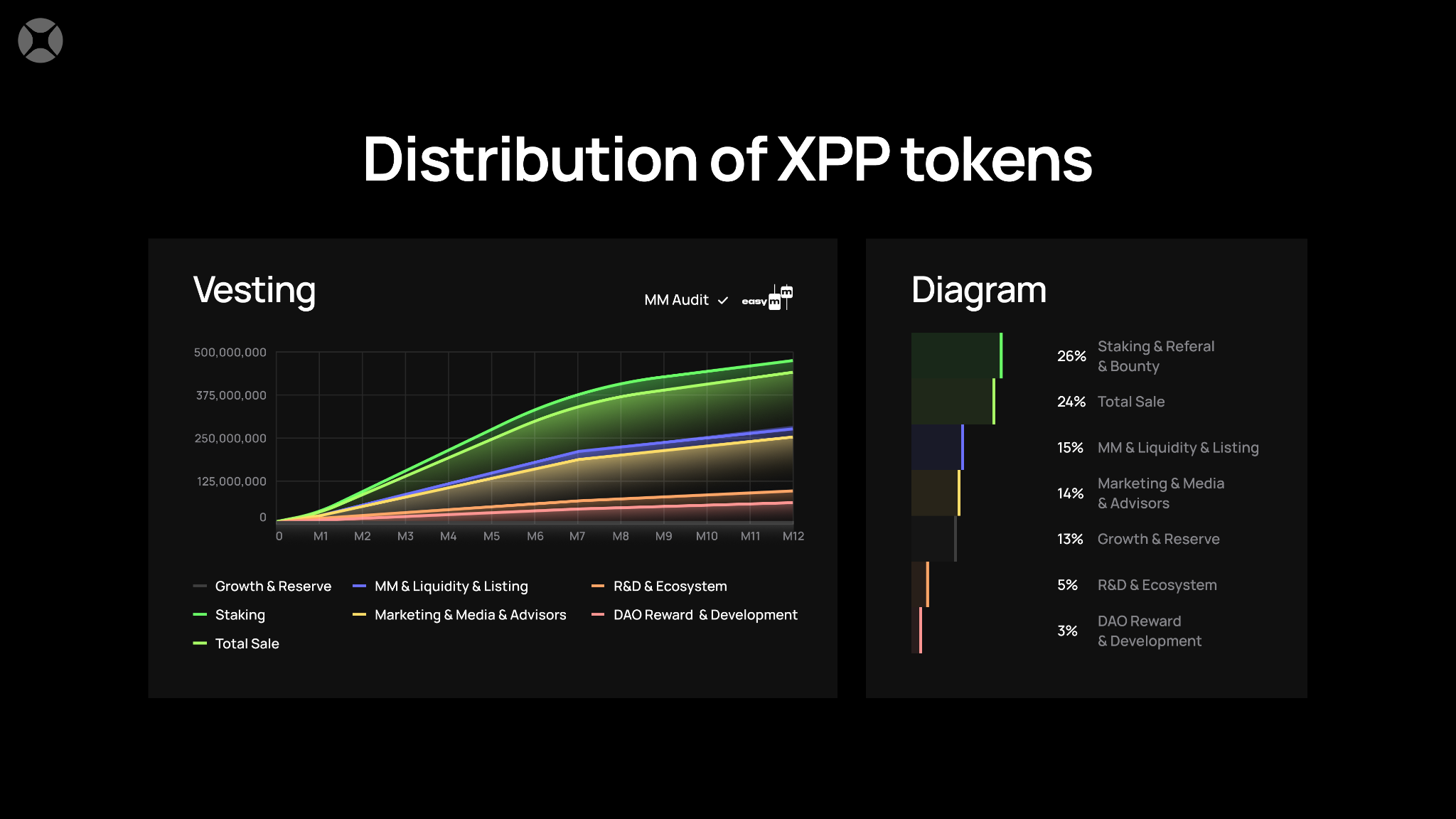

Tokenomics XPP – Benefits for Investors

Of course, no platform would be complete without a built-in utility token that powers its operation. For XPAD, the XPP token plays several important roles:

- It is used for platform fees: All service costs such as trading and governance will require XPP. This creates constant organic demand.

- Unlocks access to private sales: To participate in private project token rounds, users will need XPP holdings. Very exclusive privileges for early risers.

- Powers Staking Rewards: For those who stake their XPP long-term, lucrative yield incentives will be earned through the protocol’s revenue streams.

- Supports referral rewards: Invite new users or projects and earn a share of the transaction volume they generate by transacting on XPAD.

- Enables governance: As a DAO platform, XPP holders can vote on treasure allocation and feature priorities.

Now here’s why tokenomics themselves make XPP an inherently valuable investment proposition beyond just using the platform:

Limited total offer: Only 1.9 billion will ever exist, creating a severe shortage over time.

Deflationary burn: A portion of the fee is destroyed forever, continually reducing the circulating supply.

Strong use case benefits: As XPAD expands its user base and project listings, the demand for the various utilities provided by XPP will also increase.

With this combination of utility functions, limited emissions, and high long-term user retention rates, it is easy to predict that XPP will gain significant value as the platform expands globally . For patient investors and those willing to invest for the long term, this represents a very interesting opportunity.

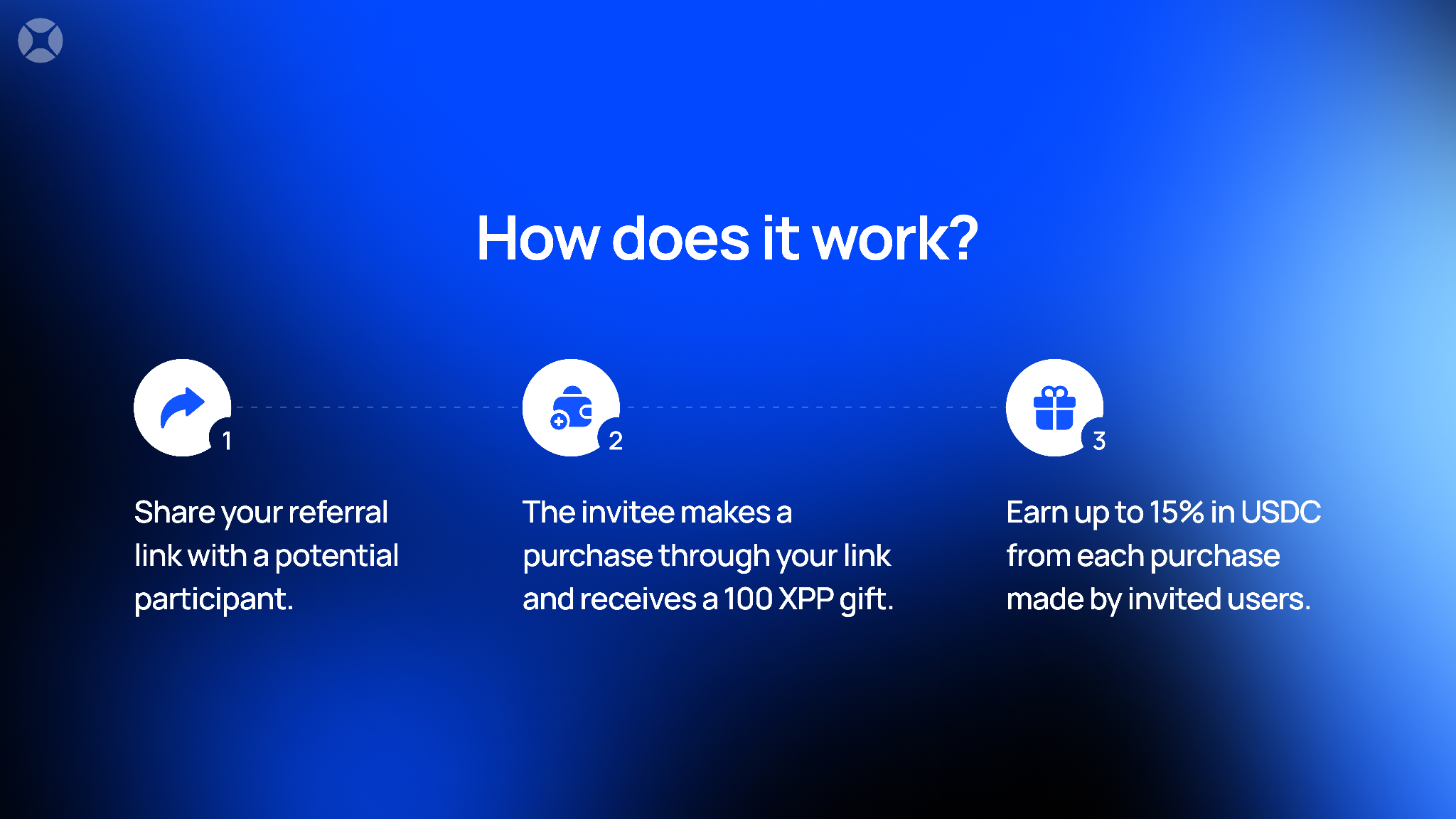

Arrive early – Referral bonus

For ambitious users willing to do a little work, XPAD wants to reward them handsomely through its generous referral program structure.

Earn 15% of their purchases after they sign up. The invited person receives a gift of 100 XPP when they purchase through your link.

With uncapped compensation paid in perpetuity as long as your sponsorship remains active, the potential to generate significant recurring rewards is real. It allows ambitious community members to earn like marketers and affiliates without having to put in much effort.

The Bottom Line: A Deep Dive into XPADPRO’s Vision and Game Plan

XPAD has all the assets to truly change the game in launchpad ecosystems. Its unique Xpad protocol establishes unprecedented security, while benefits like pre-purchase unlock premium access for the general public. With a limited and highly demanded XPP token feeder platform utility and passive income, you have as compelling an investment proposition as possible.

Keep your eyes peeled for their innovative roadmap and roster of top-tier partners like I have a bit. This is undoubtedly one of the most promising projects to emerge in the crowded launch pad space.

DeFi

Haust Network Partners with Gateway to Connect to AggLayer

Dubai, United Arab Emirates, August 1, 2024, Chainwire

Consumer adoption of cryptocurrencies is a snowball that is accelerating by the day. More and more people around the world are clamoring for access to DeFi. However, the user interface and user experience of cryptocurrencies still lag behind their fundamental utility, and users lack the simple and secure access they need to truly on-chain products.

Haust Network is a network and suite of products focused on changing this paradigm and bringing DeFi to the masses. To achieve this goal, Haust Network has announced its far-reaching partnership with bridgeseasoned veterans in rapidly delivering revolutionary blockchain utilities for projects. The Gateway team empowers blockchain developers to build DAOs, NFT platforms, payment services, and more. They drive adoption of crypto primitives for individuals and institutions around the world by helping everyone build their on-chain presence.

Gateway specializes in connecting sovereign blockchains to the Aggregation Layer (AggLayer). The AggLayer is a single unified contract that powers the Ethereum bridge of many disparate blockchains, allowing them all to connect to a single unified liquidity pool. The AggLayer abstracts away the complexities of cross-chain DeFi, making tedious multi-chain transactions as easy for the end user as a single click. It’s all about creating access to DeFi, and with Polygon’s technology and the help of Gateways, Haust is doing just that.

As part of their partnership, Gateway will build an advanced zkEVM blockchain for Haust Network, leveraging its extensive experience to deploy ultra-fast sovereign applications with unmatched security, and enabling Haust Network to deliver its products to its audience.

The recently announced launch of the Haust Wallet is a Telegram mini-app that provides users with access to DeFi directly through the Telegram interface. Users who deposit funds into the wallet will have access to all standard send/receive services and generate an automatic yield on their funds. The yield is generated by Haust Network’s interconnected network of smart contracts, Haustoria, which provides automated and passive DeFi yielding.

As part of this partnership, the Haust Network development team will work closely with Gateway developers to launch Haust Network. Gateway is an implementation provider for Polygon CDK and zkEVM technology, which the Haust wallet will leverage to deliver advanced DeFi tools directly to the wallet users’ fingertips. Haust’s partnership with Gateway comes shortly after the announcement of a high-profile alliance with the Polygon community. Together, the three will work to build Haust Network and connect its products to the AggLayer.

About Haust Network

Haust Network is an application-based absolute liquidity network and will be built to be compatible with the Ethereum Virtual Machine (EVM). Haust aims to provide native yield to all users’ assets. In Telegram’s Haust Wallet, users can spend and collect their cryptocurrencies in one easy place, at the same time. Haust operates its network of self-balancing smart contracts that interact across multiple blockchains and then efficiently funnel what has been generated to Haust users.

About Gateway

bridge is a leading white-label blockchain provider that offers no-code protocol deployment. Users can launch custom blockchains in just ten minutes. They are an implementation provider for Polygon CDK and have already helped projects like Wirex, Gnosis Pay, and PalmNFT bring new utility to the crypto landscape.

About Polygon Labs

Polygon Laboratories Polygon Labs is a software development company building and developing a network of aggregated blockchains via the AggLayer, secured by Ethereum. As a public infrastructure, the AggLayer will aggregate the user bases and liquidity of any connected chain, and leverage Ethereum as the settlement layer. Polygon Labs has also contributed to the core development of several widely adopted scaling protocols and tools for launching blockchains, including Polygon PoS, Polygon zkEVM, and Polygon Miden, which is currently under development, as well as the Polygon CDK.

Contact

Lana Kovalski

haustnetwork@gmail.com

DeFi

Ethena downplays danger of letting traders use USDe to back risky bets – DL News

- Ethena and ByBit will allow derivatives traders to use USDe as collateral.

- There is a risk in letting traders use an asset partially backed by derivatives to place more bets.

Ethena has downplayed the dangers of a new feature, which will allow traders to put up its synthetic dollar USDe as collateral when trading derivatives, which are risky bets on the prices of crypto assets.

While allowing users to underwrite their trades with yield-bearing USDe is an attractive prospect, Ethena said there is potential risk in letting traders use an asset partially backed by derivatives to place even more derivatives bets.

“We have taken this risk into account and that is why Ethena operates across more than five different sites,” said Conor Ryder, head of research at Ethena Labs. DL News.

The move comes as competition in the stablecoin sector intensifies.

In recent weeks, PayPal grown up the amount of its stablecoin PYUSD in circulation 96%, while the MakerDAO cooperative plans a rebrandingaiming to increase the supply of its DAI stablecoin to 100 billion.

US dollar growth stagnates

It comes as Ethena has lost momentum after its blockbuster launch in December.

In early July, USDe reached a record level of 3.6 billion in circulation.

That figure has now fallen by 11% to around 3.2 billion.

Join the community to receive our latest stories and updates

New uses for USDe could boost demand for Ethena’s products.

This is where the new plan, announcement Tuesday with ByBit, one of its partner exchanges, is coming.

Ethena users create USDe by depositing Bitcoin or Ether into the protocol.

Ethena then covers these deposits with short positions – bearish bets – on the corresponding asset.

This creates a stable support for USDe, unaffected by price fluctuations in Bitcoin or Ether.

Mitigate risks

While using USDe as collateral for derivatives trading is proving popular, it is unclear what the effects will be if the cryptocurrency market experiences major fluctuations.

Using derivatives as collateral to place more bets has already had disastrous effects.

In June 2022, Lido’s liquid staking token stETH broke its peg to Ether following the fallout from the Terra collapse.

Many traders who used looping leverage to increase their stETH staking yields were liquidated, creating a cascade that caused the price of Ether to drop by more than 43%.

Ethena Labs founder Guy Young said: DL News His office and his partners have taken many precautions.

Ethena spreads bearish bets supporting the USDe across the five exchanges it partners with.

According to Ethena, 48% of short positions supporting USDe are on Binance, 23% on ByBit, 20% on OKX, 5% on Deribit, and 1% on Bitget. website.

In doing so, Ethena aims to minimize the impact of an unforeseen event on a stock market.

The same theory applies to the distribution of risks across different supporting assets.

Fifty percent of USDe is backed by Bitcoin, 30% by Ether, 11% by Ether liquid staking tokens, and 8% by Tether’s USDT stablecoin.

Previous reviews

Ethena has already been criticised regarding the risks associated with USDe.

Some have compared USDe to TerraUSD, an undercollateralized stablecoin that collapsed in 2022.

“It’s not a good design for long-term stability,” said Austin Campbell, an assistant professor at Columbia Business School. said as the USDe launch approaches.

Young replied to critics, saying the industry needs to be more diligent and careful when “marketing products to users who might not understand them as well as we do.”

Ethena has since added a disclaimer on its website stating that USDe is not the same as a fiat stablecoin like USDC or USDT.

“This means that the risks involved are inherently different,” the project says on its website.

Tim Craig is DL News DeFi correspondent based in Edinburgh. Feel free to share your tips with us at tim@dlnews.com.

DeFi

Cryptocurrency and defi firms lost $266 million to hackers in July

In July 2024, the cryptocurrency industry suffered a series of devastating attacks, resulting in losses amounting to approximately $266 million.

Blockchain Research Firm Peck Shield revealed in an X post On August 1, attacks on decentralized protocols in July reached $266 million, a 51% increase from $176 million reported in June.

The most significant breach last month involved WazirX, one of India’s largest cryptocurrency exchanges, which lost $230 million in what appears to be a highly sophisticated attack by North Korean hackers. The attack was a major blow to the stock market, leading to a break in withdrawals. Subsequently, WazirX launched a program in order to recover the funds.

Another notable incident involved Compound Finance, a decentralized lending protocol, which suffered a governance attack by a group known as the “Golden Boys,” who passed a proposal who allocated 499,000 COMP tokens – valued at $24 million – to a vault under their control.

The cross-chain liquidity aggregation protocol LI.FI also fell victim On July 16, a hack resulted in losses of $9.73 million. Additionally, Bittensor, a decentralized machine learning network, was one of the first protocols to suffer an exploit last month, loming $8 million on July 3 due to an attack targeting its staking mechanism.

Meanwhile, Rho Markets, a lending protocol, suffered a $7.6 million breach. However, in an interesting twist, the exploiters research to return the stolen funds, claiming the incident was not a hack.

July 31, reports The Terra blockchain protocol was also hacked, resulting in a loss of $6.8 million across multiple cryptocurrencies. As crypto.news reported, the attack exploited a reentrancy vulnerability that had been identified a few months ago.

Dough Finance, a liquidity protocol, lost $1.8 million in Ethereum (ETH) and USD Coin (USDC) to a flash loan attack on July 12. Similarly, Minterest, a lending and borrowing protocol, saw a loss of $1.4 million due to exchange rate manipulation in one of its markets.

Decentralized staking platform MonoSwap also reported a loss of $1.3 million following an attack that allowed the perpetrators to withdraw the liquidity staked on the protocol. Finally, Delta Prime, another decentralized finance platform, suffered a $1 million breach, although $900,000 of the stolen funds was later recovered.

DeFi

The Rise of Bitcoin DeFi: Then and Now

The convergence of Bitcoin’s robust security and Layer 2 scaling solutions has catalyzed the emergence of a vibrant DeFi ecosystem.

By expanding Bitcoin’s utility beyond simple peer-to-peer payments, these advancements have opened up a new frontier of financial possibilities, allowing users to participate in decentralized lending, trading, and other complex smart contract operations on Bitcoin.

Read on to learn about the rise of Bitcoin-based decentralized finance and how the space has expanded to accommodate a new generation of native assets and features.

Note: If you want to learn candlesticks and chart trading from scratch, this is the best book available on Amazon! Get the book now!

What is DeFi?

Decentralized finance (DeFi) represents a paradigm shift in financial services, offering internet-based financial products such as trading, lending, and borrowing through the use of decentralized public blockchains.

By implementing blockchains, smart contracts, and digital assets, DeFi protocols provide financial services through a decentralized ecosystem, where participants do not have to deal with intermediaries when transacting.

What is Bitcoin DeFi?

The inherent limitations of the Bitcoin mainchain in supporting the intricacies of decentralized finance have created the need to develop smart contract-based Layer 2 solutions.

Additionally, the advent of the Ordinals protocol in 2023, which facilitated the emergence of fungible token standards such as BRC-20 and Runes, catalyzed the growth of DeFi on the Bitcoin blockchain.

This expansion in protocol diversity has broadened the applications of the world’s leading cryptocurrency network beyond the core base-layer use cases around value preservation and transactional capabilities.

Therefore, Bitcoin DeFi has become a nascent sector within the digital asset market, after previously being a missing essential part of the Bitcoin ecosystem.

Bitcoin DeFi in its early days

Integrating decentralized finance (DeFi) concepts into the Bitcoin ecosystem has been a journey of innovation and perseverance. Early attempts to bridge the gap between Bitcoin’s fundamental simplicity and DeFi’s complexities have spawned pioneering projects that, while laying essential foundations, have also encountered significant obstacles.

Colored coins

Colored coins represented an early foray into tokenizing real-world assets on the Bitcoin blockchain. By leveraging the existing network to track ownership of assets ranging from stocks to real estate, this approach highlighted Bitcoin’s potential as a platform beyond digital currency. However, scalability and practical implementation challenges have limited its widespread adoption.

Counterpart

Building on the colored coins, Counterparty has become a platform for creating and trading digital assets, including non-fungible tokens (NFTs), on Bitcoin.

The introduction of popular projects like Rare Pepe NFTs has demonstrated the growing appeal of digital collectibles. However, constraints around user experience and network efficiency have hampered its full potential.

These early experiments, while not fully realizing their ambitions, served as valuable stepping stones, informing Bitcoin DeFi’s subsequent developments. Their challenges highlighted the need for more sophisticated infrastructure and protocols to harness the full potential of decentralized finance on the Bitcoin network.

Bitcoin DeFi Today

Today, building DeFi applications on Bitcoin is primarily done in the realm of Layer 2 (L2) networks. This architectural choice is motivated by the limitations of Bitcoin’s base layer in supporting complex programmable smart contracts.

Bitcoin’s original design prioritized security and decentralization over programmability, making it difficult to develop sophisticated DeFi protocols directly on its blockchain. However, the recent emergence of protocols like Ordinals, BRC-20, and Runes, while not DeFi in their own right, has sparked possibilities for future DeFi-like applications on the main chain.

In contrast, L2 solutions offer a scalable and programmable environment built on Bitcoin, enabling the creation of various DeFi products.

By expanding Bitcoin’s capabilities without compromising its core principles, L2s have become the preferred platform for developers looking to build DeFi applications that encompass trading, lending, staking, and more.

Leading L2 networks such as Lightning Network, Rootstock, Stacks, and Build on Bitcoin provide the infrastructure for these efforts. Some of these L2s have even introduced their own native tokens to the network, further expanding Bitcoin’s DeFi ecosystem.

Essentially, while Bitcoin’s core layer presents challenges for DeFi development, its security and decentralization have provided a foundational layer for the innovative L2 landscape to thrive.

Bitcoin Layer 2 offers a promising path to building a robust and thriving Bitcoin-based DeFi ecosystem that offers trading, staking, lending, and borrowing. All you need is a DeFi Wallet like Xverse to access the new world of decentralized financial services secured by Bitcoin.

Conclusion

The integration of DeFi principles into the Bitcoin ecosystem, primarily facilitated by Layer 2 solutions, marks a significant evolution in the digital asset landscape.

Building on the foundational work of pioneers like Colored Coins and Counterparty, the industry has evolved into more sophisticated platforms like Rootstock, Stacks, and Build on Bitcoin to create a thriving Bitcoin-powered DeFi ecosystem.

Advertisement

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈