Bitcoin

The Biden Administration Is Easing Crypto (A Vibrations Analysis)

The Biden administration’s stance on crypto appears to be softening. I feel comfortable saying this despite the “whole of government” attack on the industry due to some important advances in recent weeks.

Note: The opinions expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates. This is an excerpt from The Node newsletter, a daily digest of the most important crypto news on CoinDesk and beyond. You can subscribe to get the full content newsletter here.

First, and perhaps most significantly, Monday’s news that the U.S. Securities and Exchange Commission (SEC) may be preparing to approve shares in cash ether exchange-traded funds (ETFs). This would be a major reversal of fortune for an asset class considered dead on arrival, especially considering that the securities watchdog has recently been investigating prominent Ethereum-related institutions.

Although much of this is just speculation, based partially on words heard through the grapevine (i.e., “sources with direct knowledge of the situation”), it is telling that the SEC requested amended registrations of potential ETH ETF exchanges on an expedited basis. It would be a strange move if the agency planned to reject these requests outright.

Just yesterday, Bloomberg Intelligence put the odds of SEC approval for spot ETH ETFs at 25%. Today, there is a 75% probability that these products – which would likely attract institutional capital to the second-largest crypto asset by market cap, in the same way that bitcoin has benefited from its own group of ETFs – will be launched this year. (The SEC is expected to make a decision on the VanEck spot ether ETF on May 23.)

Second, last week a bipartisan bill called the Deploying American Blockchains Act of 2023 passed with a margin of 334 to 79 by representatives of the Chamber. Although modest in scope, the bill would allow the Secretary of Commerce, currently Gina Raimondo, to “take necessary and appropriate actions to promote the competitiveness of the United States” in the blockchain industry.

This comes ahead of the Senate vote on the Financial Innovation and Technology for the 21st Century (FIT21) Act, considered the most significant piece of cryptocurrency-specific legislation most likely to actually become law. As my colleague Nikhilesh De astutely points out:

“House Democratic leaders on the Financial Services and Agriculture Committees told their members that while they opposed the FIT21 bill, they would not actively whip it – in other words, they essentially told their members to vote as they see fit. ”

This is similar to recent votes in the House and Senate to repeal the SEC’s controversial Personnel Accounting Bulletin 121, which imposed severe capital requirements on cryptocurrency custodians and all but foreclosed the possibility of banks entering the space (and hotly contested both by cryptocurrencies and banks). TradFi communities).

The theory is that when President Joseph Biden promised to veto the measure to repeal SAB121, he cleared the way for members of Congress — including prominent Democrats like Senate Majority Leader Chuck Schumer (D-NY) and the chairman of the Finance Committee, Ron Wyden (D-OR). – to vote your conscience.

It remains to be seen whether Biden will veto the measure, despite the independent Government Accountability Office (GAO) saying the SEC inappropriately enforced the guidance. However, the important thing here is that sensible, bipartisan crypto regulation is possible, despite opposition from figures like the arch-skeptical Senator Elizabeth Warren (D-MA).

Speaking of which, Warren may be losing influence in the Biden administration. Yesterday, president of the Federal Deposit Insurance Corp. Martin Gruenberg announced he would step down after Senate Banking Committee Chairman Sherod Brown called for his resignation.

While the move doesn’t directly pertain to cryptography, it’s worth mentioning that Gruenberg is a known confidant of Senator Warren — and his views on cryptography are largely cut from the same cloth. Under Gruenberg’s leadership, for example, the FDIC took a hard line against crypto during the 2023 financial crisis, which took down three midsize banks.

Although he extensively cited poor risk management and incompetent leadership, the FDIC also said Signature Bank’s “association with and dependence on crypto industry deposits” was one of the main causes of its failure in its report. That same year, the agency officially added cryptography to its annual report on the risks facing US banks and began to enter into “robust supervisory discussions” with the companies under its responsibility.

Additionally, Castle Island Ventures co-founder Nic Carter considers Gruenberg one of the greatest “architects” of what he called Operation Choke Point 2.0, or a series of maneuvers by the US government to systematically cripple the crypto industry (the name is a callback to the Obama-era effort to debank unsavory industries). In fact, after the collapse of FTX, the White House issued its first fact sheet related to crypto, essentially calling for a crackdown.

There are certainly some important caveats to consider here. Firstly, Gruenberg resigned under political pressure following a Wall Street Journal report based on widespread evidence of sexual harassment at the FDIC. The septuagenarian himself wasn’t accused of harassment, but he allowed a toxic workplace culture to fester — which is why Senator Brown called for his resignation (which Senator Warren called “political motivation”).

All of this is to say that encryption is not a motivating factor here, although some political commentators see the Gruenberg situation as a sign of the Warren faction’s waning influence. For example, John Deaton, who is challenging Senator Warren for her Senate seat in November, said it was “disgraceful” how Warren “circled the wagons to keep one of her wretched puppets in place.”

It’s also important to note that Congress is not the White House and the White House is not the SEC. In other words, there is no real reason to assume that the Biden administration is suddenly telling Gary Gensler or lawmakers to, for example, go easy on encryption. These are all discrete events, but they are positive developments for crypto.

As for the possibility of ETH ETF approval, the idea is that the SEC resisted because it was not holding productive meetings with potential issuers. And “the fact that their meetings have become productive more recently doesn’t necessarily mean there has been a policy reversal,” as Jesse Hamilton, a policy expert at CoinDesk, said.

But what if there really was a driving force behind all these developments? What explains the widespread sea change? And why would a Democrat-controlled government suddenly become pro-crypto now?

“The backdrop to all of this is an election in which the standard-bearer of the Republican Party, former President Donald Trump, explicitly appealed to crypto voters as part of his strategy,” De said.

In fact, the former president apparently intuited that the crypto contingent is something of a wealthy political force and has been currying favor. There are some cynics who argue that the billionaire real estate developer is primarily motivated by his grants (Trump has issued several NFT series and owns a good amount of ETH and other tokens), but this seems like an unnecessarily narrow view.

The alignment makes perfect sense: crypto gets people’s attention. And Trump likes to attract attention. Crypto also irritates a certain type of person, and it turns out that these are the same people that Trump likes to irritate. Crypto advocates also like powerful people willing to speak positively about crypto. And Trump likes his praise.

And while both parties can claim the “apolitical” crypto narrative for themselves, there is something to the idea that the industry’s somewhat contradictory situation of being rooted in Occupy Wall Street-era populism while also being more often associated to “hilariously rich” is undeniably Trumpian. To some extent, I’m surprised it took so long for Trump to accept this.

Which brings us to the main point: why now? Of course, Trump supported encryption because it is an issue he can use against his rival, President Biden. While the general public is likely uninformed about the basic politics of crypto regulation, a surprising amount of registered voters own crypto and have positive feelings toward it. In particular, almost 25% of self-identified independent voters (i.e. the main “swing voter”) bought crypto. And this number will only increase over time, especially after the launch of crypto ETFs.

On the other side of the equation, as Trump has established himself as a figure of opposition to the Biden administration’s slow, simmering war on encryption (which has literally won over at least a handful of voters who despise his other policies), Biden’s easiest way to solving the problem is either doing a 180 on cryptography itself or simply making it less problematic.

This is compounded by the fact that, although the majority of Americans still don’t interact or care much about cryptography, there have been a series of missteps on the part of regulators that have earned something almost akin to sympathy for the industry. The biggest problem was the way the SEC approved the approval of bitcoin ETFs, which was called “arbitrary and capricious” by an appeals court.

But there is a growing sense that this same arrogant and biased view permeates all of the Biden administration’s crypto efforts. Americans want cryptography to be secure and well regulated, they want consumer protection; they don’t want arcane debates about whether an asset is a security.

Furthermore, it is conceivable that a strong reaction to the industry’s cataclysmic failures in 2022 would be politically advantageous, but now that prices are rising again, a heavy-handed approach seems both a waste of government resources and potentially overkill. Not to mention the fact that provoking the crypto industry always generates backlash from those within.

Once again, this is all mere speculation: there is no direct evidence that Biden is reversing course. It is significant that a major piece of crypto legislation has made it this far, that ETH ETFs being approved are back in play, and that Trump has won over “single issue” crypto voters. Consider this a vibrational analysis, a theory that may never be proven, but which could grow stronger if more positive advances like this happen.

Ultimately, politics, like cryptography, is all about vibrations.

Bitcoin

Big Tech Outperforms Bitcoin (BTC) as Trump Deal Weakens Token

Bitcoin has lost out on an asset rally fueled by positive comments from the Federal Reserve, while a tight US election race casts doubt on whether Donald Trump will get the chance to implement his pro-crypto agenda.

The digital asset fell 2.4% on Wednesday, following a Fed-fueled surge in an index of megacap tech stocks Magnificent Seven by one of the largest margins in 2024. The token retreated further on Thursday, changing hands at $63,750 as of 6:10 a.m. in London.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

Bitcoin (BTC) miner Riot Platforms (RIOT)’s second-quarter loss widens to $84.4 million as costs rise

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

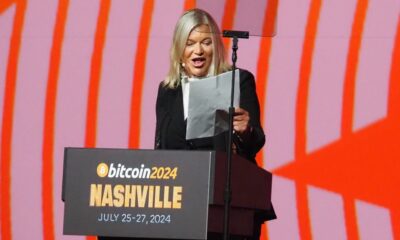

Why Trump Wants the US Government to Have a “National Stockpile” of Bitcoin

At a national bitcoin conference in Nashville, Donald Trump finally laid out some of his crypto policy proposals, including a long-awaited part of his plan — building a strategic bitcoin reserve. CNN’s Jon Sarlin explains what it is and why the crypto industry wants it.

-

News11 months ago

News11 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News11 months ago

News11 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi11 months ago

DeFi11 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets11 months ago

Markets11 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs