Markets

Telegram has become the go-to app for heroin, weapons and everything illegal. Can cryptocurrencies save him?

“Nothing near the standard you expect. Strong smell of ammonia. Very nervous. One star,” writes one customer unhappy with his $240 Colombian cocaine purchase. Another reviewer reported a better experience, leaving a five-star rating and enthusing, “Better than the street stuff around me! Advised.”

This is not a South American drug market or even an obscure dark web market. His Telegramone of the top five in the world the most downloaded app and the go-to communications platform for everyone from activists to cryptocurrency enthusiasts. A recent Fortune tour of Telegram channels that function like stores revealed that it’s quick and easy to find everything from cans of heroin to stolen stimulus checks to AK-47 machine guns.

Telegram’s end-to-end encryption means no third parties can access user data. But as a result, it has failed to build an advertising economy and regulate content. So to keep the lights on without selling user data or enduring the regulatory oversight that a stock exchange listing requires, the app has turned to cryptocurrency. (Telegram initially created the Telegram Open Network (TON), but abandoned the project due to regulatory concerns. The TON Foundation has since revived blockchain work to preserve the technology, renaming it The Open Network and launching Toncoin.)

If successful, Telegram could become a “excellent app” without needing to clean up its act. But the implications of this run deeper than simply bringing the dark web to the masses: Extremists and criminals running popular channels could earn cryptocurrency for their content.

“Creating a Telegram account is easier than creating a Facebook account,” says David Maimon, a professor of criminal justice and criminology at Georgia State University, who has been tracking thousands of illicit groups and channels on Telegram since 2019. For criminals, “Telegram is now the place to go.”

The dark web in your pocket

Telegram’s philosophy is rooted in its political origins. CEO Pavel Durov created the most popular social network in Russia, VKontakte. In 2014, he was forced to flee after refusing to share his Ukrainian users’ data with the government. Before his expulsion, he had developed Telegram to communicate with his brother, and now CTO, Nikolai, out of fear of government espionage.

With over 900 million active monthly users, Telegram has nearly doubled in size since 2021 and aims to reach 1.5 billion by 2030. Headquartered in Dubai, has “disclosed 0 bytes of user data to third parties, including governments.” As a result, it is difficult to regulate and monetize, leading to a boom in illicit channels. (Fortune messaged Telegram’s PR channel seeking further comment but did not receive a response.)

The dark web itself is slow, requires the Tor browser, and its complex URLs change often. Telegram can be easily found in the App Store. And if anyone can imagine something they want, Telegram almost certainly has it. LSD and OxyContin. Cloned credit cards. Stimulus checks. Twisted paragraphs of stolen identitieswith victims reduced to names, dates of birth, Social Security numbers, emails, passwords, home addresses and credit card numbers. Typing some vaguely related lingo into the app’s search engine gives you dozens of channels, many with tens of thousands of members competing to give you the best deal.

Channels feature drop-down menus, shopping carts, wishlists, and reviews. One “exclusively for members of the credit card industry” offers free tutorials on how to commit fraud, before customers move on to purchasing CVV codes and card clones. “Our hundreds of satisfied customers will attest to the fact that we offer only the highest quality materials for your project. We appreciate your business!” writes the administrator in a broadcast to over 50,000 members. In the most mundane corners, discounted gift cards, flights and hotel stays are traded. “It’s really crazy what’s happening. The spectrum is really broad,” Maimon says.

So attracting big ad dollars has proven to be a challenge. “If you protect data and privacy, you can’t sell ads,” Cosmo Jiang, a portfolio manager at Pantera Capital, tells Fortune. “They’ve been really bad at monetization.”

Telegram launched an advertising platform in 2021. Advertisers can post text messages of 160 characters or less in channels with at least 1,000 subscribers. Telegram channels generate 1 trillion views per month, but only 10% of those are monetized with advertising, Durov She said in February.

Switching to cryptocurrencies

An alternative option for Telegram to make some money is cryptocurrency, which promises the “highest potential to maintain control and monetize,” says Jiang of Pantera, who invested in TON. The funding is from Pantera “the biggest investment ever,” and earlier this month, the company revealed that it is adding cash to its seed money, according to a letter shared with investors and seen by Fortune.

Launched in 2018, the original TON network was abandoned in 2020 following a court battle with the Securities and Exchange Commission. But now, with a more favorable regulatory environment and improved market conditions, the company is diving headlong into cryptocurrencies in a desperate attempt to monetize without bowing to the authorities.

TON aka Toncoin, Jiang notes, is Telegram’s “largest liquid asset on their balance sheet.” It accrues staking rewards from transaction fees and protocol issuance. Additionally, there are “trade deals” where it earns more TON over time based on certain performance criteria, Jiang adds.

Telegram in September saw the launch of a self-custodial wallet called TON Space, built by third-party developers, that lets users send USDT, its native Toncoin, and Bitcoin to other users. Most illicit payments are made outside the app via cryptocurrency, Maimon says, though he has seen “some mentions” of TON wallet payments starting to appear on Russian-run channels. But with the wallet still in its infancy, TON transfers for illicit goods could become more widespread.

Capitalizing on this momentum, Telegram announced in March that channel owners would begin receiving 50% of any revenue generated from ads in their channels, with all payments settled on TON. It also revealed its Mini App feature, which allows users to create apps within Telegram, in a bid to become more like the super app WeChatwhich boasts over 1.3 billion users, mostly Chinese.

Recently, scrolling through some illicit channels, the only ads that appeared were links to rival stores. So, at least for now, criminals who run stores and extremists who broadcast propaganda will be paid in Toncoin for advertising on their channels.

So far, Telegram’s crypto-focused move is working. Toncoin has nearly tripled since March, trading near $7, according to CoinGecko data. The same month as the revenue-sharing announcement, Durov revealed the company is “close to profitability”.

“If TON really takes off, it will never have to go public,” Jiang says. In one channel about stolen stimulus checks, a salesman quotes Lil Wayne: “Fear money doesn’t make money.” In another, a storefront of stolen bank data that broadcasts to more than 27,000 subscribers, the words are: “Put food on the table.”

(This article has been updated to add clarification about The Open Network’s role in the development of the TON blockchain and that the self-custodial wallet integrated into Telegram was developed by a third party.)

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

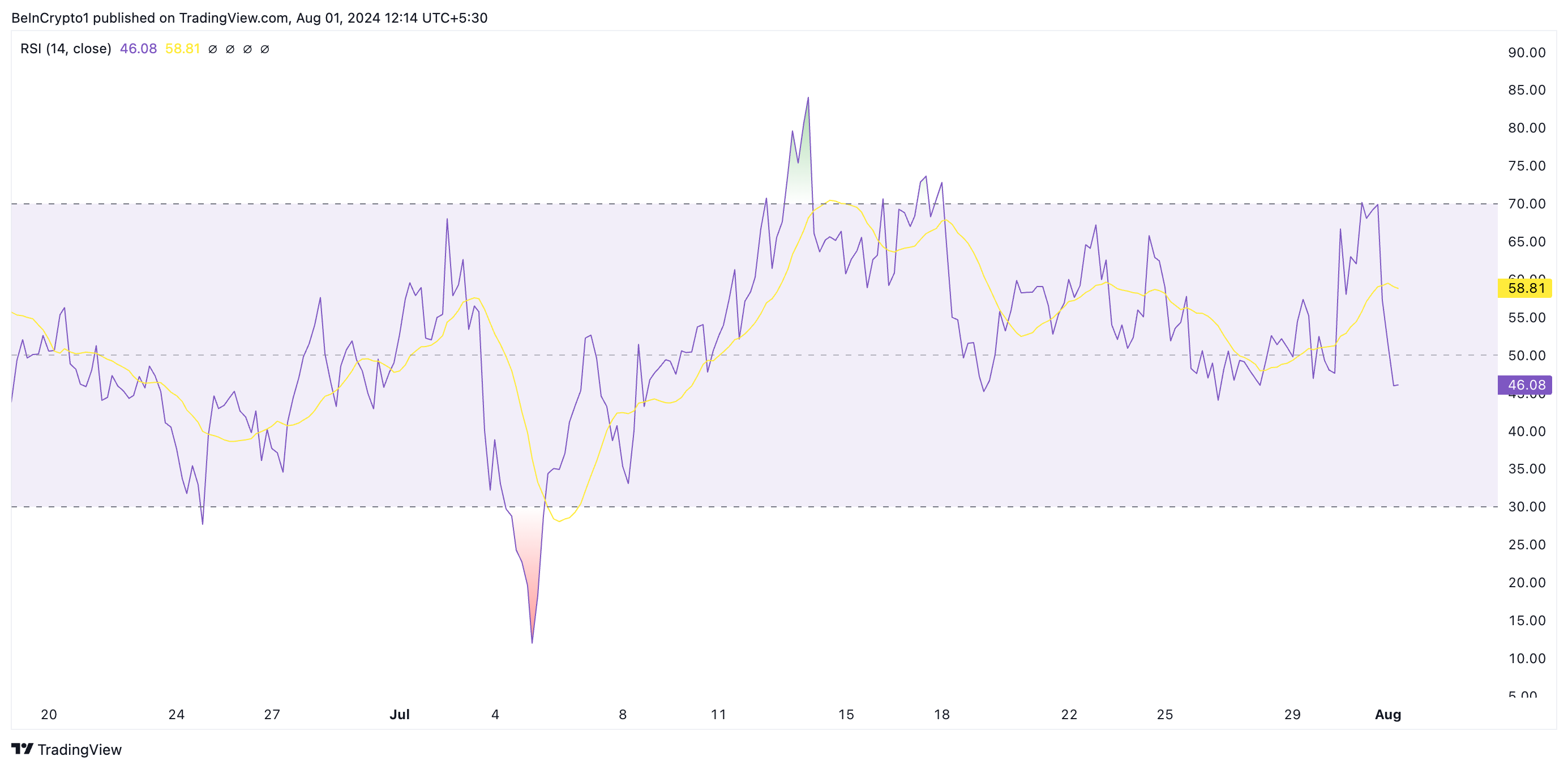

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈