Bitcoin

Riot and CleanSpark: Singer selects the best Bitcoin stocks to buy

Cryptocurrencies generate a lot of hype and headlines, for good and bad reasons – but recently, the reasons have been good. Since the start of last year, leading cryptocurrency Bitcoin has risen more than 300%, the gains fueled by BTC spot ETF approvals and the April 19 ‘halving’ event when the reward for each link of resolved blockchain was cut in half to 3,125 Bitcoins.

This last event happens approximately every four years and guarantees the most valuable characteristic of cryptography, its scarcity. Historically, the halving event has served as a catalyst for a Bitcoin bull market.

This spotlight on Bitcoin naturally extends to Bitcoin-related stocks, specifically Bitcoin miners, with Cantor Fitzgerald analyst Brett Knoblauch drawing attention to its growth potential.

“We remain bullish on the bitcoin mining sector,” said Knoblauch. “Bitcoin prices have remained elevated, and at current Bitcoin levels and the global network hash rate (~600 EH/S), every publicly traded Bitcoin miner can mine Bitcoin profitably. Bitcoin miners remain an attractive and leveraged way to play Bitcoin as they can effectively mine Bitcoin at a discount to what one would purchase Bitcoin for at spot prices.”

Knoblauch goes on to present a specific case for investors: “We favor low-cost miners that have scale and liquidity. Miners who can mine Bitcoin more cheaply generate higher gross margins, which results in greater ability to acquire additional rigs to add additional scale.”

We use the TipRanks Platform for the details on two of his picks – both were also rated Strong Buys by the analyst consensus. Let’s see why they are attracting applause from all sides.

Riot Platforms (REBELLION)

The first Cantor pick we’ll look at is Riot Platforms, a Texas-based Bitcoin mining company with two online data center mining operations in its home state. Chief among these facilities is Rockdale, which the company boasts is the largest operating Bitcoin mining facility in North America based on power capacity. The Rockdale mining data center has a power capacity of 700 megawatts.

The Rockdale facility is complemented by the Corsicana facility. This Bitcoin mining data center is still under construction and development, but the first building in the complex, Building A1, is almost fully deployed with its mining rigs – and is already online. This building has a power rating of 100 megawatts, just a fraction of the Corsicana complex’s planned total capacity of 1 gigawatt. At the end of May, Riot reported that its self-mining capacity, including the new capacity put online in Corsicana, reached 14.7 EH/s. The company expects to reach a total capacity of 20.1 EH/s later this year.

Earlier this month, Riot released its Bitcoin production numbers for the month of May. These numbers showed a significant reduction in the number of Bitcoins mined in the month, down 68% year-over-year to 215. At the same time, the company did not need to sell any Bitcoins during May and ended the month with 9,084 Bitcoins available. Additionally, the company’s energy strategy generated US$7.3 million in energy and demand response credits during the month, which are applied to mining activities and reduce the company’s cost of mining.

This news followed Riot’s 1Q24 launch, which showed the company generated $79.3 million in revenue during the first quarter of this year. This was a mixed result, up more than 8% year over year, but below forecast by more than $16 million. Ultimately, Riot reported earnings per share of 82 cents per share. This earnings per share was probably not comparable to the expected value, a loss of 21 cents per share. Management reported that first quarter revenue included several one-time charges, including a $234.1 million change in the fair value of Bitcoin, a $32 million stock-based non-cash compensation expense, and a depreciation and amortization of US$32.3 million.

After all this, Cantor analyst Knoblauch here bases his optimistic outlook on the company’s positive but intangible attributes: its growth/valuation, mining cost, and risk/reward. The analyst writes: “RIOT offers the best growth/valuation combination… RIOT has one of the lowest mining costs, has significant scale, and has the best balance sheet in the entire industry. It is poised to deliver significant organic capacity growth over the next 18 months… RIOT is very attractive from a valuation perspective, with the market valuing it at $48 million per 1 EH/S based on our estimate of hash rate for fiscal year 24E…”

Along with this bullish stance, Knoblauch gives RIOT stock an Overweight (i.e. Buy) rating, with a $23 price target that points to robust one-year upside potential of 116%. (To watch Knoblauch’s track record, Click here)

This view is in line with the general Street consensus here. RIOT’s nine recent analyst reviews, all positive, give it a unanimous Strong Buy rating, while the $18.22 average price target implies a 71% one-year gain from the current share price of U.S. $10.64. (To see Riot Stock Forecast)

CleanSpark (CLSK)

The second stock on our list is CleanSpark, a company that combines Bitcoin mining with the use of low-carbon renewable energy – and shows that it is possible to be successful at both while making a profit. The company’s Bitcoin mining data center facilities are located in Mississippi, Georgia, and New York State, and are supported by investments in renewable energy. CleanSpark is a large purchaser of high-quality renewable energy credits and supports projects that connect low-carbon power generation to the grid.

CleanSpark owns and operates a total of 9 Bitcoin mining facilities, with 134,464 mining rigs deployed as of May 31 of this year. They maintain a hash rate of 17.97 EH/s, and the company boasts of maintaining an energy efficiency of 23.05 J/TH. At the end of May, the company held 6,154 Bitcoins among its assets. Additionally, the company reported mining 417 Bitcoins in the month, totaling 3,169 this calendar year.

In early May, CleanSpark took a step that promises to significantly expand its mining capacity. The company signed an agreement to purchase two Bitcoin mining sites in the state of Wyoming and begin construction on the facilities shortly after the purchase closes. CleanSpark has agreed to pay $18.75 million for the sites and expects the completed facilities to add 4 EH/s to the company’s total production rate.

In the last full reported quarter, fiscal 2Q24 ending March 31, CleanSpark reported total revenues of $111.8 million, for an impressive year-over-year growth rate of 163%. Revenue exceeded forecasts by US$2.33 million. CleanSpark’s bottom line, given as a GAAP EPS figure of 58 cents per share, was a sharp turnaround from the prior year’s Q2 loss of 23 cents per share.

This company’s growth caught the attention of analyst Knoblauch, who sees many other strengths in the company. The Cantor analyst writes: “We believe CLSK offers the best growth story… CLSK’s biggest differentiator today is its combination of scale, liquidity and fleet efficiency. It has the most efficient mining fleet in [approximately] 24.2 J/TH, which makes CLSK the second cheapest total cost to mine one Bitcoin. Combining this with accelerated platform deployments, we believe CLSK will have the highest hash rate by the end of 2024E, with our estimates that it will have ~48 EH/S. With CLSK having the third best liquidity position, we are confident in its ability to deliver on our assumptions.”

For Knoblauch, all of this leads to an Overweight (i.e. Buy) rating on the stock. He tops it off with a $27 price target, suggesting a 56.5% 12-month gain.

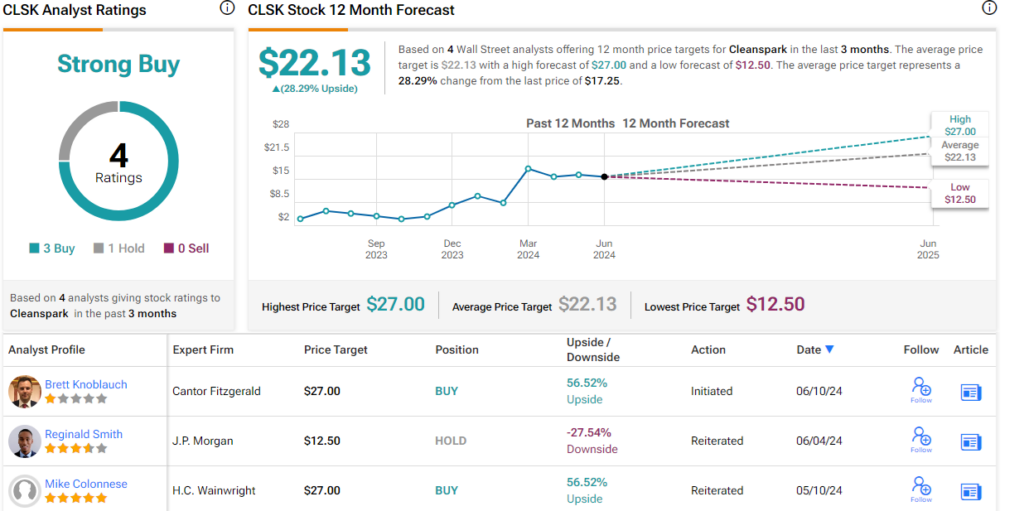

Overall, CleanSpark stock gets a Strong Buy consensus rating from the Street based on 4 reviews that split 3 to 1 favoring Buy over Hold. The stock is currently selling for $17.25 and its $22.13 average price target implies a potential upside of 28% for the coming year. (To see CleanSpark Stock Forecast)

To find good ideas for stock trading at attractive valuations, visit TipRanks’ Best stocks to buya tool that brings together all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Bitcoin

Big Tech Outperforms Bitcoin (BTC) as Trump Deal Weakens Token

Bitcoin has lost out on an asset rally fueled by positive comments from the Federal Reserve, while a tight US election race casts doubt on whether Donald Trump will get the chance to implement his pro-crypto agenda.

The digital asset fell 2.4% on Wednesday, following a Fed-fueled surge in an index of megacap tech stocks Magnificent Seven by one of the largest margins in 2024. The token retreated further on Thursday, changing hands at $63,750 as of 6:10 a.m. in London.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

Bitcoin (BTC) miner Riot Platforms (RIOT)’s second-quarter loss widens to $84.4 million as costs rise

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Why Trump Wants the US Government to Have a “National Stockpile” of Bitcoin

At a national bitcoin conference in Nashville, Donald Trump finally laid out some of his crypto policy proposals, including a long-awaited part of his plan — building a strategic bitcoin reserve. CNN’s Jon Sarlin explains what it is and why the crypto industry wants it.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈