Markets

Real-world assets: 2024 will be the breakthrough year for tokenization

Disclosure: The views and opinions expressed herein are solely those of the author and do not represent the views and opinions of the crypto.news editorial.

Integrating traditional real-world assets, or RWA, into blockchain is not a new topic of discussion. Major institutional players, from Euroclear to Goldman Sachs, have turned to tokenization to reduce transaction fees, execution times and database management costs, and to make provenance and proof-of-ownership processes much less tedious.

2023 became the year when theory finally started to turn into practice. The private credit market, destroyed by the ripple effects of the Earth-Moon collapse in 2022, recovered by 60%, and its main beneficiary base has shifted from crypto-native finance companies to the automotive sector (42% of tokenized private credit in 2023). Most important for the industry, however, has been the emergence of a completely new type of RWA products:tokenized treasures. Tokenized Treasuries aim to dethrone what currently makes up the largest share of RWA: stablecoins. Sought after by both retail and institutional investors and experiencing seven-fold growth in volume, Treasuries are bringing an integral ingredient for maturity to blockchain: stability. It appears we are approaching the most significant year for RWA tokenization.

The main blockchain technological advances in recent years have involved various types of transaction optimization, helping to bring greater efficiency, security and scalability. For example, developing level 2 solutions such as zero-knowledge proofs or optimistic rollups have helped increase the throughput of primary blockchains, reduce transaction execution times, and significantly lower and stabilize the networks’ gas fees.

While L2 has pushed forward the capabilities of individual blockchains, cross-chain communications projects have worked to create further network value. Improved ease and security of interoperability has brought greater usability to the web3 ecosystem as a whole.

In addition to these developments, new services have emerged, which have improved the efficiency of RWA tokenization. Maple, Centrifuge, Backed and many others have taken well-explored concepts of defi, liquidity pools and collateralized lending and applied them to traditional finance. This allowed their users to invest in real-world corporate bonds across different jurisdictions, get a share of the private credit pie, and engage in tokenized lending with institutional lenders.

In early 2023, Issued by Ondo Finance the Ondo Short-Term US Government Bond Fund (OUSG), which offers investors access to a tokenized version of BlackRock’s (NASDAQ: SHV) iShares Short Treasury Bond ETF. While OUSG only raised a little more than $110 million in total locked value in one year, this marked the start of a new, much more discreet trend: the rise of tokenized U.S. Treasuries.

According to Fed research and data from DeFi Llama, the total fraction of real-world assets in defi is greater than doubled over the last year. Although this can be partially attributed to the release of institutionalized infrastructure such as Goldman Sachs‘ Digital Assets Platform (GS DAP) e JP MorganThe Tokenized Collateral Network, tokenized private credit and digital bonds alone cannot explain the booming dynamics of the overall market. Rather, special attention should be paid to the issuance of tokenized US government short-term debt.

Investors may have been attracted to short-term risk-free debt following continued increases in federal funds rates, a natural market dynamic. Another part of the equation is the collapse of abnormal returns across the cryptocurrency landscape. Second compared to Coinchange’s Defi return benchmarks, minimum risk returns in Defi hovered around 4-5%. This not only significantly narrowed the spread with Treasuries, but was even pushed into negative territory at times.

Although tokenized asset markets have shown some signs of maturation in 2023, several unanswered questions continue to inhibit the transparent development of the RWA industry. The most important of these is, of course, regulation: until there is an unambiguous regulatory framework or a precedent of failure in a major jurisdiction, it cannot be said with certainty that tokenized assets represent the same right of first refusal on the underlying asset . from a legal point of view. Another degree of freedom concerns how the infrastructure will evolve to enable efficient access to tokenized asset markets.

However, the increase in broader RWA adoption is expected to continue into 2024, with tokenized Treasuries becoming the biggest beneficiaries of renewed attention. I see this asset class as a perfect product-market for risk-averse defi investors: unlike stablecoins, tokenized Treasuries are immune to changes in confidence, are absolutely safe as long as the underlying smart contract is diligently monitored, and generate yield. In fact, we’ve already seen the start of the overhaul. From April 2024, capital allocation to tokenized US Treasury securities passed $1.09 billion, nearly ten times more than the $114 million at the start of 2023.

In my opinion, such a warm welcome requires urgently expanding the scope beyond the most obvious solution, especially since tokenized Treasuries are not a one-size-fits-all tool. A market worth almost a trillion dollars growing with a compound annual rate of 19.1%, Sukuk, the closest analogy to bonds in Islamic finance, will be next to appear on the chain. Islamic law prohibits investments in interest-bearing securities as they are considered usury, a haram activity, so traditional bonds are not available to religious Muslim market participants. Instead, Sukuk circumvents the ban by providing fractional ownership of the asset and a right to a portion of the cash flow generated. I think the potential tokenization of Sukuk will offer the Muslim community the opportunity for secure, transnational halal on-chain investment, taking digital Islamic finance to a new level. With the gradual growth of regional crypto markets in the MENA region and the continued involvement of companies and governments in infrastructure investments, I believe that a potential on-chain Sukuk has a well-matched target audience.

Anticipating the rise of digital bonds does not mean that stablecoins have already vanished. On the contrary, 2024 may finally bring competition and diversification to a market that, for a long time, was effectively divided between Tether and Circle. From controversial concepts like USDe to new entrants with confidence models such as the Ripple stablecoin, the sleepy stablecoin market is experiencing a shakeup. In this regard, I believe the most underrated opportunity that deserves special attention is gold-backed stablecoins, considering that gold is in the media spotlight after reaching an all-time high price level. While not an entirely new concept, its previous efforts lacked technical excellence and liquidity and attempted to enter an inconvenient market. In a turbulent reality where Costco gold bars are located swept off the shelves, I think it’s only a matter of time before the promising idea gets a new iteration.

Overall, it appears that tokenized real-world assets have successfully passed the initial phase. In my opinion, 2024 will likely lead to more widespread adoption of existing instruments, particularly tokenized Treasuries, and spur competition and innovation, particularly in the Sukuk, fiat, and gold-backed stablecoin markets.

Alex Malkov

Alex Malkov is co-founder of HAQQ, a blockchain platform with an ethical approach, which emphasizes real-world assets. He brings extensive legal consulting experience from his work with leading blockchain and fintech companies, including AAVE, Bequant, Scalable Solutions and Nebula. His legal and regulatory knowledge ensures that HAQQ aligns with broader legal frameworks. With over a decade of experience in legal practice, Alex has spent seven years focusing on web3 projects. His experience is fundamental for navigating the complex legal landscape of blockchain technology.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

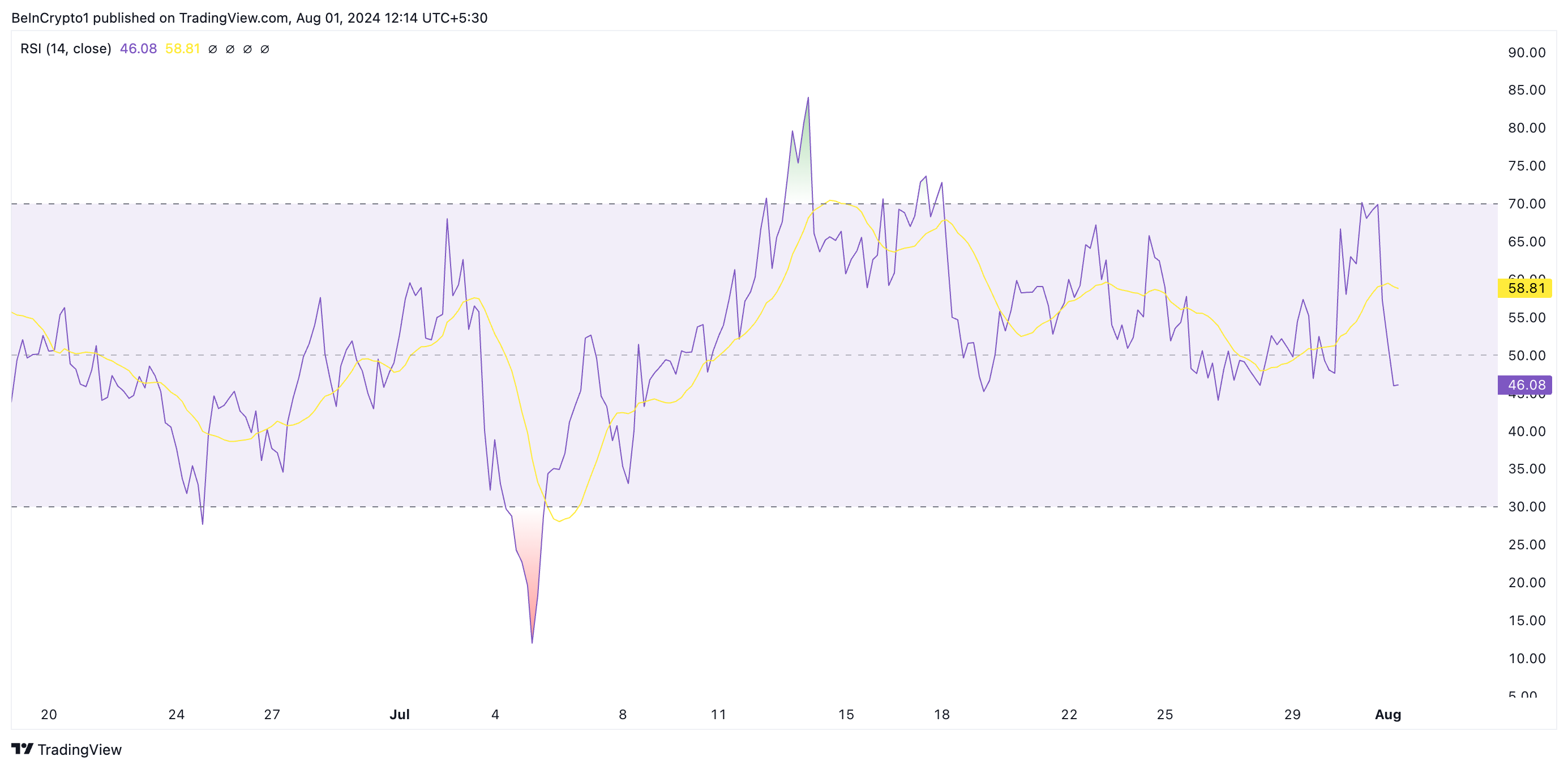

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News11 months ago

News11 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News11 months ago

News11 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi11 months ago

DeFi11 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets11 months ago

Markets11 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs