Bitcoin

How Bitcoin’s Technological Expansion Could Boost Price Growth 5x in 2 Years

- The Bitcoin blockchain is slowly becoming more than just a buying and holding platform.

- Developers have been expanding its functionality, which could lead to new demand.

- Ethereum went through a similar trend, leading to its big rally in 2021, Bitget CEO Gracy Chen told Business Insider.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go. get the app

By clicking “Register”, you accept our Service Terms It is Privacy Policy. You can unsubscribe at any time by visiting our Preferences page or clicking “unsubscribe” at the bottom of the email.

Bitcoins 2024 catalytic converters may seem like a thing of the pastbut programmers are fueling future advantages behind the scenes.

For most of its existence, the flagship cryptocurrency has captured the market’s attention as a buy-and-hold asset, and this store-of-value appeal has led to explosive gains. Furthermore, blockchain has not offered investors much else to do.

“Despite bitcoin’s diverse use cases, it is primarily viewed as ‘digital gold’ for inflation mitigation or an alternative currency that allows participants to transact in a decentralized, peer-to-peer (P2P) environment,” he said. a note from Chainalysis in March. “It’s not typically seen as the blockchain you can build on.”

This puts bitcoin a step behind certain competing networks, especially Ethereum. On this platform, investors have the freedom to trade different cryptocurrencies or gain exposure to non-fungible tokens and DeFi.

And with Ethereum’s native cryptography now approved for its own set of spot ETFs, some analysts expect these technological advantages to trigger a bull run towards it.

But bitcoin is recovering.

Although programmers have tried for years to expand its functionality, the launch of the Ordinals protocol last year provided new momentum. This system is what allows the blockchain to finally host digital data beyond the bitcoin token, such as NFTs.

Then came the BRC-20 tokens. Built on the Ordinals engine, the protocol allows tokens to be minted and traded directly on the blockchain, and new cryptocurrencies have hit Bitcoin in droves.

“The Ordinals protocol has enabled the growth of memecoins on the bitcoin blockchain, leading to an increase in liquidity within the BTC ecosystem in record time. Since the protocol’s inception, tens of thousands of BRC-20 tokens, with a combined market capitalization exceeding to $2 billion, were issued,” Gracy Chen, CEO of cryptocurrency exchange Bitget, told Business Insider in an email.

Memecoins and NFTs may, for now, appeal more to fun-seekers, but this is good news for price-conscious investors as well, she said. Added to this are bitcoin’s forays into scaling and DeFi solutions, helping to increase demand for transactions.

While key technical differences still remain between bitcoin and ethereum, she said, replicating their functionality could see bitcoin rise fivefold in just a matter of years, Chen said.

This is based on the total value locked, or the amount of assets staked in the bitcoin protocol. Currently, this metric is roughly in line with Ethereum’s position just before it hit a parabolic boom between 2020 and 2021.

In the case of Ethereum, new DeFi functions and new coin launches triggered the seismic rise, and ether jumped 3,702% from peak to trough. For bitcoin, the growing adoption of BRC-20 could be the basis for its own rise – albeit less amplified:

“Despite bitcoin’s higher capitalization, it may not experience as meteoric growth as ETH in 2020, given the absence of a low base effect and stricter regulatory conditions. However, even a rise twice as weak could still result in a fivefold increase in the main cryptocurrency,” Chen wrote in a note.

Since its creation in March, close to 67 million BRC-20 registrations It has been done.

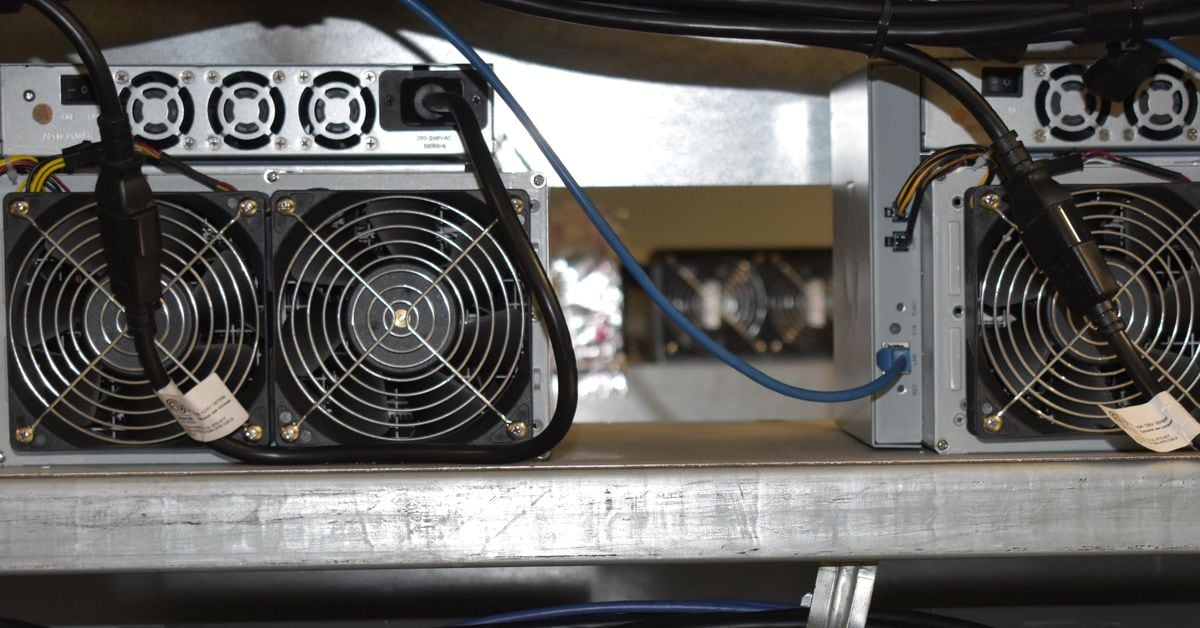

The explosive popularity has increased the profits of cryptominers, who receive a certain fee for minting these assets. While transaction fees have rarely been the main source of revenue, the increase in activity is changing the industry’s mindset, said Brian Wright, co-head of mining at Galaxy.

“We see these events occur, you know, probably not sustainably, but throughout the year, there will be some periods where miners may be more profitable than they thought they would be, just as a result of transaction fees,” he said. O Cerebro Galáxia Podcast in April.

Bitcoin

Big Tech Outperforms Bitcoin (BTC) as Trump Deal Weakens Token

Bitcoin has lost out on an asset rally fueled by positive comments from the Federal Reserve, while a tight US election race casts doubt on whether Donald Trump will get the chance to implement his pro-crypto agenda.

The digital asset fell 2.4% on Wednesday, following a Fed-fueled surge in an index of megacap tech stocks Magnificent Seven by one of the largest margins in 2024. The token retreated further on Thursday, changing hands at $63,750 as of 6:10 a.m. in London.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

Bitcoin (BTC) miner Riot Platforms (RIOT)’s second-quarter loss widens to $84.4 million as costs rise

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Why Trump Wants the US Government to Have a “National Stockpile” of Bitcoin

At a national bitcoin conference in Nashville, Donald Trump finally laid out some of his crypto policy proposals, including a long-awaited part of his plan — building a strategic bitcoin reserve. CNN’s Jon Sarlin explains what it is and why the crypto industry wants it.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit