Markets

Future Of Human And Machine

May 30, 2024 by Diana Ambolis

65

The world of cryptocurrency is a dynamic dance between human intuition and technological prowess. While AI-powered bots are making waves in automated trading, the future lies in collaboration – a powerful synergy between human expertise and machine intelligence. The Symbiotic Dance: How AI Bots and Crypto Traders Complement Each Other in Blockchain Markets The rise

The world of cryptocurrency is a dynamic dance between human intuition and technological prowess. While AI-powered bots are making waves in automated trading, the future lies in collaboration – a powerful synergy between human expertise and machine intelligence.

The Symbiotic Dance: How AI Bots and Crypto Traders Complement Each Other in Blockchain Markets

The rise of artificial intelligence (AI) has sent ripples through the financial world, and the realm of blockchain technology is no exception. AI-powered trading bots are increasingly populating crypto exchanges, raising questions about the future of crypto traders. However, the reality is not a zero-sum game. Both AI bots and crypto traders bring unique strengths to the table, and the most successful strategies will leverage their complementary skills. Let’s delve deeper into the unique advantages each possesses:

The Algorithmic Edge: The Power of AI Bots

-

Speed and Efficiency: AI bots can analyze vast amounts of market data at lightning speed, identifying patterns and trends that might escape even the most seasoned crypto trader. This allows them to react to market fluctuations instantaneously, executing trades with unmatched speed and precision. Imagine a bot monitoring millions of data points in milliseconds, capitalizing on fleeting arbitrage opportunities or executing high-frequency trading strategies that humans simply cannot replicate.

-

Emotionless Decision-Making: Crypto traders are susceptible to emotions like fear and greed, which can cloud judgment and lead to irrational decisions. AI bots, on the other hand, operate based on predefined algorithms and are immune to emotional biases. This allows them to stick to their trading plans and execute trades with unwavering logic, even in volatile market conditions.

-

24/7 Market Monitoring: The cryptocurrency market operates around the clock, unlike traditional financial markets. Crypto traders need sleep and breaks, but AI bots can tirelessly monitor the market 24/7, seizing opportunities that might arise during off-hours. This continuous vigilance can be invaluable for capitalizing on unexpected market movements.

-

Backtesting and Optimization: AI bots excel in backtesting trading strategies on historical data. This allows them to identify successful patterns and continuously refine their algorithms for optimal performance. Over time, an AI bot can learn and adapt, becoming increasingly adept at navigating the ever-changing market landscape.

The Human Touch: The Irreplaceable Value of Crypto Traders

-

Market Intuition and Experience: Seasoned crypto traders possess a wealth of experience and market intuition that cannot be easily replicated by algorithms. They can recognize unforeseen circumstances, adapt to black swan events, and make strategic decisions based on a nuanced understanding of market sentiment. This human touch is crucial for navigating complex market dynamics and making informed judgments beyond the realm of pure data analysis.

-

Risk Management and Strategic Thinking: While AI bots excel at execution, crypto traders excel at risk management and strategic planning. They can set parameters for the bots, define risk tolerance levels, and adjust strategies based on broader market trends. Humans can also identify potential weaknesses in bot algorithms and adapt accordingly, ensuring a well-rounded trading approach.

-

Fundamental Analysis and Research: AI bots primarily rely on technical analysis – identifying patterns within market data. However, fundamental analysis – understanding the underlying value of a blockchain project or cryptocurrency – is crucial for long-term success. Crypto traders can conduct in-depth research on blockchain projects, assess their potential, and make informed investment decisions that consider both technical and fundamental factors.

-

Adapting to Evolving Regulations: The regulatory landscape surrounding cryptocurrencies is constantly evolving. Crypto traders can stay abreast of regulatory changes and adjust their trading strategies accordingly. This adaptability is crucial for navigating a dynamic market with uncertain legal frameworks.

The Future: A Collaborative Approach

The future of blockchain trading lies not in a battle between AI and humans, but in a collaborative approach that leverages the strengths of both. Imagine a scenario where:

- AI bots handle the fast-paced execution and emotionless decision-making.

- Crypto traders set the overall strategy, manage risk, and incorporate fundamental analysis.

- The system continuously learns and adapts based on market data and human input.

This symbiotic partnership can lead to a more efficient, profitable, and ultimately more successful approach to blockchain trading. As AI technology continues to evolve and human expertise is combined with its capabilities, we can expect the future of blockchain markets to be shaped by a powerful collaboration between humans and machines.

Also, read – Top 10 Intriguing Ways AI Trading Bots Contribute to the Crypto Crash: Unveiling The Algorithmic Black Box

The Collaborative Dance Floor: AI and Crypto Traders in Action (2024)

The year is 2024. The once-futuristic vision of AI-powered trading bots is now a reality in the dynamic world of blockchain markets. However, instead of replacing human crypto traders, a fascinating collaboration is unfolding. Let’s delve into the intricate dance between these two forces, showcasing how their complementary strengths are shaping the future of blockchain trading:

The AI Arsenal: Powering Precision and Speed

Imagine Sarah, a seasoned crypto trader, sitting at her workstation. Her monitor displays not just charts and order books, but a sophisticated interface for her AI trading bot, aptly named “Blitz.” Blitz is Sarah’s secret weapon, a constantly evolving algorithm trained on historical data and Sarah’s own trading strategies.

-

Real-Time Market Analysis: Blitz continuously scans the market, analyzing millions of data points per second. It devours price movements, order book activity, and social media sentiment, identifying emerging trends and potential arbitrage opportunities that might escape the human eye.

-

High-Frequency Trading Prowess: When Blitz detects a fleeting arbitrage opportunity, it reacts with lightning speed. In milliseconds, it executes complex trading strategies, capitalizing on price discrepancies across different exchanges before the market corrects itself. This high-frequency precision allows Sarah to exploit short-term market inefficiencies and accumulate profits that would be impossible through manual trading.

-

Backtesting and Refinement: Sarah doesn’t simply set Blitz loose on the market. She constantly backtests its performance on historical data, analyzing its successes and failures. This allows her to refine Blitz’s algorithms, identify areas for improvement, and adapt its strategies to the ever-evolving market landscape.

-

24/7 Market Vigilance: The crypto market never sleeps. While Sarah needs rest, Blitz remains vigilant. It tirelessly monitors the market around the clock, seizing potential opportunities that might arise during off-hours. This continuous monitoring ensures Sarah doesn’t miss out on profitable trades, even when she’s away from the screen.

The Human Edge: Intuition, Strategy, and Oversight

However, Sarah isn’t just a passive observer. Her human expertise plays a crucial role in this collaborative dance:

-

Market Intuition and Experience: Years of experience have honed Sarah’s market intuition. She can sense shifts in sentiment, anticipate black swan events, and understand the broader context that pure data analysis might miss. This allows her to adjust Blitz’s strategies on the fly, factoring in unforeseen circumstances and adapting to changing market dynamics.

-

Risk Management and Portfolio Diversification: While Blitz excels at execution, Sarah prioritizes risk management. She sets clear parameters for Blitz’s trading activities, defining acceptable risk levels and ensuring the bot doesn’t overexpose her portfolio. She also understands the importance of diversification, and doesn’t rely solely on Blitz’s short-term strategies. She allocates a portion of her portfolio to long-term holdings based on her fundamental analysis of promising blockchain projects.

-

Fundamental Analysis and Project Research: AI bots primarily focus on technical analysis, but Sarah knows the importance of understanding the underlying value of a project. She delves into whitepapers, analyzes project roadmaps, and assesses the team behind a blockchain venture. This fundamental analysis allows her to make informed decisions about long-term investments, complementing Blitz’s focus on short-term market opportunities.

-

Adapting to Evolving Regulations: The regulatory landscape surrounding cryptocurrencies is constantly shifting. Sarah stays up-to-date on regulatory changes and adjusts her trading strategies accordingly. This ensures her and Blitz operate within the legal boundaries, mitigating potential risks and ensuring long-term success.

The Symbiotic Success: A Winning Combination

The collaboration between Sarah and Blitz is a masterclass in leveraging the strengths of both AI and human expertise. Blitz provides the speed, precision, and tireless vigilance, while Sarah brings the strategic thinking, risk management, and fundamental analysis. This symbiotic relationship allows them to:

- Capture fleeting market opportunities through high-frequency trading.

- Mitigate emotional biases and ensure disciplined trading decisions.

- Capitalize on 24/7 market activity and maximize potential returns.

- Make informed investment decisions based on both technical and fundamental analysis.

- Adapt to changing market dynamics and navigate evolving regulatory landscapes.

As AI technology continues to evolve and human expertise merges with its capabilities, we can expect the future of blockchain trading to be even more dynamic. This collaborative approach, where AI bots handle the fast-paced execution and crypto traders provide the strategic vision, is likely to become the dominant force shaping the success of investors and traders in the ever-evolving world of blockchain markets.

Glimpses into the Future: Real-World Examples of Human-AI Collaboration in Crypto Trading (Today in 2024)

The year is still 2024, and the future of human-AI collaboration in crypto trading isn’t just a theoretical concept – it’s already happening! Let’s explore some real-world examples of how this powerful partnership is playing out in the crypto markets today:

Example 1: The Technical Virtuoso and the Strategic Planner

-

Meet the Team: David, a young and technically adept crypto enthusiast, has built his own AI bot using open-source libraries. This bot, named “Stratagem,” excels at technical analysis, identifying trading patterns and potential arbitrage opportunities. However, David recognizes his own limitations in terms of overarching strategy and risk management.

-

The Collaborative Dance: David pairs Stratagem with a subscription service offered by a veteran crypto trader, Sarah (the same Sarah from our previous example!). This service provides pre-defined trading strategies and risk management parameters. David feeds these parameters into Stratagem, allowing the bot to execute trades within the boundaries set by Sarah’s experience.

-

The Benefits: David leverages Stratagem’s technical prowess to identify profitable opportunities, while Sarah’s strategic guidance ensures he doesn’t overexpose himself to risk. This collaboration allows David to compete with more experienced traders and potentially achieve better returns.

Example 2: The Algorithmic Hedge Fund and the Human Oversight Committee

-

The Powerhouse Players: “Cypher Capital” is a quantitative hedge fund specializing in cryptocurrencies. They utilize a sophisticated suite of AI-powered trading bots that analyze vast amounts of market data and execute complex trading strategies. However, Cypher Capital understands that AI, while powerful, isn’t infallible.

-

The Human Safety Net: Cypher Capital has established a dedicated oversight committee composed of experienced crypto traders and financial analysts. This committee monitors the performance of the AI bots, identifies potential weaknesses in their algorithms, and can intervene if necessary to prevent catastrophic losses.

-

The Winning Formula: By combining the lightning-fast execution of AI bots with the experience and judgment of human experts, Cypher Capital can navigate the volatile world of cryptocurrencies with greater confidence and potentially generate superior returns for its investors.

Example 3: The Educational Platform and the AI-powered Trading Assistant

-

Democratizing Crypto Trading: “Crypto Academy” is an online platform dedicated to educating aspiring crypto traders. They recognize that many newcomers feel overwhelmed by the complexities of market analysis and trade execution.

-

AI to the Rescue: Crypto Academy has partnered with an AI development company to create a unique trading assistant tool. This tool utilizes AI to analyze market data and suggest potential trading opportunities based on the user’s risk tolerance and investment goals.

-

Empowering Newcomers: This AI assistant empowers newcomers by providing them with data-driven insights and suggestions. Users can then make informed decisions about whether or not to execute a trade, learning from the AI’s analysis and gradually developing their own trading skills.

These are just a few examples of how human-AI collaboration is transforming the landscape of crypto trading in 2024. As AI technology continues to evolve and becomes more accessible, we can expect even more innovative applications to emerge, further democratizing access to crypto markets and empowering both experienced and novice traders to navigate this exciting and ever-changing financial frontier.

The Road Ahead: Building Trust and Defining Roles in Human-AI Crypto Collaboration

The collaborative dance between AI bots and human crypto traders holds immense promise for the future of blockchain markets. However, navigating this partnership requires careful consideration of trust, transparency, and well-defined roles. Let’s explore the challenges and opportunities that lie ahead:

Building Trust in AI: Overcoming the Black Box

-

Transparency in Algorithmic Design: One of the primary challenges lies in the inherent opacity of AI algorithms. For human traders to trust AI bots, they need a basic understanding of how the bots arrive at their decisions. This necessitates a move away from “black box” algorithms towards more transparent models that can be audited and understood.

-

Focus on Explainable AI: The field of Explainable AI (XAI) is rapidly evolving, and its principles should be integrated into the development of AI trading bots. This will allow human traders to understand the rationale behind the bot’s recommendations, fostering trust and enabling informed decision-making.

-

Human Oversight and Control Mechanisms: Ultimately, human traders should retain control over their investment strategies. Clear safeguards need to be implemented to ensure AI bots operate within pre-defined parameters and can be overridden in critical situations.

Defining Roles and Responsibilities: A Symphony, Not a Solo Act

-

Leveraging Complementary Strengths: The key to success lies in recognizing the unique strengths of both humans and AI. AI bots excel at speed, precision, and data analysis, while humans contribute strategic thinking, risk management, and the ability to adapt to unforeseen circumstances.

-

Continuous Learning and Improvement: This partnership is an ongoing learning process. Human traders need to stay up-to-date on advancements in AI technology to effectively utilize these tools. Conversely, AI developers need to incorporate human feedback and market insights into their algorithms for continuous improvement.

-

Evolving Regulatory Landscape: As AI integration in crypto trading becomes more commonplace, regulators will need to adapt. Clear guidelines regarding the use of AI bots and the allocation of responsibility in case of errors are crucial to ensure market stability and investor protection.

The Future of Collaboration: A Symbiotic Dance

By fostering trust, transparency, and clearly defined roles, human-AI collaboration can unlock the full potential of blockchain markets. Imagine a future where:

- AI bots handle the heavy lifting of data analysis and high-frequency trading.

- Human traders provide strategic oversight, manage risk, and make informed investment decisions based on both technical and fundamental analysis.

- The system continuously learns and adapts based on market data and human input.

This collaborative approach can lead to a more efficient, profitable, and ultimately more secure future for the crypto ecosystem. As AI technology continues to evolve, and humans embrace its potential as a collaborative tool, the future of blockchain trading holds the promise of a dynamic and rewarding experience for all participants.

In conclusion, the future of crypto trading is not about humans versus machines, but rather humans and machines working together. By leveraging the unique strengths of each, investors can navigate the ever-evolving crypto landscape with greater skill and potentially achieve their financial goals.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

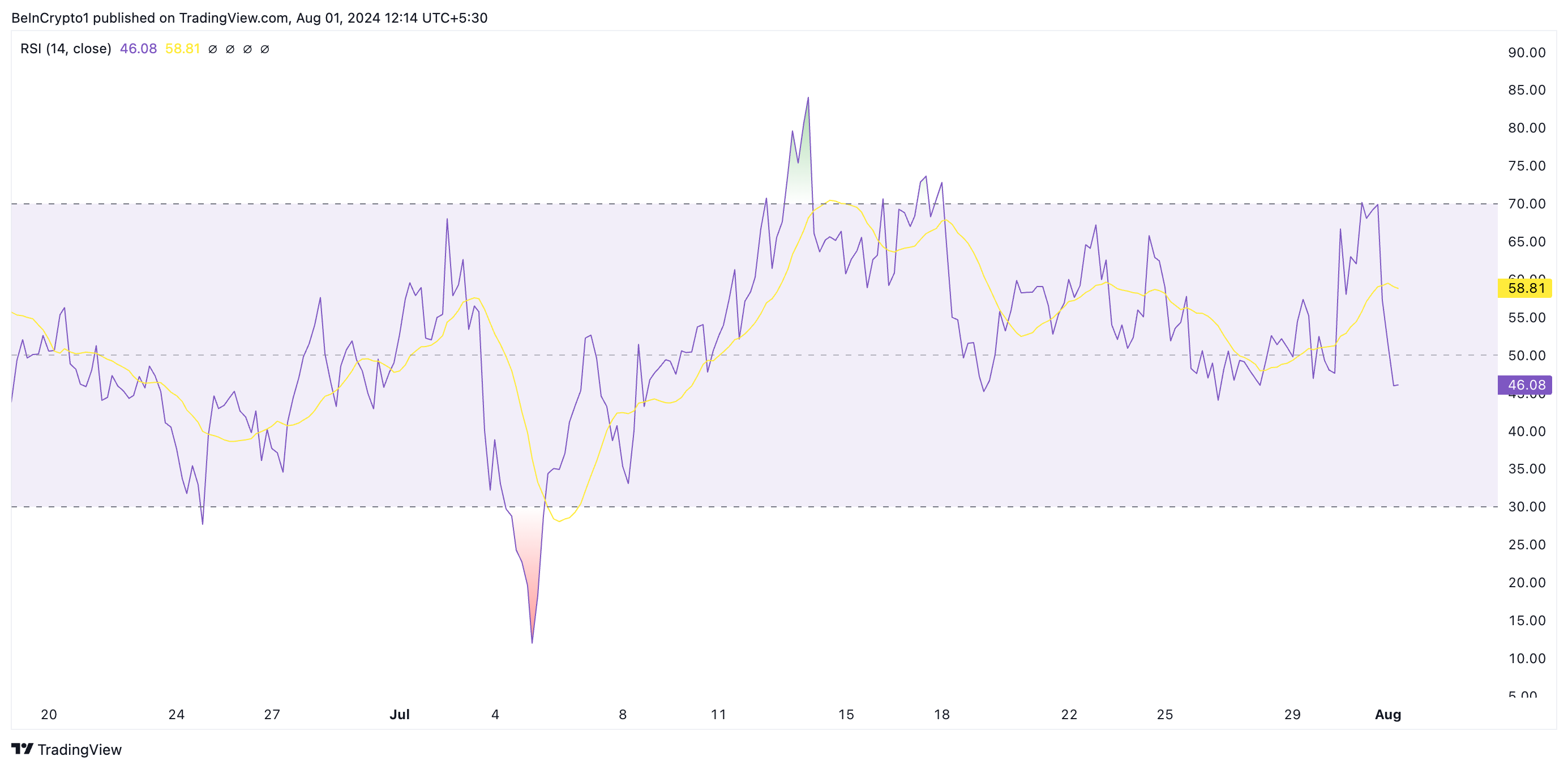

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit