News

Crypto vs traditional finance in 2023

Today’s investors are faced with many options beyond stocks and bonds, with the crypto/traditional finance narrative becoming increasingly common.

Public and private players are constantly looking for opportunities to deploy capital in investment vehicles that generate substantial returns while presenting minimal risk. However, the nature of risk appetite has evolved over the past decade with the emergence of a new asset class accessible all over the world.

Before committing resources to an industry, whether it is decentralized finance (challenge) or traditional markets, investors need to understand what separates the two. This article explores crypto versus traditional finance: the differences, the similarities, and whether now is the right time to get started.

Cryptocurrency or traditional finance

In the debate between cryptocurrency and traditional finance, the main differences lie in their operating models and accessibility. Traditional finance (tradfi) relies on centralized entities such as banks, governed by regulations often set by a few managers, and is limited by geographical and operational constraints. Although reliable due to its long history, this system often excludes people living in remote areas from access to financial services.

On the other hand, decentralized finance (defi) operates without traditional banking infrastructure, providing transparency and community involvement through verifiable codes and smart contracts. Crypto vs finance highlights the flexibility of the challenge, enabling 24/7 trading worldwide without geographical barriers, unlike the limited trading hours of traditional markets like WE Sotck exchange.

What is traditional finance? This is a system where innovation can be slow due to strict regulatory compliance, while cryptocurrencies encourage the rapid development of new financial products. Additionally, traditional finance often has higher transaction costs and slower cross-border settlements than the fast and cost-effective transactions of cryptocurrencies.

Investment analysis also differs between these sectors. Traditional financial investors focus on metrics like price-to-book ratios, while crypto investors consider project whitepapers, tokenomics, and community engagement. This comparison between crypto and finance highlights the evolving financial services landscape and the growing appeal of cryptocurrencies.

Crypto vs traditional finance in 2023

Markets have seen significant price movements throughout 2023. Inflation in the United States and other countries around the world has apparently prompted liquidity injections into many business and financial sectors to hedge against against economic downturns.

According to official data, the S&P500 recorded an increase of 24.87% year-to-date (YTD).

S&P 500 growth since the start of the year | Source: spglobal.com

Gold, one of the most popular assets in the trade, reached its all-time high price (ATH) in 2023. Prices of the yellow metal peaked in December, trading as high as $2,150 per ounce. This represents growth of 13.3% in 12 months.

Gold price in 2023. Source: goldprice.org

Bitcoin (BTC), the leading blockchain and crypto token, has grown 158% year-to-date, eclipsing both the S&P 500 and gold. The cryptocurrency, often referred to as digital gold, was trading at just $43,000 at the end of the year, approximately 36% below its ATH reached in November 2021.

Bitcoin Price in 2023 | Source: CoinMarketCap

Another major cryptocurrency, Ethereum (ETH), has seen gains of 100% year-to-date, also outpacing gold and the S&P 500 in profitability. Currently, the coin is trading at $2,404, remaining the leading blockchain for building crypto infrastructure and launching tokens and dapps.

Ethereum Price in 2023 | Source: CoinMarketCap

However, crypto typically experiences massive volatility and price fluctuation compared to TradFi.

Why people prefer crypto

The crypto industry is still in its infancy, although institutional interest is growing, as indicated by the spot exchange-traded fund (ETFs), and mass adoption is also increasing, with several jurisdictions developing clear rules to oversee digital assets.

Billions of dollars have been invested in cryptocurrencies as investors seek new markets offering significant returns. While crypto has inherent risks ranging from security issues to bad actors, it also offers transparency since anyone can view blockchain transactions with tools like Etherscan.

This transparency allows for anonymity because on-chain transactions appear under an alphanumeric wallet address rather than a bank account associated with private information such as your name and address.

On-chain transfers are immutable, meaning they cannot be altered or tampered with, adding an extra layer of trust from users. Many Defi protocols are also open source; everyone can see the underlying code, increasing transparency within the crypto community.

Thus, users can manage their risks while achieving high returns on their initial investments. Additionally, crypto is controlled by the collective and encourages peer-to-peer financial interaction in a neutral environment where demand and supply exist.

It is important to note that cryptocurrencies and the challenge are open to everyone, regardless of geographic area. You do not need government approval or banking permission to participate in crypto. Crypto trading is, however, prohibited in some countries like China.

Is now a good time to invest in crypto?

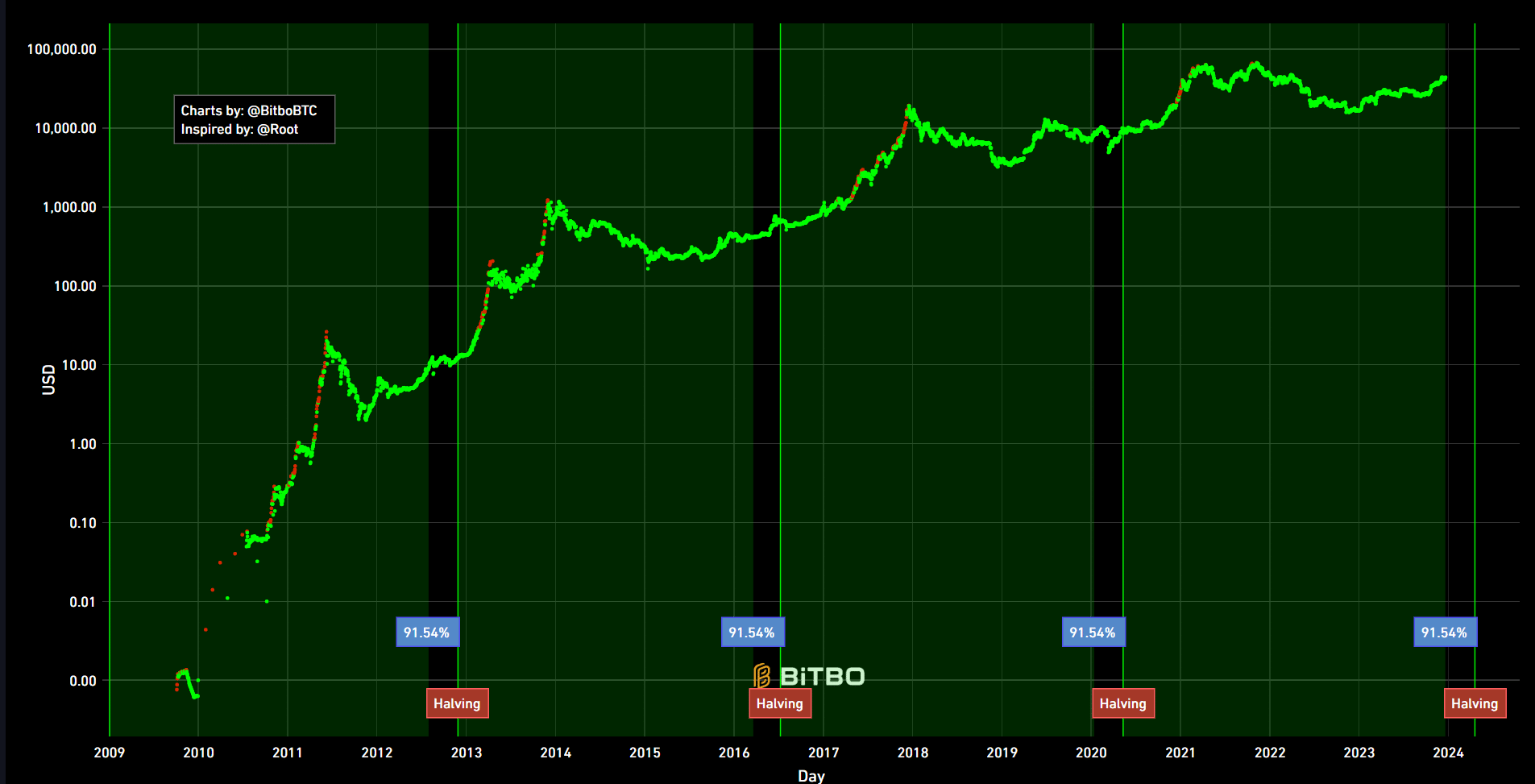

Crypto, like any financial sector, has its bear and bull cycles where the market is either going up or down. Digital asset markets historically operate in one to two year intervals, with a 12 to 34 month gap between cycles.

Considering that the last confirmed bull run ended in 2021, followed by a crash in 2022 marked by several crypto bankruptciesand a resurgence in 2023 fueled by institutional interest, this could be a good time to evaluate investments in crypto assets.

The titans of Wall Street love BlackRock have applied for exchange-traded products to invest in Bitcoin and Ethereum at spot prices. They are the two largest blockchains and cryptocurrencies in the world, with a combined market capitalization of over $1 trillion.

Traditional banks like JPMorgan Chase, the largest US bank, has decided to commercialize blockchains and promote the tokenization of real-world assets (RWA) like real estate. RWAs on blockchains are already a billion-dollar industry, according to Coingecko.

Furthermore, the Bitcoin halving is expected to take place by April 2024. This will effectively cut the supply of Bitcoin in half and create a situation that could trigger an increase in demand. Supporters are divided on whether this development is already priced into the bargain. Yet data shows that Bitcoin never returned to its pre-halving price.

A mix of cyclical patterns, institutional focus on spot crypto ETFs, BTC halving, and general bullish sentiment means this could be a good time to invest in crypto. However, when investing in speculative markets and risky assets like digital currencies, caution is required.

Bitcoin Halving Cycles | Source: bitbo.io

Conclusion

Disclosure: This article does not represent investment advice. The content and materials presented on this page are intended for educational purposes only.

Cryptocurrencies and traditional finance both experienced watershed moments in 2023. Assets like gold hit an ATH, and the world’s largest asset managers took an interest in BTC and ETH, an indicator that billions of dollars of retail money could soon be flowing into cryptos.

Overall, major cryptocurrencies outperformed traditional markets and ultimately came out on top in the traditional crypto-finance showdown in 2023. However, it is important to keep in mind that both markets can be volatile and so investors should make sure to do so. their due diligence before making any investment decisions in 2024 or later.

News

Bitcoin soars above $63,000 as money flows into new US investment products

Bitcoin has surpassed the $63,000 mark for the first time since November 2021. (Chesnot via Getty Images)

Bitcoin has broken above the $63,000 (£49,745) mark for the first time since November 2021, when the digital asset hit its all-time high of over $68,000.

Over the past 24 hours, the value of the largest digital asset by market capitalization has increased by more than 8% to trade at $63,108, at the time of writing.

Learn more: Live Cryptocurrency Prices

The price appreciation was fueled by record inflows into several U.S.-based bitcoin cash exchange-traded funds (ETFs), which were approved in January this year.

A Bitcoin spot ETF is a financial product that investors believe will pave the way for an influx of traditional capital into the cryptocurrency market. Currently, indications are favorable, with fund managers such as BlackRock (BLK) and Franklin Templeton (BEN), after allocating a record $673 million into spot Bitcoin ETFs on Wednesday.

Learn more: Bitcoin’s Success With SEC Fuels Expectations for an Ether Spot ETF

The record allocation surpassed the funds’ first day of launch, when inflows totaled $655 million. BlackRock’s iShares Bitcoin Trust ETF (I BITE) alone attracted a record $612 million yesterday.

Bitcoin Price Prediction

Earlier this week, veteran investor Peter Brandt said that bitcoin could peak at $200,000 by September 2025. “With the push above the upper boundary of the 15-month channel, the target for the current market bull cycle, which is expected to end in August/September 2025, is raised from $120,000 to $200,000,” Brandt said. published on X.

The influx of capital from the traditional financial sphere into Bitcoin spot ETFs is acting as a major price catalyst for the digital asset, but it is not the only one. The consensus among analysts is that the upcoming “bitcoin halving” could continue to drive flows into the bitcoin market.

The Bitcoin halving is an event that occurs roughly every four years and is expected to happen again next April. The halving will reduce the bitcoin reward that miners receive for validating blocks on the blockchain from 6.25 BTC to 3.125 BTC. This could lead to a supply crunch for the digital asset, which could lead to price appreciation.

The story continues

Watch: Bitcoin ETFs set to attract funds from US pension plans, says Standard Chartered analyst | Future Focus

Download the Yahoo Finance app, available for Apple And Android.

News

FRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

Forensic Risk Alliance (FRA), an independent consultancy specializing in regulatory investigations, compliance and litigation, has welcomed U.S.-based cryptocurrency specialist Thomas Hyun as a director of the firm’s global cryptocurrency investigations and compliance practice. Hyun brings to the firm years of experience building and leading anti-money laundering (AML) compliance programs, including emerging payment technologies in the blockchain and digital asset ecosystem.

Hyun has nearly 15 years of experience as a compliance officer. Prior to joining FRA, he served as Director of AML and Blockchain Strategy at PayPal for four years. He established PayPal’s financial crime policy and control framework for its cryptocurrency-related products, including PayPal’s first consumer-facing cryptocurrency offering on PayPal and Venmo, as well as PayPal’s branded stablecoin.

At PayPal, Hyun oversaw the second-line AML program for the cryptocurrency business. His responsibilities included drafting financial crime policies supporting the cryptocurrency business, establishing governance and escalation processes for high-risk partners, providing credible challenge and oversight of front-line program areas, and reporting to the Board and associated authorized committees on program performance.

Prior to joining PayPal, Hyun served as Chief Compliance Officer and Bank Secrecy Officer (BSA) at Paxos, a global blockchain infrastructure company. At Paxos, he was responsible for implementing the compliance program, including anti-money laundering and sanctions, around the company’s digital asset exchange and its asset-backed tokens and stablecoins. He also supported the company’s regulatory engagement efforts, securing regulatory approvals, supporting regulatory reviews, and ensuring compliance with relevant digital asset requirements and guidelines.

Thomas brings additional experience in payments and financial crime compliance (FCC), having previously served as Vice President of Compliance at Mastercard, where he was responsible for compliance for its consumer products portfolio. He also spent more than seven years in EY’s forensics practice, working on various FCC investigations for U.S. and foreign financial institutions.

Hyun is a Certified Anti-Money Laundering Specialist (CAMS) and a Certified Fraud Examiner (CFE). He is a graduate of New York University’s Stern School of Business, where he earned a bachelor’s degree in finance and accounting. Additionally, he serves on the board of directors for the Central Ohio Association of Certified Anti-Money Laundering Specialists (ACAMS) chapter.

Commenting on his appointment, Hyun said, “With my experience overseeing and implementing effective compliance programs at various levels of maturity and growth, whether in a startup environment or large enterprises, I am excited to help our clients overcome similar obstacles and challenges to improve their financial crime compliance programs. I am excited to join FRA and leverage my experience to help clients navigate the complexities of AML compliance and financial crime prevention in this dynamic space.”

FRA Partner, Roy Pollittadded: “As the FRA’s sponsor partner for our growing Cryptocurrency Investigations and Compliance practice, I am thrilled to have Thomas join our ever-expanding team. The rapid evolution of blockchain and digital asset technologies presents both exciting opportunities and significant compliance challenges. Hiring Thomas in a leadership role underscores our commitment to staying at the forefront of the industry by enhancing our expertise in anti-money laundering and blockchain strategy.”

“Thomas’ extensive background in financial crime compliance and proven track record of building risk-based FCC programs in the blockchain and digital asset space will be invaluable as we continue to provide our clients with the highest level of service and innovative solutions.”

“FRA strengthens cryptocurrency practice with new director Thomas Hyun” was originally created and published by International Accounting Bulletina brand owned by GlobalData.

The information on this website has been included in good faith for general information purposes only. It is not intended to amount to advice on which you should rely, and we make no representations, warranties or assurances, express or implied, as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our website.

News

Bitcoin trades around $57,000, crypto market drops 6% ahead of Fed decision

-

Bitcoin fell in line with the broader cryptocurrency market, with ether and other altcoins also falling.

-

Financial markets were weighed down by risk-off sentiment ahead of the Fed’s interest rate decision and press conference later in the day.

-

10x Research said it is targeting a price target of $52,000 to $55,000, anticipating further selling pressure.

Bitcoin {{BTC}} was trading around $57,700 during European morning trading on Wednesday after falling to its lowest level since late February, as the world’s largest cryptocurrency recorded its worst month since November 2022.

BTC has fallen about 6.3% over the past 24 hours, after breaking below the $60,000 support level late Tuesday, according to data from CoinDesk. The broader crypto market, as measured by the CoinDesk 20 Index (CD20), lost nearly 9% before recovering part of its decline.

Cryptocurrencies have been hurt by risk-off sentiment in broader financial markets amid stagflation in the United States, following indications of slowing growth and persistent inflation that have dampened hopes of an interest rate cut by the Federal Reserve. The Federal Open Market Committee is due to deliver its latest rate decision later in the day.

Ether {{ETH}} fell about 5%, dropping below $3,000, while dogecoin {{DOGE}} led the decline among other major altcoins with a 9% drop. Solana {{SOL}} and Avalanche {{AVAX}} both lost about 6%.

Bitcoin plunged in April, posting its first monthly loss since August. The 16% drop is the worst since November 2022, when cryptocurrency exchange FTX imploded, but some analysts are warning of further declines in the immediate future.

10x Research, a digital asset research firm, said it sees selling pressure toward the $52,000 level due to outflows from U.S. cash exchange-traded funds, which have totaled $540 million since the Bitcoin halving on April 20. It estimates that the average entry price for U.S. Bitcoin ETF holders is $57,300, so this could prove to be a key support level.

The closer the bitcoin spot price is to this average entry price, the greater the likelihood of a new ETF unwind, 10x CEO Markus Thielen wrote Wednesday.

“There may have been a lot of ‘TradeFi’ tourists in crypto – pushing longs all the way to the halving – that period is now over,” he wrote. “We expect more unwinding as the average Bitcoin ETF buyer will be underwater when Bitcoin trades below $57,300. This will likely push prices down to our target levels and cause a -25% to -29% correction from the $73,000 high – hence our $52,000/$55,000 price target over the past three weeks.”

The story continues

UPDATE (May 1, 8:56 UTC): Price updates throughout the process.

UPDATE (May 1, 9:57 UTC): Price updates throughout the process.

UPDATE (May 1, 11:05 UTC): Adds analysis from 10x.

News

The Cryptocurrency Industry Is Getting Back on Its Feet, for Better or Worse

Hello from Austin, where thousands of crypto enthusiasts braved storms and scorching heat to attend Consensus. The industry’s largest and longest-running conference, which can sometimes feel like a religious revival, offers opportunities to chat and listen to leading names in crypto. And for the casual observer, Consensus offers a useful glimpse into the mood of an industry prone to wild swings in fortune.

Unsurprisingly, the mood is noticeably more positive than it was a year ago, when crowds were sparse and many attendees were quietly confiding that they were considering switching to AI. In practice, that means some of the more obnoxious elements are back, but not to the level of Consensus 2018 in New York, when charlatans parked Lamborghinis outside the event and the hallways were lined with booth girls and scammers pitching “ICOs in a box.”

This time around, Elon Musk’s Cybertrucks have replaced Lamborghinis as the vehicle of choice for marketers. One of the most notable publicity stunts was a startup that paid a poor guy to parade around in the Texas sun in a Jamie Dimon costume, wig, and mask, and then staged a mock assault on him by memecoin characters.

Outside the event was a giant “RFK for President” truck, while campaign staffers manned a booth instead — a reflection of both the election year and crypto’s willingness to latch onto any candidate, no matter how outlandish, who will talk about the industry. RFK himself is scheduled to address the conference on Thursday.

Excesses aside, the general sense of optimism was understandable. The cryptocurrency market has not only recovered from the wave of fraud that nearly sank it in 2022, it is riding a new wave of political legitimacy. This month, cryptocurrencies scored once-unthinkable political victories in Washington, D.C., and there is a sense that the industry has not only withstood the relentless regulatory assaults of SEC Chairman Gary Gensler and Sen. Elizabeth Warren, but is poised to defeat them.

And while cryptocurrency is still searching for its flagship application, the optimists I spoke with pointed to signs that it is (once again) upon us. Those signs include the rapid advancement of zero-knowledge proofs as well as the popularity of Coinbase’s Base blockchain and, perhaps most importantly, the large-scale arrival of traditional finance into the world of cryptocurrencies – a development that not only provides a major financial boost, but also a new element of stability and maturity that will, perhaps, tame the worst of crypto’s wilder side. Finally, this consensus marked the end of the Austin era as the conference, under new leadership, will be held in Toronto and Hong Kong in 2025.

The story continues

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

This story was originally featured on Fortune.com

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit