Bitcoin

Bitcoin halving in 2024 is still happening. Here’s what to expect next.

Forced scarcity will be a hurdle for so-called digital gold.

O Bitcoin (Bitcoin 1.13%) The halving event (also known as halving) was, perhaps, grossly underestimated this year. By pure chance, the April 19 halving occurred while the cryptocurrency market was obsessed with SEC approval spot Bitcoin ETFs.

However, investors should not underestimate the importance the Bitcoin halving event in 2024. Although it happened over a month ago, it will have ripple effects throughout the year and beyond.

Exactly what happens next is anyone’s guess, but Bitcoin HODL-ers should look to policymakers – not just the SEC – for clues. Very similar a certain yellow metalBitcoin’s value proposition stems from its limited supply, and understanding this is key to HODLing with conviction.

Don’t try to time the halving rally

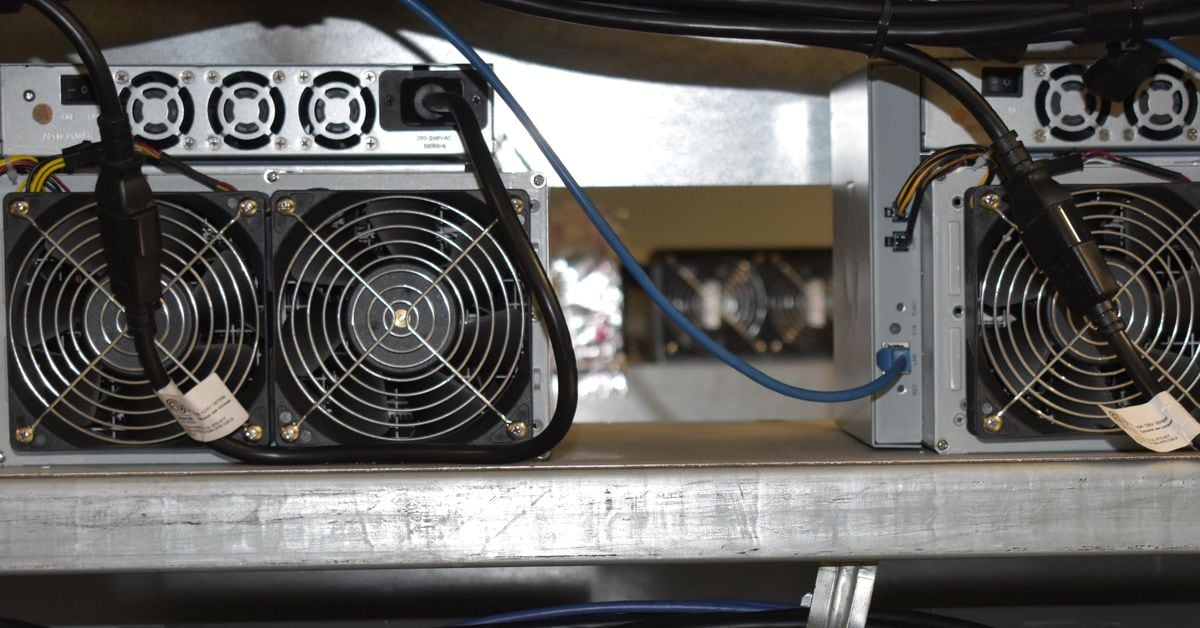

Just to recap, the April 2024 halving event reduced the reward for mining a block of Bitcoin from 6.25 BTC to just 3.125 BTC. This disincentivizes and consequently slows down Bitcoin mining activity in order to maintain a relatively low supply of tokens in circulation.

Someone could look at the three previous halvings of Bitcoin and try to predict what will happen to the token’s price in the months following the April halving. However, having such a small sample size makes such predictions almost meaningless.

In other words, don’t take the concept of “Bitcoin’s next move” too literally. By now, the highly efficient and forward-looking market has likely already priced in the expected positive effect of this year’s Bitcoin halving.

Bitcoin reached a new high of around $73,000 in mid-March. This was the first time Bitcoin reached a new all-time high before the halving. But again, the sample size is too small to draw any statistically significant conclusions here. Furthermore, this time the halving was obscured and overshadowed by the front page news of the Spot Bitcoin ETF approvals.

Despite a small pullback to around $73,000, Bitcoin’s recovery from the late 2022 low of around $16,000 has been surprising. Bitcoin tends to eliminate weaker hands before embarking on new bull cycles, so don’t be surprised if the next price movement is a pullback.

Regardless of what happens in the short term, follow the mantra of “time in the market, not timing the market.” Just as important, know why you invested in Bitcoin. Most likely, the reason will have something to do with deliberately limited supply, which is exactly the reason for the halving.

“Digital gold” versus the dollar

While this may not lead to Bitcoin’s next move, the trajectory of the US dollar will certainly inform Bitcoin throughout 2024. The price of Bitcoin (in America, at least) is measured against the dollar, and the dollar’s rise in the cumulative of the year definitely hasn’t changed. helped Bitcoin.

So what could weaken the dollar this year? A change in central bank policy could solve the problem. Even just a hint of imminent interest rate cuts by the Federal Reserve should suppress the dollar and provide a significant tailwind for Bitcoin.

Speaking of regulators, legislators and other bigwigs, there is currently a bill known as the Financial Technology and Innovation for the 21st Century Act, or informally as Fit 21, making its way through Congress. If approved, Fit 21 would increase regulatory clarity for cryptocurrency, which in turn should add a greater sense of legitimacy to Bitcoin.

Both central bank policy changes and Fit 21 have the potential to change the price of Bitcoin. However, these events should not cloud Bitcoin’s appeal as “digital gold.” Just as there is a limited amount of natural gold on Earth to extract, only 21 million Bitcoins will be produced. Thus, Bitcoin and gold not only tend to move inversely in price relative to the US dollar; they also act as a hedge against the deteriorating effect of inflation on the dollar.

If this year’s halving event caused Bitcoin’s inflation rate to rise fall below 1%, then the token could actually be as valid an inflation hedge as gold. In this context, Bitcoin’s next move must take a backseat to its inevitable move against the US dollar. Therefore, whether lawmakers and regulators help or hinder Bitcoin in the coming months, the legacy of the 2024 halving will be more favorable supply/demand balance for Bitcoin – and perhaps a share equivalent to gold if the dollar falls.

Bitcoin

Big Tech Outperforms Bitcoin (BTC) as Trump Deal Weakens Token

Bitcoin has lost out on an asset rally fueled by positive comments from the Federal Reserve, while a tight US election race casts doubt on whether Donald Trump will get the chance to implement his pro-crypto agenda.

The digital asset fell 2.4% on Wednesday, following a Fed-fueled surge in an index of megacap tech stocks Magnificent Seven by one of the largest margins in 2024. The token retreated further on Thursday, changing hands at $63,750 as of 6:10 a.m. in London.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin

Bitcoin

came back with a vengeance this year when former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcointhough it fell again this week, falling below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

Bitcoin (BTC) miner Riot Platforms (RIOT)’s second-quarter loss widens to $84.4 million as costs rise

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Why Trump Wants the US Government to Have a “National Stockpile” of Bitcoin

At a national bitcoin conference in Nashville, Donald Trump finally laid out some of his crypto policy proposals, including a long-awaited part of his plan — building a strategic bitcoin reserve. CNN’s Jon Sarlin explains what it is and why the crypto industry wants it.

-

News1 year ago

News1 year agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News1 year ago

News1 year agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi1 year ago

DeFi1 year agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets1 year ago

Markets1 year agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈