Markets

‘Elizabeth Warren’s Anti-Crypto Wing Is A Shrinking Iceberg’, Says Former Top Regulator

Former CFTC Chairman Christopher Giancarlo is bullish on crypto’s future in the U.S.

Christ Giancarlo

The Honorable J. Christopher Giancarlo served as the 13th chairman of the U.S. Commodity Futures Trading Commission. He also was a member of the U.S. Financial Stability Oversight Committee, the President’s Working Group on Financial Markets and the Executive Board of the International Organization of Securities Commissions. Giancarlo is also the author of CryptoDad—The Fight for the Future of Money, an account of his oversight of the world’s first regulated market for Bitcoin derivatives and the coming digital network transformation of financial services.

In this discussion we cover the current regulatory landscape in crypto, the outlook for new pieces of crypto legislation, whether the U.S. is falling behind the rest of the world, and how a Trump vs. Biden presidency will impact the industry over the next four years.

Forbes: How would you assess the current state of crypto?

Giancarlo: There’s a lot happening. This evolution is taking place and it’s not just startups and innovators, it’s also the traditional system as well with enterprises like Fnaility in the U.K. tokenizing central bank deposits, and the digital yuan in China, which is already in 260 million wallets. The Atlantic Council figures that there are 138 countries working on central bank digital currencies, whose countries account for 98% of the world’s GDP. The development of privately issued stablecoins, especially dollar-based stablecoins, is accelerating, and if there’s anything going to come out of this Congress, it very well may be stablecoin legislation. I was recently at dinner with Senator Tim Scott (R-SC and Ranking Member of the Senate Banking Committee), and he’s optimistic that a stablecoin bill may get done. So, I believe that stablecoins are continuing to develop. As it’s been announced, I just joined the Paxos board, which is an infrastructure provider for stablecoin development amongst other things. I’m very excited about that evolution. In the area of crypto, notwithstanding spectacular frauds like Sam Bankman-Fried and what seems to be kind of coordinated efforts at suppression by the Biden administration, Bitcoin continues to grow in its durability and its usage. So decentralized tokens, systems of value continue to grow. The current U.S. position of resistance and suppression is an outlier. I think it’s an outlier in global development.

I think it’s an outlier in American historical receptivity to innovation and politics because it seems to be confined not just to one party but a small minority of the Democrat party. And it’s unsustainable. I think if the November elections threaten that wing of the Democrat party, you’re going to see a complete rejection of the policy of the last few years of hostility to crypto innovation.

Forbes: There’s a belief that if Senate Banking Committee Chairman Sherrod Brown (D-OH) is replaced, I guess by Tim Scott, that could clear a pathway for more crypto-friendly legislation. What could that look like?

Giancarlo: I think Tim Scott is quite enthusiastic about the potential of this innovation. He very kindly showed me his copy of my book CryptoDad, in which he had many pages marked up and underlined, which was very flattering. But it also tells me this is someone who’s taken the time to read books like mine to understand crypto. So I think he is someone who could be a real leader in the area.

Forbes: Have you ever spoken with Trump about crypto?

Giancarlo: Earlier this month, I gave a speech at the DC Blockchain Summit, in which I said Trump could justifiably be named America’s first crypto president. And not because of what he said or did in the last two weeks, but because of what happened in the first year of his presidency. That was the launch of Bitcoin futures by the CFTC. Why do I say that? I laid this out very carefully in my speech, but the point I was making is that by the CFTC greenlighting bitcoin futures, we made sure that the world’s first digital commodity was priced in dollars. The reason that’s important is the dollar has many strengths, but one of its key strengths is that most of the world’s industrial natural commodities, oil, gold, iron, as well as soybeans, corn and wheat are priced in dollars. As a result, the world needs to hold dollars to buy those key minerals and agricultural and natural commodities. The pricing of commodities is not set in spot markets, but futures markets; the price of oil is not set at the gas pump. It’s set in the Chicago futures markets and so on. By greenlighting Bitcoin futures, we made sure that the price of bitcoin, the world’s first digital commodity, would be set in dollars. Now, did the Trump administration say, “CFTC, go do this?” No, but did they stop us? No. Did they mount the type of resistance that we’re seeing in the current administration to the development of a healthy, thriving, well-regulated market? No, and as I explained in my book CryptoDad, we kept Treasury Secretary Mnuchin apprised of everything we were doing quite carefully and gave him every opportunity to say, “Look, administration policy is not to create a healthy marketplace, is not to write the heightened scrutiny regulations or principles that you put in place.” They wanted to make sure we handled it right, but they’re quite satisfied, and I think that’s an enduring legacy.

Presidents get blamed if things go badly on their watch, probably to some degree unfairly, but they also get credit when things go right on their watch. I’m not saying the White House has taken a position, but I’m saying that I think they could arguably make the case based on that one step. Now, were there other perhaps missteps? I’ll leave that to others to argue, but I think the development of bitcoin futures, and by the way, there would be no bitcoin ETF right now if we hadn’t done bitcoin futures at the CFTC. I don’t think Trump particularly cares [about crypto]. I think he’s got his issues, and he’s laid them out carefully. You have to deal with immigration, oil, energy usage and other things. So I don’t think he’s wagering his campaign on whether he appeals to crypto or not, but I think history will look back 20 years from now and recognize that bitcoin futures really were an important step.

Forbes: I think the total stablecoin market cap is around $150 billion now. Tether makes up 80% of it. Then there’s USDC and everybody else. Paxos was a bigger player before BUSD got shut down. I know they provide the backend for PayPal and their own stablecoin, but those are small. How much room is there for additional private stablecoins and do you think that USDT at this point is so dominant that it’s going to be hard to knock them off of that perch?

Giancarlo: The global demand for dollars is extraordinary. The fact of the matter is that from the tip of South America to Africa to Southeast Asia, the demand for dollars remains very strong. I’ve said before that, sadly, in many countries, domestic currencies are not worth the paper they’re printed on. The dollar is still an enormously important hard currency. The problem with the dollar is it’s an analog instrument. It’s hard to assemble dollars in many parts of the world. And so I think global demand for a digital version of the dollar with all the utility and efficiency that would come with that will be tremendous. What we haven’t had to date is a streamlined licensing regime.

I think that passage of stablecoin legislation in the United States will enable well-run, well-compliant stablecoin operators to satisfy global demand. And I think once you’ve got well-regulated U.S. players, the opportunity to take market share from Tether will be significant. So I’m excited. I think Circle does a lot of things well, and I think that PayPal has an enormous distribution network. So I think the opportunities for U.S. companies properly licensed now, hopefully under legislation passed by Congress, will be able to satisfy global demand. I think that’s ultimately good for the United States.

Forbes: What do you think is an equilibrium for stablecoins that are yield-bearing versus non-yield-bearing? I know the current legislation is for non-bearing, but at some point, I would imagine token holders will get tired of giving the money to Tether and letting those guys become billionaires.

Giancarlo: I agree. Again, around the world, if you are in a country like, say, Argentina, with historically high inflation, the demand for a yield-bearing instrument that is dollar-based is going to be tremendous. It’s not just states like Argentina. I think there will be demand. I don’t think the domestic demand is the driving force here. It’s the overseas demand. The dollar is an export product.

Forbes: What is your sense of how or if the stablecoin legislation may pass and go into law this year?

Giancarlo: I’m not an odds maker on Congress. It’s an election year, after all, and we’ve got three or four or five weeks left effectively. Once we hit the 4th of July, nothing will happen or historically speaking, nothing happens in an election year after July 4th in terms of legislation. Unless there’s some crisis or market meltdown as there was in 2008. So, I don’t have high prospects, but I believe that in the long term stablecoin legislation will pass. I think there’s bipartisan support for it. And again, I think once we get past this, what I consider the short-term crypto suppression minority view of certain members of the Senate that dominate White House thinking, I think this will get done. I think the big driver is creating more demand for U.S. Treasury securities. Sadly, one of the big drivers is that we are a nation that lives on our credit card and we need more people to buy our debt, and that’s what stablecoins will provide.

Forbes: The first piece of crypto-specific legislation passed both chambers of Congress, even though it does seem likely that President Biden will veto SAB 121. What are your general thoughts about it and what that says about the legislative climate toward crypto right now?

Giancarlo: I think it says that the Elizabeth Warren wing is a shrinking iceberg. When the Senate majority leader Chuck Schumer signs the rebuke of 121, that’s a pretty good statement. Now, Machiavelli might say he can sign it because he knows the White House will veto it, but I think it’s a pretty good rebuke, and you have to think that the banks are supportive of that as well. Notwithstanding some parts of the banking system that may be resistant to digital asset innovation, forcing them to reserve a hundred percent against their holdings effectively means banks can’t be a player in this innovation. I think the rejection of this is there. So the White House may veto this, but I think it puts them in an increasingly untenable position against the tide of history, against the tide of innovation.

It’s a generational divide as well. I think this view of anti-crypto armies is an octogenarian point of view that the next generation up just doesn’t have to this innovation. One of my favorite authors is Doug Adams, who wrote the Hitchhiker’s Guide to the Galaxy series of books. Adams has a quote, which I’m going to mangle here, but it basically says, that “Anything that’s invented before you turn 35 is super cool, worthy of enormous amounts of time and attention, and might be the vocation for the rest of your life. But anything that comes about after you’re 35 is a dangerous suspect that needs to be suppressed.” I think you’ve got a lot of that generational animosity to crypto for people who grew up in the traditional banking system of paper checks and branch banks, and they just can’t get their head around it and see it as dangerous.

Forbes: What are your thoughts on the FIT for 21st Century Act? When we did an interview three years ago, you mentioned how the CFTC has historically not overseen retail markets. It’s much more of an institutional one. It seems like the CFTC would have that responsibility in this particular act. How might that work?

Giancarlo: My mind has evolved on this as well. Years ago, when I was at the CFTC, one of the things I thought then, and I still think that makes the CFTC both special and actually very capable, is the fact that, for the most part, it oversees wholesale and not retail markets. The reason why it’s mostly a wholesale regulator is because it oversees futures markets, which, for the most part, have professional traders in them. It doesn’t oversee spot markets where you’ve got a lot of retail traders. This act would give CFTC market supervision regulation power over spot markets for crypto and not just the derivative markets. Therefore, the CFTC would find itself, to some degree, engaging in retail marketplace supervision. My mind has evolved on this in part because the CFTC already has certain pockets of retail supervision, and it’s shown itself to be able to handle them very well. Secondly, at the end of the day, we as a nation need to regulate retail crypto markets, and somebody’s got to do the job. The CFTC, by doing bitcoin futures back in 2017, has demonstrated itself as a very capable crypto regulator. I mean, that market today is deep, it’s liquid, it’s transparent, it’s well regulated. I’d go even further to say that the one part of the Sam Bankman-Fried empire that didn’t fail was the piece under CFTC supervision. I think the CFTC has earned its wings in terms of this; I think it can step up to the job now. Congress is going to have to give it resources to do the job. You can’t say we will regulate an area, assign it to a regulator, and not give them additional resources to do it. But with the right resources, I think the CFTC is ready for this job.

Compared to the other choices, with great respect to the SEC, they have not been willing to write regulatory standards for crypto regulation. They’re saying the same rules that apply to equities apply to crypto. That’s like saying the same rules apply to railroad and airline transportation. They’re both means of transportation, but they’re very different technologies. The SEC has come up with different rules for municipal bonds, debt and equities. There’s no reason there couldn’t be a bespoke set of rules for crypto. But the SEC hasn’t been willing to write those rules.

Forbes: The Chicago Mercantile Exchange (CME) is evaluating offering spot trading for bitcoin and ether. How do you think such a highly regulated marketplace might impact spot markets and derivatives markets? Was that ever discussed when you were leading the CFTC?

Giancarlo: I don’t want to share a conversation that took place back then other than to say that the CME is a very serious player. They’re not only a commercial training platform but a self-regulated organization. They take compliance very seriously. They demonstrated the ability to build that Bitcoin futures market successfully. Of the players that I think could step into the spot market and build a very confident and successful spot market, I would certainly include them. We have several very strong market operators in the U.S. Nasdaq, Intercontinental Exchange, the owners of the New York Stock Exchange, and others like the CBOE. But I think CME would be a very suitable candidate.

Forbes: One interesting counterargument is that its rival, the CBOE, recently shuttered its spot market. What might that mean for the CME’s prospects?

Giancarlo: I would say that building a new marketplace is a little bit like catching lightning in a bottle. The truth of the matter is probably for every 10 new products launched, maybe one or two last and gain traction. The exchanges are constantly launching new products and markets, and they’re sort of like venture capital funds. Out of every 10, they’re hoping that one or two stick. It’s just about sometimes catching the right timing and getting the parameters of the product right. You hear about them when they’re launched, and then many of them are just quietly shut down three or four months later. They never gained any traction. I haven’t looked at that product from CBOE or spoken to anybody. So I don’t know why it didn’t gain traction.

Forbes: I want to ask you about Bluprynt because disclosures are important, and there’s the whole idea that the SEC is trying to put a square peg into a round hole in making teams try to file disclosure and registration documents that are anathema to crypto. What can you add?

Giancarlo: That’s going to be interesting. I want to stay within the parameters of what Professor Chris Brummer has said and not go outside of that. It’s not for me as an investor to make news on the Bluprynt model.

Forbes: Just in a general sense.

Giancarlo: The need for disclosure is going to be part of the digital asset future. And it’s not just here in the United States. We have our unique approach to disclosure, but other countries like Europe have now implemented MiCA (Markets in Crypto Asset Legislation) that requires disclosure and others will need trusted sources of disclosures. I don’t believe that the U.S. is going to lead as we did in the analog world. I think we’ve already missed the opportunity to lead in developing global standards for crypto disclosure because we’ve been unwilling to write rules for how to trade crypto publicly. I think it might well be Europe, which now has a law in place and an opportunity for disclosure that’s going to design global standards. And I think opportunities for Bluprynt are not limited to the United States.

Forbes: One of the big themes this year outside of bitcoin and bitcoin DeFi is memecoins. What are your thoughts on them?

Giancarlo: I’m not a critic like some who say that memecoin investors are foolish and that these tokens are a waste of everybody’s time and energy. I do think they fit into the current ethos we’re in. And by that ethos, I point to profligate money printing by the United States, putting for many young people the prospect of owning a home out of reach. Combine that with the wholesale promotion of gambling, not just by commercial actors like the NFL, but by states and governments through lotteries and with a little disclaimer that says, got a gambling problem called 1-800-Gambling. But other than that, gamble all you want. And somehow, though, we’re supposed to criticize young people for speculating on meme stocks as if that type of gambling is irresponsible, but betting on football games or betting on the state lottery is a type of responsible gambling? I think the meme stocks and tokens thing is a product of our times.

Forbes: Any concluding thoughts?

Giancarlo: I think the dam is about to break on the U.S. resistance to this innovation. I think it’s going to break regardless of what happens in November. And when the dam breaks or the door becomes ajar, it’s going to swing wide open. I believe this because of my global travels from London to Tokyo, Dubai, Singapore, and Paris. The world is saying, “Let’s build our crypto opportunity now and try to make it take root.” The reason is that all those very smart, savvy regulators in those countries believe the United States is going to turn around in the next 24 months, and the rush is going to be back to Brooklyn, back to Silicon Valley, back to Austin, Texas. They want to ensure that there’s something, some staying power in their jurisdictions. I think they’re right. They’ve seen the U.S. do this before. Winston Churchill famously said that the United States always does the right thing after trying all the alternatives. I think we’ve been trying the alternatives. I think they’re unsustainable, and the United States will be back in this innovation. We’ll have lost some opportunities. I mentioned one of them in terms of developing global standards for disclosure. But I think that ultimately the United States will come back and come back in a strong way.

Forbes: Thank you.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

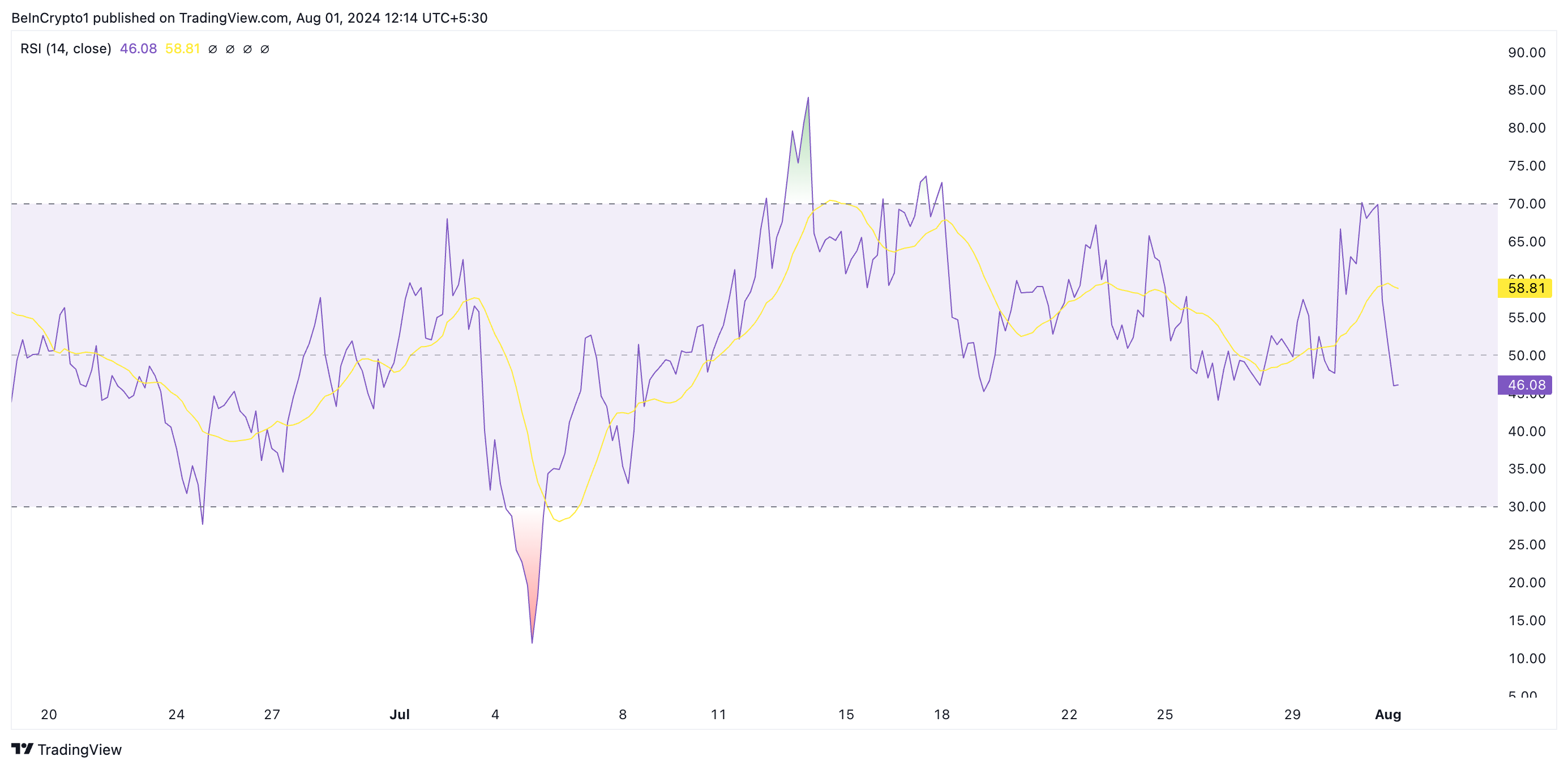

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News11 months ago

News11 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News11 months ago

News11 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi11 months ago

DeFi11 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets11 months ago

Markets11 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs