Markets

The 10+ Best Crypto Market Makers in 2024

Crypto market makers are firms, funds, or platforms that provide liquidity to exchanges. They buy and sell cryptocurrencies from individual traders, plugging gaps in the market and ensuring that prices remain as stable as possible. While they may not be very well known to retail investors, their numbers have grown in recent years, helping the cryptocurrency market mature and operate more efficiently.

This article covers the best crypto market makers operating in 2024, explaining what makes each maker unique and valuable. It also covers their key features and target markets and provides pros and cons for each.

Here’s a quick rundown of the firms we’ll feature:

- GSR Markets – Best for Cryptocurrency Miners

- Jump Trading – Best for High-Frequency Trading

- Bluesky Capital – Best for Personalisation and Customisation

- Kairon Labs – Best for EU-based Projects

- Alphatheta – Best for Token Listings

- Cumberland – Best for Big Institutions

- Acheron Trading – Best for Lower Fees

- Empirica – Best for Market Reach

- FalconX – Best for Boosting Market Depth

- Wintermute – Best for VC Funding and Incubation

The 10+ Best Crypto Market Makers in 2024

GSR Markets

Source: GSR Markets

GSR Markets has been a leading crypto market maker since its founding in 2013. The London-based firm works primarily with cryptocurrency exchanges, projects, and miners. It offers exchanges a wide range of services, including 24-hour liquidity, presence data for order books, real-time key performance indicators, trading APIs and infrastructure, post-trade analysis, regular reporting, risk management strategies, and custom services.

One advantage of GSR Markets is that it has developed its own proprietary trading platform, with which exchanges and projects can integrate in order to make their platforms more efficient. Its software can measure performance at the most basic and atomic level, enabling exchanges to gain a deeper understanding of their markets and customers. More generally, its services have a strong track record of improving market liquidity and order book depth for trading platforms while also softening big price moves and providing more efficient bid-ask spreads.

GSR currently boasts around 65 exchange integrations, yet it also works with individual cryptocurrency projects and miners. Its services for tokens and projects include introducing teams to funds and investors, over-the-counter market services, consultations on tokenomics, and market analytics that help projects understand their positions within the market. Meanwhile, it provides miners with hedging services that can help protect the value of mined and held coins, treasury management, trade services, and yield improvement strategies.

Pros

- Comprehensive and helpful services for cryptocurrency miners

- Highly efficient trading platform that works at a granular level

Cons

- Pricing can be expensive for startups and projects in their early stages

Jump Trading

Source: Jump Trading

Source: Jump Trading

Headquartered in Chicago, Jump Trading began as a quantitative trading firm focused on equities and other traditional assets. In recent years, it has branched out into crypto. This is most evident in the launch of Jump Crypto, which shows that the company brings its financial and technological expertise to virtual currency markets.

As a crypto market maker, Jump Trading provides liquidity to exchanges in both spot and derivatives markets, working in swaps, options, futures, and leveraged trading. Its services for exchanges include smart order routing, real-time market-making algorithms, and API plugins. Such services are also offered to cryptocurrency issuers and projects, helping new coins establish themselves within the cryptocurrency ecosystem and find a market. This makes it one of the most comprehensive crypto market makers operating in the industry today.

It is also a member of multiple stock exchanges internationally, including the New York Stock Exchange, the CME Group and the London Stock Exchange. In recent years it has moved away from the US cryptocurrency market in view of regulatory concerns, having severed its relationship with Robinhood in August 2023. However, it remains one of the biggest presences in crypto and arguably one of the first ports of call for any exchange or project looking for liquidity services.

Pros

- Highly effective quantitative and high-frequency trading firm

- One of the longest-running market makers in crypto

Cons

- No longer operates in the US

Bluesky Capital

Source: Bluesky Capital

Source: Bluesky Capital

Bluesky Capital is a New York-based high-frequency and quantitative trading firm that has been a fixture of markets since its launch in 2014. It has expanded into serving as a crypto market maker, working with exchanges and projects alike.

What distinguishes Bluesky from many of its peers is that it takes a very bespoke and custom approach to working with exchanges. It engages with its clients from the get-go, meeting and corresponding with exchanges to understand their particular needs and requirements and tailoring a market-making program based on their specifications. This includes pre-defining parameters and volumes for any given cryptocurrency pair while also specifying for how long they will provide 24-7 liquidity.

With cryptocurrency projects, Bluesky works along similar lines. They work with issuers and teams to decide how much volume to provide and for how long, and which exchanges to target. The firm has a strong reputation for helping new tokens gain exchange listings while also helping new coins avoid price manipulation and attract new investors.

Regardless of whether you’re an exchange or a project, Bluesky will use the same automated and sophisticated tools to support markets and coins. It offers advanced monitoring technology, responsive execution algorithms and also a robust approach to risk management, covering trading, technology, margin and counterparty risks.

Pros

- Offers highly customizable and personalized services

- Strong presence within Wall Street and the US

Cons

- Tends to prioritize American projects and teams

Kairon Labs

Source: Kairon Labs

Source: Kairon Labs

Founded in 2018, Kairon Labs is a dedicated crypto market maker that works with some of the biggest names in the sector. Its clients and partners include recognized centralized exchanges such as Binance, Bithumb, OKX, KuCoin, Gemini, UpBit, Coinbase Pro, and Kraken. It also works with a growing number of decentralized exchanges, including Uniswap, Quickswap, Spooky Swap, and PancakeSwap, making it one of the most comprehensive players in the space.

Kairon Labs’ growth has been founded on its proprietary trading software, which integrates with centralized and decentralized exchanges to seamlessly provide liquidity. Its algorithms place and fulfill orders without lag, while it also boasts an advanced reporting and monitoring system that provides in-depth analysis, helping its clients to follow changes in the market.

The firm’s services for projects include token launch support and advice, tokenomics and strategy guidance, and also exchange introductions. Its pricing structure varies according to the level of service provided, although Kairon prides itself on its competitive rates, it also aims to provide clients with a personalized service, adapting its services and trading strategies to each particular case.

Another positive aspect is that Kairon has its legal headquarters in Belgium, meaning that it operates within and according to the regulations of the European Union. This provides strong reassurance for both exchanges and projects that it will conduct itself with the utmost integrity and transparency.

Pros

- Proprietary trading algorithm provides greater efficiency and effectiveness than others

- Works with a wide range of exchanges and platforms

Cons

- High-level of regulation may limit what it can offer certain newer projects

AlphaTheta

Source: AlphaTheta

Source: AlphaTheta

AlphaTheta is a crypto market maker with a strong international presence despite having launched only in the past few years. It offers one of the strongest suites of products in the sector, catering to exchanges and projects that are looking to list or hold their initial coin offerings.

Not only does AlphaTheta offer its own in-house proprietary trading algorithms, but it also provides bots that can be deployed on numerous exchanges simultaneously and used to perform different support strategies for coins. This makes it one of the best market makers around for cryptocurrency projects. Its platform also provides around-the-clock monitoring and support, as well as the ability to customize strategies to the smallest details.

It can integrate with trading platforms within days and help exchanges contact higher-quality projects. Liquidity is provided via AlphaTheta’s trading algorithms 24 hours a day, helping exchanges maintain a more organic market that will ultimately maintain customer loyalty. It also promises bid-ask spreads that are competitive with major exchanges, helping trading platforms grow their customer bases over time.

One particularly good feature of AlphaTheta is that it specifically provides initial coin offering services. It helps to arrange the ideal timeframes and targets for a given token while also helping projects get listed on the best possible exchanges. It also helps projects quickly gain volume for their tokens, which can help with future listings and minimize arbitrage risks.

Pros

- Offers advanced trading bots that can provide more effective coin support

- Highly successful in helping projects gain coin listings

Cons

- Lacks the reach and network compared to more established market makers

Cumberland

Source: Cumberland

Source: Cumberland

A subsidiary of Chicago-based trading firm DRW, Cumberland launched in 2014 and specializes in providing spot-based liquidity to centralized and decentralized exchanges and projects looking to get off the ground. It also offers liquidity services related to derivatives, such as options, futures, and forward contracts, giving it an exhaustive and authoritative range.

On the project side, it can help new cryptocurrencies gain institutional over-the-counter liquidity against dozens of major cryptocurrencies. It doesn’t require pre-funding on the part of new projects, while it provides access to relationship managers on a 24-7 basis, helping to ensure that projects stay on top of their coins’ markets.

Cumberland has become such a fixture within the crypto space that its clients now include institutions such as Nomura and Goldman Sachs. It provides liquidity for the latter’s bitcoin derivatives service and Cboe Digital’s margin trading for BTC and ETH.

Cumberland also has recently launched Cumberland Labs, a crypto-focused venture capital fund and incubator. This makes it a more holistic service than many other market makers, helping new platforms and projects not only gain liquidity for their tokens but also acquire the funding and resources they need to grow.

Pros

- One of the best incubators and funding firms for crypto startups

- Works with some major institutions and exchanges

Cons

- Slightly expensive to work with

Acheron Trading

Source: Acheron Trading

Source: Acheron Trading

Acheron Trading launched in 2018 and has quickly grown to support over 75 centralized exchanges and 20 decentralized exchanges, working on over 400 coin listings. This makes the Singapore-based firm one of the most experienced and competent in the industry, with Acheron working not only with exchanges and issuers but also with other crypto market makers.

Its proprietary trading technology provides CEXes and DEXes with hedged liquidity, which can reduce slippage to a minimum and increase platforms’ revenues from a higher volume of smaller spreads. The tech also uses algorithms that can automatically rebalance liquidity across multiple exchanges, thereby increasing capital efficiency and reducing arbitrage.

Yet Acheron really shines in its solutions for projects, with the firm offering two main options for issuers looking to have their coins listed and supported. The first is principal market making, which does not impose a monthly fee or profit-sharing requirements on projects and involves a project supplying tokens under a loan and call-option model. The second is designated market making, which involves a project supplying tokens or cash equivalents and is available through a monthly fee and profit-share model.

Another welcome feature is that Acheron supplies its clients with an informative and intuitive dashboard. This enables customers to monitor the progress of their coins, campaigns, or markets in real-time and helps them respond to changes accordingly.

Pros

- User-friendly and highly informative dashboards and monitoring

- Lower cost than other firms with minimal fees

Cons

- Slightly less experienced than some of the other market makers in the space

Empirica

Source: Empirica

Source: Empirica

Having been building its own algorithmic trading engine since 2013, Empirica expanded into the cryptocurrency industry in 2017. Since then, it has served exchanges and Web3 projects alike. It now boasts recording hundreds of millions of USD in monthly volume while operating across 200+ markets and on more than 100 servers.

This makes Empirica one of the most effective crypto market makers around. The firm uses its own price-stabilizing algorithms at the core of its liquidity services. On the project side, it helps tokens expand their volumes organically, ensuring that coins retain a healthy market depth and narrow spreads. By doing this, Empirica can assist projects in having their tokens listed on new exchanges, with the firm advising on which trading platforms would be best for particular coins and projects.

The support Empirica offers is also of high quality, with the market maker providing full access to trading teams and advisors so that projects can discuss progress and any problems. It also reports regularly and enables clients to monitor the performance of their tokens.

As of writing, Empirica has integrated its APIs with most of the major cryptocurrency exchanges. This includes Coinbase, Binance, Kraken, KuCoin, Gate.io, Crypto.com, and Bitfinex, as well as DEXes such as Uniswap, PancakeSwap, and SushiSwap.

Pros

- Provides project access to the biggest exchanges and trading platforms

- Huge reach into a wide variety of markets

- Highly effective proprietary trading algorithms

Cons

- Selective when it comes to picking projects to work with

FalconX

Source: FalconX

Source: FalconX

As the only cryptocurrency swap dealer registered with the US Commodities and Futures Trading Commission, FalconX has one of the strongest reputations of any crypto market maker. It offers exchanges and institutions access to up to more than 400 tokens and has worked with over 600 institutions. Its total volume processed to date now exceeds $1 trillion.

One of the reasons why FalconX works with so many institutions is that it provides possibly the deepest liquidity in the market, with the firm stating that its combined spot and derivatives liquidity is 40% greater than that of Binance. Also important is that its trading algorithms maintain a high fill rate and 99.99% uptime, making its platform one of the most reliable in crypto.

FalconX provides liquidity for over-the-counter institutions and traders in addition to its exchange services. This OTC service provides highly personalized support and customized features, allowing users to access large block trading and consolidated access to multiple altcoins.

The firm’s focus is primarily on exchanges, institutions and big traders, for which it offers a nearly exhaustive range of solutions. These include options outside of market making, such as the ability to trade derivatives and exchange-traded funds. It also offers loans and leveraged trading, with up to 5x leverage.

Pros

- Extensive range of services beyond market-making

- Provides superior liquidity and market depth

Cons

- Tailored more towards institutions and bigger clients

Wintermute

Source: Wintermute

Source: Wintermute

Wintermute, founded in 2017 and based in London, is both a crypto market maker and a strategic investor. It provides liquidity to exchanges and institutions and was most recently in the news as the provider for the recently approved Bitcoin and Ethereum ETFs in Hong Kong. Besides, it also focuses heavily on providing market-making services on projects.

Wintermute describes itself as long-term-oriented and doesn’t charge integration or monthly fees. It provides liquidity for new tokens across centralized and decentralized exchanges, as well as with pools. On top of this, it furnishes detailed in-depth statistics on tokens and their performance. They also have their own DeFi team that can help with technical details, such as bridging tokens from one chain to another.

It’s entirely arguable that Wintermute is one of the top crypto market makers specifically for projects. The firm provides pretty much every kind of support and help a new token could need. It offers guidance on listing and liquidity and will work with teams on devising strategies suited to particular needs and circumstances.

As a VC investor in the cryptocurrency space, Wintermute has funded well over 100 projects and startups since 2020. These include Aave, 1inch, Clearpool, dYdX, Bitpanda, Matter Labs, Arkham, Pyth, Optimism, and Vertex. This means that ambitious projects looking for overall support may do well to seek out Wintermute’s services.

Pros

- Provides funding as well as liquidity to projects and startups

- Experienced in working with big partners

Cons

- Fees are slightly higher than other firms

How to Choose the Best Crypto Market Maker?

Choosing a good crypto market maker hinges on matching your particular needs to the particular expertise and advantages of any given firm.

Here are some things to watch out for –

- Token projects may benefit from looking for market makers that focus on supporting startups. Wintermute and Cumberland are two strong firms in this respect.

- Exchanges and institutions may prefer to seek out crypto market makers with proven track records of processing larger trading volumes and working with bigger clients. FalconX and GSR Markets are two excellent firms in this respect.

- Check for market makers that have registered and obtained licenses in recognized jurisdictions. This offers some guarantee of reliability and integrity.

- Look for market makers that have worked and partnered with recognized names. Again, this indicates that a market maker has experience and expertise.

FAQs

-

What are the risks associated with using crypto market makers?

The most notable risk market makers face relates to the inherent volatility of cryptocurrency prices. Market makers generally hold significant quantities of tokens that can fluctuate quite wildly in price. The best market-making firms adopt various hedging strategies to mitigate such dangers, yet projects should be aware that even the best firms can’t always avoid or effectively control sudden drops.Other risks include cybersecurity- and tech-related dangers, counterparty risks, and also compliance and regulatory requirements, although the most experienced market makers will take adequate steps to reduce their exposure to such threats.

-

How much do crypto market makers typically charge?

Different market makers have different business models, with some generating their revenues in different ways. When it comes to market makers for exchanges, they will usually profit from the spread they charge, meaning the difference between the prices at which they buy and sell cryptos.Market makers for projects and tokens profit from their spread and trading and may charge their clients a direct fee. This fee varies from one firm to another and from one project to another, with larger projects often receiving a more efficient rate. Most market makers also require their clients to provide the starting capital to begin trading for them.

-

Are there any regulations governing crypto market makers?

While crypto market makers have to comply with fewer regulations than their more traditional counterparts, they still have to meet certain rules. Depending on where they’re based, they will have to register as a money transmitter or gain a money transmitting license. They will also have to abide by applicable anti-money laundering and know-your-customer regulations, something which requires them to fully identify the projects and partners they work with.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

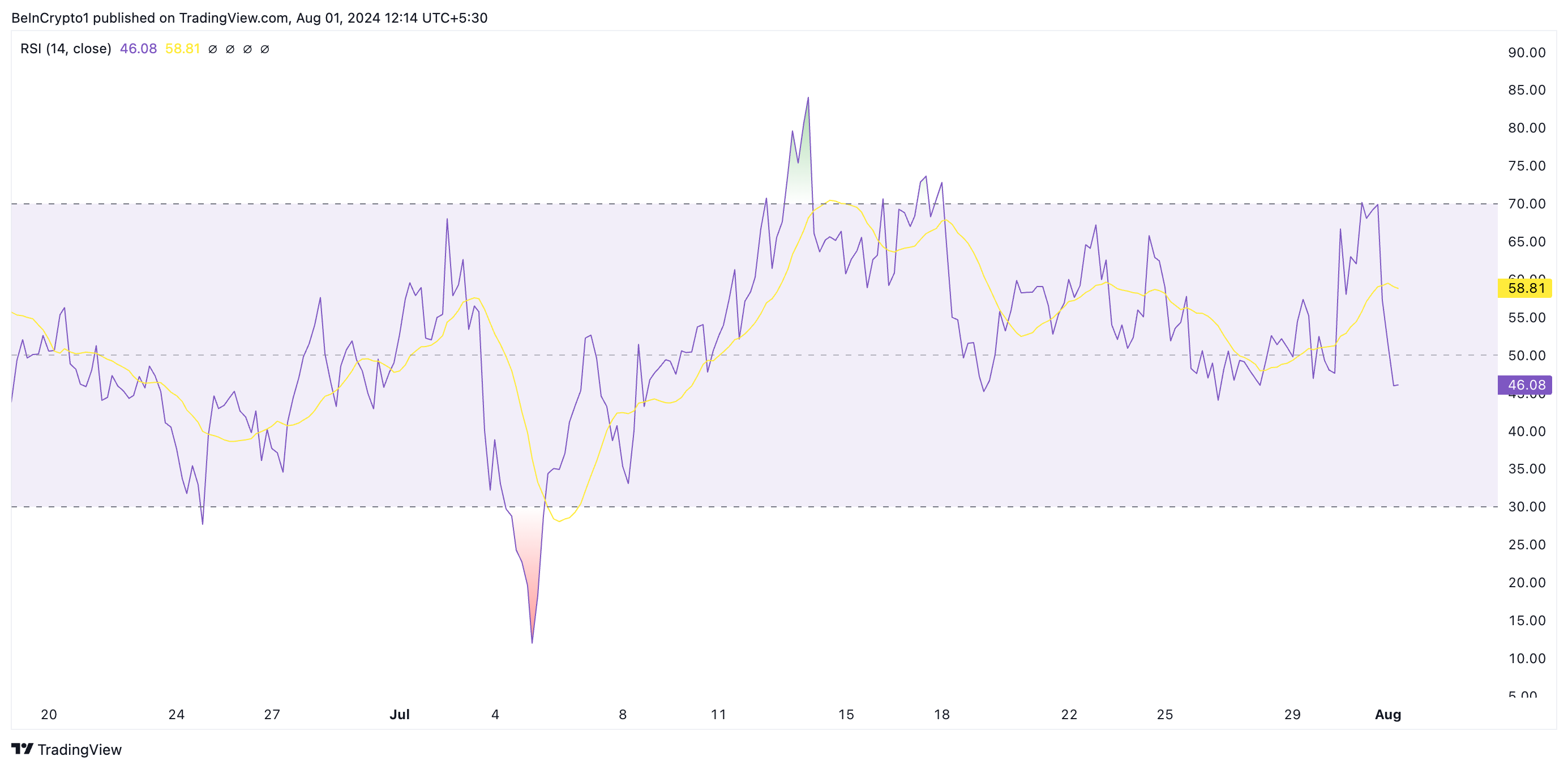

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News11 months ago

News11 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News11 months ago

News11 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi11 months ago

DeFi11 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets11 months ago

Markets11 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs