Markets

Meet the 26-Year-Old Founder Building The World’s Largest Crypto Prediction Market

Shayne Coplan, founder and CEO of Polymarket

Polymarket

Will Taylor Swift get engaged in 2024? Will JD Vance be replaced as veep nominee? Despite its questionable legality, hundreds of millions in crypto are being wagered on events like these on Polymarket.

By Nina Bambysheva, Forbes Staff

What are the chances that Vice President Kamala Harris will defeat former President Trump in November? On a blockchain-based website called Polymarket, Harris’s chances, according to the thousands betting, are put at 39%, while Trump’s are at 59%, with Michelle Obama and RFK Jr. at 1%. Will JD Vance be replaced as Trump’s VP nominee? A $100 bet will return $1,000 if Vance bows out.

Welcome to the future of betting markets, where nearly anything can be wagered on, from bitcoin’s peak price in 2024 to the speed at which Trump and Biden climb stairs, to the sex of Hailey and Justin Bieber’s new baby. On Polymarket, some $446 million is currently being wagered on the outcome of the presidential election in November. Never mind that in the United States betting on the outcome of elections is prohibited, according to the Commodities and Futures Trading Commission, which deems it against the public interest. Polymarket, whose headquarters is in New York City, is a prediction market phenom, thanks largely to the world’s current obsession with American politics.

Launched in 2020, Polymarket has already surpassed $650 million in trading volume this year, with nearly $300 million in July alone, according to data from Dune Analytics. The platform is expected to process $1 billion in wagered predictions before the year is over. Campaign managers and political analysts now turn to this unconventional oracle, seeking clues in the fluctuating market prices. Even former President Donald Trump has touted his Polymarket odds on his social media app, TruthSocial.

Though blockchain technology isn’t necessary for this type of application, Polychain uses a network called Polygon, which operates 24/7 and sits atop Ethereum, where transactions cost fractions of the chain’s normal fees. However, instead of US dollars, customers who want to make trades on Polymarket use the dollar-based stablecoin USDC. But even that is changing. Last Wednesday, Polymarket announced it is enabling users to pay for their bets using bank transfers and credit cards through a partnership with Miami-based MoonPay.

The prediction marketplace’s soaring popularity has convinced top-tier investors, including Peter Thiel’s Founders Fund and Ethereum cofounder Vitalik Buterin, to back the startup with funding totaling $74 million. Currently, markets tied to U.S. elections, of which there are more than 100, are driving most of trading volume on Polymarket. These are supposedly off-limits to U.S. residents, though 25% of his website’s traffic comes from the U.S., according to web analytics platform Similarweb. Polymarket’s 26-year old founder, Shayne Coplan, won’t say much about his teams efforts to prevent U.S.-based users from betting on elections. He prefers to emphasize his new platform’s strengths.

“Polymarket effectively takes what otherwise would be an Internet yelling match and turns that into a market where you know the person who’s right wins. We want our forecast to become ubiquitous and mainstream,” says Coplan from Polymarket’s posh penthouse office in New York City’s Soho.

Raised in Manhattan by his NYU film professor mother, Coplan says he was an Internet nerd. At 14, he was experimenting with building a cryptocurrency mining rig, and in 2014 he participated in the Ethereum presale (when the price of ether was roughly 30 cents). Coplan studied computer science at NYU but dropped out during his second semester in 2017. “I was living an isolated life reading obsessively and trying new things,” he says about his next three years.

As the world plunged into uncertainty during the pandemic lockdown in 2020, Coplan began exploring Polymarket’s predecessors like Ethereum-based prediction markets Augur, which ICO’ed in 2017 but never really gained traction. Eventually, he began developing his own prediction platform. “I wanted to know the likelihood of New York City’s opening back up, if the vaccine was going to be ready by then, if restaurants would open again,” recalls Coplan. “It was so difficult to find a signal in the noise and that is exactly what information markets or prediction markets are best at.” Polymarket’s first event market was a small wager about when New York City would reopen.

Coplan’s seed funding of $4 million came a few months later, in October 2020, and was led by another crypto wunderkind, Olaf-Carlson Wee, founder of crypto hedge fund Polychain Capital. “We’ve been fascinated with information markets for some time, but many solutions in the space have been plagued with UX [user experience] and liquidity problems,” said Carlson-Wee at the time. “Shayne and his team understand this deeply and have incorporated these learnings into their inventive, user-centric product approach.” Carlson-Wee declined to comment for this article.

Prediction markets operate on a fairly simple all-or-nothing premise: if your prediction is correct, you profit. If not, you lose funds. In these markets, the price of a “share” reflects the odds of an event occurring, ranging from $0.00 to $1.00. Currently, on Polymarket, a share for Donald Trump winning the presidential election costs 59 cents, meaning the market assigns him a 59% probability of winning. And if he prevails in November, that bet returns $1.00.

“Prediction markets are a powerful force to counter misinformation,”says Marc Bhargava, managing director at General Catalyst who personally invested in Polymarket’s seed round, in a statement to Forbes. “They are fueled by people putting their money where their mouth is to back the most accurate sentiments.”

Because Polymarket is built on a distributed ledger, it claims to offer greater efficiency and transparency than its centralized counterparts such as Kalshi and PredictIt, which are based in New York City and Wellington, New Zealand respectively. The application relies on what is called a decentralized oracle called UMA, or “Universal Market Access,” a blockchain-based system that settles disputes through token-based voting. Once an event is resolved, smart contracts automatically distribute payouts to the winning shareholders.

The blockchain powered app isn’t flawless. In June, Polymarket bettors staked over $1 million on whether Donald Trump’s 18-year-old son, Barron Trump, was involved in the launch of a memecoin DJT (the former president’s initials), which has a self-reported market capitalization of roughly $80 million. Initially, odds favored his involvement at 60%, but they quickly dropped as sufficient evidence failed to materialize. UMA’s voters ultimately settled the market in favor of those who wagered that Barron was not involved. Despite this outcome, Polymarket interceded, raised questions about the vote, and eventually overruled UMA saying that Barron Trump was involved in the DJT token “in some way.” The website wound up refunding holders of the “yes” side of the contract, who had lost money.

“Some people dismiss prediction markets because of events like this,” said Polymarket’s investor Nick Tomaino, founder and general partner of crypto-focused investment firm 1Confirmation, on the Unchained podcast. “I think this is foolish because this stuff is still being ironed out.”

P olymarket’s surge in election related volume isn’t just due to good timing. According to Art Malkov, Polymarket’s first CMO and cofounder of influencer marketing platform Lever.io, the company has invested significant amounts in influencer marketing, including promotions with Reddit channel WallStreetBets, which has helped Polymarket gain traction among retail investors.

Coplan’s leads team of some 30 people worldwide curate users’ suggestions and scour the internet for trending topics that can be turned into betting markets. There are more than 300 markets on Polymarket today, falling under seven categories: Politics, Olympics, Crypto, Pop Culture, Sports, Business and Science. All employees are required to read Austrian economist Friedrich Hayek’s “The Use of Knowledge in Society” as well as works of George Mason University economics professor Robin Hanson, best known for creating the concept of futarchy, a form of governance in which decisions are made based on betting markets.

Polymarket doesn’t charge fees, and Coplan remains elusive about how the platform will generate revenues, but hints that fees are coming. “We’re focused on growing the marketplace right now and providing the best user experience,” he says. “We’ll focus on monetization later.”

Despite the lack of revenues, and some nagging questions concerning the source of Polymarket’s trading volume, young Coplan is the darling of Silicon Valley. He is “dynamic, brilliant,” gushed billionaire venture capitalist Tim Draper in a written comment to Forbes. “Using the word ‘tenacious’ to describe entrepreneurs feels overdone, but for Shayne, it is 100% true,” adds Tom Schmidt, general partner at crypto-focused venture firm Dragonfly. “It takes true grit, passion, and vision to spend as many years as Shayne has building Polymarket… but these qualities are what it takes to build a once-in-a-generation company.” Ethereum’s cofounder Vitalik Buterin, has personally invested and promoted Polymarket in public appearances and on X.

“Shayne is a young man in a hurry, but in a hurry to do things properly,” says Chris Giancarlo, former CFTC chairman and chair of Polymarket’s advisory board, which earlier this month added election-forecasting guru Nate Silver. “There’s a generational aspect to Polymarket’s success story,” he adds. “An older generation of Americans that didn’t grow up with the type of events markets that you see in Europe, I think, perhaps don’t quite understand the value proposition but young people are not going to refrain from these marketplaces because the elders tell them to do so.”

Prediction markets can be traced back to the 16th century, when Europeans would sometimes bet on the papal successor. In the late 19th century, prediction marketplaces thrived as “bucket shops,” where bets on stock prices were placed. Over time, these markets evolved into more sophisticated platforms, especially with the rise of the Internet. The University of Iowa’s Tippie College of Business began experimenting with so-called political stock markets via its Iowa Electronic Markets in the late 1990s. The platform allows users to make small wagers on political outcomes, economic indicators, and cultural events in the name of research.

The United States government has always been wary of gambling, and as a result, prediction markets have faced legal challenges. Because they resemble futures contracts, these markets fall under the oversight of the Commodity Futures Trading Commission (CFTC).

In January 2022, the CFTC ordered Polymarket to pay a civil penalty of $1.4 million for operating in the U.S. without a registration. As part of a settlement, the company promised to wind down services in the U.S. while continuing to operate abroad.

Users in the United States aren’t technically permitted to place bets on the website, but 25% of Polymarket’s website visitors are based in the U.S. The next four most represented countries: Canada 6.3%, Netherlands 6%, Vietnam 5.9%, Mexico: 5%, according to data from Similarweb. Before the CFTC settlement, U.S. traffic share ranged between 34% and 54%. Coplan would not comment on Polymarket’s geoblocking efforts, though one former employee who spoke with Forbes on the condition of anonymity says the company “does everything it possibly can to fend off users who aren’t supposed to trade on the platform.” Still, workarounds including the use of virtual private networks, which mask a user’s location, may account for some of the U.S. activity on Polymarket.

Competitor PredictIt has been operating in the U.S. since 2014 as part of a collaboration with Victoria University of Wellington in New Zealand under a no-action letter from the CFTC, allowing it to function as a “data-gathering tool for academic researchers.” PredictIt also allows U.S. election bets—it currently places Trump’s odds at 52% and Kamala Harris’s at 49%. It charges a 10% fee on profit and limits investment in any individual contract to a maximum of $850 at any one time so volumes are much lower than Polymarket’s: $31 million is wagered on the outcome of the elections compared to $446 million in bets on Polymarket. In August 2022, the CFTC withdrew its no-action letter and ordered PredictIt to cease operations; the company is still operating while challenging the decision in court. Its clearing firm, Aristotle, is also pursuing a registration for a fully regulated venue. “We’ve operated legally in the United States for 10 years, under no-action relief and expect to operate another 10 years or more,” says John Aristotle Phillips, PredictIt’s founder and CEO.

Another competitor, CFTC-regulated Kalshi, can’t offer election bets but offers wagers on government-related events, such as the Federal Reserve’s interest rate decisions. The platform charges small fees for orders based on the maximum potential earnings from the contract and the implied probability of making those earnings. “Kalshi is focused on continuing to build a legal and regulated prediction market in the U.S,” said CEO Tarek Mansour in a comment to Forbes.

More restrictions may be on the way. In May, the CFTC proposed a ban on contracts related to political contests, awards ceremonies, or sports events, deeming them “contrary to the public interest.” In response to Forbes’ request for comment, the agency referred to its settlement with Polymarket and stated that the comment period for the rule proposal ends on August 8.

However, on June 28, the Supreme Court ruled against a federal agency regulation concerning fishing boats in the case of Loper Bright Enterprises v. Raimondo, effectively overturning so-called “Chevron deference”, which allowed federal agencies to enforce regulations based on their own interpretations of laws that were sometimes ambiguous. As a result, agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) will now face challenges to their authority . This could offer a big boost to prediction markets under pressure from the CFTC like Polymarket.

“I think the trend, longer term, will be toward acceptance of events markets,” says Giancarlo.

One big question over hanging Polymarket’s future is how it will be able to maintain its trading volume and momentum post-November 2024. Coplan and his boosters seem unconcerned. “It’s true that volumes are often driven by events like elections, but there are always major events going on and arguably more so in an increasingly volatile world. The other driver of sustained growth is a growing cohort of people eager to make predictions and see what others truly believe; this is a challenge with traditional social media and even more so with genAI given the lack of consequence for creating mass amounts of inaccurate content,” writes General Catalyst’s Bhargava.

Given the low barriers to entry in crypto, competition will be another big challenge for Polymarket. Memecoins like DJT already serve as prediction market proxies. The sector has also attracted broker-dealers like billionaire Thomas Peterffy’s Interactive Brokers, which recently announced the launch of ForecastEx, a prediction market offering contracts based on significant economic data releases like the US Fed Funds Target Rate and the US Consumer Price Index. In April, trading firm Susquehanna International, owned by billionaire Jeff Yass, set up a dedicated team to make markets on Polymarket’s competitor Kalshi.

Dragonfly’s Schmidt likes Coplan’s chances in the race to build a lasting prediction marketplace, despite competition from traditional finance. “Ultimately, Polymarket’s ability to allow an ecosystem of creators to create new markets is its secret weapon, one that TradFi competitors can’t easily replicate,” he says. “Think YouTube, not TV.”

MORE FROM FORBES

ForbesChinese Investors Helped Save A Strategic U.S. Mine-And Made This American RichBy Christopher HelmanForbesHow To Make Money Betting Against Nature’s WrathBy Brandon KochkodinForbesHow To Be Successful On Wall Street Without Beating The MarketBy William BaldwinForbesWhy ‘The Blair Witch Project’ Made A Killing For The Studio-But Not Its StarsBy Lisette Voytko-BestForbesMeet The Billionaire Investor Who Refuses To Put Money Into AI Or CryptoBy John Hyatt

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

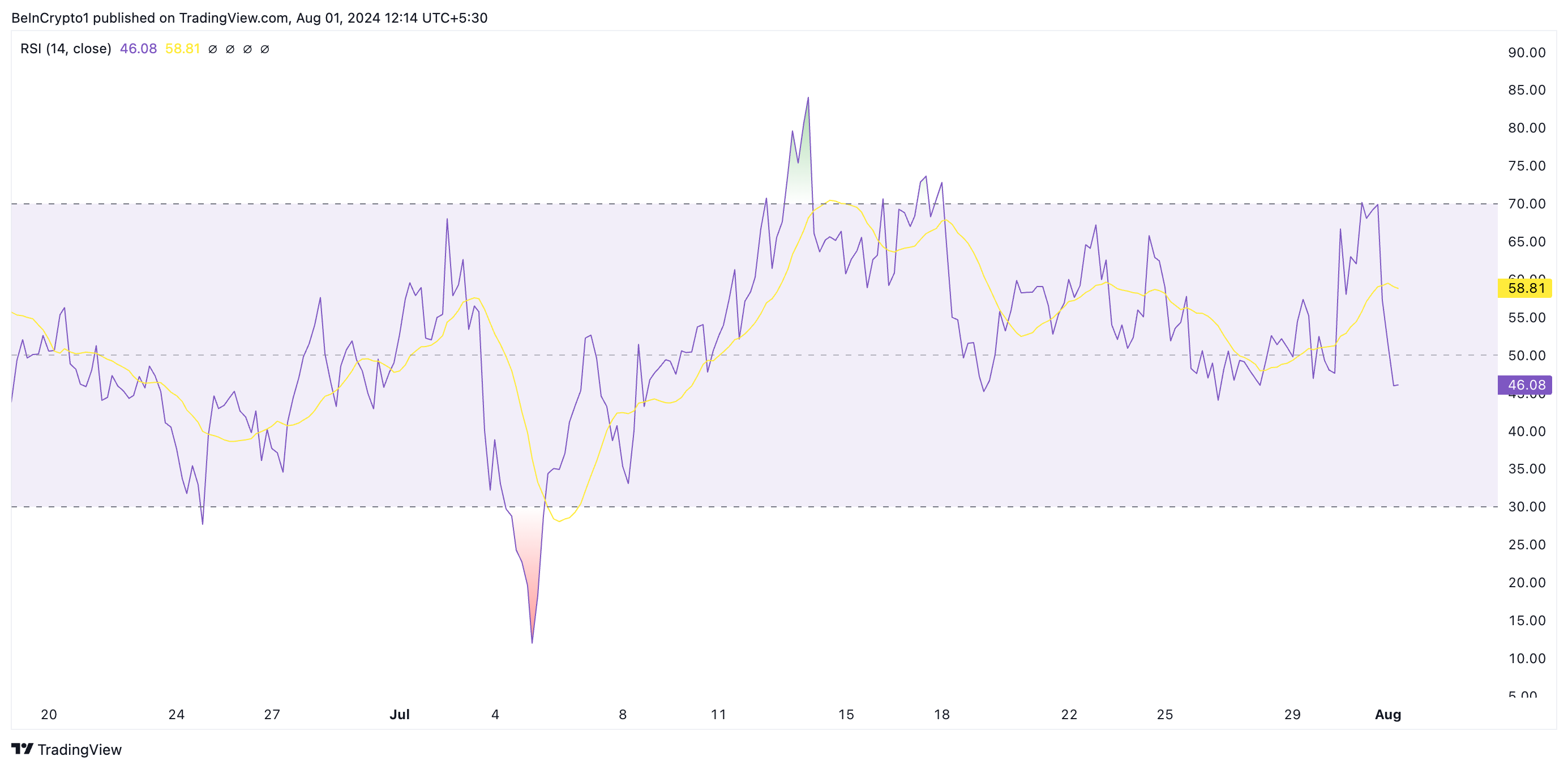

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News11 months ago

News11 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News11 months ago

News11 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi11 months ago

DeFi11 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets11 months ago

Markets11 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoa resilient industry that defies market turbulence

-

DeFi1 year ago

DeFi1 year ago👀SEC Receives Updated Spot Ether ETF Filings

-

DeFi1 year ago

DeFi1 year ago🚀 S&P says tokenization is the future

-

DeFi1 year ago

DeFi1 year ago⏱️ The SEC is not rushing the commercialization of Spot Ether ETFs