Markets

Predicting the Next President and Making Money with Decentralized Markets

What are they saying about decentralized prediction markets for the 2024 election? Find out how you can predict the next president and profit from your insights.

Have you ever wondered if you could predict the outcome of an event and profit from your foresight? Decentralized prediction markets are making this possibility a reality. These markets have seen explosive growth recently, especially as the 2024 US presidential election approaches.

Polymarket, a leading cryptocurrency prediction platform, has seen a dramatic surge in activity. According to Dune AnalysisPolymarket’s volume surpassed $100 million in June alone, marking a record-breaking month in the platform’s successful year.

The surge continued into July, with $9.3 million worth of bets placed on the first day alone. This daily volume surpassed the typical monthly volumes seen on Polymarket last year, which ranged between $3 million and $8 million.

From January to May 2024, monthly volumes on Polymarket fluctuated between $40 million and $60 million, marking a gigantic increase of 7 to 12 times compared to the monthly volumes of the previous year. In June, $111 million in bets were placed, the highest ever for the platform.

Polymarket Monthly Volume | Source: Dune Analytics

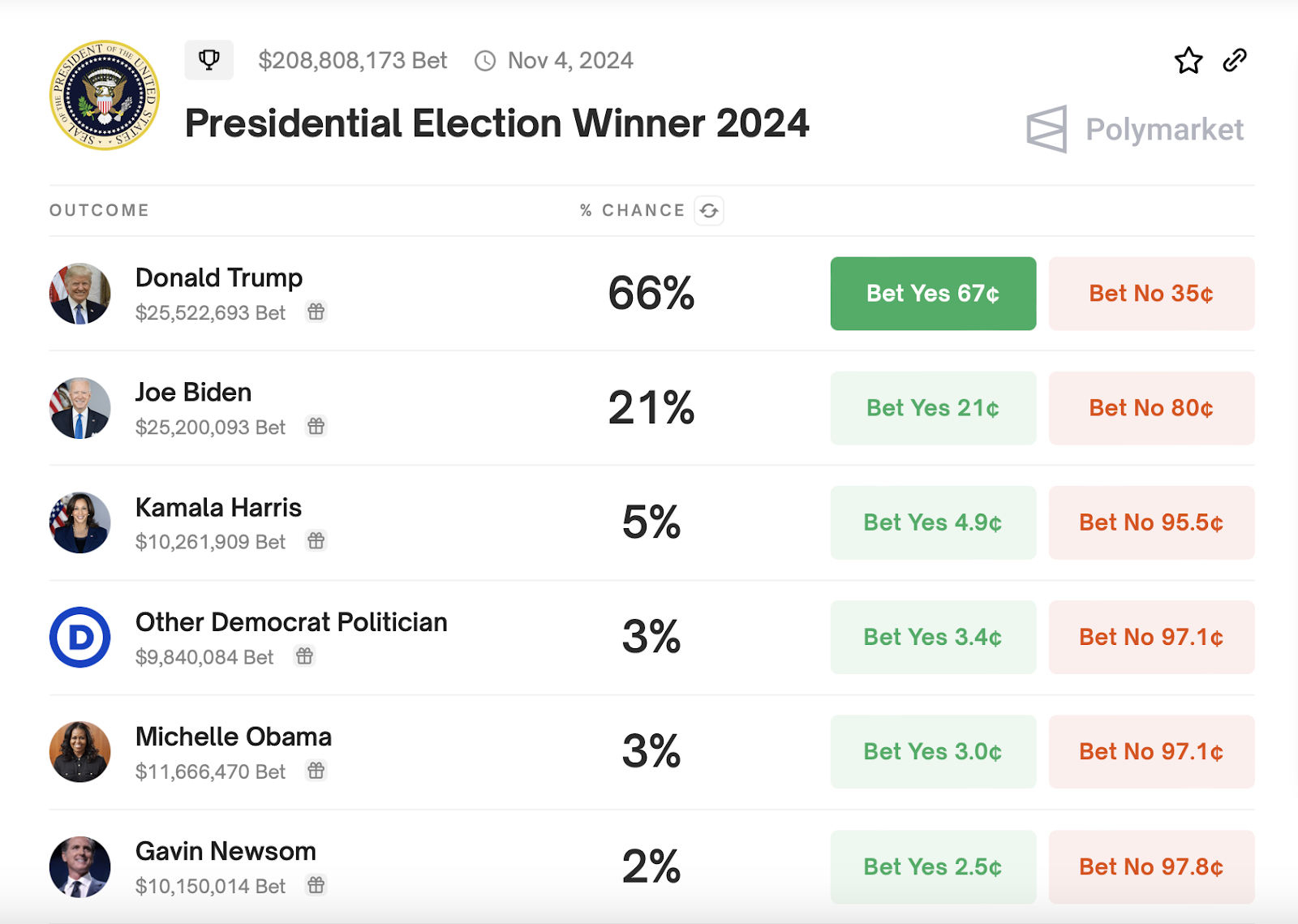

One of the most popular contests on Polymarket is the “Winner of the 2024 presidential election,” which has attracted more than $208 million in bets since its inception. The odds currently favor Donald Trump at 66% and Joe Biden at 21%.

Source: Polymarket

Source: Polymarket

Analysts at the research and brokerage firm Bernstein Note that blockchain-based platforms like Polymarket are amplifying the efficiency of election markets by providing transparency and liquidity. They mentioned this in a recent note to clients, noting how Polymarket, which is based on blockchain technology, is increasing public appreciation for the role of cryptocurrencies in politics.

With growing interest in these platforms, we delve deeper into how they work, explore the most important bets, identify the leading platforms, and find out how you can participate and potentially profit without placing bets.

What are decentralized prediction markets and how do they work?

Decentralized prediction markets are betting platforms that allow people to bet on the outcomes of real-world events using blockchain technology.

These markets operate on decentralized networks, meaning there is no central authority controlling transactions. Instead, they use smart contracts—self-executing contracts with the terms of the agreement written directly into the code. This ensures that all transactions are transparent, secure, and tamper-proof.

One of the most popular decentralized prediction markets is Polymarket. Polymarket runs on Ethereum (ETH) Level 2 (L2) network, Polygon (MATIC), and allows users to speculate on various events, such as political outcomes, entertainment and sports, using the stablecoin USDCThis integration ensures liquidity and stability in transactions.

Polymarket uses an automated market maker (AMM) Uniswap-like pool model (UNI). Liquidity providers provide on-chain market liquidity and users trade these tokenized shares to place their bets.

For example, if you believe a specific candidate will win an election, you can buy “Yes” stock at a price that reflects the current market odds. If the event happens as expected, you make money. If it doesn’t, you suffer losses. This system allows you to profit from your knowledge and predictions about various events.

Polymarket is not the only player in the decentralized prediction market. Platforms like Augur and Hedgehog also offer similar services, allowing users to speculate on a variety of events.

Augur, for example, operates on the Ethereum blockchain and uses a native token (REP) for betting. Hedgehog is another emerging platform, which uses the same principles of decentralized betting with a focus on user-friendly interfaces and diversified market offerings.

Popular bets on polymarket

The buzz surrounding the 2024 US presidential election has generated a flurry of activity on Polymarket. We look at some of the most popular bets out there and what they reveal about public sentiment.

Biden’s mediocre performance in the debate

The first presidential debate on June 27, 2024 marked a critical shift in betting patterns on Polymarket. Joe Biden’s performance, widely criticized as one of the weakest since the era of televised debates began, triggered a surge in betting.

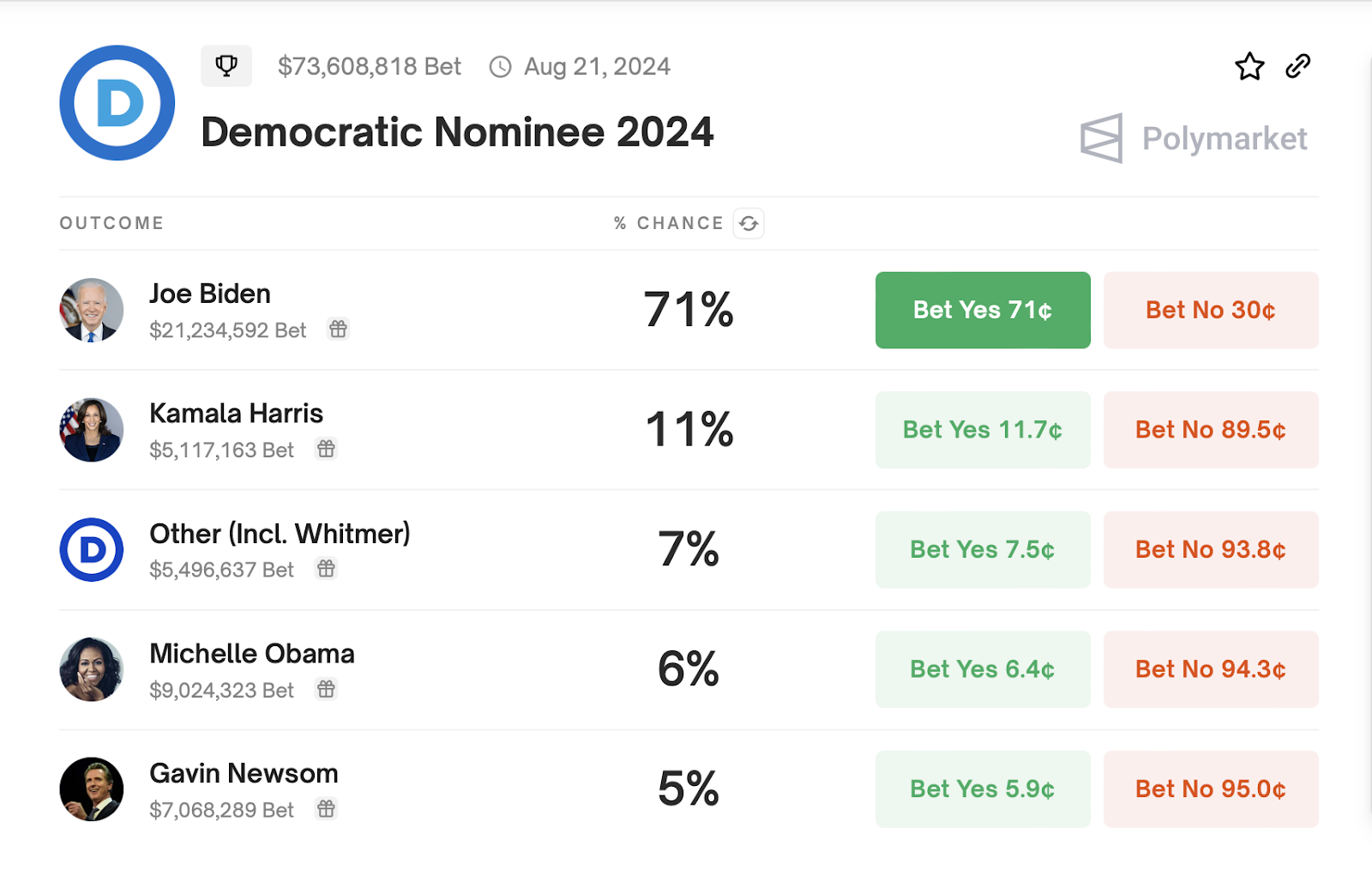

Before the debate, Biden had a 91% chance of being the Democratic nominee. However, after his performance, this fallen at 71%, with over $21.2 million bet on Biden and $5.06 million on Kamala Harris, who has so far obtained 11% of the vote.

Source: Polymarket

Source: Polymarket

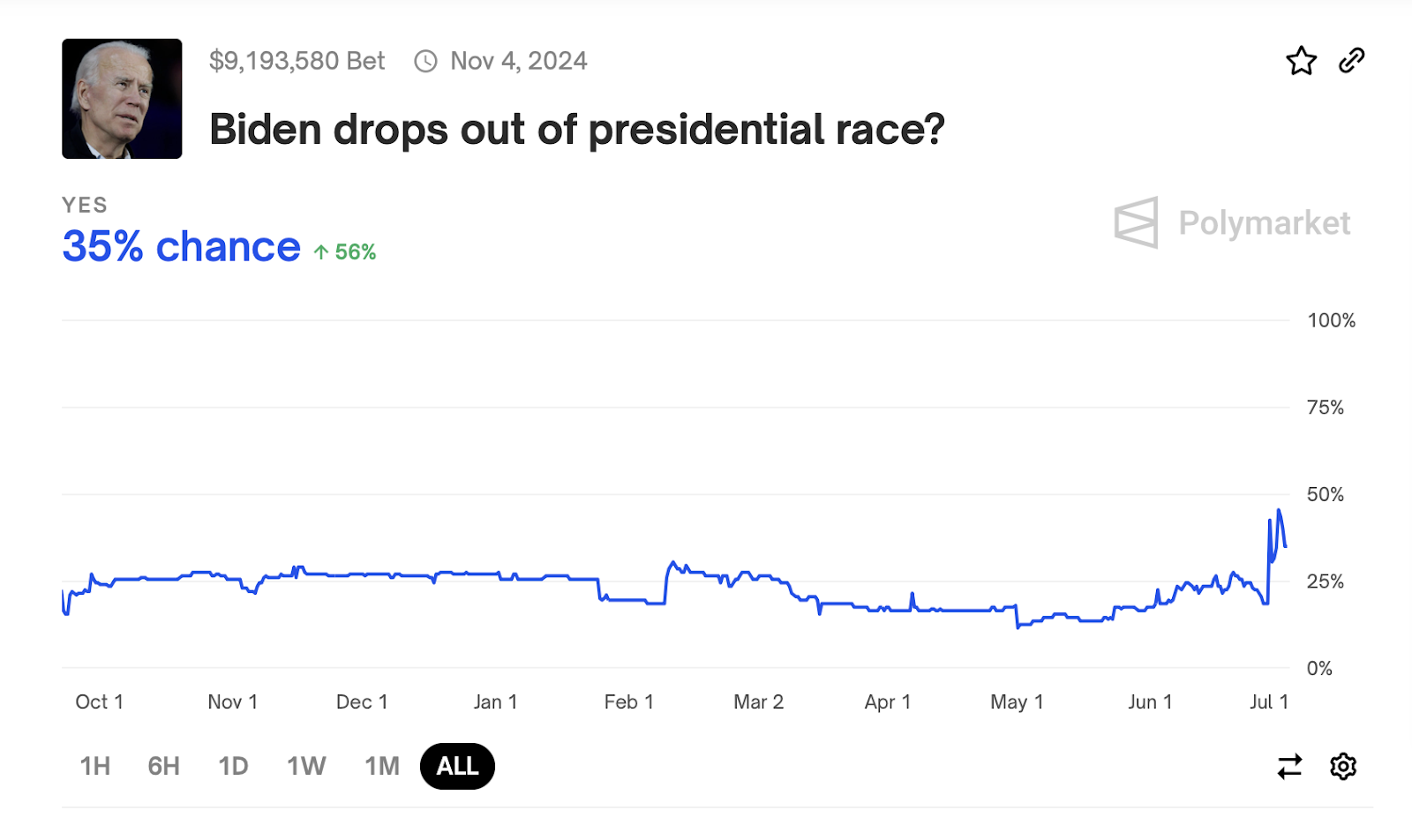

At the same time, the likelihood that Biden would drop out of the race increased significantly from 19% before the debate to 44% by July 1. While that’s slightly improved At 35%, the volatility reflects the uncertainty surrounding his campaign.

Source: Polymarket

Source: Polymarket

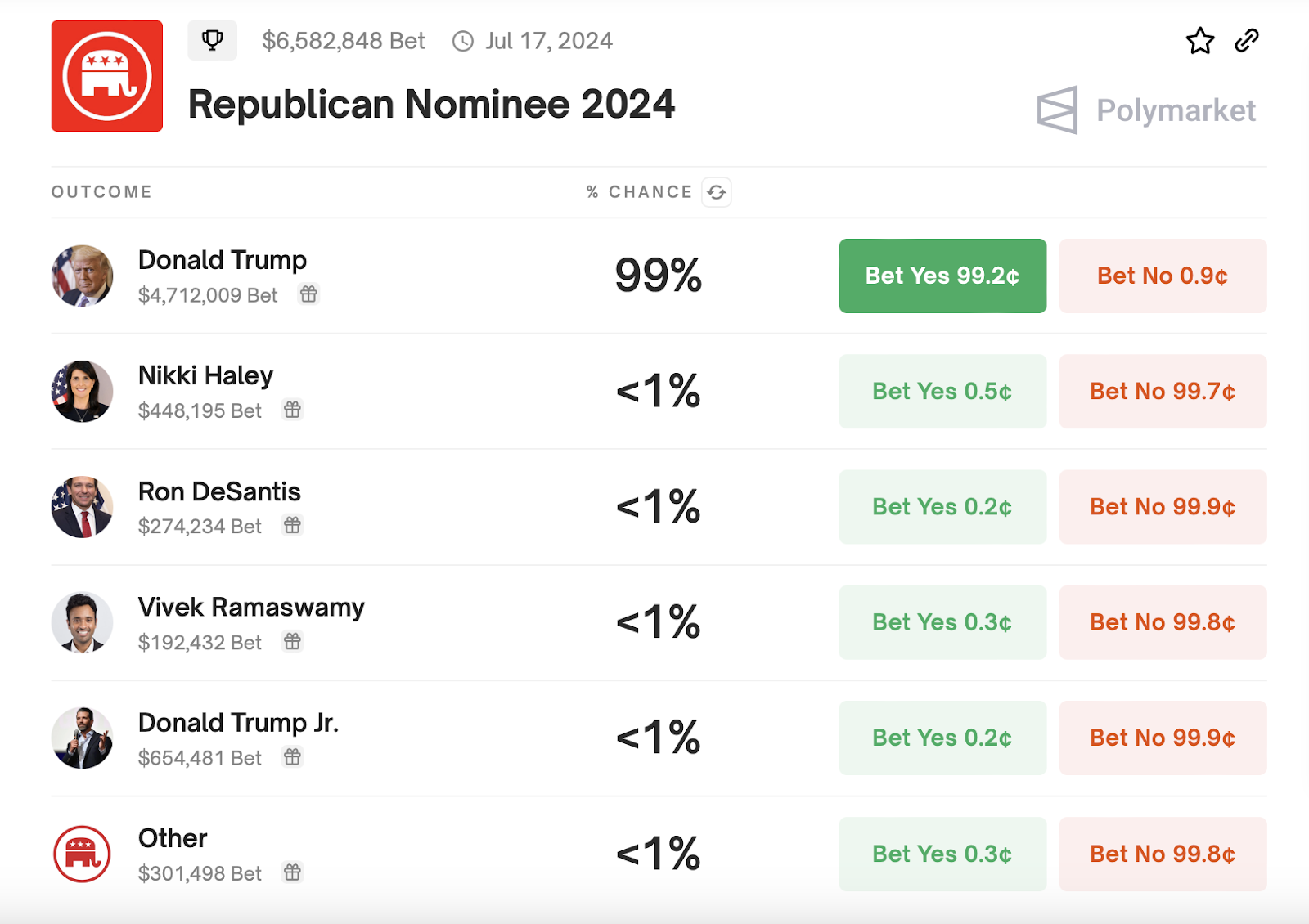

On the Republican side, betting sentiment is overwhelming favor Trump. With more than $6.6 million in bets, Trump is projected to have a 99% chance of becoming the Republican nominee, a stark contrast to the fluctuating confidence in Biden’s campaign.

Source: Polymarket

Source: Polymarket

Swing States Forecast

Swing states are crucial in determining the outcome of the election and Polymarket’s predictive polls point to a Republican victory in key states.

For example, the Republicans are expected to win Nevada (71%), Michigan (53%), Pennsylvania (58%), Arizona (73%), Wisconsin (56%), Georgia (80%) and North Carolina (83%).

With over $3 million in total bets supporting these predictions, the Republican Party emerged as the clear winner in all of these swing states.

There is also a noteworthy prediction regarding international affairs: there is a 56% chance that Israel will invade Lebanon before September, adding fuel to the fire of the already complex geopolitical situation around the world.

How to make money with decentralized betting markets?

Decentralized prediction markets offer opportunities to make money, but they also come with very high risks. Here’s how you can profit from these platforms, along with some important tips.

Becoming a Liquidity Provider

One of the easiest ways to make money on platforms like Polymarket is to become a liquidity provider. Here’s how it works:

- Deposit USDC: You can deposit USDC into the platform’s liquidity pool.

- Earn commissions: By providing liquidity, you earn a share of the trading fees every time users place bets.

- Automated Market Maker (AMM):The platform uses an AMM model, ensuring that your funds are used to facilitate trading and betting efficiently.

This method ensures a steady stream of income without having to bet directly on events, making it a less risky option than direct betting.

Making direct bets

Another way to make money is to place direct bets based on the odds of specific events. For example:

- Choose an event: Select an event you want to bet on, such as the outcome of the presidential election.

- Analyze the probabilities: Consider the current odds and make your prediction.

- Place your bet: Bet an amount you are comfortable with, knowing that if your prediction is correct, you can get a significant return.

In addition to Polymarket, several other platforms offer decentralized prediction markets. These platforms work in a similar way, allowing you to provide liquidity or place direct bets on various events.

While these opportunities can be lucrative, they come with very high risks. If the odds are not in your favor, you could suffer substantial losses.

It is essential to trade with caution and never invest more than you can afford to lose. Always do thorough research and consider seeking advice from financial experts before taking the plunge.

Disclosure: This article does not constitute investment advice. The content and materials on this page are for educational purposes only.

Markets

Bitcoin, Ethereum See Red as Markets Crash on Volatility

Bitcoin AND Etherealalong with the rest of the top 10 cryptocurrencies by market cap, appear to be in hibernation on Thursday morning.

At the time of writing, the Bitcoin Price is still below $65,000 and 2.2% lower than it was this time yesterday, according to CoinGecko data. Things are worse for the Ethereum Pricewhich is 3.7% lower than 24 hours ago at $3,185.22. The drop in ETH’s price is identical to that of Lido Staked Ethereum (stETH), a liquid staking token for Ethereum.

In recent days, falling prices have led to the liquidation of derivative contracts worth $225 million, according to Coin glassAnd about half of that, about $100 million, was liquidated in the last 12 hours.

When a trader is liquidated, it means that their position in the market has been forcibly closed by an exchange or brokerage due to a margin call or insufficient collateral. Margin is especially important when it comes to leveraged positions, which allow traders to control a multiple of their deposit, such as opening a $10,000 position with only $1,000 in their account.

Now that Bitcoin has been in the red for three days in a row, there is a chance that the world’s oldest and largest cryptocurrency could sink even further, BRN analyst Valentin Fournier said in a note shared with Decrypt.

“Bitcoin has closed in the red for three days in a row, with one-way trading showing limited resistance from bulls. Ethereum had a slightly positive Monday with strong resistance from bears who have won the last two days,” he wrote. “This momentum could take BTC to the $62,500 resistance or even the $58,000 territories.”

Looking ahead, Fournier said BRN’s strategy will be to “reduce exposure to Bitcoin and Ethereum and find a better entry point after the dip.”

This is despite Federal Reserve Chairman Jerome Powell’s comments yesterday on interest rates being widely regarded as accommodating and indicative of FOMC rate cuts in September.

Singapore-based cryptocurrency trading firm QCP Capital said the rally in stocks, which sent the S&P 500 up 1.6% from Wednesday’s close, was not felt in cryptocurrency markets.

“Cryptocurrencies have seen a broad sell-off overnight and into this morning,” the firm wrote in a trading note. “The market remains poised as traders pay close attention to daily ETH ETF outflows and further supply pressure from Mt Gox and the US government.”

Meanwhile, the other top-ranking coins are showing mixed performance.

Solana (SOL) is down 7.2% since yesterday to $169.13. Things are even worse for its most popular meme coins. In the past 24 hours, the most popular meme coins Dogwifhat (WIF) are down 12% and BONK (BONK) is down 9%, according to CoinGecko data.

Their dog-themed competitor, Ethereum OG Dogecoin (DOGE), the only meme coin in Coingecko’s top 10, is down nearly 4% since yesterday and is currently trading at $0.1205.

XRP (XRP) dropped to $0.608, which is 7% lower than it was at this time yesterday.

Binance’s BNB Coin (BNB) has kept pace with BTC and is currently trading at $571, down 2.4% from yesterday. Toncoin (TON), the native token of The Open Network, is down just 0.4% over the past day.

This leaves the stablecoins USDC (USDC) and Tether (USDT), both of which are stable as they maintain their 1:1 ratio with the US dollar.

Markets

XRP Market Activity Drops During Ripple-SEC Talks: Price Steady

The Securities and Exchange Commission (SEC) will hold another closed-door meeting with Ripple on Thursday, as the market hopes for a possible resolution to the legal battle between the two entities.

However, the cryptocurrency market remains relatively bearish, with the price and trading volume of XRP down in the last 24 hours.

Ripple holders take no risk

At press time, XRP is trading at $0.60. The altcoin’s price has dropped 6% over the past 24 hours. During that time, trading volume was $27 million, down 27%.

The SEC met before with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes one additional topic of discussion from the July 25 closed meeting: the instituting and resolving injunctive relief. That has market participants speculating whether a settlement is imminent.

In an exclusive interview with BeinCrypto, Ryan Lee, Lead Analyst at Bitget Research, noted that:

“This meeting will discuss possible resolution options for the Ripple Lawsuit. The founder of Ripple Labs said that a legal settlement could be announced soon. If an official settlement plan is released, it could positively impact XRP’s price movement.”

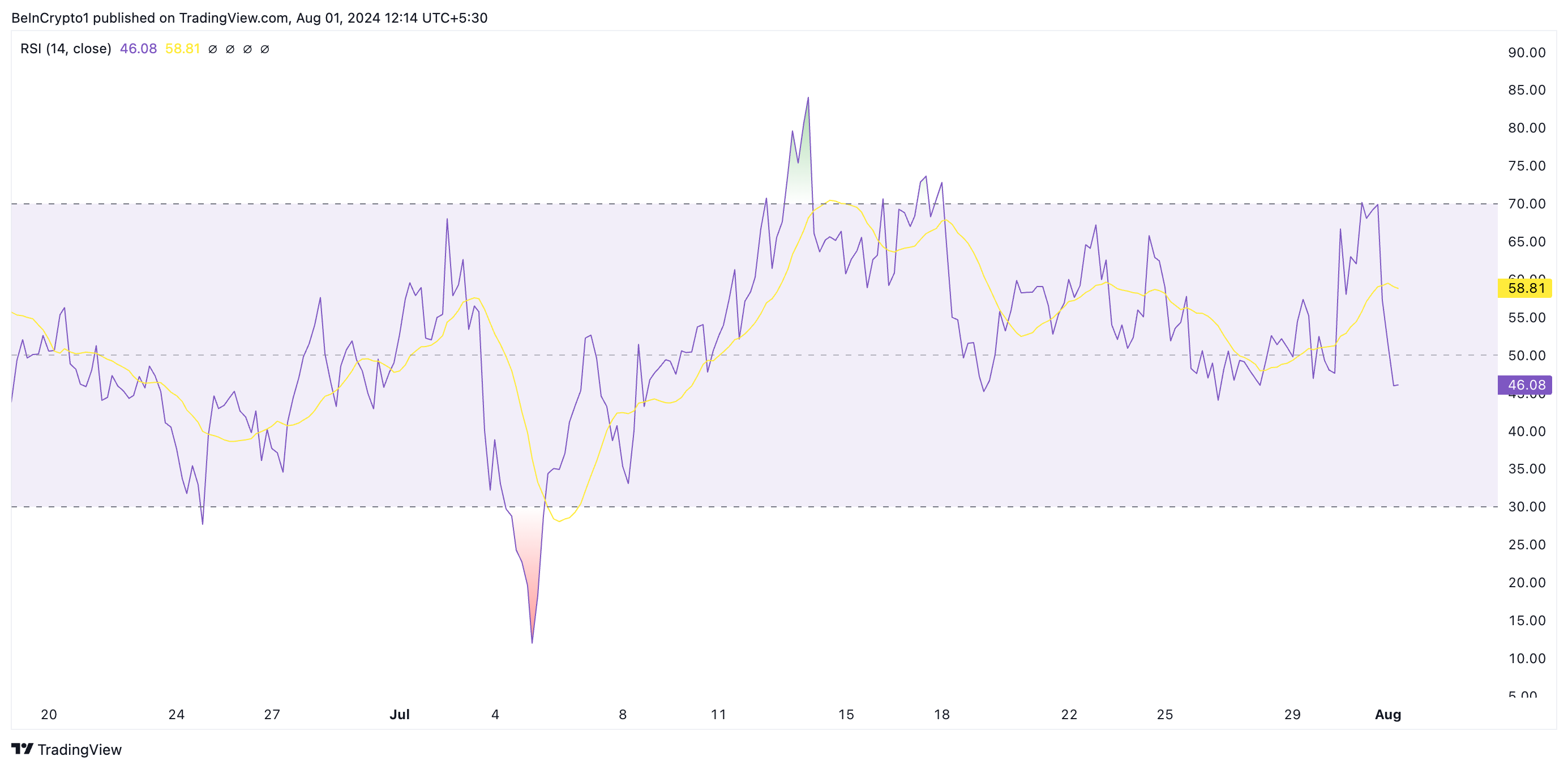

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Its Moving Average Convergence/Divergence (MACD) indicator readings show that its MACD line (blue) has crossed below its signal line (orange).

XRP 4 Hours Analysis. Source: Trading View

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set this way, it is a bearish signal that suggests selling activity is outweighing buying momentum.

Additionally, the altcoin relative strength index (RSI), at 46.08, is currently below its neutral 50 line and in a downtrend. This indicator measures overbought and oversold market conditions for an asset.

To know more: How to Buy XRP and Everything You Need to Know

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

At 43.83 at the time of writing, XRP’s RSI suggests a growing preference among the market participants for tokin distribution.

XRP Price Prediction: Derivatives Traders Exit Market

The XRP derivatives market has also seen a decline in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume has plummeted 18% and open interest has dropped 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futurethat have not yet been resolved. When it drops, traders close their positions without opening new ones. This is a bearish signal that reflects a lack of confidence in any potential positive price movement.

According to Lee, the outcome of the meeting with the SEC “would have a significant impact on the price movement of the token.” If the outcome is favorable, the price of the token could rise towards $0.75 in August.

To know more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 4 Hours Analysis. Source: Trading View

XRP 4 Hours Analysis. Source: Trading View

On the other hand, if no favorable resolutions are reached, the price could plummet to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAND Disclaimers They have been updated.

Markets

Bitcoin’s Dominance Hits Three-Year High, But Analysts Say Altcoins Are Ready to Rebound

Bitcoin is now the dominant force in the cryptocurrency market, surpassing 53% of the total cryptocurrency market, a stronger share than it has been in the past three years.

Bitcoin’s market cap now stands at $1.27 trillion, second according to CoinGecko data. In contrast, the total cryptocurrency market cap is $2.43 trillion, with Ethereum occupying 15.9% of the market, worth $389 billion.

Bitcoin’s rise to dominance this year is unusual, as altcoins typically do better than Bitcoin in a bull market. While meme coins made a strong comeback during Bitcoin’s rally to all-time highs earlier this year, the so-called “wealth effect” It has not been appreciated as much by mid-range coins, such as Ethereum and Cardano.

“ETF flows fundamentally alter market dynamics,” he wrote Meltem Demirors, former chief strategy officer at CoinShares, tweeted Wednesday: “BTC gains no longer translate to alts and the longer tail of crypto.”

Bitcoin’s takeover has continued even as the market cap of Tether (USDT) continues to grow, the world’s largest stablecoin and the third-largest cryptocurrency after BTC and ETH. Stablecoins are backed by fiat currencies and are excluded from some measures of Bitcoin dominance due to fundamentally different value models.

The surge continued to pace even after the launch of Ethereum spot ETFs last week, which ironically culminated in a news sell-off event, and net outflows from new investment products since they were launched. This went against the predictions of K33 Search so far, which predicted that ETFs would catalyze ETH’s growth over the next five months.

Despite the poorer performance of the alts, there is reason to believe that they are ready to bounce back very soon.

CryptoQuant CEO Ki Young Ju said Tuesday that whales are “preparing for the next altcoin rally,” as limit buy orders for assets other than BTC and ETH are on the rise.

The executive shared a chart showing how the “cumulative difference between purchase volume and sales volume” has increased in recent months.

“The indicator measures the difference between buy and sell orders over a year,” CryptoQuant told Decrypt. A buy/sell order is a pre-set request to buy or sell a cryptocurrency if it hits a certain price level, which creates resistance and support levels.

“If the trend is up, it means that more people are placing buy orders, showing strong interest in buying,” CryptoQuant said.

By Ryan-Ozawa.

Markets

XRP and SOL Retrace as BTC Price Drops to 2-Week Lows (Market Watch)

After Monday’s crash, in which BTC fell by several thousand dollars, the scenario has repeated itself once again in the last 12 hours, with the asset falling to a 2-week low of $63,300.

Alt coins followed suit, with most of the market in the red today. SOL and XRP lead the way from the higher cap alts.

BTC Drops To $63.3K

After a violent Thursday last week, when BTC crashed to $63,400, the asset went on the offensive over the weekend and surged above $69,000 on Saturday, as the community prepared for Donald Trump’s appearance at the 2024 Bitcoin Conference in Nashville.

His speech was followed by more volatility before the cryptocurrency settled around $67,500 on Sunday. Monday started off rather optimistically for the bulls as bitcoin hit a 7-week high of $70,000.

However, he failed to maintain his run and conquer that level decisively. On the contrary, he was rejected bad and dropped to $66,400 by the end of Monday. Tuesday and Wednesday were less eventful as BTC remained still around $66,500.

The last 12 hours or so have brought another crash. Bears have pushed the leading digital asset down hard, which has fallen to a 2-week low of $63,300 (on Bitstamp), leaving over $200 million in liquidations.

Despite the current rebound to $64,500, BTC’s market cap has fallen to $1.270 trillion, but its dominance over alts is recovering and has reached 52.6%.

Bitcoin/Price/Chart 01.08.2024. Source: TradingView

The Alts are back in red

Ripple’s native token has been at the forefront of the market challenge in recent days as pumped up to a multi-month high of over $0.66. However, its run was also interrupted and XPR fell by more than 6% in the last day to $0.6.

The other big loser among the larger-cap alternatives is SOL, which has lost 8% of its value and is now struggling to get below $170.

The rest of this altcoin cohort is also in the red, with ETH, DOGE, BNB, AVAX, ADA, SHIB, and LINK all seeing drops between 2 and 5%.

The total cryptocurrency market cap lost another $70 billion overnight, falling below $2.4 trillion today on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto SPECIAL OFFER (sponsored)

Binance $600 Free (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the authors cited. It does not represent CryptoPotato’s views on the advisability of buying, selling, or holding any investment. We recommend that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

News12 months ago

News12 months agoBitcoin soars above $63,000 as money flows into new US investment products

-

DeFi12 months ago

DeFi12 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

News12 months ago

News12 months agoFRA Strengthens Cryptocurrency Practice with New Director Thomas Hyun

-

DeFi12 months ago

DeFi12 months agoZodialtd.com to revolutionize derivatives trading with WEB3 technology

-

Markets12 months ago

Markets12 months agoBitcoin Fails to Recover from Dovish FOMC Meeting: Why?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Reached $100 Billion in 2024, Fueling Crazy Investor Optimism ⋆ ZyCrypto

-

Markets1 year ago

Markets1 year agoWhy Bitcoin’s price of $100,000 could be closer than ever ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoPancakeSwap integrates Zyfi for transparent, gas-free DeFi

-

Markets1 year ago

Markets1 year agoWhales are targeting these altcoins to make major gains during the bull market 🐋💸

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

News1 year ago

News1 year agoHow to make $1 million with crypto in just 1 year 💸📈